Key Insights

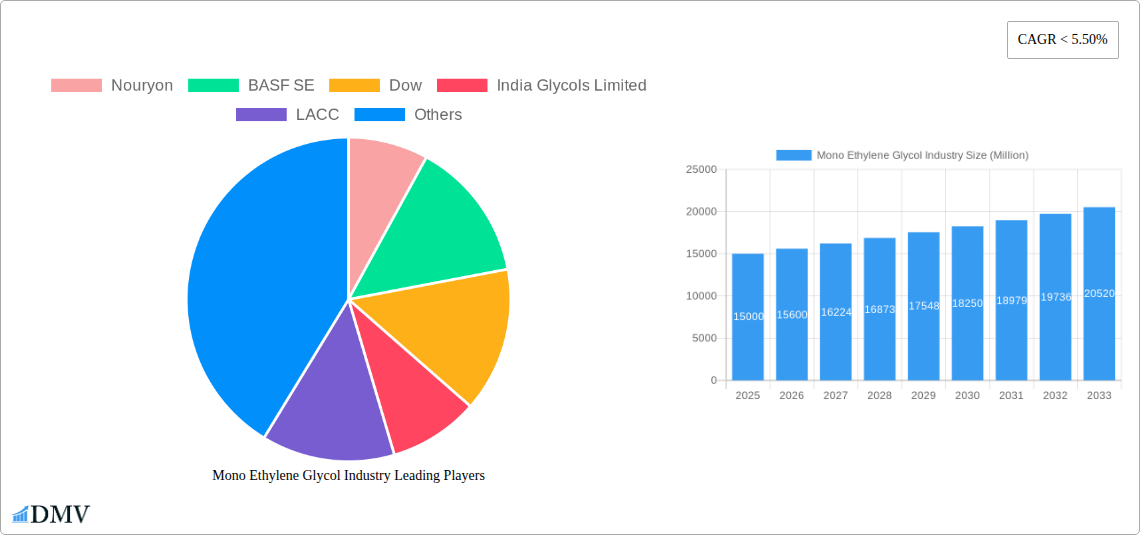

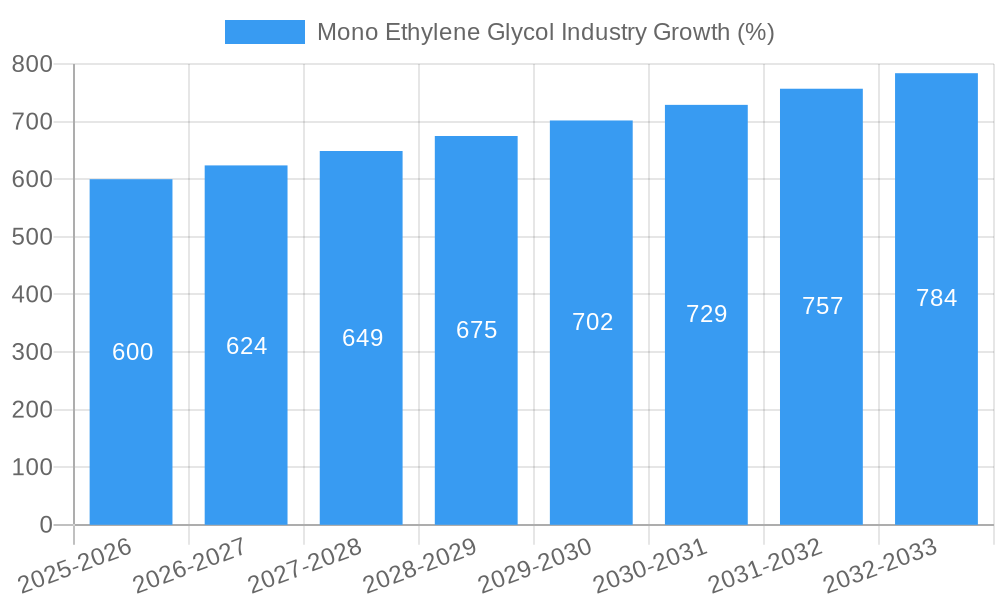

The Mono Ethylene Glycol (MEG) market experienced robust growth between 2019 and 2024, driven primarily by its extensive application in the antifreeze and coolant sector, as well as its use in polyester fiber and polyethylene terephthalate (PET) production. The increasing demand for these products, particularly in the construction and automotive industries, fueled market expansion. While precise market size figures for past years are unavailable, a logical assessment, considering typical CAGR trends in the chemical sector and the consistent demand for MEG, suggests a steady upward trajectory. Assuming a conservative average annual growth rate (CAGR) of 4% during the historical period, we can infer substantial market expansion throughout those years. The base year of 2025 shows a strong market foundation, indicating sustained demand and ongoing industry health.

Looking ahead, the forecast period (2025-2033) anticipates continued growth in the MEG market, fueled by factors such as expanding infrastructure development in emerging economies, the rise in global vehicle production, and the increasing use of PET in packaging. However, the pace of growth is expected to moderate slightly compared to the previous period, potentially settling around a CAGR of 3.5% to 4%. This moderation reflects the mature nature of the market and potential fluctuations stemming from raw material prices and global economic conditions. Technological advancements in MEG production, such as improved energy efficiency and reduced waste generation, will contribute to long-term sustainability and overall market stability, supporting continued though perhaps less dramatic growth in the years to come.

Mono Ethylene Glycol Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Mono Ethylene Glycol (MEG) industry, covering market trends, leading players, future opportunities, and challenges. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and navigate this dynamic market. The report leverages extensive data analysis to provide actionable insights and projections, offering a valuable foundation for strategic decision-making. The global MEG market is estimated to reach xx Million by 2033.

Mono Ethylene Glycol Industry Market Composition & Trends

This section delves into the intricate composition and evolving trends of the MEG market. We analyze market concentration, revealing the share distribution among key players like Nouryon, BASF SE, Dow, India Glycols Limited, LACC, LyondellBasell Industries Holdings BV, Mitsubishi Chemical Corporation, Nan Ya Plastics Corporation, Reliance Industries Limited, Royal Dutch Shell PLC, SABIC, and Solventis (list not exhaustive). The report examines innovation catalysts driving product differentiation and market expansion, including advancements in production technology and application-specific formulations. We also explore the regulatory landscape, identifying key policies and their impact on market dynamics. Furthermore, the analysis considers the influence of substitute products and evolving end-user preferences across various sectors. The report incorporates data on M&A activities, including deal values and their implications for market consolidation.

- Market Share Distribution: A detailed breakdown of market share held by major players, revealing the level of market concentration. Data will show the top 5 players controlling approximately xx% of the market in 2024.

- Innovation Catalysts: Analysis of technological advancements, including process optimization and novel product formulations, which are reshaping the competitive landscape.

- Regulatory Landscape: Assessment of key regulations impacting MEG production, distribution, and consumption across major regions, including their influence on market growth.

- Substitute Products: Evaluation of alternative materials and their competitive impact on MEG demand, along with detailed analysis of price competition and market penetration.

- End-User Profiles: Detailed segmentation of end-users across various industries, highlighting their consumption patterns and future demand projections.

- M&A Activities: Review of recent mergers and acquisitions, including their impact on market structure and competitive dynamics. Significant transactions will be analyzed, providing an understanding of the evolving landscape and market valuation metrics.

Mono Ethylene Glycol Industry Industry Evolution

This section provides a comprehensive analysis of the MEG industry's historical and projected evolution. We examine long-term growth trajectories, analyzing factors influencing market expansion and contraction. Technological advancements, from process efficiency improvements to the introduction of novel production techniques, are meticulously reviewed. Shifting consumer demands, including growing applications in new industries, are considered, with an assessment of their influence on market size and composition. The analysis integrates detailed data points such as historical and projected growth rates (CAGR), adoption metrics for new technologies, and evolving demand patterns across key end-use segments. The report also explores the effects of macroeconomic factors, such as fluctuations in raw material prices and global economic conditions, on market growth.

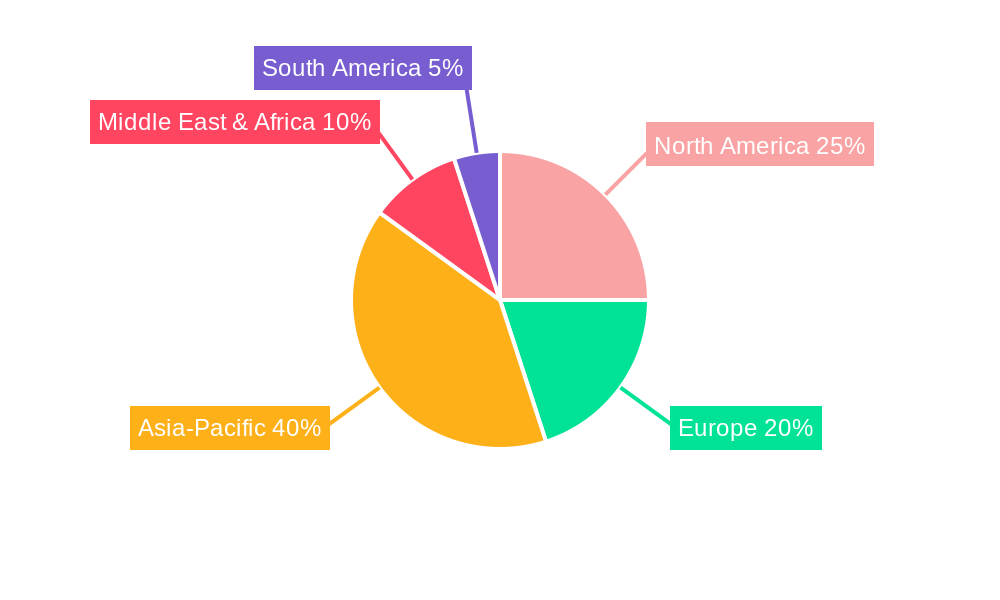

Leading Regions, Countries, or Segments in Mono Ethylene Glycol Industry

This segment pinpoints the dominant regions, countries, and segments within the MEG market. We examine the factors driving the leadership of the leading regions and countries, providing a detailed explanation of their dominance. A deep dive into market dynamics in these areas is incorporated, including specific examples of successful business strategies and prominent players.

- Key Drivers of Dominance:

- Investment Trends: Analysis of significant capital investments in production facilities and infrastructure within the leading regions, impacting production capacity and market share.

- Regulatory Support: Assessment of supportive government policies and regulations that promote industry growth and foster competitiveness.

- Access to Raw Materials: Evaluation of the accessibility and cost of ethylene, a critical raw material for MEG production, influencing production costs and profitability.

- Strong Demand: Discussion of high demand for MEG from downstream industries, supporting robust market performance.

Mono Ethylene Glycol Industry Product Innovations

This section details recent product innovations in the MEG industry, highlighting unique selling propositions and technological advancements that are driving product differentiation and market expansion. We assess performance metrics and examine how these innovations are shaping the future of the MEG market. The analysis includes new applications and their contribution to revenue growth.

Propelling Factors for Mono Ethylene Glycol Industry Growth

Several key factors are propelling the growth of the MEG market. Technological advancements leading to enhanced production efficiency and reduced costs are significant drivers. Strong economic growth in various end-use industries is another contributing factor, fueling the demand for MEG. Furthermore, supportive government policies and regulations in several regions are promoting the expansion of the MEG industry.

Obstacles in the Mono Ethylene Glycol Industry Market

The MEG industry faces several obstacles, including fluctuating raw material prices (ethylene) that impact production costs and profitability. Supply chain disruptions can lead to production delays and shortages. Intense competition among major players puts downward pressure on prices and profit margins. Strict environmental regulations in some regions impose compliance costs on manufacturers.

Future Opportunities in Mono Ethylene Glycol Industry

Emerging opportunities exist in the MEG market, including expanding into new applications and geographic regions. The development of new technologies, such as advanced production methods and sustainable solutions, will unlock further growth potential. Changing consumer preferences towards environmentally friendly products will drive demand for more sustainable MEG production.

Major Players in the Mono Ethylene Glycol Industry Ecosystem

- Nouryon

- BASF SE

- Dow

- India Glycols Limited

- LACC

- LyondellBasell Industries Holdings BV

- Mitsubishi Chemical Corporation

- Nan Ya Plastics Corporation

- Reliance Industries Limited

- Royal Dutch Shell PLC

- SABIC

- Solventis

- *List Not Exhaustive

Key Developments in Mono Ethylene Glycol Industry Industry

- November 2021: SABIC announced the initial startup activities of the Ethylene Glycol Plant - 3 at its manufacturing affiliate, Jubail United Petrochemical Company (United), with an estimated annual production capacity of 700,000 metric tons of mono-ethylene glycol. This expansion significantly increases global MEG production capacity.

- January 2022: ExxonMobil and SABIC announced the successful startup of Gulf Coast Growth Ventures' world-class manufacturing facility in San Patricio County, Texas. The new facility includes a mono-ethylene glycol unit with an annual capacity of 1.1 million metric tons. This represents a substantial increase in North American MEG production capacity and strengthens the region's position in the global market.

Strategic Mono Ethylene Glycol Industry Market Forecast

The MEG market is poised for continued growth, driven by increasing demand from various end-use sectors and technological advancements. Expanding into new applications and geographic regions will further contribute to market expansion. The focus on sustainability and the development of eco-friendly production methods will open up new opportunities. The overall market outlook is positive, indicating significant future potential for growth and profitability.

Mono Ethylene Glycol Industry Segmentation

-

1. Application

- 1.1. Polyester Fiber

- 1.2. PET Bottle

- 1.3. PET Film

- 1.4. Antifreeze

- 1.5. Industrial

-

2. End-user Industry

- 2.1. Textile

- 2.2. Packaging

- 2.3. Plastic

- 2.4. Automotive and Transportation

- 2.5. Other End-user Industries (Electronics, Paints)

Mono Ethylene Glycol Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. US

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. UK

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Mono Ethylene Glycol Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for PET in the Packaging Sector; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Growing Demand for PET in the Packaging Sector; Other Drivers

- 3.4. Market Trends

- 3.4.1. Textile Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mono Ethylene Glycol Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Polyester Fiber

- 5.1.2. PET Bottle

- 5.1.3. PET Film

- 5.1.4. Antifreeze

- 5.1.5. Industrial

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Textile

- 5.2.2. Packaging

- 5.2.3. Plastic

- 5.2.4. Automotive and Transportation

- 5.2.5. Other End-user Industries (Electronics, Paints)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Mono Ethylene Glycol Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Polyester Fiber

- 6.1.2. PET Bottle

- 6.1.3. PET Film

- 6.1.4. Antifreeze

- 6.1.5. Industrial

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Textile

- 6.2.2. Packaging

- 6.2.3. Plastic

- 6.2.4. Automotive and Transportation

- 6.2.5. Other End-user Industries (Electronics, Paints)

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Mono Ethylene Glycol Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Polyester Fiber

- 7.1.2. PET Bottle

- 7.1.3. PET Film

- 7.1.4. Antifreeze

- 7.1.5. Industrial

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Textile

- 7.2.2. Packaging

- 7.2.3. Plastic

- 7.2.4. Automotive and Transportation

- 7.2.5. Other End-user Industries (Electronics, Paints)

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Mono Ethylene Glycol Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Polyester Fiber

- 8.1.2. PET Bottle

- 8.1.3. PET Film

- 8.1.4. Antifreeze

- 8.1.5. Industrial

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Textile

- 8.2.2. Packaging

- 8.2.3. Plastic

- 8.2.4. Automotive and Transportation

- 8.2.5. Other End-user Industries (Electronics, Paints)

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Mono Ethylene Glycol Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Polyester Fiber

- 9.1.2. PET Bottle

- 9.1.3. PET Film

- 9.1.4. Antifreeze

- 9.1.5. Industrial

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Textile

- 9.2.2. Packaging

- 9.2.3. Plastic

- 9.2.4. Automotive and Transportation

- 9.2.5. Other End-user Industries (Electronics, Paints)

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East Mono Ethylene Glycol Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Polyester Fiber

- 10.1.2. PET Bottle

- 10.1.3. PET Film

- 10.1.4. Antifreeze

- 10.1.5. Industrial

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Textile

- 10.2.2. Packaging

- 10.2.3. Plastic

- 10.2.4. Automotive and Transportation

- 10.2.5. Other End-user Industries (Electronics, Paints)

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Saudi Arabia Mono Ethylene Glycol Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Polyester Fiber

- 11.1.2. PET Bottle

- 11.1.3. PET Film

- 11.1.4. Antifreeze

- 11.1.5. Industrial

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Textile

- 11.2.2. Packaging

- 11.2.3. Plastic

- 11.2.4. Automotive and Transportation

- 11.2.5. Other End-user Industries (Electronics, Paints)

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Nouryon

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 BASF SE

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Dow

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 India Glycols Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 LACC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 LyondellBasell Industries Holdings BV

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Mitsubishi Chemical Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Nan Ya Plastics Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Reliance Industries Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Royal Dutch Shell PLC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 SABIC

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Solventis*List Not Exhaustive

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Nouryon

List of Figures

- Figure 1: Global Mono Ethylene Glycol Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Mono Ethylene Glycol Industry Revenue (Million), by Application 2024 & 2032

- Figure 3: Asia Pacific Mono Ethylene Glycol Industry Revenue Share (%), by Application 2024 & 2032

- Figure 4: Asia Pacific Mono Ethylene Glycol Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 5: Asia Pacific Mono Ethylene Glycol Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 6: Asia Pacific Mono Ethylene Glycol Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Mono Ethylene Glycol Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: North America Mono Ethylene Glycol Industry Revenue (Million), by Application 2024 & 2032

- Figure 9: North America Mono Ethylene Glycol Industry Revenue Share (%), by Application 2024 & 2032

- Figure 10: North America Mono Ethylene Glycol Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 11: North America Mono Ethylene Glycol Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 12: North America Mono Ethylene Glycol Industry Revenue (Million), by Country 2024 & 2032

- Figure 13: North America Mono Ethylene Glycol Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Mono Ethylene Glycol Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: Europe Mono Ethylene Glycol Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Mono Ethylene Glycol Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: Europe Mono Ethylene Glycol Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: Europe Mono Ethylene Glycol Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Mono Ethylene Glycol Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: South America Mono Ethylene Glycol Industry Revenue (Million), by Application 2024 & 2032

- Figure 21: South America Mono Ethylene Glycol Industry Revenue Share (%), by Application 2024 & 2032

- Figure 22: South America Mono Ethylene Glycol Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 23: South America Mono Ethylene Glycol Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 24: South America Mono Ethylene Glycol Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: South America Mono Ethylene Glycol Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Middle East Mono Ethylene Glycol Industry Revenue (Million), by Application 2024 & 2032

- Figure 27: Middle East Mono Ethylene Glycol Industry Revenue Share (%), by Application 2024 & 2032

- Figure 28: Middle East Mono Ethylene Glycol Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 29: Middle East Mono Ethylene Glycol Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 30: Middle East Mono Ethylene Glycol Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East Mono Ethylene Glycol Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Saudi Arabia Mono Ethylene Glycol Industry Revenue (Million), by Application 2024 & 2032

- Figure 33: Saudi Arabia Mono Ethylene Glycol Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: Saudi Arabia Mono Ethylene Glycol Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 35: Saudi Arabia Mono Ethylene Glycol Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 36: Saudi Arabia Mono Ethylene Glycol Industry Revenue (Million), by Country 2024 & 2032

- Figure 37: Saudi Arabia Mono Ethylene Glycol Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 7: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China Mono Ethylene Glycol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Mono Ethylene Glycol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan Mono Ethylene Glycol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Korea Mono Ethylene Glycol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia Pacific Mono Ethylene Glycol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: US Mono Ethylene Glycol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada Mono Ethylene Glycol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico Mono Ethylene Glycol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Germany Mono Ethylene Glycol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: UK Mono Ethylene Glycol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Mono Ethylene Glycol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: France Mono Ethylene Glycol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Europe Mono Ethylene Glycol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Brazil Mono Ethylene Glycol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Argentina Mono Ethylene Glycol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Mono Ethylene Glycol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 35: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 36: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 37: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 38: Global Mono Ethylene Glycol Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 39: South Africa Mono Ethylene Glycol Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Middle East Mono Ethylene Glycol Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mono Ethylene Glycol Industry?

The projected CAGR is approximately < 5.50%.

2. Which companies are prominent players in the Mono Ethylene Glycol Industry?

Key companies in the market include Nouryon, BASF SE, Dow, India Glycols Limited, LACC, LyondellBasell Industries Holdings BV, Mitsubishi Chemical Corporation, Nan Ya Plastics Corporation, Reliance Industries Limited, Royal Dutch Shell PLC, SABIC, Solventis*List Not Exhaustive.

3. What are the main segments of the Mono Ethylene Glycol Industry?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for PET in the Packaging Sector; Other Drivers.

6. What are the notable trends driving market growth?

Textile Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

Growing Demand for PET in the Packaging Sector; Other Drivers.

8. Can you provide examples of recent developments in the market?

January 2022: ExxonMobil and SABIC announced the successful startup of Gulf Coast Growth Ventures' world-class manufacturing facility in San Patricio County, Texas. The new facility operations include a mono-ethylene glycol unit with an annual capacity of 1.1 million metric tons.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mono Ethylene Glycol Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mono Ethylene Glycol Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mono Ethylene Glycol Industry?

To stay informed about further developments, trends, and reports in the Mono Ethylene Glycol Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence