Key Insights

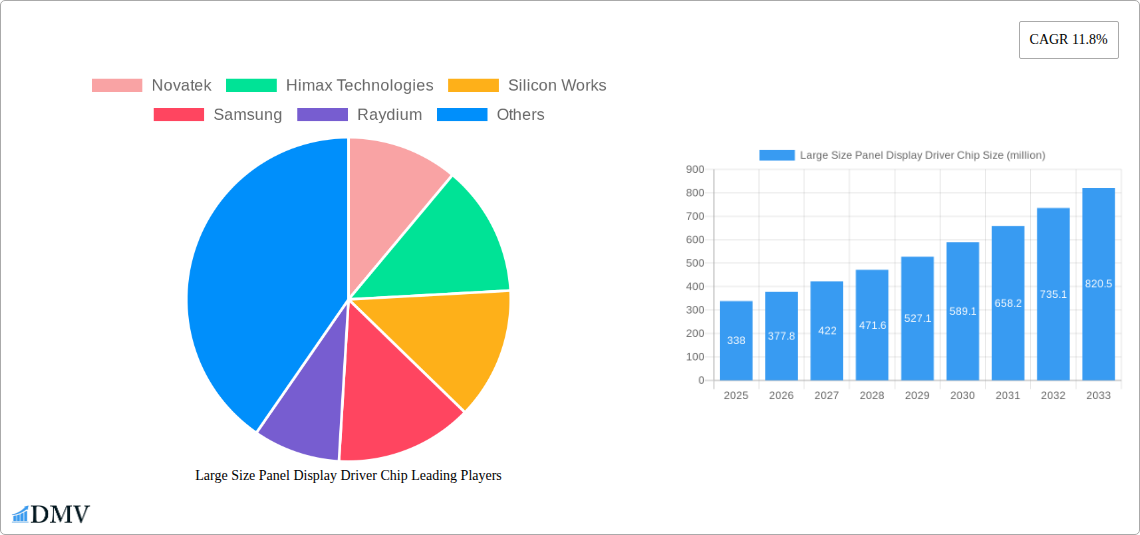

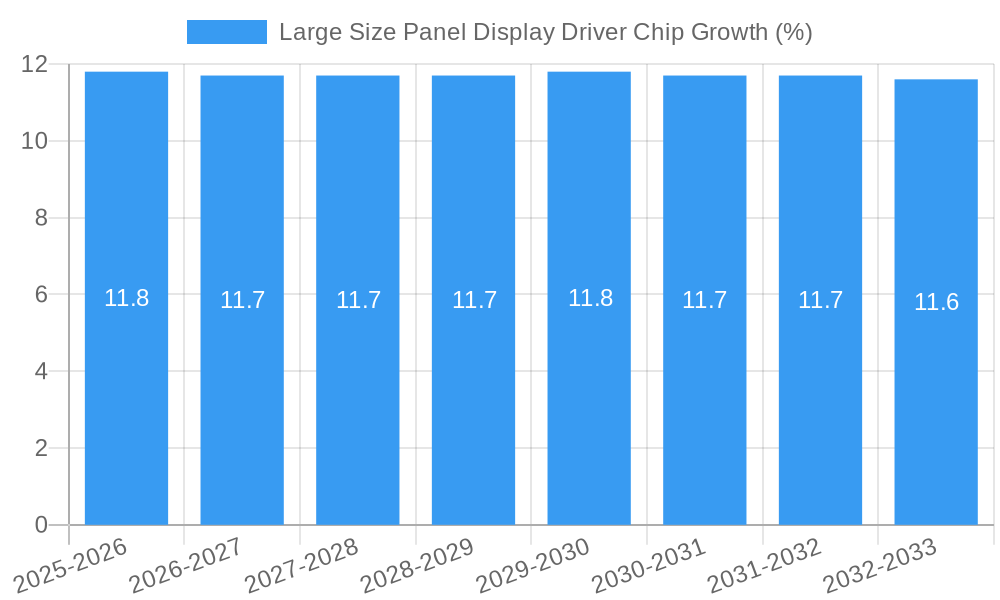

The global Large Size Panel Display Driver Chip market is poised for substantial growth, projected to reach an estimated USD 338 million by 2025. This expansion is fueled by an impressive Compound Annual Growth Rate (CAGR) of 11.8%, indicating a robust and dynamic market landscape. Key drivers for this surge include the escalating demand for larger, more immersive display technologies across various sectors. The proliferation of high-definition televisions, the increasing adoption of large-format monitors in professional settings, and the growing integration of advanced displays in automotive interiors are primary catalysts. Furthermore, the ongoing technological advancements in display resolution and refresh rates necessitate more sophisticated and powerful driver chips, contributing significantly to market expansion. The market's trajectory suggests a strong upward trend, driven by innovation and the continuous need for superior visual experiences.

The market is segmented into distinct applications and types, reflecting the diverse needs of end-users. In terms of applications, the TV and Monitor segments are anticipated to dominate, driven by consumer electronics upgrades and enterprise digital transformation initiatives. The Car Display segment, however, presents a rapidly growing area, spurred by the automotive industry's focus on connected and autonomous vehicles, where sophisticated infotainment and control displays are paramount. The "Others" category, encompassing industrial displays and digital signage, also contributes to overall market growth. By type, both LCD Display Driver Chips and OLED Display Driver Chips are crucial, with OLEDs gaining traction due to their superior contrast ratios and thinner form factors, while LCDs continue to be a cost-effective and widely adopted solution. Leading companies like Novatek, Himax Technologies, and Silicon Works are at the forefront of this innovation, actively shaping the market through their research and development efforts.

Absolutely! Here's the SEO-optimized and insightful report description for the "Large Size Panel Display Driver Chip Market," ready for immediate use.

Large Size Panel Display Driver Chip Market Composition & Trends

This comprehensive report delves into the intricate composition and evolving trends of the Large Size Panel Display Driver Chip Market. We meticulously evaluate market concentration, identifying key players and their strategic maneuvers that influence market dynamics. Innovation catalysts are spotlighted, showcasing how advancements in LCD Display Driver Chip and OLED Display Driver Chip technologies are reshaping product offerings. The regulatory landscape's impact on market entry and product development is analyzed, alongside the persistent threat of substitute products. End-user profiles are profiled, offering insights into the demanding needs of the TV, Monitor, and Car Display segments. Furthermore, the report dissects Mergers & Acquisitions (M&A) activities, providing data on deal values and strategic rationale behind consolidation.

- Market Share Distribution: Analysis of leading companies' market share within the large size panel driver chip sector, reaching an estimated value of over $20,000 million by 2025.

- M&A Deal Values: Examination of recent M&A transactions, with an aggregate deal value exceeding $5,000 million during the historical period, signaling industry consolidation and strategic realignment.

- Innovation Hubs: Identification of key regions and companies driving innovation in high-performance display driver ICs.

- Regulatory Impact Assessment: Evaluation of how emerging regulations concerning energy efficiency and material sourcing influence market strategies.

- Substitute Technology Analysis: Assessment of the competitive threat posed by alternative display technologies and their impact on driver chip demand.

Large Size Panel Display Driver Chip Industry Evolution

The Large Size Panel Display Driver Chip Industry is undergoing a remarkable evolution, driven by a confluence of technological breakthroughs, escalating consumer demand for immersive visual experiences, and rapid adoption across diverse applications. This section provides an in-depth analysis of the market's growth trajectories, charting a course from its nascent stages to its current robust state. We explore how advancements in manufacturing processes and semiconductor technology have enabled the production of increasingly sophisticated driver chips, essential for the seamless operation of large-format displays found in everything from high-definition televisions and professional monitors to sophisticated automotive infotainment systems. The report details the historical trajectory of LCD Display Driver Chip and the burgeoning rise of OLED Display Driver Chip technologies, examining their respective market penetration and innovation pipelines.

Consumer demand for brighter, sharper, and more energy-efficient displays fuels the continuous innovation in driver chip functionalities. The transition towards higher resolutions (4K, 8K), wider color gamuts, and faster refresh rates necessitates driver ICs with enhanced processing power and lower power consumption. The Car Display segment, in particular, is witnessing exponential growth, with integrated digital dashboards, advanced driver-assistance systems (ADAS) displays, and in-car entertainment systems demanding specialized and high-reliability driver solutions. The report quantifies these shifts by analyzing growth rates of adoption for various display types and the corresponding increase in demand for advanced driver chips. For instance, the adoption rate of OLED technology in large-format displays is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 15% from 2025 to 2033. Similarly, the automotive segment is expected to contribute over $8,000 million to the market by 2033. We also examine the impact of global economic factors and geopolitical events on supply chains and manufacturing capabilities, providing a holistic view of the industry's development. The study period of 2019–2033, with the base year set at 2025, allows for a comprehensive understanding of historical trends and a precise forecasting of future market dynamics.

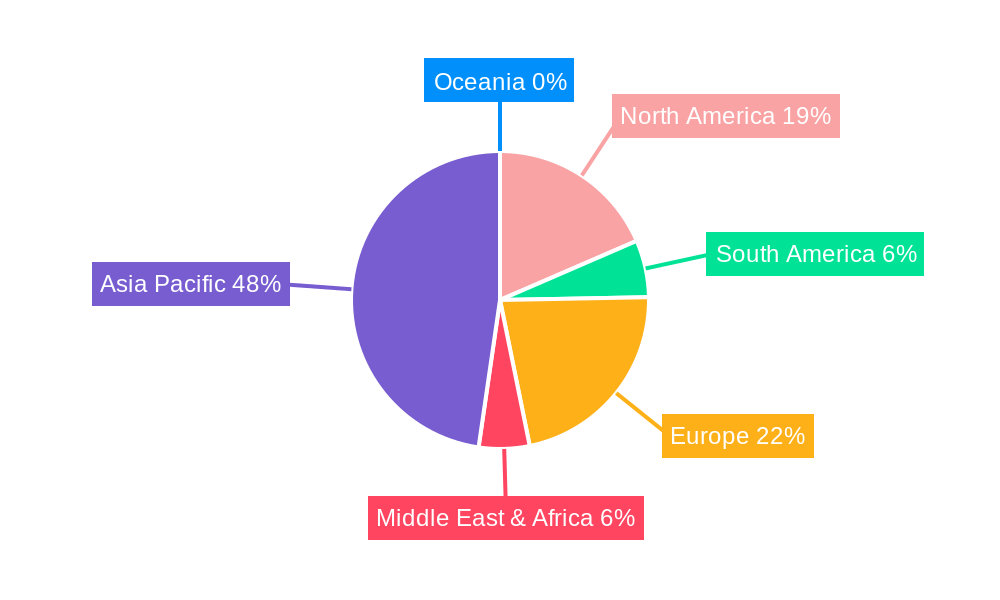

Leading Regions, Countries, or Segments in Large Size Panel Display Driver Chip

This section meticulously highlights the dominant forces shaping the Large Size Panel Display Driver Chip Market, dissecting geographical leadership, country-specific dominance, and segment-wise supremacy. We focus on the pivotal Application segments: TV, Monitor, and Car Display, alongside the Type segments: LCD Display Driver Chip and OLED Display Driver Chip.

The dominance of Asia-Pacific, particularly South Korea and Taiwan, is undeniable, driven by their robust manufacturing infrastructure for display panels and significant investments in semiconductor R&D. These regions are home to a majority of the leading display panel manufacturers and chip foundries, creating a synergistic ecosystem for driver chip development and production.

Dominant Regions:

- Asia-Pacific: Accounts for over 70% of the global market share in large size panel driver chips, with South Korea and Taiwan as key manufacturing hubs.

- North America & Europe: Significant contributors, driven by high demand for premium TV and Monitor displays, and a growing automotive sector.

Dominant Application Segments:

- TV Segment: Represents the largest market share, estimated at over $12,000 million in 2025. The relentless pursuit of larger screen sizes, higher resolutions (4K, 8K), and advanced display technologies like QLED and Mini-LED continues to fuel demand for sophisticated driver chips. Companies are investing heavily in developing driver ICs that support higher refresh rates, wider color gamuts, and improved power efficiency for premium television sets.

- Monitor Segment: Experiencing robust growth, projected to reach over $6,000 million by 2025. The increasing prevalence of remote work, gaming, and professional content creation drives demand for high-performance, large-format monitors with advanced features, requiring specialized driver solutions.

- Car Display Segment: Exhibiting the fastest growth trajectory, anticipated to exceed $8,000 million by 2033. The integration of digital cockpits, large central infotainment displays, and ADAS visualization systems is creating a substantial demand for reliable, high-resolution, and power-efficient automotive-grade driver chips.

Dominant Type Segments:

- LCD Display Driver Chip: Continues to hold a significant market share due to its established presence and cost-effectiveness in various applications. However, its market share is gradually being challenged by the advancements in OLED technology.

- OLED Display Driver Chip: Witnessing substantial growth, driven by its superior contrast ratios, faster response times, and energy efficiency, particularly in premium TV and emerging foldable display applications. The market for OLED driver chips is projected to grow at a CAGR of approximately 15% from 2025–2033.

Key drivers for regional and segment dominance include government incentives for semiconductor manufacturing, substantial R&D investments, the presence of a skilled workforce, and strong partnerships between display panel manufacturers and chip designers. Regulatory support for adopting advanced display technologies and stringent quality standards in the automotive sector also play crucial roles.

Large Size Panel Display Driver Chip Product Innovations

Product innovations in the Large Size Panel Display Driver Chip market are centered on enhancing display performance, reducing power consumption, and enabling new functionalities for TV, Monitor, and Car Display applications. Companies are developing advanced LCD Display Driver Chip solutions that support higher resolutions, improved contrast ratios, and faster response times, while OLED Display Driver Chip innovations are focused on enabling higher brightness, superior color accuracy, and longer lifespan. Key advancements include integrated timing controllers (TCONs), source and gate driver ICs with advanced power management features, and driver chips designed for specific pixel architectures. For example, novel driver chips are being introduced with integrated signal processing capabilities that reduce the need for external components, leading to more compact and cost-effective display modules. Performance metrics like reduced pixel defects, improved uniformity, and ultra-low power consumption are becoming critical selling propositions, driving adoption in energy-conscious markets and advanced automotive systems.

Propelling Factors for Large Size Panel Display Driver Chip Growth

The Large Size Panel Display Driver Chip Market is propelled by several potent factors. The relentless demand for immersive visual experiences across TVs, Monitors, and Car Displays is a primary catalyst. Advancements in display technologies, such as Mini-LED and Micro-LED for backlighting and pixel structures, necessitate more sophisticated driver ICs with higher precision and control. The burgeoning automotive industry, with its increasing integration of large, high-resolution displays for infotainment and ADAS, presents a significant growth avenue. Furthermore, the drive towards energy efficiency in consumer electronics and automotive applications is pushing the development of low-power LCD Display Driver Chip and OLED Display Driver Chip solutions. Government initiatives promoting domestic semiconductor manufacturing and technological innovation also provide a supportive environment for market expansion.

Obstacles in the Large Size Panel Display Driver Chip Market

Despite robust growth prospects, the Large Size Panel Display Driver Chip Market faces several obstacles. Intense price competition among chip manufacturers, especially for high-volume LCD Display Driver Chip applications, can compress profit margins. Supply chain disruptions, exacerbated by global semiconductor shortages and geopolitical uncertainties, pose a significant risk to production and delivery timelines. The substantial R&D investments required for developing cutting-edge OLED Display Driver Chip technologies can be a barrier for smaller players. Additionally, stringent qualification processes and long design cycles in the automotive sector, while ensuring reliability, can slow down the adoption of new driver chip solutions. Evolving environmental regulations and material sourcing complexities add another layer of challenge.

Future Opportunities in Large Size Panel Display Driver Chip

The future holds immense opportunities for the Large Size Panel Display Driver Chip Market. The continued proliferation of smart home devices and the increasing demand for large-format, high-resolution displays in commercial and industrial applications represent untapped markets. The rapid advancements in flexible and foldable display technologies are creating a demand for specialized driver chips capable of handling complex form factors and dynamic screen configurations. The growing adoption of augmented reality (AR) and virtual reality (VR) technologies will also necessitate advanced driver solutions for high-density, high-refresh-rate displays. Furthermore, the integration of AI and machine learning into display driver ICs for intelligent image processing and personalized user experiences presents a significant innovation frontier.

Major Players in the Large Size Panel Display Driver Chip Ecosystem

- Novatek

- Himax Technologies

- Silicon Works

- Samsung

- Raydium

- Fitipower

- DB HiTek

- Chiponeic

- ESWIN

- ILITEK Corp

- Parade Technologies

- FocalTech

- Magnachip Semiconductor

- LX Semicon

- Segments

Key Developments in Large Size Panel Display Driver Chip Industry

- 2023 October: Novatek launches a new series of advanced display driver ICs for 8K TVs, enhancing image quality and power efficiency.

- 2023 September: Himax Technologies announces a strategic partnership with a major automotive OEM to develop next-generation driver chips for in-car displays.

- 2023 August: Silicon Works introduces an innovative OLED display driver chip with enhanced brightness control for premium smartphones and wearables.

- 2023 July: Samsung Display showcases its latest foldable display technology, driving demand for flexible driver ICs.

- 2023 June: Raydium announces significant expansion of its manufacturing capacity for large-size display driver chips to meet growing market demand.

- 2023 May: Fitipower introduces a new generation of power management ICs for display applications, leading to substantial energy savings.

- 2023 April: DB HiTek invests in advanced foundry processes to boost production of high-performance logic and mixed-signal chips for display drivers.

- 2023 March: Chiponeic announces a new OLED driver IC with an industry-leading number of output channels, enabling higher resolution displays.

- 2023 February: ESWIN demonstrates its latest flexible OLED driver solutions for emerging applications in the automotive and consumer electronics sectors.

- 2023 January: ILITEK Corp unveils a new generation of touch and display driver integrated circuits (TDDI) for large-format tablets and monitors.

- 2022 December: Parade Technologies expands its portfolio with new Thunderbolt controller chips, enabling higher bandwidth for monitor connectivity.

- 2022 November: FocalTech announces breakthroughs in its COG (Chip-on-Glass) technology, enabling thinner and more cost-effective display modules.

- 2022 October: Magnachip Semiconductor launches a new high-performance OLED display driver for automotive applications, meeting stringent industry standards.

- 2022 September: LX Semicon announces a significant increase in production volume for its high-resolution LCD driver ICs, catering to the growing demand for premium TVs.

Strategic Large Size Panel Display Driver Chip Market Forecast

The Large Size Panel Display Driver Chip Market is poised for sustained growth, driven by accelerating demand for advanced visual experiences in TVs, Monitors, and particularly in the rapidly expanding Car Display segment. Innovation in OLED Display Driver Chip technology, coupled with continued improvements in LCD Display Driver Chip efficiency, will be key growth catalysts. Strategic investments in R&D, coupled with efforts to mitigate supply chain vulnerabilities, will be crucial for market participants. Emerging applications in AR/VR and flexible displays present significant future opportunities. The market is expected to witness substantial expansion, reaching an estimated value exceeding $40,000 million by 2033, reflecting strong underlying market potential and continuous technological evolution.

Large Size Panel Display Driver Chip Segmentation

-

1. Application

- 1.1. TV

- 1.2. Monitor

- 1.3. Car Display

- 1.4. Others

-

2. Type

- 2.1. LCD Display Driver Chip

- 2.2. OLED Display Driver Chip

Large Size Panel Display Driver Chip Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Large Size Panel Display Driver Chip REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.8% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Large Size Panel Display Driver Chip Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. TV

- 5.1.2. Monitor

- 5.1.3. Car Display

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. LCD Display Driver Chip

- 5.2.2. OLED Display Driver Chip

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Large Size Panel Display Driver Chip Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. TV

- 6.1.2. Monitor

- 6.1.3. Car Display

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. LCD Display Driver Chip

- 6.2.2. OLED Display Driver Chip

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Large Size Panel Display Driver Chip Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. TV

- 7.1.2. Monitor

- 7.1.3. Car Display

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. LCD Display Driver Chip

- 7.2.2. OLED Display Driver Chip

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Large Size Panel Display Driver Chip Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. TV

- 8.1.2. Monitor

- 8.1.3. Car Display

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. LCD Display Driver Chip

- 8.2.2. OLED Display Driver Chip

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Large Size Panel Display Driver Chip Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. TV

- 9.1.2. Monitor

- 9.1.3. Car Display

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. LCD Display Driver Chip

- 9.2.2. OLED Display Driver Chip

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Large Size Panel Display Driver Chip Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. TV

- 10.1.2. Monitor

- 10.1.3. Car Display

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. LCD Display Driver Chip

- 10.2.2. OLED Display Driver Chip

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Novatek

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Himax Technologies

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Silicon Works

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Samsung

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Raydium

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fitipower

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DB HiTek

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Chiponeic

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ESWIN

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ILITEK Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Parade Technologies

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 FocalTech

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Magnachip Semiconductor

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 LX Semicon

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Novatek

List of Figures

- Figure 1: Global Large Size Panel Display Driver Chip Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Large Size Panel Display Driver Chip Revenue (million), by Application 2024 & 2032

- Figure 3: North America Large Size Panel Display Driver Chip Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Large Size Panel Display Driver Chip Revenue (million), by Type 2024 & 2032

- Figure 5: North America Large Size Panel Display Driver Chip Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Large Size Panel Display Driver Chip Revenue (million), by Country 2024 & 2032

- Figure 7: North America Large Size Panel Display Driver Chip Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Large Size Panel Display Driver Chip Revenue (million), by Application 2024 & 2032

- Figure 9: South America Large Size Panel Display Driver Chip Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Large Size Panel Display Driver Chip Revenue (million), by Type 2024 & 2032

- Figure 11: South America Large Size Panel Display Driver Chip Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Large Size Panel Display Driver Chip Revenue (million), by Country 2024 & 2032

- Figure 13: South America Large Size Panel Display Driver Chip Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Large Size Panel Display Driver Chip Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Large Size Panel Display Driver Chip Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Large Size Panel Display Driver Chip Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Large Size Panel Display Driver Chip Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Large Size Panel Display Driver Chip Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Large Size Panel Display Driver Chip Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Large Size Panel Display Driver Chip Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Large Size Panel Display Driver Chip Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Large Size Panel Display Driver Chip Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Large Size Panel Display Driver Chip Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Large Size Panel Display Driver Chip Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Large Size Panel Display Driver Chip Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Large Size Panel Display Driver Chip Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Large Size Panel Display Driver Chip Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Large Size Panel Display Driver Chip Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Large Size Panel Display Driver Chip Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Large Size Panel Display Driver Chip Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Large Size Panel Display Driver Chip Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Large Size Panel Display Driver Chip Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Large Size Panel Display Driver Chip Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Large Size Panel Display Driver Chip Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Large Size Panel Display Driver Chip Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Large Size Panel Display Driver Chip Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Large Size Panel Display Driver Chip Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Large Size Panel Display Driver Chip Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Large Size Panel Display Driver Chip Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Large Size Panel Display Driver Chip Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Large Size Panel Display Driver Chip Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Large Size Panel Display Driver Chip Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Large Size Panel Display Driver Chip Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Large Size Panel Display Driver Chip Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Large Size Panel Display Driver Chip Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Large Size Panel Display Driver Chip Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Large Size Panel Display Driver Chip Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Large Size Panel Display Driver Chip Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Large Size Panel Display Driver Chip Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Large Size Panel Display Driver Chip Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Large Size Panel Display Driver Chip Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Large Size Panel Display Driver Chip?

The projected CAGR is approximately 11.8%.

2. Which companies are prominent players in the Large Size Panel Display Driver Chip?

Key companies in the market include Novatek, Himax Technologies, Silicon Works, Samsung, Raydium, Fitipower, DB HiTek, Chiponeic, ESWIN, ILITEK Corp, Parade Technologies, FocalTech, Magnachip Semiconductor, LX Semicon.

3. What are the main segments of the Large Size Panel Display Driver Chip?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 338 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Large Size Panel Display Driver Chip," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Large Size Panel Display Driver Chip report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Large Size Panel Display Driver Chip?

To stay informed about further developments, trends, and reports in the Large Size Panel Display Driver Chip, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence