Key Insights

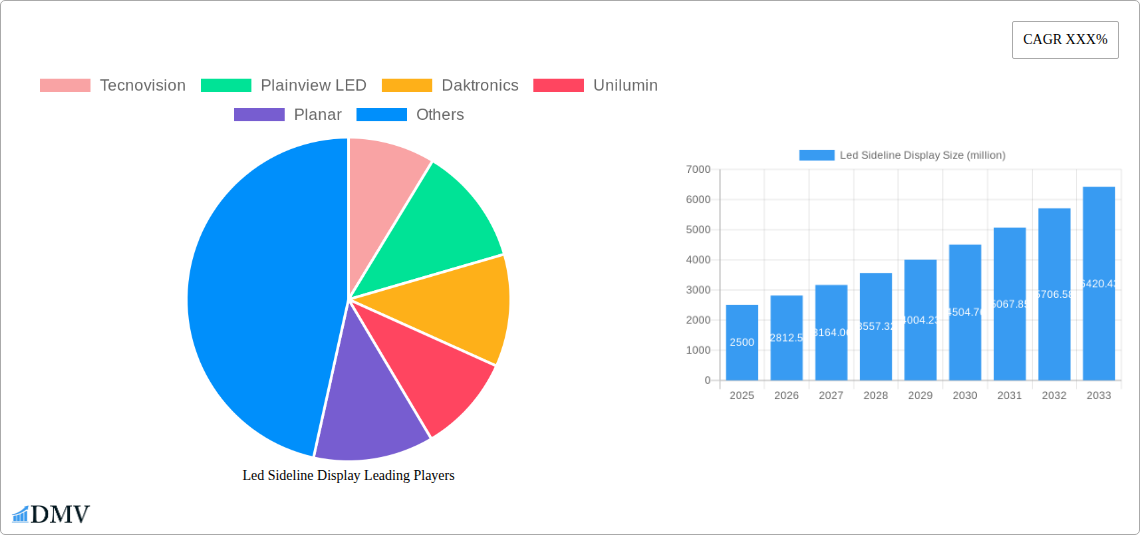

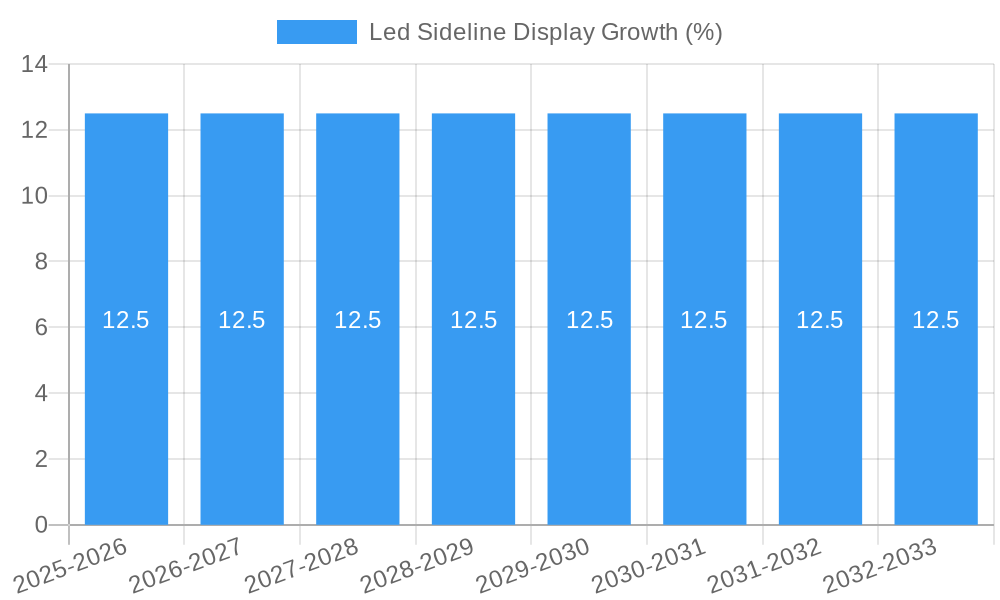

The global LED sideline display market is poised for significant growth, projected to reach an estimated $2,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12.5% expected from 2025 to 2033. This expansion is primarily fueled by the increasing demand for dynamic and engaging visual experiences in sports stadiums and entertainment venues. The rising popularity of professional sports leagues worldwide, coupled with a surge in investment in modernizing stadium infrastructure, are key drivers. Furthermore, advancements in LED technology, leading to higher resolution, brighter displays, and improved energy efficiency, are making these displays more attractive and cost-effective for a wider range of applications. The integration of real-time data, interactive features, and live streaming capabilities further enhances their appeal, transforming traditional sidelines into vibrant multimedia hubs. The market is segmented into Indoor and Outdoor LED sideline displays, catering to the diverse needs of venues, with applications spanning stadiums, theaters, theme parks, and other entertainment facilities.

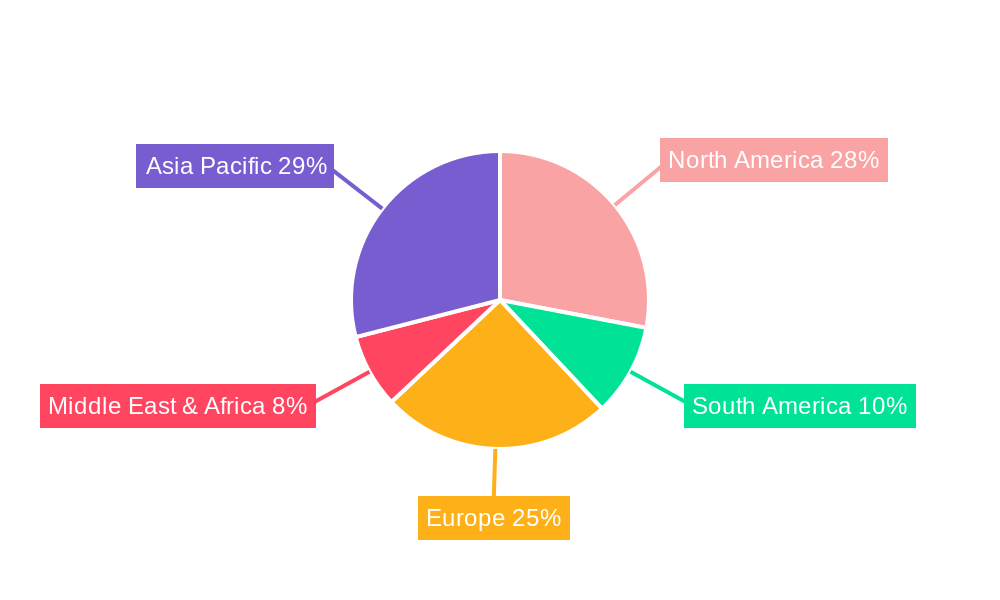

The growth trajectory of the LED sideline display market is further bolstered by emerging trends such as the increasing adoption of modular LED displays, allowing for flexible configurations and easier maintenance. The development of advanced software for content management and real-time analytics is also contributing to the market's dynamism. While the market exhibits strong growth, potential restraints such as the high initial investment cost for some high-end systems and the need for skilled personnel for installation and maintenance could pose challenges. However, the long-term benefits of enhanced fan engagement, increased sponsorship opportunities, and improved operational efficiency are expected to outweigh these concerns. Geographically, the Asia Pacific region, particularly China, is anticipated to dominate the market due to rapid infrastructure development and a burgeoning sports and entertainment industry. North America and Europe also represent significant markets, driven by established sports leagues and a high adoption rate of advanced display technologies. The competitive landscape features key players like Daktronics, Unilumin, and Absen, who are continuously innovating to capture market share.

Led Sideline Display Market Composition & Trends

The LED Sideline Display market is characterized by a dynamic competitive landscape, with established giants and agile innovators vying for market share. Market concentration is moderate, with leading companies like Daktronics, Unilumin, and Planar holding significant portions, yet numerous smaller players and emerging technologies contribute to a vibrant ecosystem. Innovation catalysts are primarily driven by advancements in pixel pitch, brightness, durability, and intelligent control systems, catering to the ever-increasing demand for immersive visual experiences in sports and entertainment. Regulatory landscapes, while generally supportive of technological adoption, can vary by region concerning public display advertising and safety standards. Substitute products, such as traditional static signage and projection systems, are gradually losing ground as LED technology offers superior visual impact and flexibility. End-user profiles span a broad spectrum, from professional sports leagues and major entertainment venues to corporate events and public spaces, each with distinct requirements and budget considerations. Mergers and acquisitions (M&A) activities are expected to continue as larger companies seek to consolidate market presence and acquire specialized technological expertise. M&A deal values are projected to reach hundreds of millions as strategic partnerships and consolidations shape the future of the industry.

- Market Share Distribution: Leading players collectively hold over 60% of the market, with significant contributions from companies like Tecnovision and Plainview LED.

- Innovation Focus: Key areas include ultra-fine pixel pitches for close-proximity viewing and enhanced outdoor durability against weather elements.

- Regulatory Impact: Emerging standards for energy efficiency and data privacy are influencing product development and deployment strategies.

- End-User Demands: A growing emphasis on interactivity, real-time data integration, and customizable content solutions.

- M&A Activity: Projected to see an increase in strategic acquisitions aimed at expanding product portfolios and geographical reach, with an estimated aggregate deal value of 500 million over the forecast period.

Led Sideline Display Industry Evolution

The LED Sideline Display industry has undergone a remarkable transformation over the historical period (2019-2024), driven by rapid technological advancements and an escalating demand for dynamic, high-impact visual communication. The market growth trajectory has been consistently upward, fueled by the adoption of LED sideline displays in a multitude of applications, from enhancing fan engagement in stadiums to creating captivating atmospheres in theme parks and theaters. During the base year of 2025, the market is projected to exhibit robust expansion, a trend that is anticipated to continue and accelerate through the forecast period (2025-2033). Technological advancements have been pivotal, with continuous improvements in LED chip efficiency leading to brighter, more energy-efficient displays with superior color accuracy and contrast ratios. The introduction of modular designs has simplified installation and maintenance, while the development of sophisticated control software has enabled seamless integration of live feeds, replays, graphics, and interactive content. Shifting consumer demands have played an equally crucial role, with audiences now expecting more than just passive viewing. They seek immersive experiences, real-time information, and personalized interactions, all of which LED sideline displays are uniquely positioned to deliver. The adoption of finer pixel pitches has enabled crystal-clear imagery even at close distances, making them suitable for a wider range of applications, including indoor settings where traditional large displays might have been impractical. Furthermore, the increasing affordability and reliability of LED technology have democratized access, allowing a broader range of venues and events to leverage its benefits. The market has seen a significant increase in deployment for advertising, sponsorship activations, and in-venue information dissemination, directly contributing to the financial viability of sporting events and entertainment productions. The evolution from basic display units to sophisticated, data-driven visual platforms underscores the industry's dynamic nature and its pivotal role in shaping modern spectator experiences. Historical growth rates averaged around 12% annually, with projections indicating a sustained growth of approximately 15% through 2033.

Leading Regions, Countries, or Segments in Led Sideline Display

The global LED Sideline Display market exhibits a distinct regional and segmental dominance, driven by a confluence of investment trends, regulatory support, and end-user adoption. North America, particularly the United States, stands out as a leading region, owing to its mature sports and entertainment infrastructure, substantial corporate sponsorship budgets, and a populace with a high appetite for live event experiences. The region's dominance is further amplified by a proactive regulatory environment that encourages technological innovation and investment in public venues.

Application: Stadium Dominance

The Stadium application segment is arguably the most significant driver of the LED Sideline Display market. The sheer scale of professional sports stadiums, coupled with the constant need for enhanced fan engagement and lucrative sponsorship opportunities, makes them prime candidates for extensive LED sideline display installations.

- Key Drivers for Stadium Dominance:

- Fan Engagement: Dynamic content, instant replays, and interactive features significantly enhance the spectator experience, boosting ticket sales and venue loyalty. Companies like Daktronics and Unilumin are at the forefront of delivering these immersive solutions.

- Sponsorship Revenue: LED sideline displays offer prime real estate for advertising, allowing teams and leagues to generate substantial revenue streams. The flexibility to display dynamic advertisements attracts a wider range of sponsors, from global brands to local businesses.

- Technological Integration: The ability to seamlessly integrate live game feeds, player statistics, social media feeds, and promotional content creates a holistic and engaging environment.

- Operational Efficiency: Real-time information dissemination for crowd management, safety announcements, and wayfinding contributes to smoother event operations.

- Investment Trends: Major sports leagues and stadium owners consistently invest millions in upgrading their facilities, with LED sideline displays being a significant component of these capital expenditures. The average stadium upgrade project involving LED displays can range from 10 million to 50 million.

Type: Outdoor LED Sideline Display

Within the display type segmentation, Outdoor LED Sideline Displays command a substantial market share, especially in stadium and theme park applications where visibility under varying light conditions is paramount.

- Key Drivers for Outdoor Dominance:

- Durability and Resilience: Outdoor displays are engineered to withstand harsh weather conditions, including extreme temperatures, rain, and UV exposure, ensuring longevity and reliability. Brands like Absen and Barco specialize in these robust solutions.

- Brightness and Visibility: High brightness levels are crucial for clear visibility in bright daylight, a common challenge for outdoor venues. Advancements in LED technology have significantly improved brightness without compromising energy efficiency.

- Cost-Effectiveness over Time: While initial investment might be higher, the durability and lower maintenance requirements of outdoor LED displays make them a cost-effective solution for long-term deployment.

- Impactful Advertising: The large-scale nature of outdoor displays in stadiums and entertainment districts offers unparalleled visual impact for advertising and branding.

- Growth in Entertainment Venues: The expansion of theme parks and outdoor entertainment complexes globally is a direct catalyst for the demand in this segment.

The dominant regions also benefit from the presence of major manufacturers and integrators like Leyard, INFiLED, and Ledman, who cater to the immense demand. Countries with robust economies and a strong sporting culture, such as the United States, China, and parts of Europe, represent the largest consumer bases. While indoor applications are growing, particularly in theaters and convention centers, the sheer scale and revenue potential associated with outdoor stadium displays solidify their leading position in the global LED Sideline Display market. The total market value for outdoor LED sideline displays alone is estimated to reach over 2,000 million by 2025.

Led Sideline Display Product Innovations

Recent product innovations in the LED Sideline Display market are revolutionizing visual experiences. Manufacturers are pushing boundaries with ultra-fine pixel pitch displays, offering unparalleled clarity for close-proximity viewing, effectively blurring the lines between digital screens and high-resolution video. Innovations in modular design have led to seamless, large-format installations with improved durability and easier maintenance. Advanced control systems now enable real-time content adaptation, intelligent data integration for fan analytics, and interactive overlays, transforming passive displays into dynamic communication hubs. Furthermore, increased energy efficiency and enhanced brightness, even in direct sunlight, are key performance metrics driving adoption across various applications, from vibrant stadium displays by companies like Lightking Tech Group to sophisticated theatrical backdrops.

Propelling Factors for Led Sideline Display Growth

Several key factors are propelling the growth of the LED Sideline Display market. Technological advancements, particularly in pixel pitch reduction, brightness, and energy efficiency, are making these displays more versatile and cost-effective. The escalating demand for immersive fan engagement in sports and entertainment venues is a significant driver, with stadiums and theme parks investing heavily in visual technology. The lucrative advertising and sponsorship opportunities presented by these dynamic displays attract businesses seeking impactful brand exposure. Furthermore, supportive government initiatives in some regions promoting digital infrastructure and smart city development indirectly foster the adoption of advanced display technologies. The increasing integration of interactive features and real-time data capabilities further enhances their appeal to end-users.

Obstacles in the Led Sideline Display Market

Despite robust growth, the LED Sideline Display market faces several obstacles. High initial capital investment remains a barrier for smaller venues and organizations, even with declining prices. Supply chain disruptions, particularly for critical components like LED chips and control boards, can lead to production delays and cost fluctuations. Intense competition among numerous manufacturers, including Lopu and Mary, can lead to price wars, squeezing profit margins. Additionally, the need for skilled technicians for installation, operation, and maintenance can pose a challenge in certain regions. Evolving regulatory landscapes regarding advertising content and data privacy also require continuous adaptation by market players.

Future Opportunities in Led Sideline Display

The future of the LED Sideline Display market is rife with opportunities. The expansion of 5G technology will enable even more seamless and real-time data integration, unlocking new possibilities for interactive fan experiences and dynamic content delivery. The growing trend of esports will create a significant demand for specialized LED displays in arenas and broadcast studios. As smart city initiatives gain momentum, LED sideline displays will likely find increasing applications in public spaces for information dissemination and advertising. The development of more sustainable and energy-efficient LED technologies will further enhance their appeal. Emerging markets in developing economies represent untapped potential for widespread adoption.

Major Players in the Led Sideline Display Ecosystem

- Tecnovision

- Plainview LED

- Daktronics

- Unilumin

- Planar

- Leyard

- Absen

- AOTO

- Barco

- INFiLED

- Ledman

- Liantronics

- Lighthouse

- Lightking Tech Group

- Lopu

- Mary

- QSTech

- Samsung

- Sansitech

- Yaham

- Yestech Optoelectronic

Key Developments in Led Sideline Display Industry

- 2019: Introduction of ultra-fine pixel pitch LED displays (e.g., 1.5mm) enabling indoor stadium applications by major manufacturers.

- 2020: Increased focus on remote monitoring and control solutions for LED displays due to global event disruptions.

- 2021: Significant advancements in LED display brightness and HDR capabilities, enhancing outdoor visibility.

- 2022: Integration of 5G connectivity enabling real-time data streaming and enhanced interactivity in stadium displays.

- 2023: Emergence of AI-powered content management systems for personalized and dynamic sideline advertising.

- 2024: Growing adoption of sustainable and energy-efficient LED technologies, with several companies launching eco-friendly product lines.

Strategic Led Sideline Display Market Forecast

The strategic LED Sideline Display market forecast indicates a period of sustained and robust growth, driven by an insatiable demand for enhanced visual experiences in sports, entertainment, and public spaces. Projections suggest that technological innovations in pixel density, brightness, and interactive capabilities will continue to be key growth catalysts. The increasing investment in stadium infrastructure and the burgeoning esports market will further fuel demand. Emerging economies present significant untapped potential, poised to adopt these advanced display solutions as their entertainment sectors mature. The integration of 5G and AI will unlock new avenues for dynamic content delivery and personalized advertising, solidifying the market's upward trajectory and promising a vibrant future for LED sideline displays.

Led Sideline Display Segmentation

-

1. Application

- 1.1. Stadium

- 1.2. Theater

- 1.3. Theme Park

- 1.4. Others

-

2. Type

- 2.1. Indoor LED Sideline Display

- 2.2. Outdoor LED Sideline Display

Led Sideline Display Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Led Sideline Display REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Led Sideline Display Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Stadium

- 5.1.2. Theater

- 5.1.3. Theme Park

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Indoor LED Sideline Display

- 5.2.2. Outdoor LED Sideline Display

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Led Sideline Display Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Stadium

- 6.1.2. Theater

- 6.1.3. Theme Park

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Indoor LED Sideline Display

- 6.2.2. Outdoor LED Sideline Display

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Led Sideline Display Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Stadium

- 7.1.2. Theater

- 7.1.3. Theme Park

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Indoor LED Sideline Display

- 7.2.2. Outdoor LED Sideline Display

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Led Sideline Display Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Stadium

- 8.1.2. Theater

- 8.1.3. Theme Park

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Indoor LED Sideline Display

- 8.2.2. Outdoor LED Sideline Display

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Led Sideline Display Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Stadium

- 9.1.2. Theater

- 9.1.3. Theme Park

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Indoor LED Sideline Display

- 9.2.2. Outdoor LED Sideline Display

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Led Sideline Display Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Stadium

- 10.1.2. Theater

- 10.1.3. Theme Park

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Indoor LED Sideline Display

- 10.2.2. Outdoor LED Sideline Display

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Tecnovision

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Plainview LED

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Daktronics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Unilumin

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Planar

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Leyard

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Absen

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AOTO

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Barco

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 INFiLED

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ledman

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Liantronics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Lighthouse

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Lightking Tech Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Lopu

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Mary

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 QSTech

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Samsung

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Sansitech

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Yaham

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Yestech Optoelectronic

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.1 Tecnovision

List of Figures

- Figure 1: Global Led Sideline Display Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Led Sideline Display Revenue (million), by Application 2024 & 2032

- Figure 3: North America Led Sideline Display Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Led Sideline Display Revenue (million), by Type 2024 & 2032

- Figure 5: North America Led Sideline Display Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Led Sideline Display Revenue (million), by Country 2024 & 2032

- Figure 7: North America Led Sideline Display Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Led Sideline Display Revenue (million), by Application 2024 & 2032

- Figure 9: South America Led Sideline Display Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Led Sideline Display Revenue (million), by Type 2024 & 2032

- Figure 11: South America Led Sideline Display Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Led Sideline Display Revenue (million), by Country 2024 & 2032

- Figure 13: South America Led Sideline Display Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Led Sideline Display Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Led Sideline Display Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Led Sideline Display Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Led Sideline Display Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Led Sideline Display Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Led Sideline Display Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Led Sideline Display Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Led Sideline Display Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Led Sideline Display Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Led Sideline Display Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Led Sideline Display Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Led Sideline Display Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Led Sideline Display Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Led Sideline Display Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Led Sideline Display Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Led Sideline Display Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Led Sideline Display Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Led Sideline Display Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Led Sideline Display Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Led Sideline Display Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Led Sideline Display Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Led Sideline Display Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Led Sideline Display Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Led Sideline Display Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Led Sideline Display Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Led Sideline Display Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Led Sideline Display Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Led Sideline Display Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Led Sideline Display Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Led Sideline Display Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Led Sideline Display Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Led Sideline Display Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Led Sideline Display Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Led Sideline Display Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Led Sideline Display Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Led Sideline Display Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Led Sideline Display Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Led Sideline Display Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Led Sideline Display?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Led Sideline Display?

Key companies in the market include Tecnovision, Plainview LED, Daktronics, Unilumin, Planar, Leyard, Absen, AOTO, Barco, INFiLED, Ledman, Liantronics, Lighthouse, Lightking Tech Group, Lopu, Mary, QSTech, Samsung, Sansitech, Yaham, Yestech Optoelectronic.

3. What are the main segments of the Led Sideline Display?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Led Sideline Display," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Led Sideline Display report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Led Sideline Display?

To stay informed about further developments, trends, and reports in the Led Sideline Display, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence