Key Insights

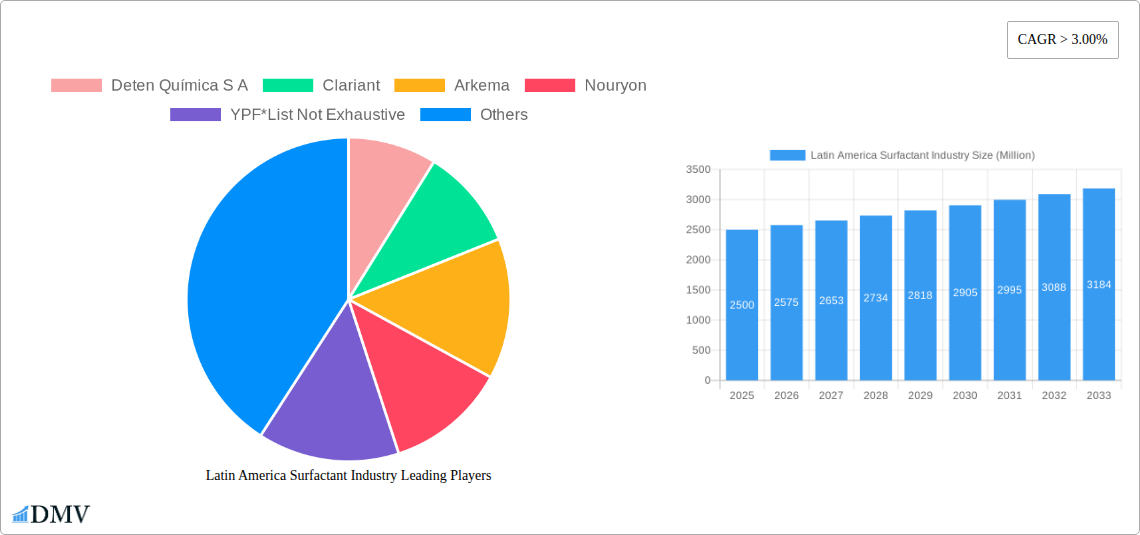

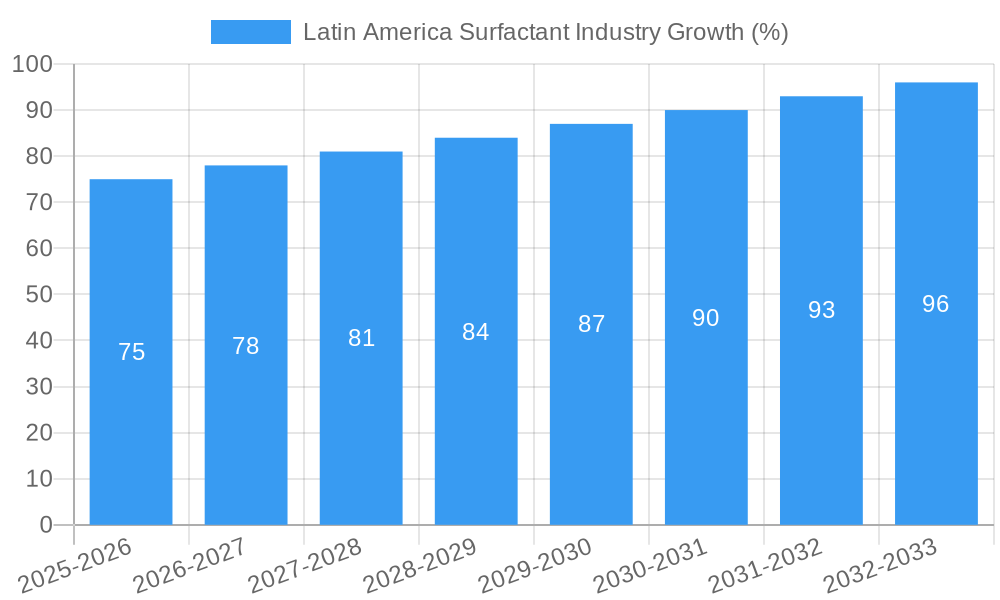

The Latin American surfactant market, valued at approximately $X million in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 3.00% from 2025 to 2033. This growth is fueled by several key drivers. The burgeoning personal care and household cleaning sectors across the region are significantly boosting demand for surfactants. Increasing disposable incomes and a rising middle class are fueling consumption of these products. Furthermore, the expanding industrial sector, particularly in countries like Brazil and Mexico, is creating substantial demand for surfactants in applications like textile processing and oilfield chemicals. The adoption of bio-based surfactants, driven by growing environmental concerns and sustainability initiatives, represents a significant market trend. However, the market also faces certain restraints. Fluctuations in raw material prices and economic instability in some Latin American countries could impact market growth. Competition among established players and the emergence of new entrants add complexity to the landscape.

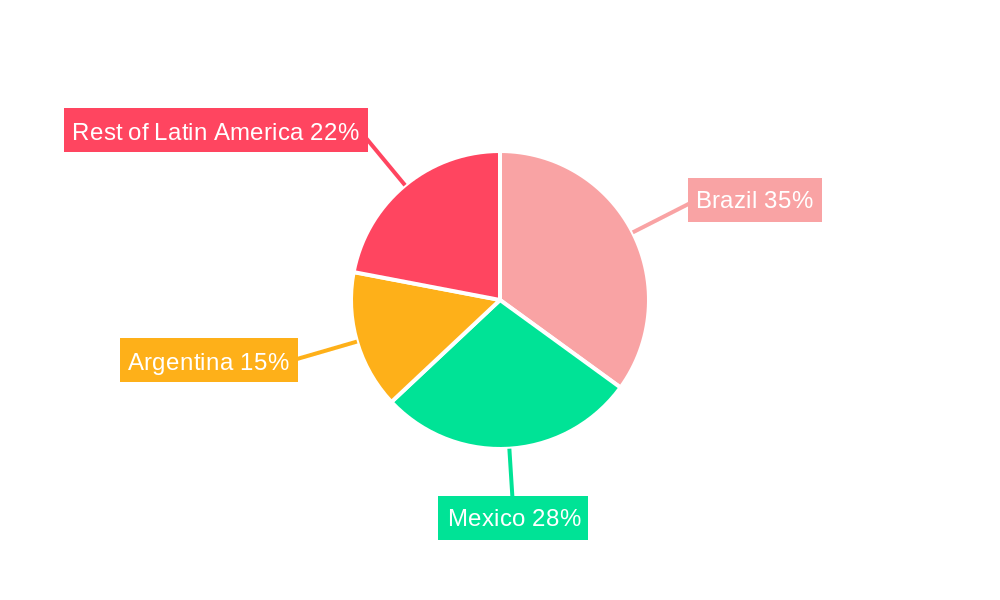

Market segmentation reveals a diverse product mix. Anionic surfactants maintain a considerable share, driven by their widespread use in detergents and cleaning products. The increasing demand for eco-friendly alternatives is fostering growth in the bio-based segment, with sucrose esters, alkyl polyglycosides, and fatty acid glucamides gaining popularity. The personal care segment is expected to be a major contributor to overall market expansion, followed by household soap and detergent applications. Geographically, Brazil, Mexico, and Argentina are the key contributors, reflecting their larger economies and higher consumption levels. The "Rest of Latin America" segment also holds potential for future growth as consumer demand and industrial activity increase in these markets. Leading players like Clariant, Arkema, and others are strategically investing in research and development and expanding their manufacturing capacity to meet the rising regional demand.

Latin America Surfactant Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Latin America surfactant industry, offering valuable insights for stakeholders seeking to navigate this dynamic market. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, key players, and future opportunities. The study encompasses a wide range of surfactant types, including anionic, cationic, and non-ionic surfactants, as well as bio-based and synthetic options, across diverse applications spanning household products, personal care, industrial cleaning, and more. Expect detailed market sizing, competitive landscapes, and growth projections to help you make informed business decisions.

Latin America Surfactant Industry Market Composition & Trends

This section analyzes the competitive landscape, encompassing market share distribution among key players like Deten Química S A, Clariant, Arkema, Nouryon, and YPF, along with other significant participants including Reliance Industries Ltd, Bayer AG, Solvay, Indorama Ventures Public Company Limited, Evonik Industries AG, 3M, Stepan Company, P&G Chemicals, Croda International Plc, Ashland, BASF SE, Dow, Lonza, Kao Corporation, Innospec, TENSAC, and Godrej Industries. The report delves into the factors driving market concentration, including mergers and acquisitions (M&A) activity. We examine the influence of regulatory landscapes, the emergence of substitute products, evolving end-user profiles, and the impact of innovation on market dynamics. Market share distribution will be presented for the major players, with estimated M&A deal values in the Millions. For example, in 2024, the top five players held an estimated xx% market share, with M&A activity exceeding $xx Million.

- Market Concentration: Analysis of market share distribution amongst leading players.

- Innovation Catalysts: Assessment of R&D investments and technological advancements.

- Regulatory Landscape: Review of relevant regulations and their impact on the market.

- Substitute Products: Evaluation of competitive pressures from alternative products.

- End-User Profiles: Characterization of key consumer segments and their purchasing behavior.

- M&A Activity: Analysis of mergers, acquisitions, and their effects on market dynamics.

Latin America Surfactant Industry Industry Evolution

This section offers a detailed examination of the Latin America surfactant market's growth trajectory from 2019 to 2033. We analyze technological advancements, shifting consumer preferences toward sustainable products (such as bio-based surfactants), and the impact of these factors on market expansion. The report provides specific data points such as compound annual growth rates (CAGR) and adoption rates of new technologies. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching a market value of $xx Million by 2033. The increasing demand for eco-friendly products is driving the growth of the bio-based surfactant segment, with an expected market share of xx% by 2033. Technological advancements, such as the development of novel polymerizable surfactants and high-performance biosurfactants, are also contributing to market expansion.

Leading Regions, Countries, or Segments in Latin America Surfactant Industry

This section identifies the leading regions, countries, and segments within the Latin America surfactant market. The analysis considers various categories including: Other Cationic Surfactants, Non-ionic Surfactants, Other Non-ionic Surfactants, Synthetic Surfactants, Bio-based Surfactants (including Sucrose Ester, Alkyl Polyglycoside, Fatty Acid Glucamide, Sorbitan Ester, and other Chemically Synthesized Bio-based Surfactants), Bio-surfactants (Glycolipid, Fatty Acid, Phospholipid, Neutral Lipid, Lipopeptide, Polymeric Bio-surfactant), and applications in Household Soap and Detergent, Personal Care, Lubricants and Fuel Additives, Industry and Institutional Cleaning, Food and Beverages, Oilfield Chemicals, Agricultural Chemicals, Textile Processing, and Other Applications. The dominant segment will be identified, supported by an in-depth analysis of the factors driving its leadership. Brazil and Mexico are expected to be the leading countries due to their large and growing consumer markets and industrial sectors.

- Key Drivers: Investment trends in specific regions, regulatory support for sustainable surfactants, and growing consumer demand in key application areas will be analyzed.

Latin America Surfactant Industry Product Innovations

Recent years have witnessed significant product innovations within the Latin American surfactant market. Companies are focusing on developing sustainable, high-performance surfactants to meet the growing demand for environmentally friendly products. This includes the introduction of novel bio-based surfactants and polymerizable surfactants with enhanced properties. For example, Solvay's launch of Mirasoft SL L60 and Mirasoft SL A60 biosurfactants highlights the trend towards sustainable beauty care products. These innovations are characterized by improved efficiency, enhanced performance in specific applications, and reduced environmental impact. The unique selling propositions of these new products include enhanced sustainability, improved performance characteristics, and greater versatility across various applications.

Propelling Factors for Latin America Surfactant Industry Growth

Several factors contribute to the projected growth of the Latin American surfactant market. Technological advancements, leading to the development of more efficient and sustainable products, are a key driver. Economic growth across Latin America, particularly in key consumer markets, fuels demand for household and personal care products. Furthermore, supportive government regulations promoting sustainable practices are encouraging the adoption of bio-based surfactants. Specific examples include the growing demand for personal care products and cleaning solutions, driven by increasing disposable incomes and improved living standards.

Obstacles in the Latin America Surfactant Industry Market

The Latin America surfactant market faces certain challenges. Regulatory hurdles and varying standards across different countries can create complexities for manufacturers. Supply chain disruptions caused by global events can significantly impact production and pricing. Furthermore, intense competition from both domestic and international players exerts pressure on margins and market share. These challenges create volatility in supply and pricing, requiring manufacturers to adapt to ensure long-term profitability and competitiveness.

Future Opportunities in Latin America Surfactant Industry

The Latin American surfactant market presents promising future opportunities. The growing demand for sustainable and bio-based surfactants offers significant potential for expansion. Emerging markets and increasing consumer awareness of environmentally friendly products present significant growth prospects. The focus on innovative and sustainable product development offers opportunities for market leadership and profitability. Moreover, strategic partnerships and collaborations will become crucial for expanding market reach and competitiveness.

Major Players in the Latin America Surfactant Industry Ecosystem

- Deten Química S A

- Clariant

- Arkema

- Nouryon

- YPF

- Reliance Industries Ltd

- Bayer AG

- Solvay

- Indorama Ventures Public Company Limited

- Evonik Industries AG

- 3M

- Stepan Company

- P&G Chemicals

- Croda International Plc

- Ashland

- BASF SE

- Dow

- Lonza

- Kao Corporation

- Innospec

- TENSAC

- Godrej Industries

Key Developments in Latin America Surfactant Industry Industry

- November 2022: Solvay introduced Reactsurf 2490, a novel APE-free polymerizable surfactant enhancing emulsion performance in coatings and adhesives.

- June 2022: Solvay launched Mirasoft SL L60 and Mirasoft SL A60, high-performance biosurfactants for sustainable beauty care products.

- February 2022: Clariant introduced its Vita line of 100% bio-based surfactants and PEGs, addressing climate change concerns.

Strategic Latin America Surfactant Industry Market Forecast

The Latin America surfactant market is poised for robust growth, driven by increasing demand for sustainable products, economic expansion, and technological advancements. The shift towards bio-based and high-performance surfactants will further fuel market expansion. Opportunities exist in expanding into new markets, leveraging technological innovations, and catering to evolving consumer preferences. The market is expected to experience significant growth, presenting attractive opportunities for both established players and new entrants.

Latin America Surfactant Industry Segmentation

-

1. Type

-

1.1. Anionic Surfactants

- 1.1.1. Linear Alkylbenzene Sulfolane (LAS or LABS)

- 1.1.2. Alcohol Ethoxy Sulfates (AES)

- 1.1.3. Alpha Olefin Sulfonates (AOS)

- 1.1.4. Secondary Alkane Sulfonate (SAS)

- 1.1.5. Methyl Ester Sulfonates (MES)

- 1.1.6. Sulfosuccinates

- 1.1.7. Other Anionic Surfactants

-

1.2. Cationic Surfactants

- 1.2.1. Quaternary Ammonium Compounds

- 1.2.2. Other Cationic Surfactants

-

1.3. Non-ionic Surfactants

- 1.3.1. Alcohol Ethoxylates

- 1.3.2. Ethoxylated Alkyl-phenols

- 1.3.3. Fatty Acid Esters

- 1.3.4. Other Non-ionic Surfactants

- 1.4. Other Types

-

1.1. Anionic Surfactants

-

2. Origin

- 2.1. Synthetic Surfactants

-

2.2. Bio-based Surfactants

-

2.2.1. Chemically Synthesized Bio-based Surfactants

- 2.2.1.1. Sucrose Ester

- 2.2.1.2. Alkyl Polyglycoside

- 2.2.1.3. Fatty Acid Glucamide

- 2.2.1.4. Sorbitan Ester

- 2.2.1.5. Other Chemically Synthesized Bio-based Surfactants

-

2.2.2. Bio-surfactant

- 2.2.2.1. Glycolipid

- 2.2.2.2. Fatty Acid, Phospholipid, Neutral Lipid

- 2.2.2.3. Lipopeptide

- 2.2.2.4. Polymeric Bio-surfactant

-

2.2.1. Chemically Synthesized Bio-based Surfactants

-

3. Application

- 3.1. Household Soap and Detergent

- 3.2. Personal Care

- 3.3. Lubricants and Fuel Additives

- 3.4. Industry and Institutional Cleaning

- 3.5. Food and Beverages

- 3.6. Oilfield Chemicals

- 3.7. Agricultural Chemicals

- 3.8. Textile Processing

- 3.9. Other Applications

-

4. Geography

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Argentina

- 4.4. Chile

- 4.5. Colombia

- 4.6. Rest of Latin America

Latin America Surfactant Industry Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Argentina

- 4. Chile

- 5. Colombia

- 6. Rest of Latin America

Latin America Surfactant Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Personal Care and Home Care Industry in Latin America; The Growth of the Oleo Chemicals Market Driving Bio-based Surfactants

- 3.3. Market Restrains

- 3.3.1. Increasing Focus on Environmental Regulations; Other Restraints

- 3.4. Market Trends

- 3.4.1. Growing Demand from Household Soap and Detergent Application

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Surfactant Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Anionic Surfactants

- 5.1.1.1. Linear Alkylbenzene Sulfolane (LAS or LABS)

- 5.1.1.2. Alcohol Ethoxy Sulfates (AES)

- 5.1.1.3. Alpha Olefin Sulfonates (AOS)

- 5.1.1.4. Secondary Alkane Sulfonate (SAS)

- 5.1.1.5. Methyl Ester Sulfonates (MES)

- 5.1.1.6. Sulfosuccinates

- 5.1.1.7. Other Anionic Surfactants

- 5.1.2. Cationic Surfactants

- 5.1.2.1. Quaternary Ammonium Compounds

- 5.1.2.2. Other Cationic Surfactants

- 5.1.3. Non-ionic Surfactants

- 5.1.3.1. Alcohol Ethoxylates

- 5.1.3.2. Ethoxylated Alkyl-phenols

- 5.1.3.3. Fatty Acid Esters

- 5.1.3.4. Other Non-ionic Surfactants

- 5.1.4. Other Types

- 5.1.1. Anionic Surfactants

- 5.2. Market Analysis, Insights and Forecast - by Origin

- 5.2.1. Synthetic Surfactants

- 5.2.2. Bio-based Surfactants

- 5.2.2.1. Chemically Synthesized Bio-based Surfactants

- 5.2.2.1.1. Sucrose Ester

- 5.2.2.1.2. Alkyl Polyglycoside

- 5.2.2.1.3. Fatty Acid Glucamide

- 5.2.2.1.4. Sorbitan Ester

- 5.2.2.1.5. Other Chemically Synthesized Bio-based Surfactants

- 5.2.2.2. Bio-surfactant

- 5.2.2.2.1. Glycolipid

- 5.2.2.2.2. Fatty Acid, Phospholipid, Neutral Lipid

- 5.2.2.2.3. Lipopeptide

- 5.2.2.2.4. Polymeric Bio-surfactant

- 5.2.2.1. Chemically Synthesized Bio-based Surfactants

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Household Soap and Detergent

- 5.3.2. Personal Care

- 5.3.3. Lubricants and Fuel Additives

- 5.3.4. Industry and Institutional Cleaning

- 5.3.5. Food and Beverages

- 5.3.6. Oilfield Chemicals

- 5.3.7. Agricultural Chemicals

- 5.3.8. Textile Processing

- 5.3.9. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Mexico

- 5.4.2. Brazil

- 5.4.3. Argentina

- 5.4.4. Chile

- 5.4.5. Colombia

- 5.4.6. Rest of Latin America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Mexico

- 5.5.2. Brazil

- 5.5.3. Argentina

- 5.5.4. Chile

- 5.5.5. Colombia

- 5.5.6. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Mexico Latin America Surfactant Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Anionic Surfactants

- 6.1.1.1. Linear Alkylbenzene Sulfolane (LAS or LABS)

- 6.1.1.2. Alcohol Ethoxy Sulfates (AES)

- 6.1.1.3. Alpha Olefin Sulfonates (AOS)

- 6.1.1.4. Secondary Alkane Sulfonate (SAS)

- 6.1.1.5. Methyl Ester Sulfonates (MES)

- 6.1.1.6. Sulfosuccinates

- 6.1.1.7. Other Anionic Surfactants

- 6.1.2. Cationic Surfactants

- 6.1.2.1. Quaternary Ammonium Compounds

- 6.1.2.2. Other Cationic Surfactants

- 6.1.3. Non-ionic Surfactants

- 6.1.3.1. Alcohol Ethoxylates

- 6.1.3.2. Ethoxylated Alkyl-phenols

- 6.1.3.3. Fatty Acid Esters

- 6.1.3.4. Other Non-ionic Surfactants

- 6.1.4. Other Types

- 6.1.1. Anionic Surfactants

- 6.2. Market Analysis, Insights and Forecast - by Origin

- 6.2.1. Synthetic Surfactants

- 6.2.2. Bio-based Surfactants

- 6.2.2.1. Chemically Synthesized Bio-based Surfactants

- 6.2.2.1.1. Sucrose Ester

- 6.2.2.1.2. Alkyl Polyglycoside

- 6.2.2.1.3. Fatty Acid Glucamide

- 6.2.2.1.4. Sorbitan Ester

- 6.2.2.1.5. Other Chemically Synthesized Bio-based Surfactants

- 6.2.2.2. Bio-surfactant

- 6.2.2.2.1. Glycolipid

- 6.2.2.2.2. Fatty Acid, Phospholipid, Neutral Lipid

- 6.2.2.2.3. Lipopeptide

- 6.2.2.2.4. Polymeric Bio-surfactant

- 6.2.2.1. Chemically Synthesized Bio-based Surfactants

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Household Soap and Detergent

- 6.3.2. Personal Care

- 6.3.3. Lubricants and Fuel Additives

- 6.3.4. Industry and Institutional Cleaning

- 6.3.5. Food and Beverages

- 6.3.6. Oilfield Chemicals

- 6.3.7. Agricultural Chemicals

- 6.3.8. Textile Processing

- 6.3.9. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Mexico

- 6.4.2. Brazil

- 6.4.3. Argentina

- 6.4.4. Chile

- 6.4.5. Colombia

- 6.4.6. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Brazil Latin America Surfactant Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Anionic Surfactants

- 7.1.1.1. Linear Alkylbenzene Sulfolane (LAS or LABS)

- 7.1.1.2. Alcohol Ethoxy Sulfates (AES)

- 7.1.1.3. Alpha Olefin Sulfonates (AOS)

- 7.1.1.4. Secondary Alkane Sulfonate (SAS)

- 7.1.1.5. Methyl Ester Sulfonates (MES)

- 7.1.1.6. Sulfosuccinates

- 7.1.1.7. Other Anionic Surfactants

- 7.1.2. Cationic Surfactants

- 7.1.2.1. Quaternary Ammonium Compounds

- 7.1.2.2. Other Cationic Surfactants

- 7.1.3. Non-ionic Surfactants

- 7.1.3.1. Alcohol Ethoxylates

- 7.1.3.2. Ethoxylated Alkyl-phenols

- 7.1.3.3. Fatty Acid Esters

- 7.1.3.4. Other Non-ionic Surfactants

- 7.1.4. Other Types

- 7.1.1. Anionic Surfactants

- 7.2. Market Analysis, Insights and Forecast - by Origin

- 7.2.1. Synthetic Surfactants

- 7.2.2. Bio-based Surfactants

- 7.2.2.1. Chemically Synthesized Bio-based Surfactants

- 7.2.2.1.1. Sucrose Ester

- 7.2.2.1.2. Alkyl Polyglycoside

- 7.2.2.1.3. Fatty Acid Glucamide

- 7.2.2.1.4. Sorbitan Ester

- 7.2.2.1.5. Other Chemically Synthesized Bio-based Surfactants

- 7.2.2.2. Bio-surfactant

- 7.2.2.2.1. Glycolipid

- 7.2.2.2.2. Fatty Acid, Phospholipid, Neutral Lipid

- 7.2.2.2.3. Lipopeptide

- 7.2.2.2.4. Polymeric Bio-surfactant

- 7.2.2.1. Chemically Synthesized Bio-based Surfactants

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Household Soap and Detergent

- 7.3.2. Personal Care

- 7.3.3. Lubricants and Fuel Additives

- 7.3.4. Industry and Institutional Cleaning

- 7.3.5. Food and Beverages

- 7.3.6. Oilfield Chemicals

- 7.3.7. Agricultural Chemicals

- 7.3.8. Textile Processing

- 7.3.9. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Mexico

- 7.4.2. Brazil

- 7.4.3. Argentina

- 7.4.4. Chile

- 7.4.5. Colombia

- 7.4.6. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Argentina Latin America Surfactant Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Anionic Surfactants

- 8.1.1.1. Linear Alkylbenzene Sulfolane (LAS or LABS)

- 8.1.1.2. Alcohol Ethoxy Sulfates (AES)

- 8.1.1.3. Alpha Olefin Sulfonates (AOS)

- 8.1.1.4. Secondary Alkane Sulfonate (SAS)

- 8.1.1.5. Methyl Ester Sulfonates (MES)

- 8.1.1.6. Sulfosuccinates

- 8.1.1.7. Other Anionic Surfactants

- 8.1.2. Cationic Surfactants

- 8.1.2.1. Quaternary Ammonium Compounds

- 8.1.2.2. Other Cationic Surfactants

- 8.1.3. Non-ionic Surfactants

- 8.1.3.1. Alcohol Ethoxylates

- 8.1.3.2. Ethoxylated Alkyl-phenols

- 8.1.3.3. Fatty Acid Esters

- 8.1.3.4. Other Non-ionic Surfactants

- 8.1.4. Other Types

- 8.1.1. Anionic Surfactants

- 8.2. Market Analysis, Insights and Forecast - by Origin

- 8.2.1. Synthetic Surfactants

- 8.2.2. Bio-based Surfactants

- 8.2.2.1. Chemically Synthesized Bio-based Surfactants

- 8.2.2.1.1. Sucrose Ester

- 8.2.2.1.2. Alkyl Polyglycoside

- 8.2.2.1.3. Fatty Acid Glucamide

- 8.2.2.1.4. Sorbitan Ester

- 8.2.2.1.5. Other Chemically Synthesized Bio-based Surfactants

- 8.2.2.2. Bio-surfactant

- 8.2.2.2.1. Glycolipid

- 8.2.2.2.2. Fatty Acid, Phospholipid, Neutral Lipid

- 8.2.2.2.3. Lipopeptide

- 8.2.2.2.4. Polymeric Bio-surfactant

- 8.2.2.1. Chemically Synthesized Bio-based Surfactants

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Household Soap and Detergent

- 8.3.2. Personal Care

- 8.3.3. Lubricants and Fuel Additives

- 8.3.4. Industry and Institutional Cleaning

- 8.3.5. Food and Beverages

- 8.3.6. Oilfield Chemicals

- 8.3.7. Agricultural Chemicals

- 8.3.8. Textile Processing

- 8.3.9. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Mexico

- 8.4.2. Brazil

- 8.4.3. Argentina

- 8.4.4. Chile

- 8.4.5. Colombia

- 8.4.6. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Chile Latin America Surfactant Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Anionic Surfactants

- 9.1.1.1. Linear Alkylbenzene Sulfolane (LAS or LABS)

- 9.1.1.2. Alcohol Ethoxy Sulfates (AES)

- 9.1.1.3. Alpha Olefin Sulfonates (AOS)

- 9.1.1.4. Secondary Alkane Sulfonate (SAS)

- 9.1.1.5. Methyl Ester Sulfonates (MES)

- 9.1.1.6. Sulfosuccinates

- 9.1.1.7. Other Anionic Surfactants

- 9.1.2. Cationic Surfactants

- 9.1.2.1. Quaternary Ammonium Compounds

- 9.1.2.2. Other Cationic Surfactants

- 9.1.3. Non-ionic Surfactants

- 9.1.3.1. Alcohol Ethoxylates

- 9.1.3.2. Ethoxylated Alkyl-phenols

- 9.1.3.3. Fatty Acid Esters

- 9.1.3.4. Other Non-ionic Surfactants

- 9.1.4. Other Types

- 9.1.1. Anionic Surfactants

- 9.2. Market Analysis, Insights and Forecast - by Origin

- 9.2.1. Synthetic Surfactants

- 9.2.2. Bio-based Surfactants

- 9.2.2.1. Chemically Synthesized Bio-based Surfactants

- 9.2.2.1.1. Sucrose Ester

- 9.2.2.1.2. Alkyl Polyglycoside

- 9.2.2.1.3. Fatty Acid Glucamide

- 9.2.2.1.4. Sorbitan Ester

- 9.2.2.1.5. Other Chemically Synthesized Bio-based Surfactants

- 9.2.2.2. Bio-surfactant

- 9.2.2.2.1. Glycolipid

- 9.2.2.2.2. Fatty Acid, Phospholipid, Neutral Lipid

- 9.2.2.2.3. Lipopeptide

- 9.2.2.2.4. Polymeric Bio-surfactant

- 9.2.2.1. Chemically Synthesized Bio-based Surfactants

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Household Soap and Detergent

- 9.3.2. Personal Care

- 9.3.3. Lubricants and Fuel Additives

- 9.3.4. Industry and Institutional Cleaning

- 9.3.5. Food and Beverages

- 9.3.6. Oilfield Chemicals

- 9.3.7. Agricultural Chemicals

- 9.3.8. Textile Processing

- 9.3.9. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Mexico

- 9.4.2. Brazil

- 9.4.3. Argentina

- 9.4.4. Chile

- 9.4.5. Colombia

- 9.4.6. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Colombia Latin America Surfactant Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Anionic Surfactants

- 10.1.1.1. Linear Alkylbenzene Sulfolane (LAS or LABS)

- 10.1.1.2. Alcohol Ethoxy Sulfates (AES)

- 10.1.1.3. Alpha Olefin Sulfonates (AOS)

- 10.1.1.4. Secondary Alkane Sulfonate (SAS)

- 10.1.1.5. Methyl Ester Sulfonates (MES)

- 10.1.1.6. Sulfosuccinates

- 10.1.1.7. Other Anionic Surfactants

- 10.1.2. Cationic Surfactants

- 10.1.2.1. Quaternary Ammonium Compounds

- 10.1.2.2. Other Cationic Surfactants

- 10.1.3. Non-ionic Surfactants

- 10.1.3.1. Alcohol Ethoxylates

- 10.1.3.2. Ethoxylated Alkyl-phenols

- 10.1.3.3. Fatty Acid Esters

- 10.1.3.4. Other Non-ionic Surfactants

- 10.1.4. Other Types

- 10.1.1. Anionic Surfactants

- 10.2. Market Analysis, Insights and Forecast - by Origin

- 10.2.1. Synthetic Surfactants

- 10.2.2. Bio-based Surfactants

- 10.2.2.1. Chemically Synthesized Bio-based Surfactants

- 10.2.2.1.1. Sucrose Ester

- 10.2.2.1.2. Alkyl Polyglycoside

- 10.2.2.1.3. Fatty Acid Glucamide

- 10.2.2.1.4. Sorbitan Ester

- 10.2.2.1.5. Other Chemically Synthesized Bio-based Surfactants

- 10.2.2.2. Bio-surfactant

- 10.2.2.2.1. Glycolipid

- 10.2.2.2.2. Fatty Acid, Phospholipid, Neutral Lipid

- 10.2.2.2.3. Lipopeptide

- 10.2.2.2.4. Polymeric Bio-surfactant

- 10.2.2.1. Chemically Synthesized Bio-based Surfactants

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Household Soap and Detergent

- 10.3.2. Personal Care

- 10.3.3. Lubricants and Fuel Additives

- 10.3.4. Industry and Institutional Cleaning

- 10.3.5. Food and Beverages

- 10.3.6. Oilfield Chemicals

- 10.3.7. Agricultural Chemicals

- 10.3.8. Textile Processing

- 10.3.9. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. Mexico

- 10.4.2. Brazil

- 10.4.3. Argentina

- 10.4.4. Chile

- 10.4.5. Colombia

- 10.4.6. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Latin America Latin America Surfactant Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Anionic Surfactants

- 11.1.1.1. Linear Alkylbenzene Sulfolane (LAS or LABS)

- 11.1.1.2. Alcohol Ethoxy Sulfates (AES)

- 11.1.1.3. Alpha Olefin Sulfonates (AOS)

- 11.1.1.4. Secondary Alkane Sulfonate (SAS)

- 11.1.1.5. Methyl Ester Sulfonates (MES)

- 11.1.1.6. Sulfosuccinates

- 11.1.1.7. Other Anionic Surfactants

- 11.1.2. Cationic Surfactants

- 11.1.2.1. Quaternary Ammonium Compounds

- 11.1.2.2. Other Cationic Surfactants

- 11.1.3. Non-ionic Surfactants

- 11.1.3.1. Alcohol Ethoxylates

- 11.1.3.2. Ethoxylated Alkyl-phenols

- 11.1.3.3. Fatty Acid Esters

- 11.1.3.4. Other Non-ionic Surfactants

- 11.1.4. Other Types

- 11.1.1. Anionic Surfactants

- 11.2. Market Analysis, Insights and Forecast - by Origin

- 11.2.1. Synthetic Surfactants

- 11.2.2. Bio-based Surfactants

- 11.2.2.1. Chemically Synthesized Bio-based Surfactants

- 11.2.2.1.1. Sucrose Ester

- 11.2.2.1.2. Alkyl Polyglycoside

- 11.2.2.1.3. Fatty Acid Glucamide

- 11.2.2.1.4. Sorbitan Ester

- 11.2.2.1.5. Other Chemically Synthesized Bio-based Surfactants

- 11.2.2.2. Bio-surfactant

- 11.2.2.2.1. Glycolipid

- 11.2.2.2.2. Fatty Acid, Phospholipid, Neutral Lipid

- 11.2.2.2.3. Lipopeptide

- 11.2.2.2.4. Polymeric Bio-surfactant

- 11.2.2.1. Chemically Synthesized Bio-based Surfactants

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Household Soap and Detergent

- 11.3.2. Personal Care

- 11.3.3. Lubricants and Fuel Additives

- 11.3.4. Industry and Institutional Cleaning

- 11.3.5. Food and Beverages

- 11.3.6. Oilfield Chemicals

- 11.3.7. Agricultural Chemicals

- 11.3.8. Textile Processing

- 11.3.9. Other Applications

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. Mexico

- 11.4.2. Brazil

- 11.4.3. Argentina

- 11.4.4. Chile

- 11.4.5. Colombia

- 11.4.6. Rest of Latin America

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Brazil Latin America Surfactant Industry Analysis, Insights and Forecast, 2019-2031

- 13. Argentina Latin America Surfactant Industry Analysis, Insights and Forecast, 2019-2031

- 14. Mexico Latin America Surfactant Industry Analysis, Insights and Forecast, 2019-2031

- 15. Peru Latin America Surfactant Industry Analysis, Insights and Forecast, 2019-2031

- 16. Chile Latin America Surfactant Industry Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Latin America Latin America Surfactant Industry Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Deten Química S A

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Clariant

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Arkema

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Nouryon

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 YPF*List Not Exhaustive

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Reliance Industries Ltd

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Bayer AG

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Solvay

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Indorama Ventures Public Company Limited

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Evonik Industries AG

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 3M

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Stepan Company

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 P&G Chemicals

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 Croda International Plc

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.15 Ashland

- 18.2.15.1. Overview

- 18.2.15.2. Products

- 18.2.15.3. SWOT Analysis

- 18.2.15.4. Recent Developments

- 18.2.15.5. Financials (Based on Availability)

- 18.2.16 BASF SE

- 18.2.16.1. Overview

- 18.2.16.2. Products

- 18.2.16.3. SWOT Analysis

- 18.2.16.4. Recent Developments

- 18.2.16.5. Financials (Based on Availability)

- 18.2.17 Dow

- 18.2.17.1. Overview

- 18.2.17.2. Products

- 18.2.17.3. SWOT Analysis

- 18.2.17.4. Recent Developments

- 18.2.17.5. Financials (Based on Availability)

- 18.2.18 Lonza

- 18.2.18.1. Overview

- 18.2.18.2. Products

- 18.2.18.3. SWOT Analysis

- 18.2.18.4. Recent Developments

- 18.2.18.5. Financials (Based on Availability)

- 18.2.19 Kao Corporation

- 18.2.19.1. Overview

- 18.2.19.2. Products

- 18.2.19.3. SWOT Analysis

- 18.2.19.4. Recent Developments

- 18.2.19.5. Financials (Based on Availability)

- 18.2.20 Innospec

- 18.2.20.1. Overview

- 18.2.20.2. Products

- 18.2.20.3. SWOT Analysis

- 18.2.20.4. Recent Developments

- 18.2.20.5. Financials (Based on Availability)

- 18.2.21 TENSAC

- 18.2.21.1. Overview

- 18.2.21.2. Products

- 18.2.21.3. SWOT Analysis

- 18.2.21.4. Recent Developments

- 18.2.21.5. Financials (Based on Availability)

- 18.2.22 Godrej Industries

- 18.2.22.1. Overview

- 18.2.22.2. Products

- 18.2.22.3. SWOT Analysis

- 18.2.22.4. Recent Developments

- 18.2.22.5. Financials (Based on Availability)

- 18.2.1 Deten Química S A

List of Figures

- Figure 1: Latin America Surfactant Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Surfactant Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America Surfactant Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Surfactant Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Latin America Surfactant Industry Revenue Million Forecast, by Origin 2019 & 2032

- Table 4: Latin America Surfactant Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Latin America Surfactant Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Latin America Surfactant Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Latin America Surfactant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Brazil Latin America Surfactant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Argentina Latin America Surfactant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Latin America Surfactant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Peru Latin America Surfactant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Chile Latin America Surfactant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Latin America Latin America Surfactant Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Latin America Surfactant Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Latin America Surfactant Industry Revenue Million Forecast, by Origin 2019 & 2032

- Table 16: Latin America Surfactant Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Latin America Surfactant Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Latin America Surfactant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Latin America Surfactant Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Latin America Surfactant Industry Revenue Million Forecast, by Origin 2019 & 2032

- Table 21: Latin America Surfactant Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Latin America Surfactant Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 23: Latin America Surfactant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Latin America Surfactant Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Latin America Surfactant Industry Revenue Million Forecast, by Origin 2019 & 2032

- Table 26: Latin America Surfactant Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Latin America Surfactant Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Latin America Surfactant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Latin America Surfactant Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Latin America Surfactant Industry Revenue Million Forecast, by Origin 2019 & 2032

- Table 31: Latin America Surfactant Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Latin America Surfactant Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Latin America Surfactant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Latin America Surfactant Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Latin America Surfactant Industry Revenue Million Forecast, by Origin 2019 & 2032

- Table 36: Latin America Surfactant Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 37: Latin America Surfactant Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: Latin America Surfactant Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 39: Latin America Surfactant Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Latin America Surfactant Industry Revenue Million Forecast, by Origin 2019 & 2032

- Table 41: Latin America Surfactant Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 42: Latin America Surfactant Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 43: Latin America Surfactant Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Surfactant Industry?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Latin America Surfactant Industry?

Key companies in the market include Deten Química S A, Clariant, Arkema, Nouryon, YPF*List Not Exhaustive, Reliance Industries Ltd, Bayer AG, Solvay, Indorama Ventures Public Company Limited, Evonik Industries AG, 3M, Stepan Company, P&G Chemicals, Croda International Plc, Ashland, BASF SE, Dow, Lonza, Kao Corporation, Innospec, TENSAC, Godrej Industries.

3. What are the main segments of the Latin America Surfactant Industry?

The market segments include Type, Origin, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Personal Care and Home Care Industry in Latin America; The Growth of the Oleo Chemicals Market Driving Bio-based Surfactants.

6. What are the notable trends driving market growth?

Growing Demand from Household Soap and Detergent Application.

7. Are there any restraints impacting market growth?

Increasing Focus on Environmental Regulations; Other Restraints.

8. Can you provide examples of recent developments in the market?

November 2022: Solvay introduced Reactsurf 2490, a novel APE-free1 polymerizable surfactant developed as a major emulsifier for acrylic, vinyl-acrylic, and styrene-acrylic latex systems. In comparison to traditional surfactants, Reactsurf 2490 enhances emulsion performance to give improved functional and aesthetic benefits in exterior coatings and pressure-sensitive adhesives (PSAs), even at high temperatures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Surfactant Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Surfactant Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Surfactant Industry?

To stay informed about further developments, trends, and reports in the Latin America Surfactant Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence