Key Insights

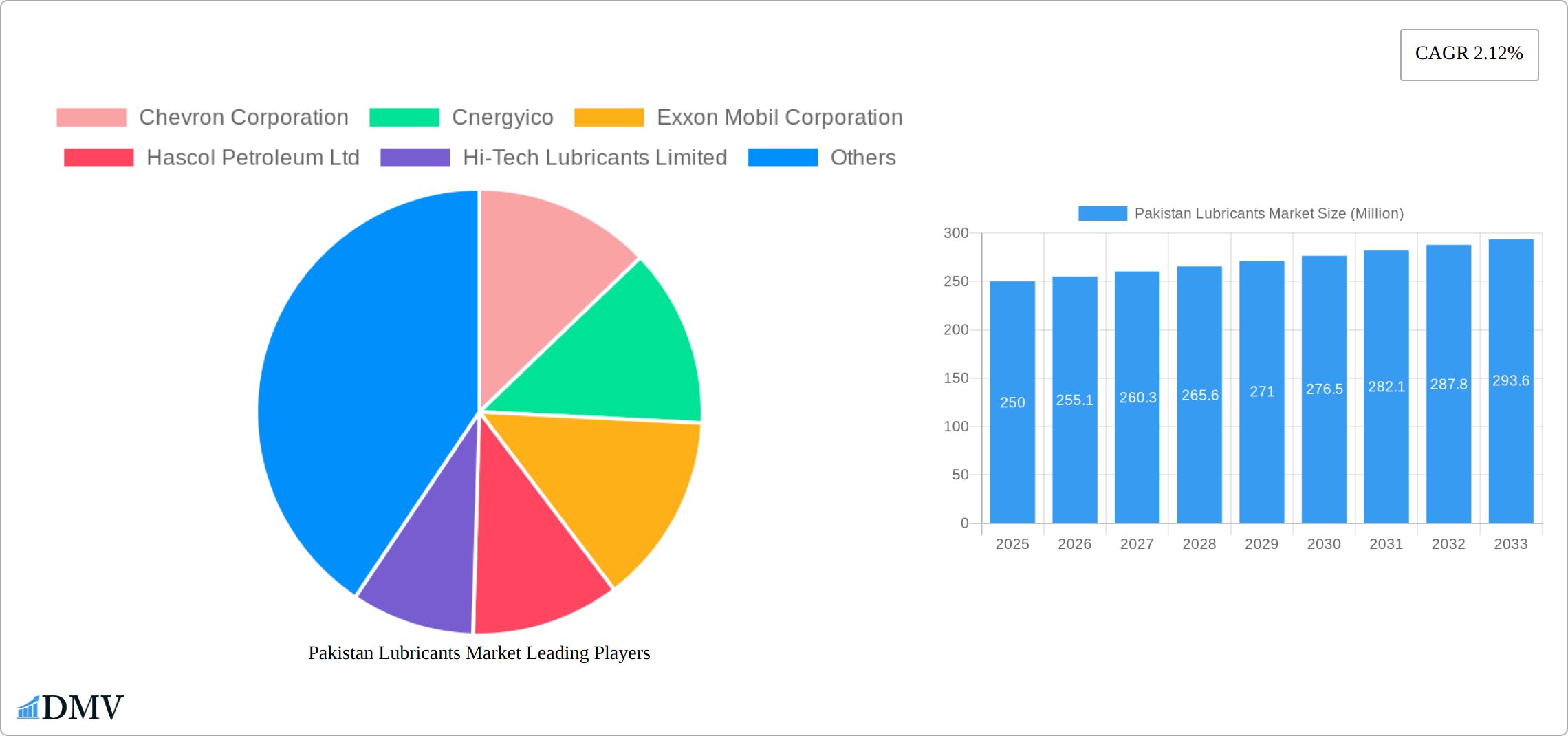

The Pakistan lubricants market, valued at approximately $XXX million in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 2.12% from 2025 to 2033. This growth is primarily driven by the expanding automotive sector, particularly the two-wheeler and commercial vehicle segments, coupled with increasing industrialization and infrastructure development within the country. The rising demand for high-performance lubricants, driven by advancements in engine technology and a growing focus on fuel efficiency, further contributes to market expansion. Key players like Chevron, ExxonMobil, and Shell, alongside local manufacturers such as Pakistan State Oil and Hascol Petroleum, compete fiercely within this market. However, fluctuating crude oil prices and economic instability represent significant challenges to consistent growth. The market is segmented by lubricant type (engine oils, gear oils, greases, etc.), application (automotive, industrial, etc.), and region (Punjab, Sindh, etc.). Future growth will likely be influenced by government policies aimed at promoting energy efficiency and sustainable transportation, alongside the adoption of advanced lubrication technologies.

While challenges such as economic volatility exist, the long-term outlook for the Pakistan lubricants market remains positive, driven by continued infrastructure development, industrial growth, and the increasing penetration of vehicles. The market's segmentation offers opportunities for specialized lubricant manufacturers to cater to specific needs. Strategic partnerships between international and local players will also likely shape the competitive landscape. Growth in the automotive sector, especially in commercial vehicles due to rising e-commerce and logistics needs, will act as a significant driver. The market is expected to see increased demand for synthetic lubricants due to superior performance compared to mineral-based oils. However, maintaining price competitiveness in the face of fluctuating input costs will remain a critical challenge for all market participants.

Pakistan Lubricants Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Pakistan lubricants market, offering a comprehensive overview of its current state and future projections. Spanning the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this study is essential for stakeholders seeking to understand market dynamics, identify lucrative opportunities, and make informed strategic decisions. The market size is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Pakistan Lubricants Market Composition & Trends

This section delves into the intricate composition of the Pakistan lubricants market, evaluating key trends shaping its evolution. We analyze market concentration, revealing the market share distribution among leading players such as Chevron Corporation, Exxon Mobil Corporation, Shell, and others. The report examines innovation catalysts driving product development, including advancements in synthetic lubricants and environmentally friendly formulations. A thorough analysis of the regulatory landscape, including import/export regulations and environmental standards, is also provided. Furthermore, the report explores the impact of substitute products and identifies key end-user segments, including automotive, industrial, and agricultural sectors. Finally, we assess recent mergers and acquisitions (M&A) activities, analyzing deal values and their influence on market dynamics. The total M&A deal value during the historical period is estimated at xx Million.

- Market Concentration: High concentration with top 5 players holding xx% market share.

- Innovation Catalysts: Growing demand for energy-efficient and environmentally friendly lubricants.

- Regulatory Landscape: Stringent emission norms driving adoption of advanced lubricants.

- Substitute Products: Limited substitute products with specialized applications.

- End-User Profiles: Automotive sector dominates, followed by industrial and agricultural applications.

- M&A Activities: Consolidation trend observed, with xx major deals recorded during 2019-2024.

Pakistan Lubricants Market Industry Evolution

This section meticulously traces the evolution of the Pakistan lubricants market, examining its growth trajectory, technological advancements, and shifting consumer preferences. We analyze historical growth rates and project future market expansion, considering factors such as economic growth, infrastructure development, and increasing vehicle ownership. The report also explores the adoption of advanced technologies, including the increasing use of synthetic lubricants and biolubricants. Furthermore, we analyze changes in consumer demand, focusing on the growing preference for high-performance lubricants with extended drain intervals. Specific data points, including growth rates and adoption metrics for various lubricant types, are provided, offering a granular understanding of market evolution. The market exhibited a growth rate of xx% during the historical period.

Leading Regions, Countries, or Segments in Pakistan Lubricants Market

This section identifies the dominant regions, countries, or segments within the Pakistan lubricants market. Detailed analysis explores the factors contributing to their dominance, considering investment trends, regulatory support, and infrastructural development. The key factors behind the dominance are discussed in detail below.

- Key Drivers for Dominant Region/Segment:

- Significant investments in infrastructure projects.

- Favorable government policies and incentives.

- Rapid growth in the automotive and industrial sectors.

- High vehicle ownership and increasing demand for high-performance lubricants.

Pakistan Lubricants Market Product Innovations

The Pakistan lubricants market witnesses continuous product innovation, focusing on enhancing performance, extending service life, and improving environmental compatibility. New product launches include advanced synthetic lubricants offering superior performance in extreme conditions, along with bio-based lubricants reducing environmental impact. These innovations cater to the increasing demand for energy efficiency and reduced emissions, aligning with global sustainability goals.

Propelling Factors for Pakistan Lubricants Market Growth

Several key factors fuel the growth of the Pakistan lubricants market. Economic expansion stimulates demand from various industries, driving increased lubricant consumption. Technological advancements lead to the development of higher-performance lubricants with improved efficiency. Furthermore, supportive government regulations and infrastructure development create favorable market conditions. The expanding automotive sector and increasing industrial activities are significant growth drivers.

Obstacles in the Pakistan Lubricants Market

The Pakistan lubricants market faces several challenges, including supply chain disruptions affecting lubricant availability and pricing. Regulatory hurdles, such as import restrictions and stringent environmental regulations, pose additional obstacles. Furthermore, intense competition among established players and the emergence of new entrants create pricing pressures. These factors collectively impact market growth.

Future Opportunities in Pakistan Lubricants Market

The Pakistan lubricants market presents promising opportunities. Expansion into untapped market segments, such as the renewable energy sector, holds significant potential. Technological advancements, including the development of novel lubricant formulations and improved distribution channels, offer promising avenues for growth. Further, a growing awareness of sustainability drives demand for environmentally friendly lubricants, presenting opportunities for eco-conscious businesses.

Major Players in the Pakistan Lubricants Market Ecosystem

- Chevron Corporation

- Cnergyico

- Exxon Mobil Corporation

- Hascol Petroleum Ltd

- Hi-Tech Lubricants Limited

- Karachi Lubricants (pvt) Ltd

- Pak HY-Oils

- Pakistan Lubricants (Pvt ) Ltd

- Pakistan State Oil

- Petroliam Nasional Berhad (PETRONAS)

- Shell

- TotalEnergies

- List Not Exhaustive

Key Developments in Pakistan Lubricants Market Industry

- July 2022: Shell Pakistan's collaboration with Burque Corporation expanded lubricant distribution to 6,000 village outlets and 40,000 additional outlets across Pakistan, significantly enhancing market reach.

- March 2022: Chevron Pakistan Lubricants' partnership with MG JW Automobile Pakistan secured a supply contract for Delo and Havoline branded synthetic lubricants, strengthening its position in the automotive sector.

Strategic Pakistan Lubricants Market Forecast

The Pakistan lubricants market is poised for sustained growth, driven by robust economic expansion and the increasing adoption of advanced technologies. Future opportunities lie in developing specialized lubricants for niche applications and expanding distribution networks to reach underserved markets. The market's potential is significant, with continued growth expected throughout the forecast period.

Pakistan Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oil

- 1.2. Transmission and Hydraulic Fluid

- 1.3. General Industrial Oil

- 1.4. Gear Oils

- 1.5. Grease

- 1.6. Other Product Types (Process Oil and Turbine Oil)

-

2. End-user Industry

- 2.1. Power Generation

- 2.2. Automotive and Transportation

- 2.3. Heavy Equipment

- 2.4. Food and Beverage

- 2.5. Other En

Pakistan Lubricants Market Segmentation By Geography

- 1. Pakistan

Pakistan Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.12% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Positive Outlook for the Automotive Industry; Increasing Chinese Investments in the Country

- 3.3. Market Restrains

- 3.3.1. Positive Outlook for the Automotive Industry; Increasing Chinese Investments in the Country

- 3.4. Market Trends

- 3.4.1. Engine Oil to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Pakistan Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oil

- 5.1.2. Transmission and Hydraulic Fluid

- 5.1.3. General Industrial Oil

- 5.1.4. Gear Oils

- 5.1.5. Grease

- 5.1.6. Other Product Types (Process Oil and Turbine Oil)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power Generation

- 5.2.2. Automotive and Transportation

- 5.2.3. Heavy Equipment

- 5.2.4. Food and Beverage

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Pakistan

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Chevron Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cnergyico

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Exxon Mobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hascol Petroleum Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hi-Tech Lubricants Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Karachi Lubricants (pvt) Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pak HY-Oils

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Pakistan Lubricants (Pvt ) Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pakistan State Oil

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Petroliam Nasional Berhad (PETRONAS)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Shell

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 TotalEnergies*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Chevron Corporation

List of Figures

- Figure 1: Pakistan Lubricants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Pakistan Lubricants Market Share (%) by Company 2024

List of Tables

- Table 1: Pakistan Lubricants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Pakistan Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Pakistan Lubricants Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Pakistan Lubricants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Pakistan Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 6: Pakistan Lubricants Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 7: Pakistan Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pakistan Lubricants Market?

The projected CAGR is approximately 2.12%.

2. Which companies are prominent players in the Pakistan Lubricants Market?

Key companies in the market include Chevron Corporation, Cnergyico, Exxon Mobil Corporation, Hascol Petroleum Ltd, Hi-Tech Lubricants Limited, Karachi Lubricants (pvt) Ltd, Pak HY-Oils, Pakistan Lubricants (Pvt ) Ltd, Pakistan State Oil, Petroliam Nasional Berhad (PETRONAS), Shell, TotalEnergies*List Not Exhaustive.

3. What are the main segments of the Pakistan Lubricants Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Positive Outlook for the Automotive Industry; Increasing Chinese Investments in the Country.

6. What are the notable trends driving market growth?

Engine Oil to Dominate the Market.

7. Are there any restraints impacting market growth?

Positive Outlook for the Automotive Industry; Increasing Chinese Investments in the Country.

8. Can you provide examples of recent developments in the market?

July 2022: Shell Pakistan appointed Burque Corporation, which has planned to expand the distribution of its lubricants in Quetta. With the collaboration, Shell Pakistan covered 6,000 outlets in villages and 40,000 additional outlets across Pakistan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pakistan Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pakistan Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pakistan Lubricants Market?

To stay informed about further developments, trends, and reports in the Pakistan Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence