Key Insights

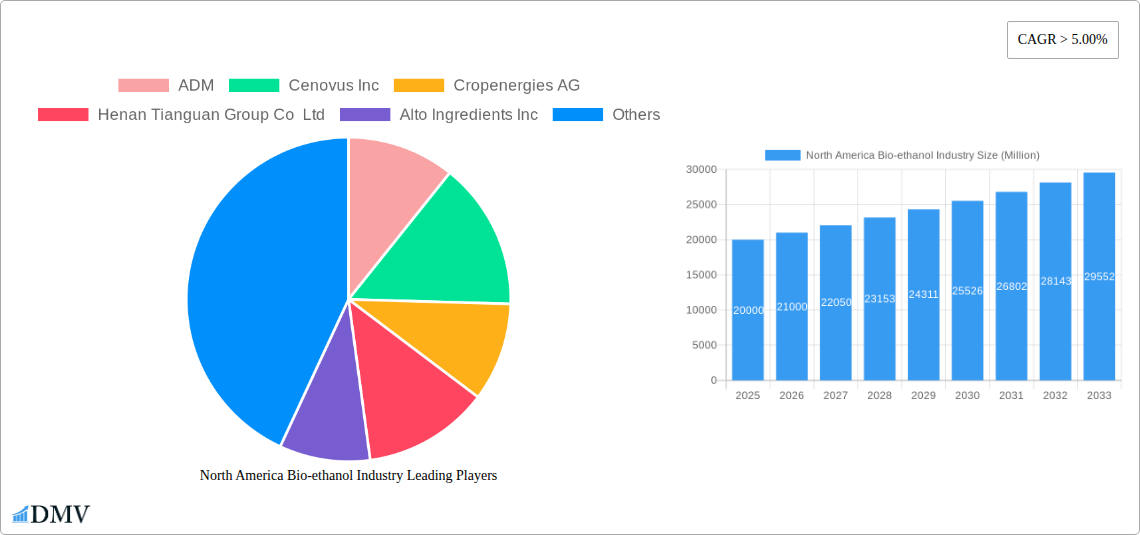

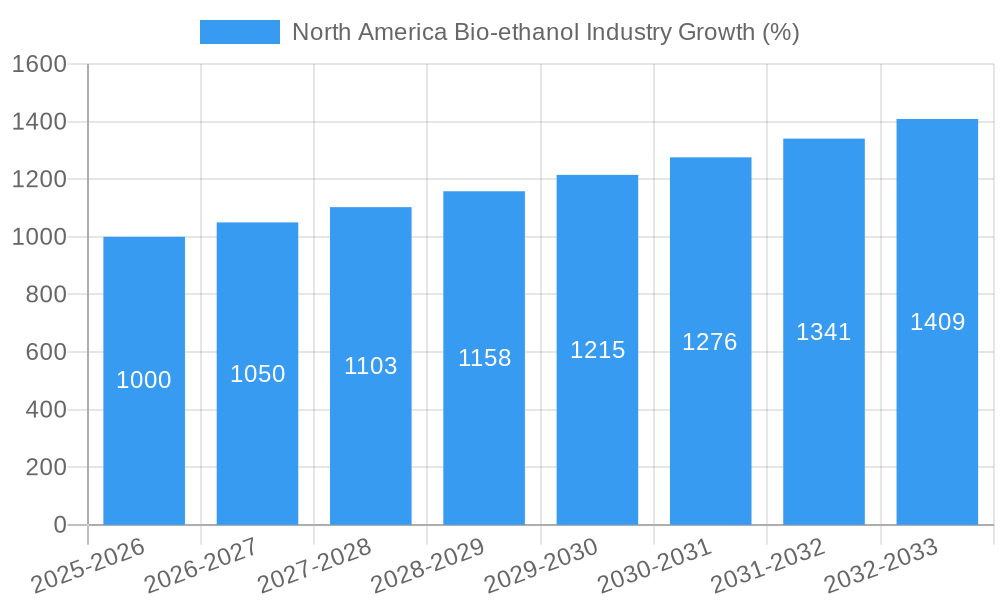

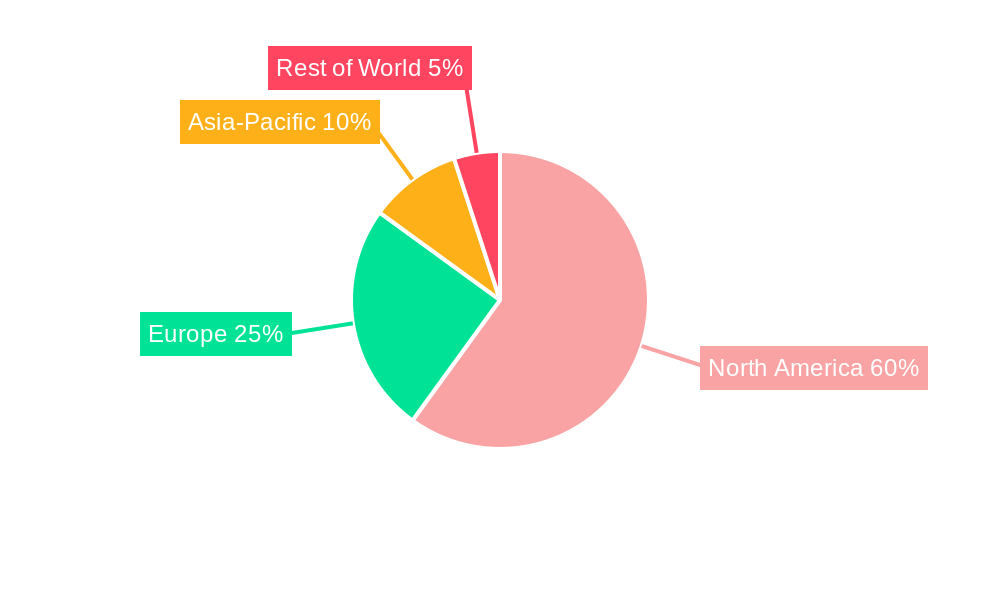

The North American bioethanol industry, currently valued at approximately $XX million (assuming a logical value based on global market size and North America's significant share), is projected to experience robust growth, exceeding a 5% Compound Annual Growth Rate (CAGR) through 2033. This expansion is driven by several key factors. Firstly, increasing government mandates and incentives promoting renewable fuels are significantly boosting bioethanol production and consumption. Secondly, the growing demand for sustainable transportation fuels, coupled with rising concerns about greenhouse gas emissions, is creating a favorable market environment. The automotive and transportation sector remains the dominant application for bioethanol, but expanding applications in food and beverage, cosmetics, and pharmaceuticals are adding further impetus to market growth. Corn remains the primary feedstock, benefiting from established infrastructure and agricultural practices, while sugarcane and other feedstocks are gradually gaining market share, driven by technological advancements and sustainability initiatives. However, challenges such as feedstock price volatility, competition from other renewable fuels, and land use concerns act as potential restraints. Major players like ADM, Poet LLC, and Green Plains Inc. are strategically investing in research and development, capacity expansions, and efficient production technologies to maintain their competitive edge. The United States holds the largest market share within North America, followed by Canada and Mexico, with the U.S. benefiting from its large agricultural base and supportive policies. Regional variations in feedstock availability, government regulations, and market demand influence the overall growth dynamics within the North American bioethanol market.

The forecast period (2025-2033) anticipates continuous market expansion, with the growth rate potentially influenced by fluctuations in global oil prices, technological breakthroughs in bioethanol production, and the overall global shift toward renewable energy solutions. The ongoing evolution of biorefinery technology, enabling the production of multiple value-added products from the same feedstock, is expected to further enhance the economic viability and sustainability of the bioethanol industry. Strategic partnerships between bioethanol producers and downstream industries will play a crucial role in fostering innovation and market expansion. A focus on improving the efficiency of bioethanol production, reducing costs, and addressing environmental concerns are critical for long-term sustainable growth and the establishment of the bioethanol industry as a key player in the global renewable energy landscape.

North America Bio-ethanol Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the North America bio-ethanol industry, offering a detailed examination of market trends, leading players, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025, this study offers invaluable insights for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The report leverages extensive data analysis and expert insights to provide a clear and concise overview of the market's current state and its future trajectory. The total market value in 2025 is estimated at $XX Million, with a projected value of $XX Million by 2033.

North America Bio-ethanol Industry Market Composition & Trends

This section delves into the competitive landscape of the North America bio-ethanol market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. The market is characterized by a mix of large multinational corporations and smaller, specialized players, resulting in a moderately concentrated market structure. Key drivers include increasing demand for renewable fuels, supportive government policies, and technological advancements in biofuel production. However, competition from substitute products like petroleum-based fuels and fluctuating feedstock prices pose significant challenges.

- Market Share Distribution: ADM, Green Plains Inc, and Valero hold a significant portion of the market share, with ADM leading at approximately xx%. The remaining share is dispersed among numerous smaller players.

- M&A Activity: The report analyzes notable M&A transactions, including ADM's sale of its Peoria ethanol plant in October 2021 for an estimated value of $XX Million, highlighting strategic shifts within the industry. The total value of M&A deals in the industry between 2019 and 2024 reached approximately $XX Million.

- Regulatory Landscape: A detailed analysis of government regulations and incentives influencing bio-ethanol production and consumption in North America, covering policies related to renewable fuel standards (RFS) and carbon emission reduction targets.

- Innovation Catalysts: The report details how technological advancements in feedstock utilization, fermentation processes, and biofuel conversion are driving innovation and increasing the efficiency of bio-ethanol production.

North America Bio-ethanol Industry Industry Evolution

This section meticulously tracks the evolution of the North America bio-ethanol industry, showcasing growth trajectories, technological breakthroughs, and the evolving preferences of consumers. The industry has witnessed significant growth over the past decade, driven by factors such as stringent environmental regulations and government support for renewable fuels. The industry's growth rate from 2019 to 2024 averaged approximately XX% annually, driven by strong demand from the automotive and transportation sector. However, the industry is facing challenges related to feedstock availability and price volatility. Technological advancements, such as the development of cellulosic ethanol, are opening up new opportunities for growth and sustainability. Consumer demand for bio-ethanol is also increasing, reflecting growing awareness of environmental issues and the desire for cleaner energy sources. The adoption rate of bio-ethanol in the automotive sector has grown by an estimated XX% since 2019.

Leading Regions, Countries, or Segments in North America Bio-ethanol Industry

This section pinpoints the dominant regions, countries, and segments within the North America bio-ethanol industry.

Dominant Feedstock: Corn remains the dominant feedstock in North America, accounting for approximately xx% of total bio-ethanol production due to its widespread availability and established infrastructure.

Dominant Application: The automotive and transportation sector is the largest consumer of bio-ethanol, fueled by government mandates and growing consumer preference for cleaner fuels.

Key Drivers (Bullet Points):

- Corn Belt States: High corn production in states like Iowa, Illinois, and Nebraska facilitates economies of scale.

- Government Incentives: Tax credits and renewable fuel standards (RFS) incentivize bio-ethanol production and use.

- Investment in Infrastructure: Significant investments have expanded bio-ethanol production facilities and distribution networks.

Factors Contributing to Dominance:

The dominance of corn as a feedstock and the automotive sector as a primary application stem from a combination of factors including established supply chains, government support, and the high energy content of corn-based ethanol. This dominance is however, likely to evolve with growing interest and investment in alternative feedstocks and applications.

North America Bio-ethanol Industry Product Innovations

Recent product innovations have focused on improving the efficiency and sustainability of bio-ethanol production. Advancements in cellulosic ethanol production, utilizing non-food biomass like wood chips and agricultural residues, promise a more sustainable and less food-competitive biofuel source. This includes VERBIO AG’s pioneering cellulosic RNG plant, capable of producing 7 million EGE of RNG annually. Further innovations are aimed at enhancing the performance characteristics of bio-ethanol blends, including their octane ratings and compatibility with existing engine technologies. These innovations contribute to the cost-competitiveness and environmental benefits of bio-ethanol, expanding its market potential.

Propelling Factors for North America Bio-ethanol Industry Growth

Several factors are driving the growth of the North America bio-ethanol industry. Stringent environmental regulations promoting renewable fuels, increasing consumer demand for sustainable alternatives, and technological advancements in production efficiency significantly boost market expansion. Government incentives, such as tax credits and mandates like the RFS, also incentivize production and consumption, while the expansion of flexible fuel vehicles (FFVs) creates wider market adoption opportunities. The development of cellulosic ethanol offers an even more sustainable alternative, promising increased market growth.

Obstacles in the North America Bio-ethanol Industry Market

Despite its potential, the North America bio-ethanol industry faces challenges. Volatility in feedstock prices (corn, sugarcane, etc.) significantly impacts production costs and profitability. Competition from cheaper fossil fuels remains a barrier, while logistical hurdles and infrastructure limitations restrict wider market access. Furthermore, regulatory uncertainties and the potential for conflicting environmental regulations can create uncertainty and hamper growth.

Future Opportunities in North America Bio-ethanol Industry

The future of the North America bio-ethanol industry looks promising. Increased research and development into advanced biofuels (cellulosic ethanol, biobutanol), along with the emergence of new markets (e.g., biochemicals) offer significant opportunities. Expansion into new feedstock sources and enhancing the integration of bio-refineries to produce multiple value-added products (e.g., animal feed) presents further growth avenues. Moreover, continued government support and evolving consumer preferences for sustainable transportation fuels will further drive market growth.

Major Players in the North America Bio-ethanol Industry Ecosystem

- ADM (ADM)

- Cenovus Inc (Cenovus Inc)

- Cropenergies AG (Cropenergies AG)

- Henan Tianguan Group Co Ltd

- Alto Ingredients Inc (Alto Ingredients Inc)

- Green Plains Inc (Green Plains Inc)

- Suncor Energy Inc (Suncor Energy Inc)

- Valero (Valero)

- Ethanol Technologies

- Verbio Vereinigte Bioenergie AG (Verbio Vereinigte Bioenergie AG)

- Abengoa

- Granbio Investimentos SA

- Sekab

- Blue Bio Fuels Inc

- Lantmannen

- Cristalco

- Poet LLC

- Jilin Fuel Ethanol Co Ltd

- Raizen

- KWST

Key Developments in North America Bio-ethanol Industry Industry

- May 2022: VERBIO AG launched its first cellulosic RNG plant in the US, achieving full-scale production of 7 Million EGE of RNG annually by mid-summer 2022. This plant is expected to produce 60 Million gallons of corn-based ethanol annually starting in 2023, significantly increasing the supply of renewable fuels and demonstrating the feasibility of cellulosic ethanol production on a large scale.

- October 2021: ADM sold its ethanol manufacturing plant in Peoria, Illinois, to BioUrja Group. This transaction reflects ongoing industry consolidation and strategic repositioning by major players.

Strategic North America Bio-ethanol Industry Market Forecast

The North America bio-ethanol industry is poised for sustained growth driven by factors such as increasing environmental regulations, the growing adoption of renewable fuels, and ongoing technological advancements. The market is expected to witness robust expansion over the forecast period (2025-2033), with significant opportunities arising from the growing demand for sustainable transportation fuels, the development of advanced biofuels, and the expansion of biorefineries into diversified product portfolios. Continuous innovation and supportive government policies will contribute to further market growth and solidify the role of bio-ethanol in the transition towards a more sustainable energy future.

North America Bio-ethanol Industry Segmentation

-

1. Feedstock Type

- 1.1. Sugarcane

- 1.2. Corn

- 1.3. Wheat

- 1.4. Other Feedstocks

-

2. Application

- 2.1. Automotive and Transportation

- 2.2. Food and Beverage

- 2.3. Pharmaceutical

- 2.4. Cosmetics and Personal Care

- 2.5. Other Applications

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Bio-ethanol Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Bio-ethanol Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Favorable Initiatives and Blending Mandates by Regulatory Bodies; Rising Environmental Concerns by the Use of Fossil Fuels and Need for the Bio-fuels

- 3.3. Market Restrains

- 3.3.1. Phasing out of Fuel-based Vehicles Due to Rising Demand for Electric Vehicles; Shifting Focus to Bio-butanol

- 3.4. Market Trends

- 3.4.1. Automotive and Transportation Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Bio-ethanol Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 5.1.1. Sugarcane

- 5.1.2. Corn

- 5.1.3. Wheat

- 5.1.4. Other Feedstocks

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Automotive and Transportation

- 5.2.2. Food and Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Cosmetics and Personal Care

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 6. United States North America Bio-ethanol Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 6.1.1. Sugarcane

- 6.1.2. Corn

- 6.1.3. Wheat

- 6.1.4. Other Feedstocks

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Automotive and Transportation

- 6.2.2. Food and Beverage

- 6.2.3. Pharmaceutical

- 6.2.4. Cosmetics and Personal Care

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 7. Canada North America Bio-ethanol Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 7.1.1. Sugarcane

- 7.1.2. Corn

- 7.1.3. Wheat

- 7.1.4. Other Feedstocks

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Automotive and Transportation

- 7.2.2. Food and Beverage

- 7.2.3. Pharmaceutical

- 7.2.4. Cosmetics and Personal Care

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 8. Mexico North America Bio-ethanol Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 8.1.1. Sugarcane

- 8.1.2. Corn

- 8.1.3. Wheat

- 8.1.4. Other Feedstocks

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Automotive and Transportation

- 8.2.2. Food and Beverage

- 8.2.3. Pharmaceutical

- 8.2.4. Cosmetics and Personal Care

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Feedstock Type

- 9. United States North America Bio-ethanol Industry Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Bio-ethanol Industry Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Bio-ethanol Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Bio-ethanol Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 ADM

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Cenovus Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Cropenergies AG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Henan Tianguan Group Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Alto Ingredients Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Green Plains Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Suncor Energy Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Valero

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Ethanol Technologies

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Verbio Vereinigte Bioenergie AG*List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Abengoa

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Granbio Investimentos SA

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Sekab

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Blue Bio Fuels Inc

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Lantmannen

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Cristalco

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Poet LLC

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 Jilin Fuel Ethanol Co Ltd

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.19 Raizen

- 13.2.19.1. Overview

- 13.2.19.2. Products

- 13.2.19.3. SWOT Analysis

- 13.2.19.4. Recent Developments

- 13.2.19.5. Financials (Based on Availability)

- 13.2.20 KWST

- 13.2.20.1. Overview

- 13.2.20.2. Products

- 13.2.20.3. SWOT Analysis

- 13.2.20.4. Recent Developments

- 13.2.20.5. Financials (Based on Availability)

- 13.2.1 ADM

List of Figures

- Figure 1: North America Bio-ethanol Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Bio-ethanol Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Bio-ethanol Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Bio-ethanol Industry Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 3: North America Bio-ethanol Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: North America Bio-ethanol Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Bio-ethanol Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Bio-ethanol Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Bio-ethanol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Bio-ethanol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Bio-ethanol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Bio-ethanol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Bio-ethanol Industry Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 12: North America Bio-ethanol Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 13: North America Bio-ethanol Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Bio-ethanol Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Bio-ethanol Industry Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 16: North America Bio-ethanol Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: North America Bio-ethanol Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Bio-ethanol Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Bio-ethanol Industry Revenue Million Forecast, by Feedstock Type 2019 & 2032

- Table 20: North America Bio-ethanol Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 21: North America Bio-ethanol Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Bio-ethanol Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Bio-ethanol Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the North America Bio-ethanol Industry?

Key companies in the market include ADM, Cenovus Inc, Cropenergies AG, Henan Tianguan Group Co Ltd, Alto Ingredients Inc, Green Plains Inc, Suncor Energy Inc, Valero, Ethanol Technologies, Verbio Vereinigte Bioenergie AG*List Not Exhaustive, Abengoa, Granbio Investimentos SA, Sekab, Blue Bio Fuels Inc, Lantmannen, Cristalco, Poet LLC, Jilin Fuel Ethanol Co Ltd, Raizen, KWST.

3. What are the main segments of the North America Bio-ethanol Industry?

The market segments include Feedstock Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Favorable Initiatives and Blending Mandates by Regulatory Bodies; Rising Environmental Concerns by the Use of Fossil Fuels and Need for the Bio-fuels.

6. What are the notable trends driving market growth?

Automotive and Transportation Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Phasing out of Fuel-based Vehicles Due to Rising Demand for Electric Vehicles; Shifting Focus to Bio-butanol.

8. Can you provide examples of recent developments in the market?

May 2022: VERBIO AG opened the first cellulosic RNG plant in the United States, achieving full-scale production of 7 million ethanol gallons equivalent (EGE) of RNG annually by mid-summer 2022. In 2023, this project is expected to start functioning as a biorefinery, producing 60 million gallons of corn-based ethanol annually.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Bio-ethanol Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Bio-ethanol Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Bio-ethanol Industry?

To stay informed about further developments, trends, and reports in the North America Bio-ethanol Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence