Key Insights

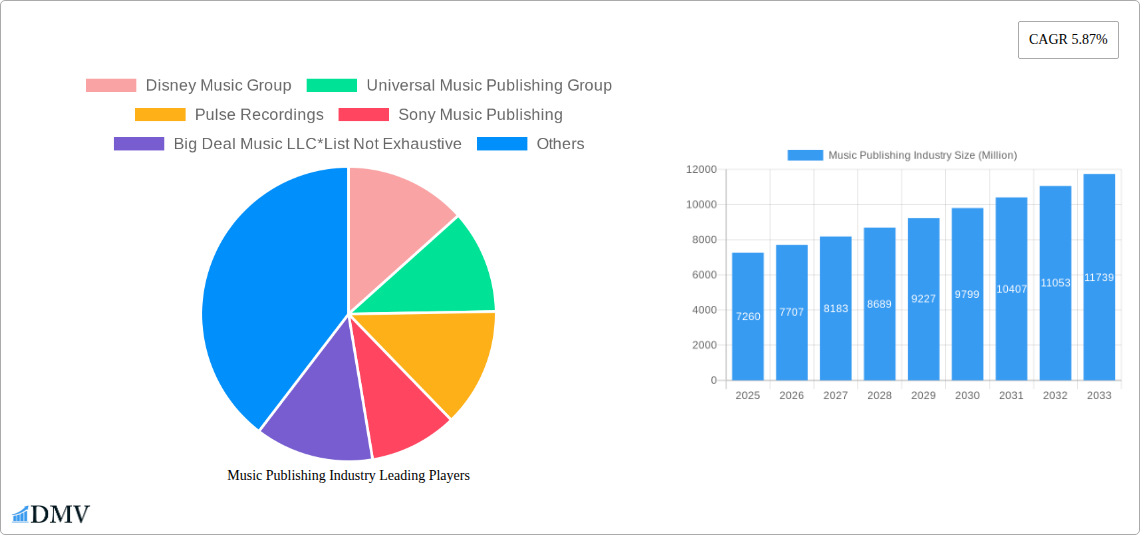

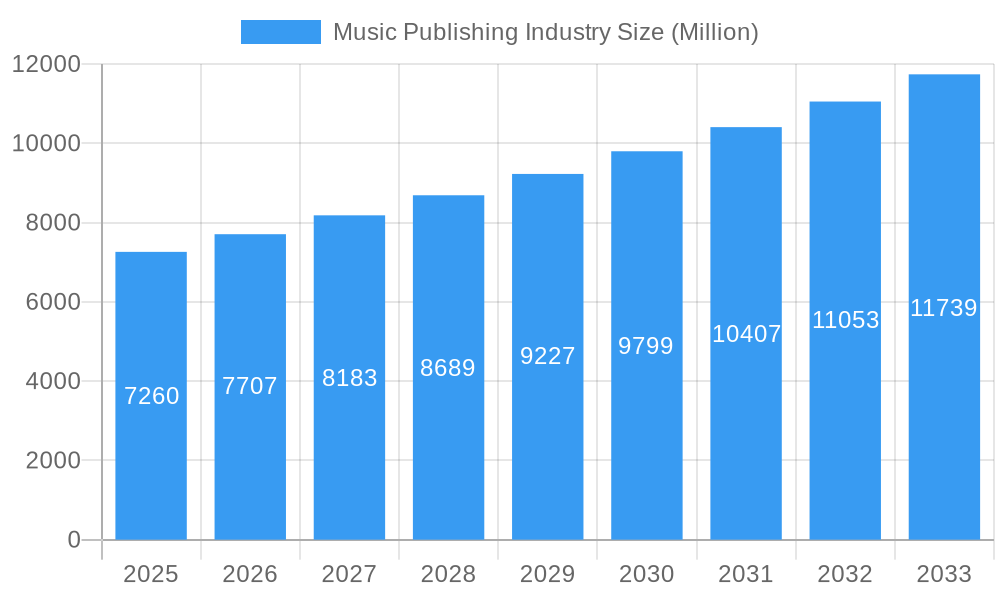

The music publishing industry, valued at $7.26 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 5.87% from 2025 to 2033. This growth is fueled by several key factors. The rise of streaming services has significantly increased digital revenue streams for publishers, offsetting declines in physical sales. Furthermore, the increasing popularity of sync licensing (using music in film, television, and advertising) contributes to a diversified revenue model, mitigating reliance on any single income source. The industry's diversification extends to its revenue segments, with performance royalties (from radio airplay and live performances), synchronization royalties, and digital revenues each playing a crucial role. The expanding use of music in various media, coupled with the growing popularity of independent artists and labels, creates further opportunities for growth. While challenges such as copyright infringement and the complexities of royalty collection persist, the industry's adaptability and innovative approaches to revenue generation suggest a promising future.

Music Publishing Industry Market Size (In Billion)

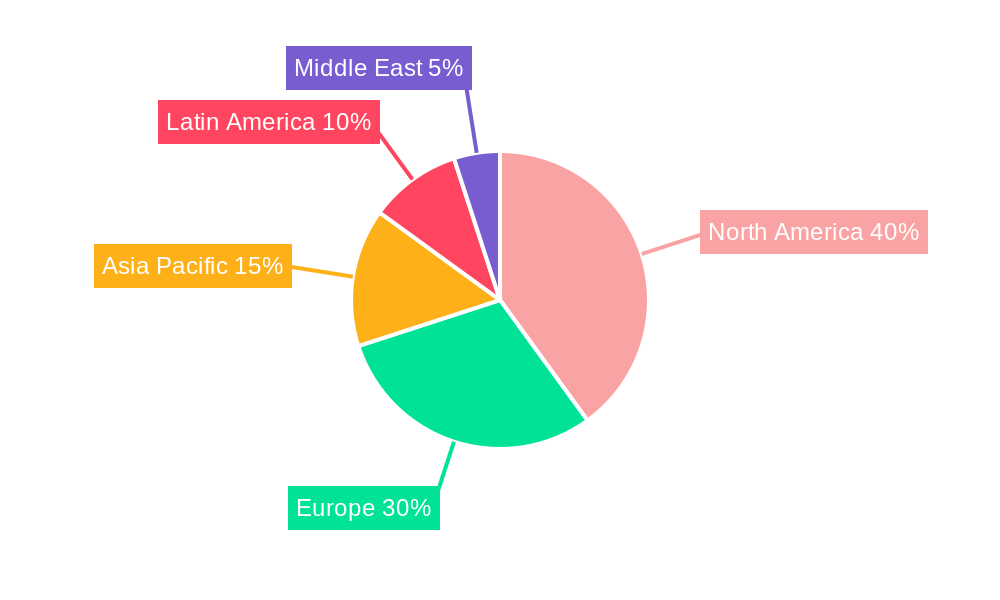

Despite the positive outlook, the music publishing industry faces certain headwinds. Negotiating fair compensation for music usage in the digital landscape remains a significant challenge, particularly with the emergence of new platforms and technologies. Competition among music publishers is fierce, requiring companies to actively pursue innovative strategies to attract and retain talent. Maintaining profitability in the face of fluctuating royalty rates and changing consumption patterns necessitates effective management practices and strategic partnerships. Geographical differences in market growth will also influence overall industry trends, with regions such as North America and Europe potentially experiencing faster expansion compared to others. Understanding these dynamics is crucial for stakeholders to navigate the complexities of the market and capitalize on its evolving landscape. Successful players will be those that effectively leverage technological advancements, cultivate strong relationships with artists and composers, and navigate the complexities of international licensing and distribution.

Music Publishing Industry Company Market Share

Music Publishing Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the global music publishing industry, encompassing market trends, leading players, and future forecasts. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers crucial data for stakeholders seeking to navigate this dynamic sector. The forecast period covers 2025-2033, while the historical period analyzed is 2019-2024. Expect comprehensive data on revenue streams, market share distribution, and significant M&A activity, all presented with a focus on maximizing your return on investment. The total market value is predicted to reach xx Million by 2033.

Music Publishing Industry Market Composition & Trends

The music publishing industry is characterized by a concentrated market structure, with a few major players commanding significant market share. While exact figures vary by segment, the top five publishers (Universal Music Publishing Group, Sony Music Publishing, Warner Chappell Music Inc, Kobalt Music Group Ltd, and BMG Rights Management GmbH) likely account for over 50% of the global market. This concentration is reflected in the high value of M&A transactions, with deals often exceeding hundreds of Millions. Innovation is driven by technological advancements such as blockchain for royalty management and AI-powered music discovery tools. The regulatory landscape varies globally, impacting licensing agreements and royalty distribution. Substitute products, such as independent artists distributing directly via streaming platforms, exert competitive pressure. End-users are primarily music users, but also include film and advertising companies using synchronization licenses.

- Market Share Distribution (Estimated 2025): Universal Music Publishing Group (xx%), Sony Music Publishing (xx%), Warner Chappell Music Inc (xx%), Kobalt Music Group Ltd (xx%), BMG Rights Management GmbH (xx%), Others (xx%).

- M&A Activity (2019-2024): Total deal value exceeding xx Million. Notable deals include Universal Music Group's acquisition of Neil Diamond's catalog (Feb 2022).

- Key Innovation Catalysts: Blockchain technology, AI-powered music discovery, improved royalty tracking systems.

- Regulatory Landscape: Varies significantly across jurisdictions, impacting licensing and copyright regulations.

Music Publishing Industry Industry Evolution

The music publishing industry has undergone a significant transformation driven by digital disruption. The shift from physical media to digital streaming platforms has reshaped revenue models and forced publishers to adapt to new distribution channels. Growth has been uneven across segments, with digital revenue experiencing the most dramatic increase while physical revenue continues its decline. Technological advancements in music production and distribution have lowered barriers to entry for independent artists, increasing competition. Consumer demands have shifted towards on-demand streaming and personalized playlists, requiring publishers to develop strategies for audience engagement in the digital landscape. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx%, and is projected to be xx% during the forecast period (2025-2033). Adoption rates of digital music streaming services are near saturation in major markets, while growth now centers on emerging markets and evolving user habits like short-form video platforms.

Leading Regions, Countries, or Segments in Music Publishing Industry

The United States remains the largest market for music publishing, followed by the United Kingdom and other major European countries. However, growth is being seen in regions like Asia and Latin America, fueled by rising disposable incomes and increased internet penetration.

- By Royalties:

- Digital Revenue: This segment dominates the market, driven by the popularity of streaming services. Key drivers include high rates of subscription adoption, increasing user engagement in short-form videos, and the ongoing evolution of streaming services towards enhanced personalization capabilities.

- Performance Royalties: These revenues are heavily tied to radio airplay and public performances, and remain significant but show slower growth compared to digital.

- Synchronization Royalties: This segment, associated with the use of music in film, television, and advertising, offers diverse revenue opportunities and continued steady growth.

- Physical Revenue: This segment continues to decline due to the preference for digital music consumption.

Music Publishing Industry Product Innovations

Recent innovations focus on enhancing royalty collection and distribution transparency through blockchain technology, improving music discovery through AI-powered tools, and developing sophisticated data analytics to optimize licensing and marketing strategies. The development of customized music licensing solutions for the expanding Metaverse and other emerging interactive platforms showcases innovative approaches to adapting to evolving trends in digital media consumption.

Propelling Factors for Music Publishing Industry Growth

Technological advancements in music production and distribution, coupled with the increasing consumption of digital music through streaming services, are major growth drivers. Furthermore, the expansion of global markets and favorable regulatory environments in some regions are boosting the industry's overall performance. The growth of short-form video platforms further provides new avenues for music usage and royalty generation.

Obstacles in the Music Publishing Industry Market

Copyright infringement remains a significant challenge, alongside the complexities of royalty collection and distribution across numerous platforms and territories. Competition from independent artists and labels is increasing, while fluctuations in the global economy impact spending on music licensing.

Future Opportunities in Music Publishing Industry

Emerging opportunities include further expansion into developing markets, the integration of blockchain technology for enhanced transparency, and strategic partnerships with technology companies focused on AI-powered music discovery. The exploration of the Metaverse and Web3 offers new avenues for music licensing and revenue generation. Capitalizing on the increased integration of personalized music services and expanding into niche genres also represent key avenues for future growth.

Major Players in the Music Publishing Industry Ecosystem

- Disney Music Group

- Universal Music Publishing Group

- Pulse Recordings

- Sony Music Publishing

- Big Deal Music LLC

- Big Yellow Dog Music LLC

- Kobalt Music Group Ltd

- Black River Entertainment

- BMG Rights Management GmbH

- Reach Music Publishing Inc

- Round Hill Music

- Warner Chappell Music Inc

Key Developments in Music Publishing Industry Industry

- May 2022: Sony Music Publishing UK signs rising singer-songwriter Kal Lavelle to a global publishing deal.

- February 2022: Universal Music Publishing Group acquires Neil Diamond's entire song catalog.

- February 2022: Warner Music Group partners with Influence Media Partners and BlackRock to create a music rights platform.

Strategic Music Publishing Industry Market Forecast

The music publishing industry is poised for continued growth driven by the ongoing expansion of digital music consumption and the emergence of new technologies and platforms. Strategic partnerships, technological innovation, and effective copyright protection will be crucial for sustained success in this competitive environment. The market is expected to experience steady growth, propelled by increasing digital penetration and new avenues for revenue generation.

Music Publishing Industry Segmentation

-

1. Royalties

- 1.1. Performance

- 1.2. Synchronization

- 1.3. Digital Revenue

- 1.4. Physical Revenue

Music Publishing Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Music Publishing Industry Regional Market Share

Geographic Coverage of Music Publishing Industry

Music Publishing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Popularity of Music Streaming Services; Increasing Live Concerts and Performances; Growing Adoption of Digital Music

- 3.3. Market Restrains

- 3.3.1. Privacy Issues; Decline in Physical Volume Sales

- 3.4. Market Trends

- 3.4.1. Digital Revenue has the Largest Growth in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Music Publishing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Royalties

- 5.1.1. Performance

- 5.1.2. Synchronization

- 5.1.3. Digital Revenue

- 5.1.4. Physical Revenue

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Royalties

- 6. North America Music Publishing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Royalties

- 6.1.1. Performance

- 6.1.2. Synchronization

- 6.1.3. Digital Revenue

- 6.1.4. Physical Revenue

- 6.1. Market Analysis, Insights and Forecast - by Royalties

- 7. Europe Music Publishing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Royalties

- 7.1.1. Performance

- 7.1.2. Synchronization

- 7.1.3. Digital Revenue

- 7.1.4. Physical Revenue

- 7.1. Market Analysis, Insights and Forecast - by Royalties

- 8. Asia Pacific Music Publishing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Royalties

- 8.1.1. Performance

- 8.1.2. Synchronization

- 8.1.3. Digital Revenue

- 8.1.4. Physical Revenue

- 8.1. Market Analysis, Insights and Forecast - by Royalties

- 9. Latin America Music Publishing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Royalties

- 9.1.1. Performance

- 9.1.2. Synchronization

- 9.1.3. Digital Revenue

- 9.1.4. Physical Revenue

- 9.1. Market Analysis, Insights and Forecast - by Royalties

- 10. Middle East and Africa Music Publishing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Royalties

- 10.1.1. Performance

- 10.1.2. Synchronization

- 10.1.3. Digital Revenue

- 10.1.4. Physical Revenue

- 10.1. Market Analysis, Insights and Forecast - by Royalties

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Disney Music Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Universal Music Publishing Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pulse Recordings

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sony Music Publishing

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Big Deal Music LLC*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Big Yellow Dog Music LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kobalt Music Group Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Black River Entertainment

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BMG Rights Management GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Reach Music Publishing Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Round Hill Music

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Warner Chappell Music Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Disney Music Group

List of Figures

- Figure 1: Global Music Publishing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Music Publishing Industry Revenue (Million), by Royalties 2025 & 2033

- Figure 3: North America Music Publishing Industry Revenue Share (%), by Royalties 2025 & 2033

- Figure 4: North America Music Publishing Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Music Publishing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Music Publishing Industry Revenue (Million), by Royalties 2025 & 2033

- Figure 7: Europe Music Publishing Industry Revenue Share (%), by Royalties 2025 & 2033

- Figure 8: Europe Music Publishing Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Music Publishing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Music Publishing Industry Revenue (Million), by Royalties 2025 & 2033

- Figure 11: Asia Pacific Music Publishing Industry Revenue Share (%), by Royalties 2025 & 2033

- Figure 12: Asia Pacific Music Publishing Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Music Publishing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Music Publishing Industry Revenue (Million), by Royalties 2025 & 2033

- Figure 15: Latin America Music Publishing Industry Revenue Share (%), by Royalties 2025 & 2033

- Figure 16: Latin America Music Publishing Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Music Publishing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Music Publishing Industry Revenue (Million), by Royalties 2025 & 2033

- Figure 19: Middle East and Africa Music Publishing Industry Revenue Share (%), by Royalties 2025 & 2033

- Figure 20: Middle East and Africa Music Publishing Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Music Publishing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Music Publishing Industry Revenue Million Forecast, by Royalties 2020 & 2033

- Table 2: Global Music Publishing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Music Publishing Industry Revenue Million Forecast, by Royalties 2020 & 2033

- Table 4: Global Music Publishing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Music Publishing Industry Revenue Million Forecast, by Royalties 2020 & 2033

- Table 6: Global Music Publishing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Music Publishing Industry Revenue Million Forecast, by Royalties 2020 & 2033

- Table 8: Global Music Publishing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Music Publishing Industry Revenue Million Forecast, by Royalties 2020 & 2033

- Table 10: Global Music Publishing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Music Publishing Industry Revenue Million Forecast, by Royalties 2020 & 2033

- Table 12: Global Music Publishing Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Music Publishing Industry?

The projected CAGR is approximately 5.87%.

2. Which companies are prominent players in the Music Publishing Industry?

Key companies in the market include Disney Music Group, Universal Music Publishing Group, Pulse Recordings, Sony Music Publishing, Big Deal Music LLC*List Not Exhaustive, Big Yellow Dog Music LLC, Kobalt Music Group Ltd, Black River Entertainment, BMG Rights Management GmbH, Reach Music Publishing Inc, Round Hill Music, Warner Chappell Music Inc.

3. What are the main segments of the Music Publishing Industry?

The market segments include Royalties.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Music Streaming Services; Increasing Live Concerts and Performances; Growing Adoption of Digital Music.

6. What are the notable trends driving market growth?

Digital Revenue has the Largest Growth in the Market.

7. Are there any restraints impacting market growth?

Privacy Issues; Decline in Physical Volume Sales.

8. Can you provide examples of recent developments in the market?

May 2022 - A global publishing deal was signed by rising singer-songwriter Kal Lavelle, according to Sony Music Publishing United Kingdom. Due to her collaborations with Ed Sheeran, Irish-born singer-songwriter Kal Lavelle has quickly emerged as one of the genre's most promising hitmakers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Music Publishing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Music Publishing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Music Publishing Industry?

To stay informed about further developments, trends, and reports in the Music Publishing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence