Key Insights

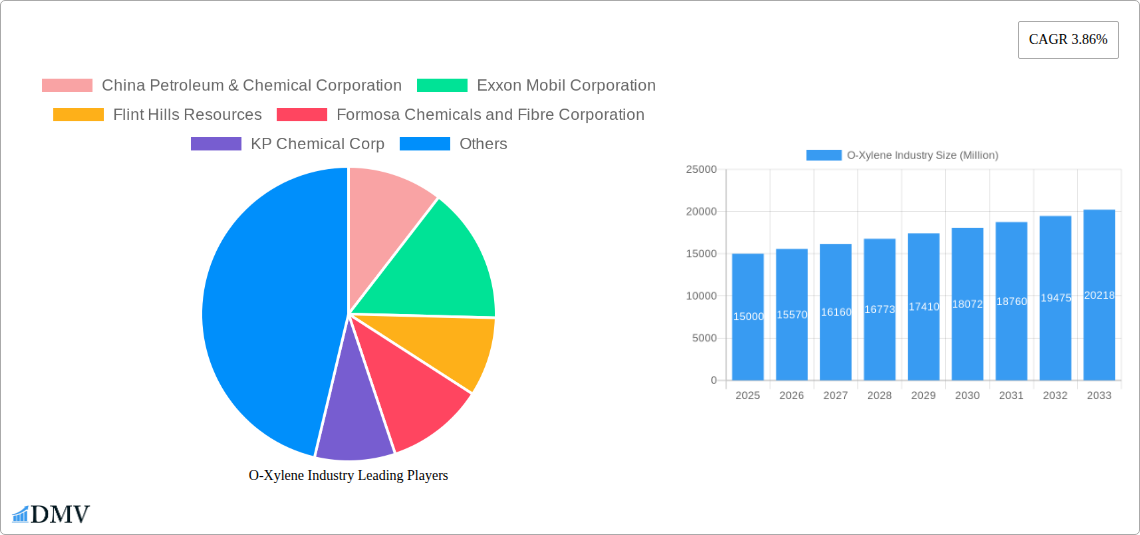

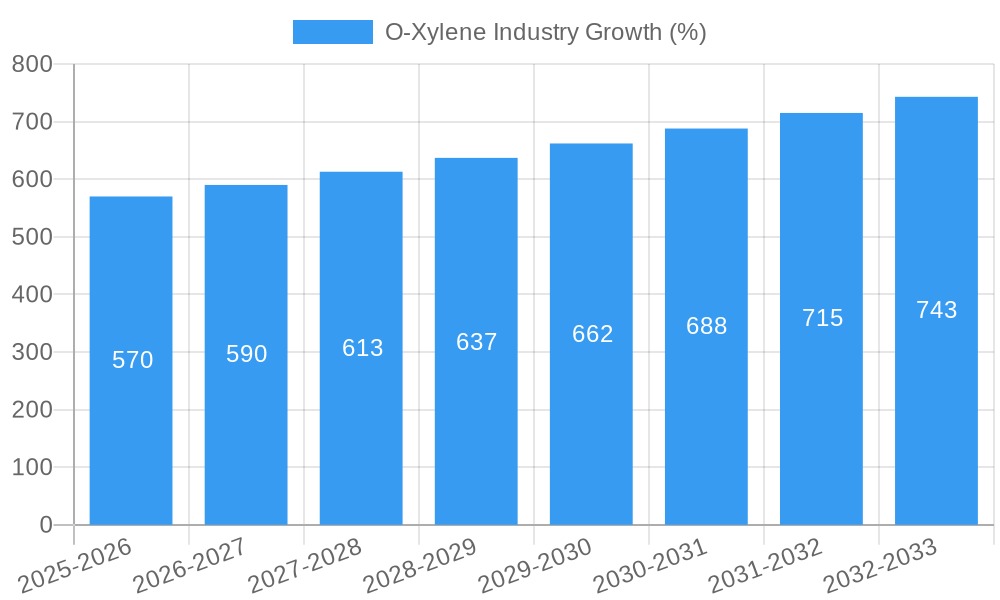

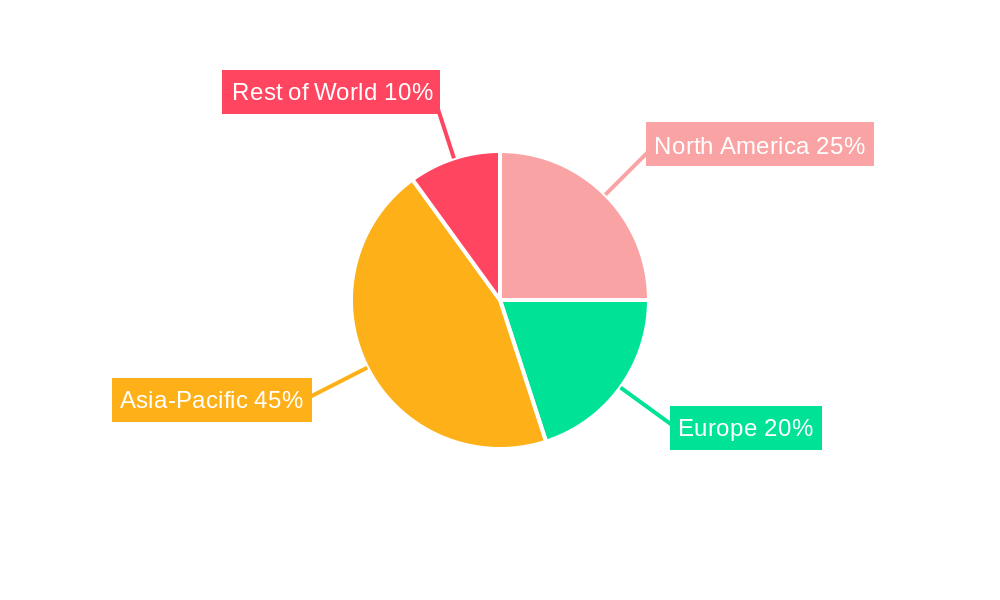

The global O-Xylene market, valued at approximately $XX million in 2025, is projected to experience steady growth, driven primarily by robust demand from the downstream petrochemical industry. A Compound Annual Growth Rate (CAGR) of 3.86% from 2025 to 2033 indicates a continuous expansion, largely fueled by the increasing production of polyester fibers and plastics. The rising global population and expanding middle class in developing economies are key factors contributing to this demand surge. Growth is further supported by advancements in O-Xylene production technologies, leading to increased efficiency and reduced production costs. However, the market faces challenges such as fluctuations in crude oil prices, which directly impact raw material costs and overall profitability. Furthermore, environmental regulations concerning volatile organic compound (VOC) emissions associated with O-Xylene production and usage pose a restraint on market growth. Key players like China Petroleum & Chemical Corporation, Exxon Mobil Corporation, and Reliance Industries Ltd. are strategically investing in capacity expansions and technological advancements to maintain their market share and capitalize on emerging opportunities. The market is segmented based on applications (polyester, plastics, solvents), production methods, and geographical regions. Regional variations in demand exist, with Asia-Pacific expected to dominate owing to its rapidly growing industrial sector.

The competitive landscape is characterized by a mix of large multinational corporations and regional players. The presence of these established players, combined with technological advancements and strategic partnerships, contributes to market stability and growth. However, emerging competitors and potential disruptions from alternative materials could present challenges in the coming years. The forecast period of 2025-2033 promises continued expansion, albeit with potential fluctuations based on macroeconomic conditions and governmental policies influencing the chemical industry. Future growth will hinge on continuous innovation, sustainable production practices, and successful adaptation to evolving market demands and regulatory landscapes. Further analysis of regional specifics, detailed application segmentation, and a deeper dive into the competitive dynamics would provide a more granular understanding of the opportunities and challenges inherent in the O-Xylene market.

O-Xylene Industry Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the global O-Xylene industry, offering valuable insights for stakeholders seeking to navigate this dynamic market. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report delivers critical data and projections to inform strategic decision-making. The global O-Xylene market is estimated to be valued at XX Million in 2025, poised for significant growth in the coming years.

O-Xylene Industry Market Composition & Trends

This section meticulously examines the competitive landscape of the O-Xylene market, dissecting market concentration, innovation drivers, regulatory influences, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The report reveals market share distribution among key players and analyzes the financial impact of significant M&A deals, offering a detailed understanding of market dynamics. For example, the market share held by China Petroleum & Chemical Corporation (Sinopec) is estimated at XX%, while Exxon Mobil Corporation holds approximately XX%. The report also details recent M&A activity, with a focus on deal values exceeding XX Million.

- Market Concentration: High/Medium/Low (Choose one and justify with data)

- Innovation Catalysts: Focus on R&D investments in new production techniques and downstream applications.

- Regulatory Landscape: Analysis of environmental regulations and their impact on production costs.

- Substitute Products: Examination of alternative chemicals and their competitive pressure.

- End-User Profiles: Detailed analysis of consumption patterns across various industries (e.g., plastics, textiles).

- M&A Activities: Review of major mergers, acquisitions, and joint ventures, analyzing their implications on market structure.

O-Xylene Industry Evolution

This section traces the evolutionary path of the O-Xylene industry, examining market growth trajectories, technological advancements, and the evolution of consumer demand from 2019 to 2024 and projecting this trend to 2033. The report leverages historical data to forecast future growth, providing precise growth rates and adoption metrics for various technologies. For example, the report details the shift towards more sustainable production methods, including the adoption of XX technology, leading to a projected XX% increase in market growth between 2025 and 2033. Furthermore, the increasing demand from the XX industry is expected to fuel market expansion.

Leading Regions, Countries, or Segments in O-Xylene Industry

This section pinpoints the dominant regions, countries, and segments within the O-Xylene industry. It provides a comprehensive analysis of the factors driving their market leadership, including investment trends and regulatory support.

- Key Drivers for Dominant Region/Country/Segment:

- Strong government support for petrochemical industries.

- Abundant feedstock availability and lower production costs.

- Established infrastructure and logistics networks.

- Favorable investment climate and incentives for new projects.

The report delves into the reasons behind the dominance, providing insights into geographical advantages, resource availability, and economic factors driving growth. For instance, the dominance of Asia, specifically China, can be attributed to factors like high demand from the downstream industries and the presence of major petrochemical producers.

O-Xylene Industry Product Innovations

The report examines cutting-edge product innovations, their applications, and performance metrics within the O-Xylene industry. It highlights unique selling propositions (USPs) and technological advancements that enhance product performance and efficiency, resulting in increased demand and improved market competitiveness. For instance, the development of high-purity O-Xylene grades suitable for specialty applications is driving market expansion.

Propelling Factors for O-Xylene Industry Growth

This section identifies and analyzes the key drivers stimulating the growth of the O-Xylene industry. These drivers encompass technological advancements, economic factors, and supportive regulatory frameworks. Examples include the rising demand for plastics and fibers, coupled with government initiatives to boost the petrochemical sector in key regions.

Obstacles in the O-Xylene Industry Market

This section outlines the challenges and restraints impacting the O-Xylene market. This includes regulatory hurdles, supply chain disruptions, and intensifying competitive pressure, quantifying their impact on market growth. For example, fluctuations in crude oil prices and potential environmental regulations pose significant risks.

Future Opportunities in O-Xylene Industry

This section highlights promising emerging opportunities within the O-Xylene industry. These include exploring new markets, adopting innovative technologies, and capitalizing on evolving consumer trends. Examples include expanding into niche applications and developing sustainable production methods.

Major Players in the O-Xylene Industry Ecosystem

- China Petroleum & Chemical Corporation (Sinopec)

- Exxon Mobil Corporation (ExxonMobil)

- Flint Hills Resources

- Formosa Chemicals and Fibre Corporation

- KP Chemical Corp

- Nouri Petrochemical Company

- Reliance industries Ltd (Reliance Industries)

- Royal Dutch Shell PLC (Shell)

- SK Global Chemical Co Ltd

Key Developments in O-Xylene Industry Industry

- [Month, Year]: Launch of a new O-Xylene production facility by [Company Name], expanding capacity by XX Million tons.

- [Month, Year]: [Company Name] announces a strategic partnership to develop a new application for O-Xylene.

- [Month, Year]: New environmental regulations implemented in [Region], impacting production costs and market dynamics.

- Note: Add more bullet points with specific examples as available.

Strategic O-Xylene Industry Market Forecast

The O-Xylene market is poised for robust growth, driven by factors like increasing demand from downstream industries and technological advancements. The forecast period, 2025-2033, anticipates a Compound Annual Growth Rate (CAGR) of XX%, presenting substantial opportunities for market participants. The report provides detailed segmentation analysis and insights into future market potential for informed strategic investment decisions.

O-Xylene Industry Segmentation

-

1. Application

- 1.1. Phthalic Anhydride

- 1.2. Bactericides

- 1.3. Soybean Herbicides

- 1.4. Lube Oil Additives

- 1.5. Other Applications

O-Xylene Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

O-Xylene Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.86% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand as an Intermediate for PVC Production; Extensive Usage of Ortho-xylene in Paints and Adhesive Industries

- 3.3. Market Restrains

- 3.3.1. ; Increasing Demand as an Intermediate for PVC Production; Extensive Usage of Ortho-xylene in Paints and Adhesive Industries

- 3.4. Market Trends

- 3.4.1. Phthalic Anhydride (PA) to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global O-Xylene Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Phthalic Anhydride

- 5.1.2. Bactericides

- 5.1.3. Soybean Herbicides

- 5.1.4. Lube Oil Additives

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East

- 5.2.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific O-Xylene Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Phthalic Anhydride

- 6.1.2. Bactericides

- 6.1.3. Soybean Herbicides

- 6.1.4. Lube Oil Additives

- 6.1.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America O-Xylene Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Phthalic Anhydride

- 7.1.2. Bactericides

- 7.1.3. Soybean Herbicides

- 7.1.4. Lube Oil Additives

- 7.1.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe O-Xylene Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Phthalic Anhydride

- 8.1.2. Bactericides

- 8.1.3. Soybean Herbicides

- 8.1.4. Lube Oil Additives

- 8.1.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America O-Xylene Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Phthalic Anhydride

- 9.1.2. Bactericides

- 9.1.3. Soybean Herbicides

- 9.1.4. Lube Oil Additives

- 9.1.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East O-Xylene Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Phthalic Anhydride

- 10.1.2. Bactericides

- 10.1.3. Soybean Herbicides

- 10.1.4. Lube Oil Additives

- 10.1.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Saudi Arabia O-Xylene Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Phthalic Anhydride

- 11.1.2. Bactericides

- 11.1.3. Soybean Herbicides

- 11.1.4. Lube Oil Additives

- 11.1.5. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 China Petroleum & Chemical Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Exxon Mobil Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Flint Hills Resources

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Formosa Chemicals and Fibre Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 KP Chemical Corp

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Nouri Petrochemical Company

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Reliance industries Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Royal Dutch Shell PLC

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 SK Global Chemical Co Ltd*List Not Exhaustive

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 China Petroleum & Chemical Corporation

List of Figures

- Figure 1: Global O-Xylene Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific O-Xylene Industry Revenue (Million), by Application 2024 & 2032

- Figure 3: Asia Pacific O-Xylene Industry Revenue Share (%), by Application 2024 & 2032

- Figure 4: Asia Pacific O-Xylene Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Asia Pacific O-Xylene Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America O-Xylene Industry Revenue (Million), by Application 2024 & 2032

- Figure 7: North America O-Xylene Industry Revenue Share (%), by Application 2024 & 2032

- Figure 8: North America O-Xylene Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: North America O-Xylene Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe O-Xylene Industry Revenue (Million), by Application 2024 & 2032

- Figure 11: Europe O-Xylene Industry Revenue Share (%), by Application 2024 & 2032

- Figure 12: Europe O-Xylene Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: Europe O-Xylene Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: South America O-Xylene Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: South America O-Xylene Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: South America O-Xylene Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: South America O-Xylene Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Middle East O-Xylene Industry Revenue (Million), by Application 2024 & 2032

- Figure 19: Middle East O-Xylene Industry Revenue Share (%), by Application 2024 & 2032

- Figure 20: Middle East O-Xylene Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: Middle East O-Xylene Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Saudi Arabia O-Xylene Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Saudi Arabia O-Xylene Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Saudi Arabia O-Xylene Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Saudi Arabia O-Xylene Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global O-Xylene Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global O-Xylene Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global O-Xylene Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global O-Xylene Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global O-Xylene Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China O-Xylene Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India O-Xylene Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan O-Xylene Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea O-Xylene Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Asia Pacific O-Xylene Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global O-Xylene Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Global O-Xylene Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States O-Xylene Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada O-Xylene Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico O-Xylene Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global O-Xylene Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global O-Xylene Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Germany O-Xylene Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United Kingdom O-Xylene Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Italy O-Xylene Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: France O-Xylene Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Europe O-Xylene Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global O-Xylene Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global O-Xylene Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Brazil O-Xylene Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina O-Xylene Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of South America O-Xylene Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global O-Xylene Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global O-Xylene Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Global O-Xylene Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Global O-Xylene Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: South Africa O-Xylene Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Middle East O-Xylene Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the O-Xylene Industry?

The projected CAGR is approximately 3.86%.

2. Which companies are prominent players in the O-Xylene Industry?

Key companies in the market include China Petroleum & Chemical Corporation, Exxon Mobil Corporation, Flint Hills Resources, Formosa Chemicals and Fibre Corporation, KP Chemical Corp, Nouri Petrochemical Company, Reliance industries Ltd, Royal Dutch Shell PLC, SK Global Chemical Co Ltd*List Not Exhaustive.

3. What are the main segments of the O-Xylene Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand as an Intermediate for PVC Production; Extensive Usage of Ortho-xylene in Paints and Adhesive Industries.

6. What are the notable trends driving market growth?

Phthalic Anhydride (PA) to Dominate the Market.

7. Are there any restraints impacting market growth?

; Increasing Demand as an Intermediate for PVC Production; Extensive Usage of Ortho-xylene in Paints and Adhesive Industries.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "O-Xylene Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the O-Xylene Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the O-Xylene Industry?

To stay informed about further developments, trends, and reports in the O-Xylene Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence