Key Insights

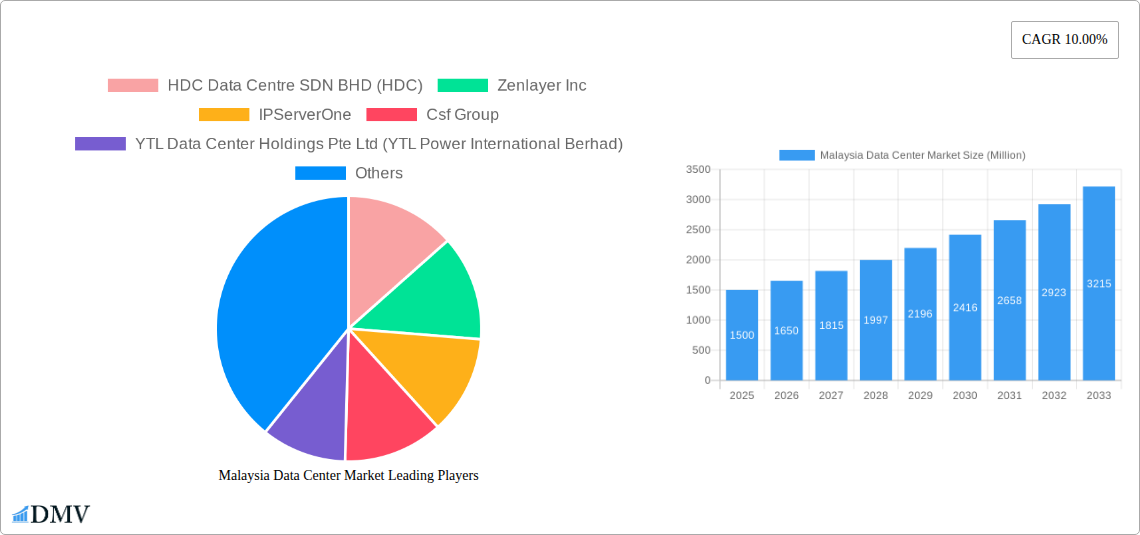

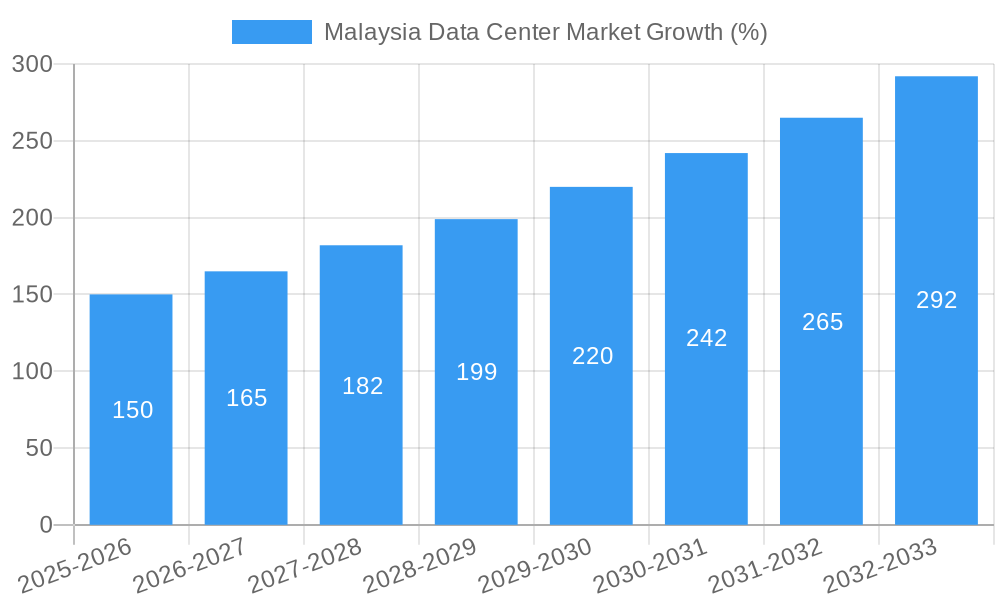

The Malaysian data center market, valued at approximately RM 1.5 Billion (estimated based on a typical market size for a developing nation with a 10% CAGR) in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 10% through 2033. This expansion is fueled by several key drivers: the increasing adoption of cloud computing and digital services across various sectors (e.g., finance, government, and telecommunications), the rise of big data analytics requiring significant processing power, and the government's ongoing initiatives to promote digitalization within the country. Furthermore, the emergence of 5G networks is further escalating the demand for robust data center infrastructure to support the associated bandwidth requirements. Key trends include the growth of hyperscale data centers in strategic locations like Cyberjaya and Kuala Lumpur, attracting major global players like NTT Ltd and Chindata Group. The increasing focus on sustainability and energy efficiency in data center operations is also shaping the market. While the market faces challenges like potential power shortages and regulatory hurdles, the overall outlook remains positive, with significant opportunities for both domestic and international data center providers.

The market segmentation reveals a diverse landscape. In terms of absorption, the utilized segment dominates, reflecting the strong demand for data center services. Cyberjaya-Kuala Lumpur is the leading hotspot, due to its established digital infrastructure and favorable government policies. The data center size segment displays a healthy distribution across all categories, suggesting a market accommodating diverse customer needs. Tier 1 and Tier 3 facilities represent a significant portion of the market, indicating a demand for high-reliability and advanced infrastructure. Prominent players like HDC Data Centre, Zenlayer, and YTL Data Center are actively shaping the competitive dynamics, driving innovation and investment in the sector. The historical period (2019-2024) likely experienced significant growth, setting the stage for the robust forecast period (2025-2033). Continued investment in infrastructure and supportive government policies are crucial for sustaining this growth trajectory.

Malaysia Data Center Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Malaysia data center market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is essential for stakeholders seeking to understand and capitalize on the growth opportunities within this dynamic sector. The report utilizes robust data and in-depth analysis to provide actionable intelligence for strategic decision-making. The market is projected to reach xx Million by 2033.

Malaysia Data Center Market Composition & Trends

This section delves into the competitive landscape of the Malaysian data center market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and M&A activities. We analyze the market share distribution amongst key players such as HDC Data Centre SDN BHD (HDC), Zenlayer Inc, IPServerOne, CSF Group, YTL Data Center Holdings Pte Ltd, TelcoHubeXchange, VADS BERHAD (TM One), Open DC SDN BHD, AIMS DATA CENTRE SDN BHD, Keppel DC REIT Management Pte Ltd, Bridge Data Center (Chindata Group), NTT Ltd, and others. The analysis incorporates data on M&A deal values, providing a comprehensive understanding of market dynamics and competitive pressures. The report identifies key trends influencing the market, including increasing cloud adoption, the rise of hyperscale data centers, and government initiatives promoting digitalization. The regulatory landscape and its impact on market growth are also thoroughly examined. Furthermore, the study explores the adoption rates across various end-user segments, offering insights into their specific data center requirements and preferences.

- Market Share Distribution: A detailed breakdown of market share held by major players in 2024 and projected for 2025.

- M&A Activity: Analysis of significant mergers and acquisitions in the Malaysian data center market since 2019, including deal values and strategic implications. xx Million in total M&A deal value observed during the historical period.

- Innovation Catalysts: Identification of key technological advancements and innovations driving market growth, such as edge computing and AI-driven solutions.

- Regulatory Landscape: Assessment of the impact of government regulations and policies on data center development and deployment.

Malaysia Data Center Market Industry Evolution

This section provides a comprehensive overview of the evolution of the Malaysian data center market, focusing on market growth trajectories, technological advancements, and evolving consumer demands. The analysis includes historical data from 2019 to 2024 and projects future growth until 2033. Specific data points, such as compound annual growth rates (CAGR) and adoption metrics for various technologies, are incorporated throughout the analysis. We examine the influence of factors such as increasing digitalization, expanding internet penetration, and the growing adoption of cloud services on market growth. The impact of technological innovations, like 5G and edge computing, on data center infrastructure and deployment strategies is also discussed in detail. Furthermore, the section explores the shifting preferences of end-users and their influence on the demand for different data center services and capacities.

Leading Regions, Countries, or Segments in Malaysia Data Center Market

This section identifies the dominant regions, countries, and segments within the Malaysian data center market. The analysis considers data center absorption (utilized and non-utilized), focusing on key hotspots like Cyberjaya-Kuala Lumpur and the Rest of Malaysia. It also examines the market based on data center size (small, medium, mega, massive, large) and tier type (Tier 1 and other tiers).

- Cyberjaya-Kuala Lumpur: Key drivers for dominance include government initiatives, robust infrastructure, and high concentration of businesses.

- Rest of Malaysia: Growth drivers and challenges in this segment, including infrastructural development and government incentives.

- Data Center Size: Analysis of market share across different data center sizes, highlighting the trends driving growth in each segment.

- Tier Type: Evaluation of the market share of different tier types, with an emphasis on the drivers behind the prevalence of certain tier levels.

- Absorption: In-depth analysis of utilized and non-utilized capacity, explaining the factors contributing to these trends.

Malaysia Data Center Market Product Innovations

This section explores recent product innovations, applications, and performance metrics in the Malaysian data center market. It highlights unique selling propositions (USPs) and technological advancements shaping the industry. The analysis includes advancements in areas such as cooling technologies, energy efficiency solutions, and security measures. The focus is on innovations that enhance operational efficiency, reduce costs, and improve performance.

Propelling Factors for Malaysia Data Center Market Growth

Several factors are driving the growth of the Malaysian data center market. These include:

- Government Support: Government initiatives promoting digitalization and investment in digital infrastructure are significantly boosting the market.

- Technological Advancements: Innovations in cloud computing, 5G, and edge computing are creating new opportunities for data center development.

- Economic Growth: The growing economy and increasing adoption of digital technologies are creating strong demand for data center services.

Obstacles in the Malaysia Data Center Market

Challenges facing the Malaysian data center market include:

- Regulatory Hurdles: Navigating regulatory requirements and obtaining necessary permits can be time-consuming and complex.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of critical components and equipment.

- Competition: The market is becoming increasingly competitive, with both domestic and international players vying for market share.

Future Opportunities in Malaysia Data Center Market

Future opportunities in the Malaysian data center market include:

- Expansion into New Regions: There's potential for significant growth in data center infrastructure outside of major metropolitan areas.

- Emerging Technologies: Adoption of new technologies, such as AI and blockchain, will create new demand for data center services.

- Growth in specific industries: Expansion of data centers to support the specific needs of certain industries like finance and healthcare.

Major Players in the Malaysia Data Center Market Ecosystem

- HDC Data Centre SDN BHD (HDC)

- Zenlayer Inc

- IPServerOne

- CSF Group

- YTL Data Center Holdings Pte Ltd (YTL Power International Berhad)

- TelcoHubeXchange

- VADS BERHAD (TM One)

- Open DC SDN BHD

- AIMS DATA CENTRE SDN BHD

- Keppel DC REIT Management Pte Ltd

- Bridge Data Center (Chindata Group)

- NTT Ltd

Key Developments in Malaysia Data Center Market Industry

- October 2022: Zenlayer's joint venture with Megaport enhances network connectivity and service offerings globally.

- September 2022: NTT Ltd commences construction of its sixth data center in Cyberjaya, investing over USD 50 Million and adding 22MW capacity.

- April 2022: Open DC partners with the Malaysian government to build a data center in northern Malaysia to improve internet connectivity.

Strategic Malaysia Data Center Market Forecast

The Malaysian data center market is poised for significant growth, driven by increasing digitalization, government support, and technological advancements. The projected market expansion offers substantial opportunities for both established players and new entrants. The continued development of key infrastructure projects and the increasing demand for cloud services will contribute to the market's continued expansion throughout the forecast period.

Malaysia Data Center Market Segmentation

-

1. Hotspot

- 1.1. Cyberjaya-Kuala Lumpur

- 1.2. Rest of Malaysia

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

Malaysia Data Center Market Segmentation By Geography

- 1. Malaysia

Malaysia Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness of Energy Consumption Control

- 3.3. Market Restrains

- 3.3.1. High Risk Associated with Data

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Cyberjaya-Kuala Lumpur

- 5.1.2. Rest of Malaysia

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 HDC Data Centre SDN BHD (HDC)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Zenlayer Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IPServerOne

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Csf Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 YTL Data Center Holdings Pte Ltd (YTL Power International Berhad)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TelcoHubeXchange

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 VADS BERHAD (TM One)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Open DC SDN BHD

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AIMS DATA CENTRE SDN BHD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Keppel DC REIT Management Pte Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bridge Data Center (Chindata Group)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 NTT Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 HDC Data Centre SDN BHD (HDC)

List of Figures

- Figure 1: Malaysia Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Malaysia Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 4: Malaysia Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 5: Malaysia Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 6: Malaysia Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 7: Malaysia Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 8: Malaysia Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 9: Malaysia Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 10: Malaysia Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 11: Malaysia Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 12: Malaysia Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 13: Malaysia Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Malaysia Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 15: Malaysia Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 16: Malaysia Data Center Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 17: Malaysia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Malaysia Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Malaysia Data Center Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 20: Malaysia Data Center Market Volume K Unit Forecast, by Hotspot 2019 & 2032

- Table 21: Malaysia Data Center Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 22: Malaysia Data Center Market Volume K Unit Forecast, by Data Center Size 2019 & 2032

- Table 23: Malaysia Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 24: Malaysia Data Center Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 25: Malaysia Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 26: Malaysia Data Center Market Volume K Unit Forecast, by Absorption 2019 & 2032

- Table 27: Malaysia Data Center Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 28: Malaysia Data Center Market Volume K Unit Forecast, by Colocation Type 2019 & 2032

- Table 29: Malaysia Data Center Market Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Malaysia Data Center Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 31: Malaysia Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Malaysia Data Center Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Data Center Market?

The projected CAGR is approximately 10.00%.

2. Which companies are prominent players in the Malaysia Data Center Market?

Key companies in the market include HDC Data Centre SDN BHD (HDC), Zenlayer Inc , IPServerOne, Csf Group, YTL Data Center Holdings Pte Ltd (YTL Power International Berhad), TelcoHubeXchange, VADS BERHAD (TM One), Open DC SDN BHD, AIMS DATA CENTRE SDN BHD, Keppel DC REIT Management Pte Ltd, Bridge Data Center (Chindata Group), NTT Ltd.

3. What are the main segments of the Malaysia Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness of Energy Consumption Control.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Risk Associated with Data.

8. Can you provide examples of recent developments in the market?

October 2022: Zenlayer entered into a joint venture with Megaport to strengthen and expand its presence globally. The partnership is aimed at providing enhanced services such as improved network connectivity, real time provisioning, and on demand private connectivity for its clients around the globe.September 2022: NTT Ltd announced the commencement of the construction of its sixth data centre in Cyberjaya. NTT plans to initially invest over USD 50 million in the sixth data centre, which is also known as Cyberjaya 6 (CBJ6). Further, CBJ6 and CBJ5 will have a total facility load of 22MW, spanning a combined 200,000 sq ft.April 2022: Malaysian data center firm Open DC aanounced that they are partnering with the Malaysian government to build a data center in the north of the country. The company aim to improve the Internet development at the northern border, to emulate the existing neighboring Internet Exchange (IX) via the Malaysia-Singapore border.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Data Center Market?

To stay informed about further developments, trends, and reports in the Malaysia Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence