Key Insights

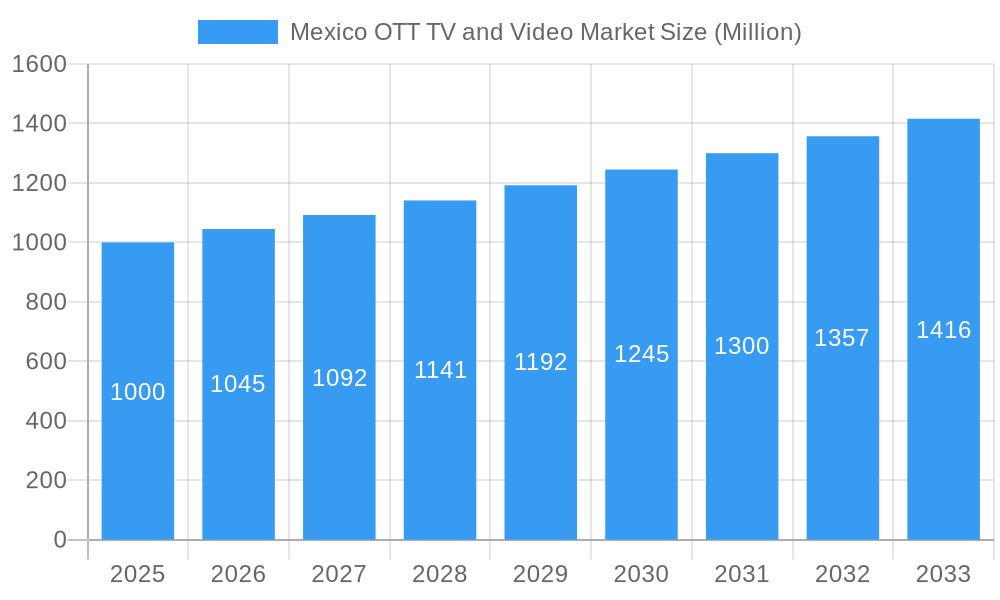

The Mexico OTT TV and Video Market is experiencing robust growth, projected to reach a substantial market size by 2033. A compound annual growth rate (CAGR) of 4.50% from 2025 to 2033 indicates a consistently expanding market, driven primarily by increasing internet penetration, affordability of smartphones and data plans, and a growing preference for on-demand content among Mexican consumers. The popularity of SVOD (Subscription Video on Demand) services like Netflix, Disney+, and HBO Max is a significant contributor, alongside the rise of AVOD (Advertising-based Video on Demand) platforms offering free, ad-supported content. This dynamic market is further segmented by content delivery method (SVOD, TVOD, DTO), reflecting diverse consumer preferences and viewing habits. While the dominance of established players like Netflix and Disney+ is undeniable, the market also presents opportunities for smaller, niche players catering to specific linguistic or cultural preferences. Competition is intensifying, necessitating strategic partnerships, content diversification, and innovative pricing models to maintain a competitive edge. Challenges include piracy, regulatory hurdles, and ensuring sufficient high-speed internet infrastructure to support the expanding viewership.

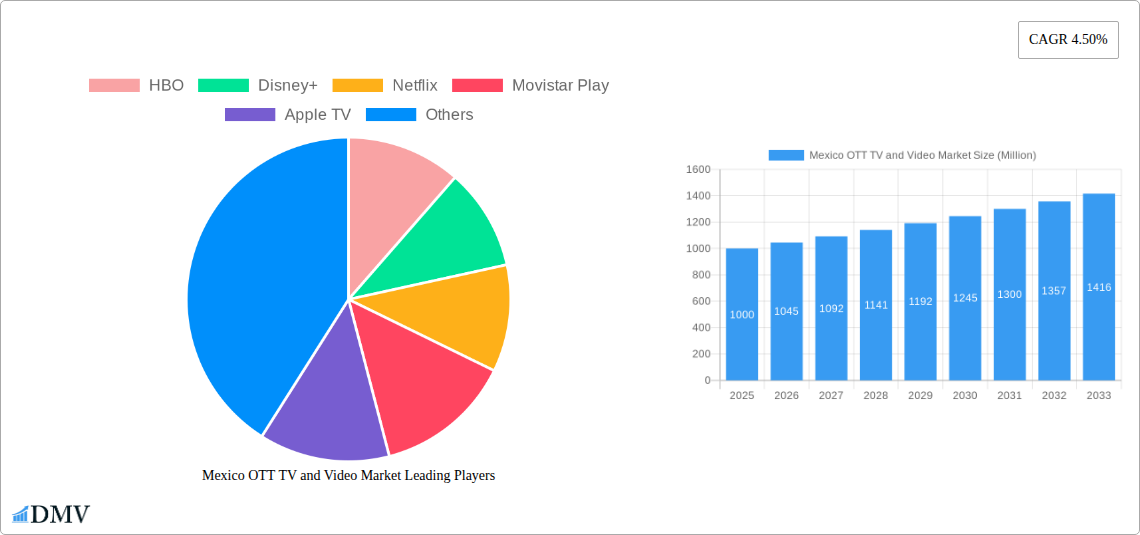

Mexico OTT TV and Video Market Market Size (In Billion)

The future growth of the Mexican OTT market is significantly influenced by factors like the economic climate, technological advancements (e.g., 5G rollout), and evolving consumer behavior. The continued expansion of streaming services, coupled with enhancements in user experience and personalization, will likely further drive market expansion. Regional variations in internet access and content consumption patterns will play a key role in shaping the competitive landscape. Furthermore, the increasing adoption of smart TVs and connected devices will significantly influence content consumption and the success of various OTT platforms. Strategies focusing on localized content, tailored marketing campaigns, and strategic alliances will be critical for success within this dynamic and fiercely competitive market. We estimate the 2025 market size to be around $1 billion USD, based on extrapolation from previous year data trends and reported CAGRs.

Mexico OTT TV and Video Market Company Market Share

Mexico OTT TV and Video Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic Mexico OTT TV and Video market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a focus on 2025, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the opportunities within this rapidly evolving market. The report analyzes market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, future opportunities, and key players, culminating in a strategic market forecast. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033.

Mexico OTT TV and Video Market Market Composition & Trends

This section delves into the competitive landscape of the Mexican OTT market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, user demographics, and mergers and acquisitions (M&A) activity. We analyze the market share distribution amongst key players, including Netflix, HBO Max, Disney+, and others, providing insights into their strategic positioning and market dominance. The analysis also considers the impact of regulatory changes and evolving consumer preferences on market dynamics. M&A activity is assessed, with an estimation of deal values contributing to market consolidation and expansion.

- Market Concentration: Netflix and Disney+ currently hold significant market share, estimated at xx% and xx% respectively in 2025. However, local players like Blim are also contributing significantly.

- Innovation Catalysts: The rise of mobile penetration and affordable data plans are key drivers of innovation.

- Regulatory Landscape: Government regulations concerning content and data privacy impact market dynamics.

- Substitute Products: Traditional cable TV and free-to-air television still compete for viewership.

- End-User Profiles: A growing young, tech-savvy population drives OTT adoption.

- M&A Activities: The total value of M&A deals in the sector from 2019-2024 is estimated at xx Million, indicating significant consolidation.

Mexico OTT TV and Video Market Industry Evolution

This section meticulously tracks the evolution of the Mexican OTT TV and Video market, examining growth trajectories, technological advancements, and shifting consumer demands. Data points such as compound annual growth rates (CAGR) and adoption rates for various OTT services are presented. The influence of technological advancements, such as improved streaming quality (e.g., 4K, HDR) and the rise of smart TVs, are explored in relation to market growth. Furthermore, the changing viewing habits of Mexican consumers and their impact on the market are analyzed. The historical period (2019-2024) reveals a CAGR of xx%, while the forecast period (2025-2033) projects a CAGR of xx%. The increasing affordability and availability of high-speed internet are crucial factors fueling market expansion.

Leading Regions, Countries, or Segments in Mexico OTT TV and Video Market

This section identifies the dominant regions, countries, or segments within the Mexican OTT market, focusing on revenue generation and subscriber base. The analysis differentiates between various service models: Subscription Video on Demand (SVOD), Transactional Video on Demand (TVOD), Download-to-Own (DTO), and Advertising Video on Demand (AVOD). The key drivers behind the dominance of specific segments are explored, considering investment trends and regulatory support.

SVOD Dominance: Driven by the popularity of Netflix, Disney+, and HBO Max, SVOD is the leading segment, accounting for xx% of market revenue in 2025. Key drivers include the convenience and extensive content libraries offered.

AVOD Growth: The launch of services like ViX is fueling AVOD growth. This segment is expected to witness significant expansion owing to its affordability and appeal to a broader audience.

TVOD and DTO: These segments hold smaller market shares, though niche content and specific user preferences contribute to their continued presence.

Mexico OTT TV and Video Market Product Innovations

This section highlights recent product innovations, applications, and performance metrics within the Mexican OTT market. The focus is on unique selling propositions (USPs) and technological advancements. The integration of personalized recommendations, enhanced user interfaces, and the growing adoption of interactive features are significant trends driving market growth. The emergence of 4K/HDR streaming and multilingual support are improving viewer experience.

Propelling Factors for Mexico OTT TV and Video Market Growth

Several key factors propel the growth of the Mexico OTT TV and Video market. These include the increasing affordability of smartphones and data plans, expanding internet penetration, the rising popularity of streaming services, and government initiatives promoting digital media consumption. The increasing demand for high-quality content in Spanish further fuels market expansion.

Obstacles in the Mexico OTT TV and Video Market Market

Challenges facing the market include piracy, which significantly impacts revenue streams, uneven internet access across the country, resulting in a digital divide, and the high cost of producing localized content. Competition from established players and the need for continuous investment in technology and content represent significant obstacles.

Future Opportunities in Mexico OTT TV and Video Market

Future growth is expected from the expansion of 5G networks, enhancing streaming capabilities, the increasing demand for interactive and immersive content (e.g., AR/VR), and the growing popularity of mobile gaming integration within OTT platforms. Further growth will be driven by tailored content targeting specific demographics and increased adoption of smart TVs.

Major Players in the Mexico OTT TV and Video Market Ecosystem

- HBO Max

- Disney+

- Netflix

- Movistar Play

- Apple TV

- Blim

- Crackle

- Claro Video

- Amazon Prime Video

Key Developments in Mexico OTT TV and Video Market Industry

- March 2022: Launch of TelevisaUnivision's ViX, a free, ad-supported streaming service offering extensive Spanish-language content, significantly impacting the AVOD segment and market competition. This has broadened access to streaming for a larger segment of the population.

Strategic Mexico OTT TV and Video Market Market Forecast

The Mexican OTT TV and Video market is poised for sustained growth driven by increasing internet penetration, rising disposable incomes, and the continuous evolution of streaming technology. The forecast period (2025-2033) anticipates substantial expansion, with opportunities for both established players and new entrants. The market’s trajectory is shaped by consumer preferences for on-demand, personalized content and the increasing integration of mobile devices and smart TVs into daily life. The continued emergence of innovative content formats and business models promises to further fuel this growth.

Mexico OTT TV and Video Market Segmentation

-

1. Source

- 1.1. SVOD

-

1.2. TVOD

- 1.2.1. Rental

- 1.2.2. Download to Own (DTO)

- 1.3. AVOD

Mexico OTT TV and Video Market Segmentation By Geography

- 1. Mexico

Mexico OTT TV and Video Market Regional Market Share

Geographic Coverage of Mexico OTT TV and Video Market

Mexico OTT TV and Video Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Penetration of Smart TVs and the Presence of Major OTT Providers

- 3.3. Market Restrains

- 3.3.1. Payment for Premium OTT Take-up; Challenges and Costs of Licensing Premium Quality Content

- 3.4. Market Trends

- 3.4.1. OTT industry is expected to register a significant growth in the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico OTT TV and Video Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. SVOD

- 5.1.2. TVOD

- 5.1.2.1. Rental

- 5.1.2.2. Download to Own (DTO)

- 5.1.3. AVOD

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 HBO

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Disney+

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Netflix

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Movistar Play

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Apple TV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Blim

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Crackle

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Claro Video

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Amazon Prime Video

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 HBO

List of Figures

- Figure 1: Mexico OTT TV and Video Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Mexico OTT TV and Video Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico OTT TV and Video Market Revenue undefined Forecast, by Source 2020 & 2033

- Table 2: Mexico OTT TV and Video Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Mexico OTT TV and Video Market Revenue undefined Forecast, by Source 2020 & 2033

- Table 4: Mexico OTT TV and Video Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico OTT TV and Video Market?

The projected CAGR is approximately 16.79%.

2. Which companies are prominent players in the Mexico OTT TV and Video Market?

Key companies in the market include HBO, Disney+, Netflix, Movistar Play, Apple TV, Blim, Crackle, Claro Video, Amazon Prime Video.

3. What are the main segments of the Mexico OTT TV and Video Market?

The market segments include Source.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

High Penetration of Smart TVs and the Presence of Major OTT Providers.

6. What are the notable trends driving market growth?

OTT industry is expected to register a significant growth in the market.

7. Are there any restraints impacting market growth?

Payment for Premium OTT Take-up; Challenges and Costs of Licensing Premium Quality Content.

8. Can you provide examples of recent developments in the market?

March 2022: TelevisaUnivision's new streaming service ViX, which brings the world's largest offering of Spanish-language entertainment, news, and sports content, became available to all users in the United States, Mexico, and most Spanish-speaking Latin America. ViX users can stream original programming and top live sports and news free of charge in the first broadcast-quality ad-supported offering for Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico OTT TV and Video Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico OTT TV and Video Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico OTT TV and Video Market?

To stay informed about further developments, trends, and reports in the Mexico OTT TV and Video Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence