Key Insights

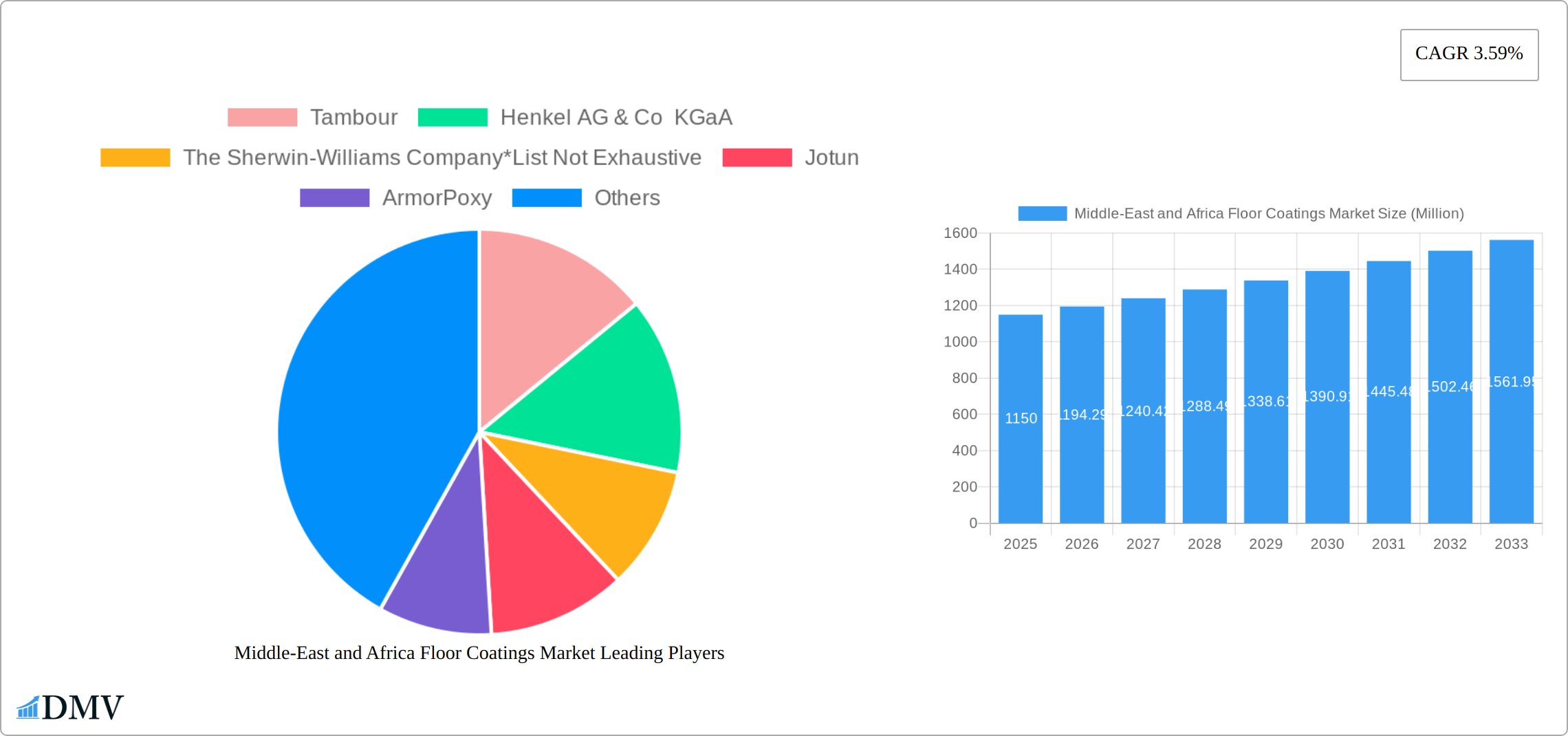

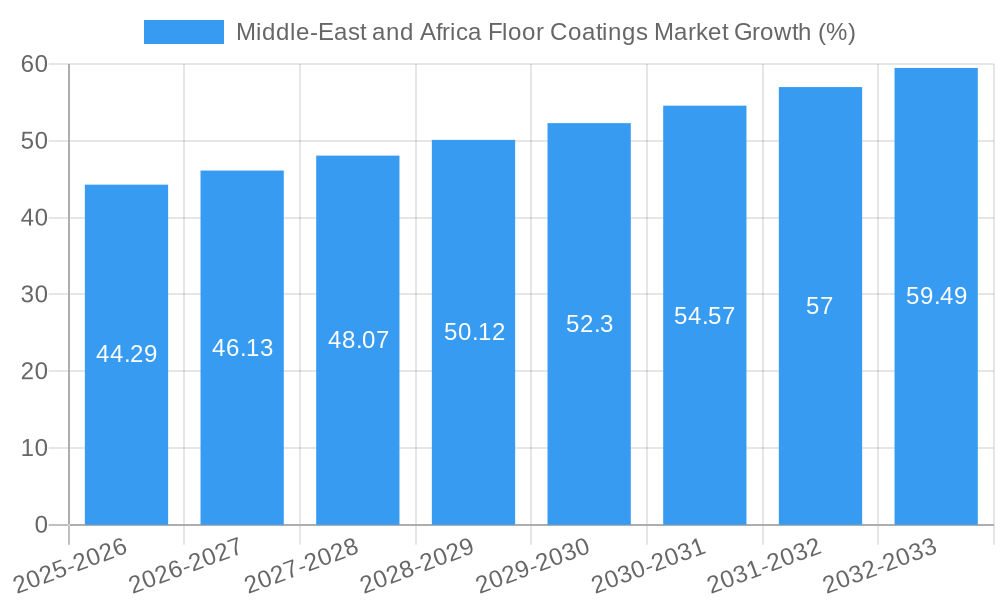

The Middle East and Africa (MEA) floor coatings market, valued at $1.15 billion in 2025, is projected to experience robust growth, driven by factors such as increasing construction activity across both residential and commercial sectors in rapidly developing economies. The rising demand for aesthetically pleasing and durable flooring solutions in new construction projects, coupled with the growing need for refurbishment and rehabilitation in existing buildings, fuels market expansion. Specific growth drivers include the burgeoning hospitality and retail industries in major urban centers, the expansion of industrial facilities requiring high-performance coatings, and a growing awareness of the importance of hygiene and easy maintenance in various settings. The preference for epoxy and polyurethane coatings due to their superior durability and resistance to chemicals and abrasion further contributes to market growth. However, factors such as volatile raw material prices and economic fluctuations in some regions within the MEA could pose challenges to sustained growth. Segmentation reveals that the concrete floor material segment holds a significant share due to its prevalence in construction across the region. Major players like Henkel, Sherwin-Williams, and Jotun are leveraging their established distribution networks and product innovation to capture significant market shares, while regional players are focusing on catering to specific local needs and preferences. The market's future trajectory indicates a positive outlook, albeit with potential fluctuations driven by macroeconomic factors and regional variations in construction activity. The forecast period of 2025-2033 anticipates continued market expansion, mirroring global trends in construction and infrastructural development.

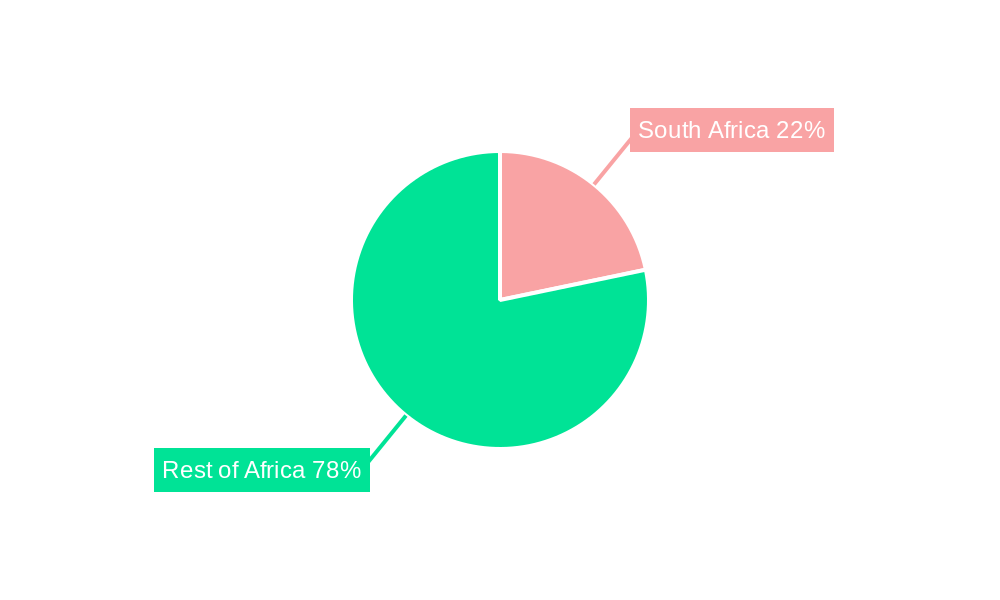

The market's segment-wise analysis reveals significant growth potential within the commercial and industrial segments, spurred by increasing investments in infrastructure and industrial expansion across the region. The repair and refurbishment segment is also expected to show considerable growth, driven by the need to renovate and upgrade existing infrastructure and buildings. Product type-wise, epoxy and polyurethane coatings are anticipated to retain their dominance due to their superior properties. Regional variations exist within the MEA market, with certain countries experiencing more rapid growth than others depending on factors like economic development and construction trends. South Africa, owing to its comparatively developed infrastructure and economy, is likely to represent a substantial segment of the market, followed by countries experiencing significant infrastructure development. The competitive landscape is characterized by both multinational corporations and regional players, leading to intense competition and continuous innovation in product offerings and service provision.

Middle-East and Africa Floor Coatings Market Market Composition & Trends

The Middle-East and Africa Floor Coatings Market is characterized by a dynamic interplay of various factors influencing its composition and trends. The market concentration is moderate, with several key players like Tambour, Henkel AG & Co KGaA, and The Sherwin-Williams Company dominating significant market shares. In 2025, these companies are estimated to hold approximately 30% of the market share combined. Innovation is a key catalyst, driven by the need for durable and eco-friendly coatings. Regulatory landscapes vary across countries, with some nations imposing strict environmental regulations, pushing manufacturers towards sustainable solutions. Substitute products such as traditional flooring materials pose a challenge, yet the demand for specialized floor coatings remains strong across residential, commercial, and industrial sectors. End-user profiles indicate a growing preference for high-performance coatings in industrial settings, while residential applications favor aesthetic and easy-to-maintain options. M&A activities have been notable, with deals totaling around $200 Million in the last five years, aimed at expanding product portfolios and market reach.

- Market Concentration: Moderate, with top players holding 30% market share in 2025.

- Innovation Catalysts: Demand for durable and eco-friendly coatings.

- Regulatory Landscapes: Varying environmental regulations across countries.

- Substitute Products: Traditional flooring materials.

- End-user Profiles: Industrial sector demands high-performance; residential sector focuses on aesthetics.

- M&A Activities: $200 Million in deals over the past five years.

Middle-East and Africa Floor Coatings Market Industry Evolution

The Middle-East and Africa Floor Coatings Market has undergone significant evolution over the study period from 2019 to 2033, with the base year set at 2025. The market has experienced a steady growth trajectory, with a compound annual growth rate (CAGR) of approximately 5% during the forecast period of 2025-2033. Technological advancements have played a pivotal role in this evolution, with innovations in epoxy and polyurethane coatings enhancing durability and performance. The adoption of these advanced coatings in industrial applications has seen a rise from 40% in 2019 to an estimated 50% by 2025. Consumer demands have shifted towards more sustainable and eco-friendly solutions, influencing manufacturers to develop green products. The residential sector has shown a preference for aesthetically pleasing coatings, contributing to a 3% annual growth in this segment. Meanwhile, the commercial sector has seen a demand for coatings that offer both durability and cost-effectiveness, growing at a rate of 4% annually. The repair and refurbishing segment has also seen increased activity, driven by the need to extend the lifespan of existing structures, with a growth rate of 6% per year. These trends indicate a robust and evolving market, poised for further growth and innovation.

Leading Regions, Countries, or Segments in Middle-East and Africa Floor Coatings Market

The Middle-East and Africa Floor Coatings Market exhibits varying levels of dominance across different regions, countries, and segments. The industrial segment stands out as the leading end-user industry, driven by the region's booming construction and manufacturing sectors. Within this segment, epoxy coatings are the most preferred product type due to their superior durability and chemical resistance.

Industrial Segment:

Key Drivers: High demand for durable and chemical-resistant coatings in manufacturing and construction.

Investment Trends: Increased investments in industrial infrastructure across the Middle East and Africa.

Regulatory Support: Government initiatives promoting industrial growth and sustainable practices.

Epoxy Coatings:

Key Drivers: Superior durability and chemical resistance.

Investment Trends: R&D investments focused on improving epoxy formulations.

Regulatory Support: Compliance with stringent environmental regulations.

Concrete Floor Material:

Key Drivers: Widespread use in industrial and commercial settings.

Investment Trends: Investments in new construction and refurbishment projects.

Regulatory Support: Building codes favoring durable and sustainable flooring solutions.

The dominance of the industrial segment can be attributed to the rapid industrialization in countries like Saudi Arabia and South Africa, where large-scale projects require robust flooring solutions. Epoxy coatings have gained traction due to their ability to withstand harsh industrial environments, making them a top choice for manufacturers. Concrete remains the preferred floor material due to its cost-effectiveness and versatility, supported by regulatory frameworks that encourage the use of durable materials in construction.

Middle-East and Africa Floor Coatings Market Product Innovations

Product innovations in the Middle-East and Africa Floor Coatings Market have focused on enhancing performance and sustainability. Recent developments include the introduction of water-based polyurethane coatings, offering low VOC emissions and improved durability. Epoxy coatings have seen advancements in UV resistance and faster curing times, making them ideal for high-traffic areas. These innovations are driven by the need for coatings that meet stringent environmental standards while providing superior performance. The unique selling propositions of these products lie in their ability to offer both aesthetic appeal and functional benefits, catering to the diverse needs of end-users.

Propelling Factors for Middle-East and Africa Floor Coatings Market Growth

The Middle East and Africa floor coatings market is experiencing robust growth fueled by a confluence of factors. Significant advancements in coating formulations are leading to superior product performance, increased durability, and enhanced sustainability, aligning with growing environmental consciousness. The region's economic expansion, particularly in countries like Saudi Arabia and the UAE, is driving a surge in construction and infrastructure projects, creating a substantial demand for high-quality floor coatings. This demand is further amplified by the increasing adoption of green building standards and stringent environmental regulations promoting eco-friendly and sustainable products. The implementation of these regulations is accelerating the shift towards coatings with lower VOC emissions and reduced environmental impact, creating a strong market pull for sustainable options.

Obstacles in the Middle-East and Africa Floor Coatings Market Market

The Middle-East and Africa Floor Coatings Market faces several obstacles that could hinder its growth. Regulatory challenges, such as varying environmental standards across countries, can complicate compliance for manufacturers. Supply chain disruptions, exacerbated by geopolitical tensions, have led to delays and increased costs. Competitive pressures are intense, with numerous players vying for market share, which can result in price wars and reduced profit margins. These barriers have a quantifiable impact, with supply chain issues estimated to have increased costs by 10% in 2024.

Future Opportunities in Middle-East and Africa Floor Coatings Market

The future of the Middle East and Africa floor coatings market is brimming with opportunities. The rapid urbanization and development of smart cities across the region are generating significant demand for innovative and sustainable flooring solutions. This trend is further fueled by rising investments in sustainable building initiatives, creating a lucrative market for eco-conscious coatings. Groundbreaking advancements in nanotechnology and the development of self-healing coatings are poised to revolutionize the industry, offering enhanced performance, longevity, and reduced maintenance costs. Furthermore, evolving consumer preferences towards aesthetically pleasing and personalized flooring options are opening new avenues for product diversification and market expansion, catering to diverse design aesthetics and functional requirements.

Major Players in the Middle-East and Africa Floor Coatings Market Ecosystem

- Tambour

- Henkel AG & Co KGaA

- The Sherwin-Williams Company

- Jotun

- ArmorPoxy

- LATICRETE International Inc

- Akzo Nobel NV

- Jazeera Paints

- Mapei

- PPG Industries Inc

- Epoxy-Coat

- BASF SE

- Kansai Nerolac Paints Limited

- Sika AG

- Asian Paints

Key Developments in Middle-East and Africa Floor Coatings Market Industry

- August 2022: Jazeera Paints' strategic expansion with the opening of its sixth showroom in Iraq underscores the company's commitment to the Middle Eastern market and facilitates increased sales of its floor coating products, including those exported from Saudi Arabia. This move is expected to significantly boost market visibility and drive sales growth within the region.

- September 2021: MAPEI Construction Chemicals LLC's prominent participation at Expo 2020, showcasing its sustainable building solutions and supplying eco-friendly products to over 55 pavilions, significantly elevated its brand visibility and market reach. This successful demonstration of its commitment to sustainable practices propelled increased demand for its eco-friendly floor coatings within the market.

- [Add more recent developments here with dates and concise descriptions of their impact on the market]

Strategic Middle-East and Africa Floor Coatings Market Market Forecast

The Middle East and Africa floor coatings market is projected to experience sustained and robust growth throughout the forecast period (2025-2033). This growth trajectory is primarily driven by the synergistic effect of several key factors: the ongoing adoption of technologically advanced and sustainable coatings, the flourishing construction sector fueled by regional economic growth, and the increasing regulatory support for environmentally friendly solutions. Future market expansion will be significantly shaped by the ongoing development of smart cities and the widespread adoption of innovative technologies, such as nanotechnology, in the construction and infrastructure sectors. The market presents substantial potential for growth, particularly within the residential, commercial, and industrial sectors, driven by the increasing demand for high-performance, durable, and aesthetically appealing floor coatings that meet diverse functional and design requirements.

Middle-East and Africa Floor Coatings Market Segmentation

-

1. Product Type

- 1.1. Epoxy

- 1.2. Polyaspartics

- 1.3. Acrylic

- 1.4. Polyurethane

- 1.5. Other Product Types

-

2. Floor Material

- 2.1. Wood

- 2.2. Concrete

- 2.3. Other Floor Materials

-

3. End-user Industry

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

-

4. Construction Type

- 4.1. New Construction

- 4.2. Repair & Refurbishing/Rehabilitation

-

5. Geography

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle-East and Africa

Middle-East and Africa Floor Coatings Market Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. Rest of Middle East and Africa

Middle-East and Africa Floor Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction Activities in Saudi Arabia; Strong Demand for Floor Coatings in Industrial Sector

- 3.3. Market Restrains

- 3.3.1. Strict Regulations on VOCs Released for Floor Coatings; Other Market Restraints

- 3.4. Market Trends

- 3.4.1. Rising Application of Floor Coatings in the Industrial Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Floor Coatings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Epoxy

- 5.1.2. Polyaspartics

- 5.1.3. Acrylic

- 5.1.4. Polyurethane

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Floor Material

- 5.2.1. Wood

- 5.2.2. Concrete

- 5.2.3. Other Floor Materials

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Construction Type

- 5.4.1. New Construction

- 5.4.2. Repair & Refurbishing/Rehabilitation

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. Saudi Arabia

- 5.5.2. South Africa

- 5.5.3. Rest of Middle-East and Africa

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Saudi Arabia

- 5.6.2. South Africa

- 5.6.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia Middle-East and Africa Floor Coatings Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Epoxy

- 6.1.2. Polyaspartics

- 6.1.3. Acrylic

- 6.1.4. Polyurethane

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Floor Material

- 6.2.1. Wood

- 6.2.2. Concrete

- 6.2.3. Other Floor Materials

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.3.3. Industrial

- 6.4. Market Analysis, Insights and Forecast - by Construction Type

- 6.4.1. New Construction

- 6.4.2. Repair & Refurbishing/Rehabilitation

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. Saudi Arabia

- 6.5.2. South Africa

- 6.5.3. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South Africa Middle-East and Africa Floor Coatings Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Epoxy

- 7.1.2. Polyaspartics

- 7.1.3. Acrylic

- 7.1.4. Polyurethane

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Floor Material

- 7.2.1. Wood

- 7.2.2. Concrete

- 7.2.3. Other Floor Materials

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.3.3. Industrial

- 7.4. Market Analysis, Insights and Forecast - by Construction Type

- 7.4.1. New Construction

- 7.4.2. Repair & Refurbishing/Rehabilitation

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. Saudi Arabia

- 7.5.2. South Africa

- 7.5.3. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of Middle East and Africa Middle-East and Africa Floor Coatings Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Epoxy

- 8.1.2. Polyaspartics

- 8.1.3. Acrylic

- 8.1.4. Polyurethane

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Floor Material

- 8.2.1. Wood

- 8.2.2. Concrete

- 8.2.3. Other Floor Materials

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Residential

- 8.3.2. Commercial

- 8.3.3. Industrial

- 8.4. Market Analysis, Insights and Forecast - by Construction Type

- 8.4.1. New Construction

- 8.4.2. Repair & Refurbishing/Rehabilitation

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. Saudi Arabia

- 8.5.2. South Africa

- 8.5.3. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South Africa Middle-East and Africa Floor Coatings Market Analysis, Insights and Forecast, 2019-2031

- 10. Sudan Middle-East and Africa Floor Coatings Market Analysis, Insights and Forecast, 2019-2031

- 11. Uganda Middle-East and Africa Floor Coatings Market Analysis, Insights and Forecast, 2019-2031

- 12. Tanzania Middle-East and Africa Floor Coatings Market Analysis, Insights and Forecast, 2019-2031

- 13. Kenya Middle-East and Africa Floor Coatings Market Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Africa Middle-East and Africa Floor Coatings Market Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Tambour

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Henkel AG & Co KGaA

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 The Sherwin-Williams Company*List Not Exhaustive

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Jotun

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 ArmorPoxy

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 LATICRETE International Inc

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Akzo Nobel NV

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Jazeera Paints

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Mapei

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 PPG Industries Inc

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Epoxy-Coat

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.12 BASF SE

- 15.2.12.1. Overview

- 15.2.12.2. Products

- 15.2.12.3. SWOT Analysis

- 15.2.12.4. Recent Developments

- 15.2.12.5. Financials (Based on Availability)

- 15.2.13 Kansai Nerolac Paints Limited

- 15.2.13.1. Overview

- 15.2.13.2. Products

- 15.2.13.3. SWOT Analysis

- 15.2.13.4. Recent Developments

- 15.2.13.5. Financials (Based on Availability)

- 15.2.14 Sika AG

- 15.2.14.1. Overview

- 15.2.14.2. Products

- 15.2.14.3. SWOT Analysis

- 15.2.14.4. Recent Developments

- 15.2.14.5. Financials (Based on Availability)

- 15.2.15 Asian Paints

- 15.2.15.1. Overview

- 15.2.15.2. Products

- 15.2.15.3. SWOT Analysis

- 15.2.15.4. Recent Developments

- 15.2.15.5. Financials (Based on Availability)

- 15.2.1 Tambour

List of Figures

- Figure 1: Middle-East and Africa Floor Coatings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle-East and Africa Floor Coatings Market Share (%) by Company 2024

List of Tables

- Table 1: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Region 2019 & 2032

- Table 3: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Product Type 2019 & 2032

- Table 5: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Floor Material 2019 & 2032

- Table 6: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Floor Material 2019 & 2032

- Table 7: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by End-user Industry 2019 & 2032

- Table 9: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 10: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Construction Type 2019 & 2032

- Table 11: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Geography 2019 & 2032

- Table 13: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Region 2019 & 2032

- Table 15: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Country 2019 & 2032

- Table 17: South Africa Middle-East and Africa Floor Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Africa Middle-East and Africa Floor Coatings Market Volume (liter ) Forecast, by Application 2019 & 2032

- Table 19: Sudan Middle-East and Africa Floor Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Sudan Middle-East and Africa Floor Coatings Market Volume (liter ) Forecast, by Application 2019 & 2032

- Table 21: Uganda Middle-East and Africa Floor Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Uganda Middle-East and Africa Floor Coatings Market Volume (liter ) Forecast, by Application 2019 & 2032

- Table 23: Tanzania Middle-East and Africa Floor Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Tanzania Middle-East and Africa Floor Coatings Market Volume (liter ) Forecast, by Application 2019 & 2032

- Table 25: Kenya Middle-East and Africa Floor Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Kenya Middle-East and Africa Floor Coatings Market Volume (liter ) Forecast, by Application 2019 & 2032

- Table 27: Rest of Africa Middle-East and Africa Floor Coatings Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Africa Middle-East and Africa Floor Coatings Market Volume (liter ) Forecast, by Application 2019 & 2032

- Table 29: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 30: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Product Type 2019 & 2032

- Table 31: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Floor Material 2019 & 2032

- Table 32: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Floor Material 2019 & 2032

- Table 33: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 34: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by End-user Industry 2019 & 2032

- Table 35: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 36: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Construction Type 2019 & 2032

- Table 37: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Geography 2019 & 2032

- Table 39: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Country 2019 & 2032

- Table 41: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 42: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Product Type 2019 & 2032

- Table 43: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Floor Material 2019 & 2032

- Table 44: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Floor Material 2019 & 2032

- Table 45: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 46: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by End-user Industry 2019 & 2032

- Table 47: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 48: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Construction Type 2019 & 2032

- Table 49: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 50: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Geography 2019 & 2032

- Table 51: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Country 2019 & 2032

- Table 53: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 54: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Product Type 2019 & 2032

- Table 55: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Floor Material 2019 & 2032

- Table 56: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Floor Material 2019 & 2032

- Table 57: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 58: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by End-user Industry 2019 & 2032

- Table 59: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Construction Type 2019 & 2032

- Table 60: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Construction Type 2019 & 2032

- Table 61: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 62: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Geography 2019 & 2032

- Table 63: Middle-East and Africa Floor Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 64: Middle-East and Africa Floor Coatings Market Volume liter Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Floor Coatings Market?

The projected CAGR is approximately 3.59%.

2. Which companies are prominent players in the Middle-East and Africa Floor Coatings Market?

Key companies in the market include Tambour, Henkel AG & Co KGaA, The Sherwin-Williams Company*List Not Exhaustive, Jotun, ArmorPoxy, LATICRETE International Inc, Akzo Nobel NV, Jazeera Paints, Mapei, PPG Industries Inc, Epoxy-Coat, BASF SE, Kansai Nerolac Paints Limited, Sika AG, Asian Paints.

3. What are the main segments of the Middle-East and Africa Floor Coatings Market?

The market segments include Product Type, Floor Material, End-user Industry, Construction Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction Activities in Saudi Arabia; Strong Demand for Floor Coatings in Industrial Sector.

6. What are the notable trends driving market growth?

Rising Application of Floor Coatings in the Industrial Sector.

7. Are there any restraints impacting market growth?

Strict Regulations on VOCs Released for Floor Coatings; Other Market Restraints.

8. Can you provide examples of recent developments in the market?

August 2022: Jazeera Paints opened its sixth showroom in Iraq. The new museum's opening will expand the Middle East and support Saudi exports to the region. The showroom will display and sell Jazeera Paints' extensive line of decorative, architectural, industrial paints, wood paints, protective paints, metals paints, fire-resistant paints, road marking paints, eco-friendly paints, floor coatings, dry mortar finishing materials, and other unique products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Floor Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Floor Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Floor Coatings Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Floor Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence