Key Insights

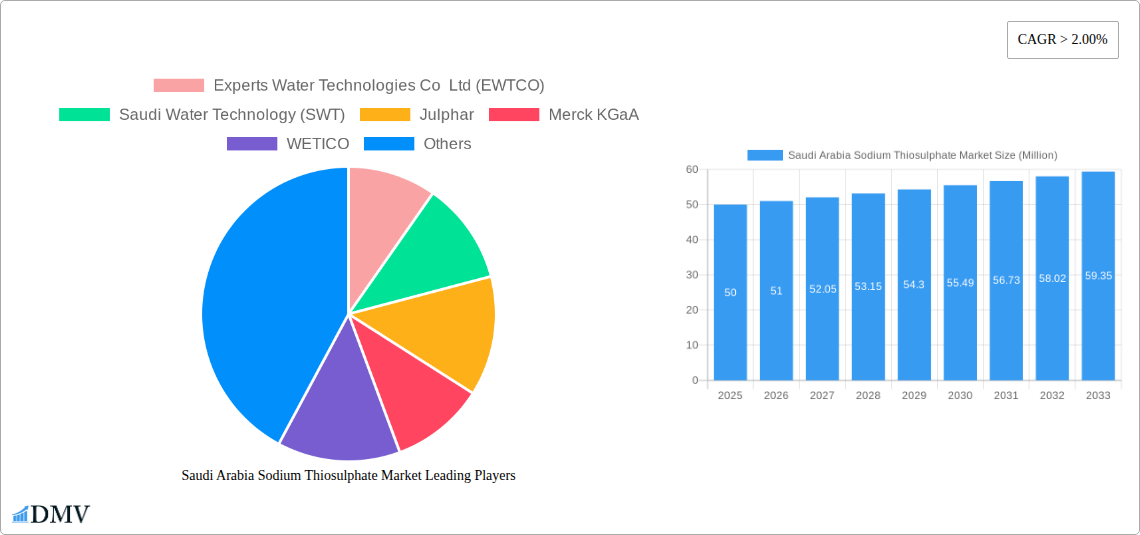

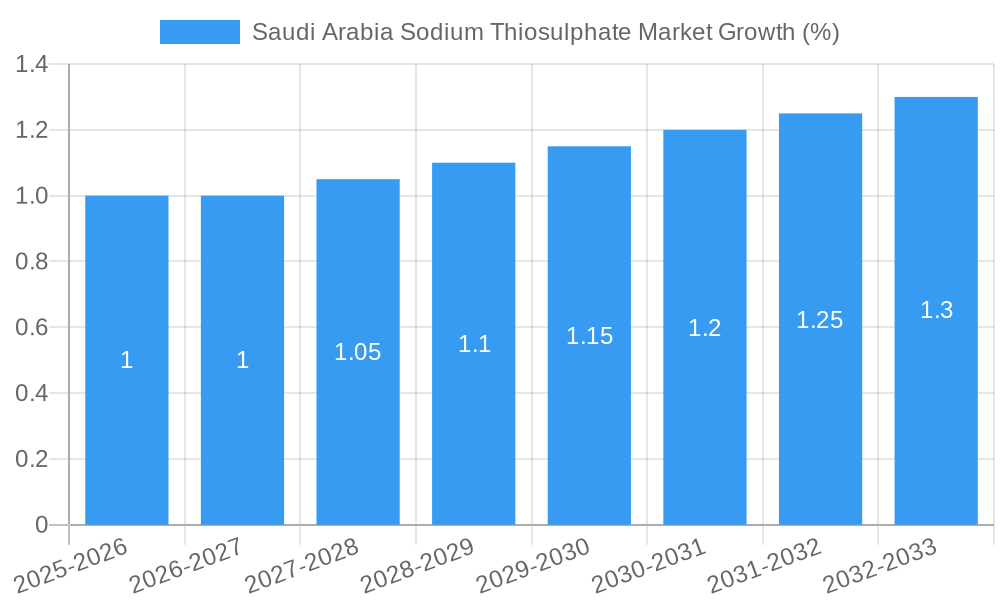

The Saudi Arabia sodium thiosulfate market is experiencing robust growth, driven by increasing demand across diverse sectors. The market's Compound Annual Growth Rate (CAGR) exceeding 2.00% indicates a steady expansion projected through 2033. Key application segments fueling this growth include medical applications (e.g., pharmaceuticals and antidotes), photographic processing (though declining globally, niche applications remain in Saudi Arabia), gold extraction (a significant driver given the region's mining activities), and water treatment (particularly in industrial and municipal settings). The presence of established players like Experts Water Technologies Co Ltd (EWTCO), Saudi Water Technology (SWT), and international companies such as Merck KGaA, underscores the market's maturity and competitive landscape. Growth is further supported by Saudi Arabia's ongoing infrastructure development and industrialization, creating significant demand for water treatment chemicals. While specific market size figures are not explicitly provided, a reasonable estimation can be made based on the CAGR and regional economic indicators. Assuming a 2025 market size of approximately $50 million (a conservative estimate given the industrial activity), this would imply a market value exceeding $60 million by 2030, given a 2%+ CAGR. However, this estimate should be validated with further market research. Restraints on growth could include fluctuations in global raw material prices and potential shifts in technological preferences within application sectors. However, the overall outlook for the Saudi Arabia sodium thiosulfate market remains positive.

The market is characterized by a mix of local and international companies, indicating a balance between established players and potential new entrants. Major customers include industrial giants and government entities involved in water treatment, mining, and related sectors. This highlights the market's reliance on large-scale consumers and the potential for future growth to be linked to expansion in these sectors. While regional data is limited to Saudi Arabia, the country's strategic position and economic plans suggest its sodium thiosulfate market is representative of a broader regional trend and could serve as a barometer for similar markets in the Middle East and North Africa. Further investigation into specific consumption patterns across different applications could provide more granular insights and support refined market estimations.

Saudi Arabia Sodium Thiosulphate Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Saudi Arabia sodium thiosulphate market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a focus on 2025, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The market is projected to reach xx Million by 2033, growing at a CAGR of xx% during the forecast period (2025-2033).

Saudi Arabia Sodium Thiosulphate Market Composition & Trends

This section delves into the intricacies of the Saudi Arabian sodium thiosulphate market, examining its competitive landscape, driving forces, and regulatory environment. We analyze market concentration, revealing that the market is moderately fragmented, with no single dominant player commanding over 30% market share in 2025. Key players like Experts Water Technologies Co Ltd (EWTCO), Saudi Water Technology (SWT), and Merck KGaA hold significant positions. The report further explores innovation catalysts, including advancements in water treatment technologies and the growing demand for environmentally friendly solutions. The regulatory landscape is scrutinized, highlighting the impact of environmental regulations on market growth. Substitute products and their impact on market dynamics are also discussed. Finally, the report provides an overview of M&A activities, including a detailed analysis of notable deals and their respective values (e.g., a xx Million acquisition in 2022). End-user profiles are meticulously analyzed, segmented by industry, to provide a comprehensive understanding of consumption patterns across various sectors.

- Market Share Distribution (2025): EWTCO (xx%), SWT (xx%), Merck KGaA (xx%), Others (xx%)

- M&A Activity (2019-2024): Three significant M&A deals totaling approximately xx Million USD.

- Key End-Users: Water treatment facilities, mining companies (e.g., Maaden), and medical institutions.

Saudi Arabia Sodium Thiosulphate Market Industry Evolution

This section provides a detailed historical and future outlook on the market's growth trajectory, fueled by factors such as increasing industrialization, stringent environmental regulations promoting water treatment, and expanding healthcare infrastructure. Technological advancements, including the development of higher-purity sodium thiosulphate, have also significantly impacted market growth. The report analyzes the evolving consumer demands, showcasing a shift towards eco-friendly and cost-effective solutions. The historical period (2019-2024) saw a steady growth, with a CAGR of xx%, while the forecast period (2025-2033) projects a more rapid expansion, driven by government initiatives focusing on water conservation and industrial growth. Specific adoption metrics, such as the increasing penetration of sodium thiosulphate in water treatment plants, are quantified and presented.

Leading Regions, Countries, or Segments in Saudi Arabia Sodium Thiosulphate Market

The water treatment segment constitutes the largest application area for sodium thiosulphate in Saudi Arabia, driven by the increasing demand for potable water and stringent environmental regulations governing wastewater discharge. This dominance is fueled by substantial investments in water desalination and treatment infrastructure projects, as well as strong government support for sustainable water management practices.

- Key Drivers for Water Treatment Segment Dominance:

- Massive investments in desalination plants.

- Stringent environmental regulations on industrial wastewater discharge.

- Growing awareness of water scarcity and the need for efficient water management.

- Government initiatives supporting water conservation and treatment technologies.

The report provides a detailed breakdown of each application segment (Medical, Photographic Processing, Gold Extraction, Other Applications) and an in-depth comparative analysis of growth rates and market shares.

Saudi Arabia Sodium Thiosulphate Market Product Innovations

Recent product innovations have focused on developing higher-purity sodium thiosulphate with enhanced performance characteristics for various applications. These advancements cater to the growing demand for improved efficacy, cost-effectiveness, and environmental compatibility. The introduction of specialized formulations for specific applications, such as enhanced water treatment chemicals, has also driven market expansion. Unique selling propositions include improved stability, reduced impurities, and optimized performance in diverse environments.

Propelling Factors for Saudi Arabia Sodium Thiosulphate Market Growth

The Saudi Arabia sodium thiosulphate market is propelled by several key factors. Rapid industrialization and urbanization are driving demand for advanced water treatment solutions, thus increasing sodium thiosulphate consumption. Stringent government regulations aimed at improving water quality and managing wastewater further contribute to market growth. Furthermore, the expanding healthcare sector and the need for high-purity sodium thiosulphate in medical applications are additional growth drivers.

Obstacles in the Saudi Arabia Sodium Thiosulphate Market

The market faces challenges such as price volatility of raw materials, potential supply chain disruptions due to geopolitical factors, and intense competition from both domestic and international players. Regulatory hurdles, though supportive overall, can also create short-term complexities. The fluctuation in global sodium thiosulphate prices impacts profitability for local producers.

Future Opportunities in Saudi Arabia Sodium Thiosulphate Market

Future opportunities lie in the development of innovative, sustainable sodium thiosulphate formulations for niche applications and in expanding into new market segments. Exploring potential uses in emerging industrial sectors and leveraging advancements in nanotechnology to enhance product performance offer significant potential. The growing focus on circular economy principles presents opportunities for companies to develop sustainable sourcing and recycling strategies for sodium thiosulphate.

Major Players in the Saudi Arabia Sodium Thiosulphate Market Ecosystem

Experts Water Technologies Co Ltd (EWTCO)

Saudi Water Technology (SWT)

Julphar

Merck KGaA

WETICO

Acme Engineering Prod Ltd

ENEXIO Water Technologies GmbH

Reza Industrial Solution

Al-Jazira Water Treatment Chemicals

Toray Membrane Middle East LLC

Saudi Water Treatment Company (SWTC)

QED Environmental Systems Ltd

Getinge Group Middle East

Kefi Mineral

Saudi(Overseas) Marketing & Trading Company (SOMATCO)

AES Arabia Ltd

Chemsol

Fouz Chemical Co

GE Water & Process Technologies (Suez)

SAWACO Water Desalination

Maaden - Saudi Arabian Mining Company

AquaChemie

Key Developments in Saudi Arabia Sodium Thiosulphate Market Industry

- 2022 Q3: EWTCO launched a new high-purity sodium thiosulphate formulation for the medical industry.

- 2021 Q4: A joint venture between SWT and a foreign company resulted in enhanced production capacity.

- 2020 Q1: New environmental regulations imposed stricter limits on wastewater discharge, boosting demand for sodium thiosulphate-based treatment solutions. (Further developments to be added based on data)

Strategic Saudi Arabia Sodium Thiosulphate Market Forecast

The Saudi Arabia sodium thiosulphate market is poised for robust growth, driven by sustained investments in infrastructure, ongoing industrial expansion, and a growing emphasis on environmental sustainability. The forecast period (2025-2033) anticipates significant market expansion, particularly within the water treatment and medical sectors. The market's growth trajectory is expected to be influenced by technological advancements, government policies, and evolving consumer demands. This creates opportunities for both established and emerging players to participate in this dynamic and expanding market.

Saudi Arabia Sodium Thiosulphate Market Segmentation

-

1. Application

- 1.1. Medical

- 1.2. Photographic Processing

- 1.3. Gold Extraction

- 1.4. Water Treatment

- 1.5. Other Applications

Saudi Arabia Sodium Thiosulphate Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Sodium Thiosulphate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Use of Sodium Thiosulfate in the Gold Leaching Application

- 3.3. Market Restrains

- 3.3.1. ; Concerns Regarding Side Effects of the Intravenous Sodium Thiosulfate Administration

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Water Treatment Applications

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Sodium Thiosulphate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical

- 5.1.2. Photographic Processing

- 5.1.3. Gold Extraction

- 5.1.4. Water Treatment

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Experts Water Technologies Co Ltd (EWTCO)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Saudi Water Technology (SWT)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Julphar

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Merck KGaA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 WETICO

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Acme Engineering Prod Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ENEXIO Water Technologies GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Reza Industrial Solution

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al-Jazira Water Treatment Chemicals

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toray Membrane Middle East LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Saudi Water Treatment Company (SWTC)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 QED Environmental Systems Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Getinge Group Middle East

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Kefi Mineral

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Saudi(Overseas) Marketing & Trading Company (SOMATCO)*List Not Exhaustive 6 5 List of Customers

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 AES Arabia Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Chemsol

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Fouz Chemical Co

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 GE Water & Process Technologies (Suez)

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 SAWACO Water Desalination

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Maaden - Saudi Arabian Mining Company

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 AquaChemie

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.1 Experts Water Technologies Co Ltd (EWTCO)

List of Figures

- Figure 1: Saudi Arabia Sodium Thiosulphate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Sodium Thiosulphate Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Sodium Thiosulphate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Sodium Thiosulphate Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Sodium Thiosulphate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Saudi Arabia Sodium Thiosulphate Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 5: Saudi Arabia Sodium Thiosulphate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Saudi Arabia Sodium Thiosulphate Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 7: Saudi Arabia Sodium Thiosulphate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Saudi Arabia Sodium Thiosulphate Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 9: Saudi Arabia Sodium Thiosulphate Market Revenue Million Forecast, by Application 2019 & 2032

- Table 10: Saudi Arabia Sodium Thiosulphate Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 11: Saudi Arabia Sodium Thiosulphate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Saudi Arabia Sodium Thiosulphate Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Sodium Thiosulphate Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Saudi Arabia Sodium Thiosulphate Market?

Key companies in the market include Experts Water Technologies Co Ltd (EWTCO), Saudi Water Technology (SWT), Julphar, Merck KGaA, WETICO, Acme Engineering Prod Ltd, ENEXIO Water Technologies GmbH, Reza Industrial Solution, Al-Jazira Water Treatment Chemicals, Toray Membrane Middle East LLC, Saudi Water Treatment Company (SWTC), QED Environmental Systems Ltd, Getinge Group Middle East, Kefi Mineral, Saudi(Overseas) Marketing & Trading Company (SOMATCO)*List Not Exhaustive 6 5 List of Customers, AES Arabia Ltd, Chemsol, Fouz Chemical Co, GE Water & Process Technologies (Suez), SAWACO Water Desalination, Maaden - Saudi Arabian Mining Company, AquaChemie.

3. What are the main segments of the Saudi Arabia Sodium Thiosulphate Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Use of Sodium Thiosulfate in the Gold Leaching Application.

6. What are the notable trends driving market growth?

Increasing Demand from Water Treatment Applications.

7. Are there any restraints impacting market growth?

; Concerns Regarding Side Effects of the Intravenous Sodium Thiosulfate Administration.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Sodium Thiosulphate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Sodium Thiosulphate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Sodium Thiosulphate Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Sodium Thiosulphate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence