Key Insights

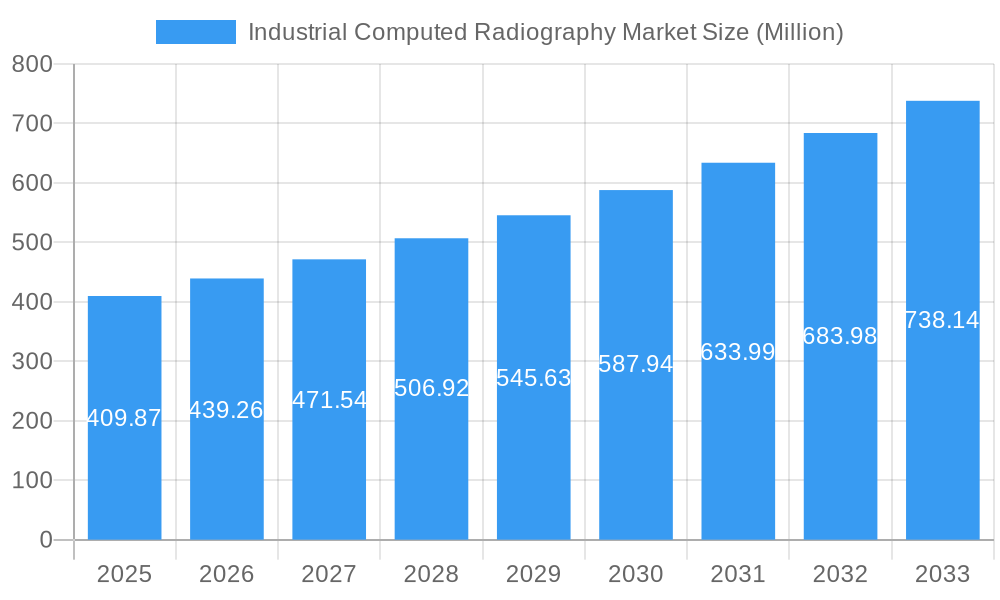

The Industrial Computed Radiography (ICR) market is experiencing robust growth, projected to reach \$409.87 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.93% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for non-destructive testing (NDT) in crucial industries like oil and gas, petrochemicals, and aerospace and defense is a major catalyst. Stringent quality control requirements and safety regulations across these sectors necessitate the adoption of advanced ICR technologies for detecting internal flaws and ensuring structural integrity. Furthermore, technological advancements in ICR systems, such as improved image resolution, faster processing speeds, and enhanced software capabilities, are driving market adoption. The growing adoption of automation and digitalization in manufacturing processes also contributes to the rising demand for efficient and reliable ICR solutions.

Industrial Computed Radiography Market Market Size (In Million)

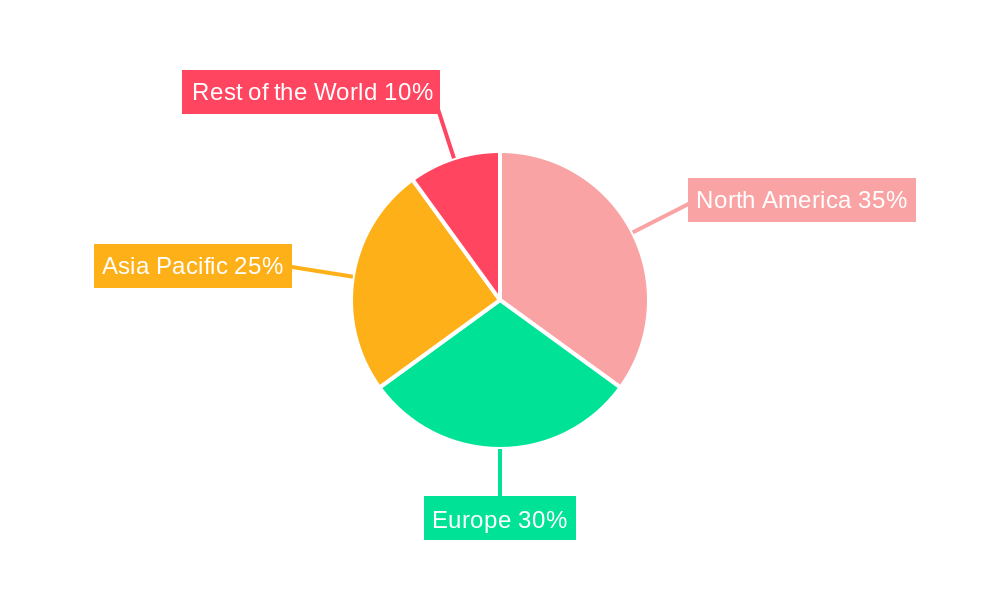

The market segmentation reveals a diverse landscape, with oil and gas, and petrochemical and chemical sectors dominating the applications segment. Foundries and aerospace and defense are also significant contributors, representing industries where defect detection is critical for safety and operational efficiency. Geographically, North America and Europe currently hold significant market shares, but the Asia-Pacific region is expected to witness substantial growth driven by industrialization and infrastructure development. Competitive dynamics are shaped by key players such as Baker Hughes, Fujifilm Corporation, and others, who are continuously innovating to offer advanced ICR systems and services to meet evolving market needs. The forecast period shows sustained growth based on ongoing industry demands and technological advancements. Specific regional market share data is not provided, and will need to be researched further to generate an accurate prediction.

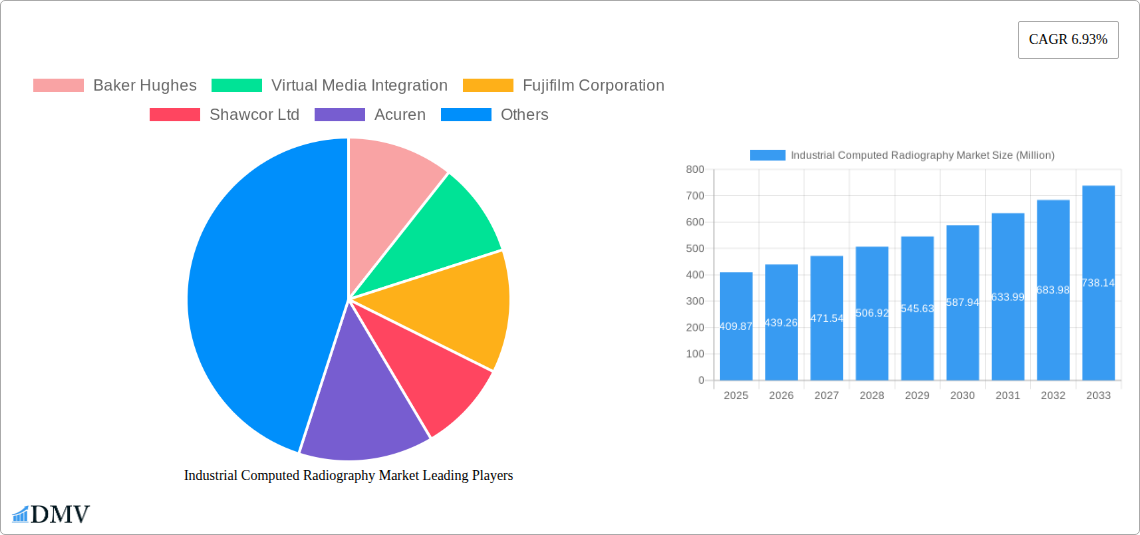

Industrial Computed Radiography Market Company Market Share

Industrial Computed Radiography Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Industrial Computed Radiography (ICR) market, offering invaluable insights for stakeholders seeking to understand market dynamics, growth trajectories, and future opportunities. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report projects a market size exceeding xx Million by 2033, driven by several key factors analyzed within.

Industrial Computed Radiography Market Composition & Trends

The Industrial Computed Radiography market exhibits a moderately concentrated landscape, with key players like Baker Hughes, Fujifilm Corporation, and Rigaku Corporation holding significant market share. The exact distribution varies across segments and regions; however, the market is witnessing increasing consolidation through mergers and acquisitions (M&A) activities, with deal values estimated to reach xx Million in 2024. Innovation is driven by the need for higher resolution imaging, faster processing speeds, and enhanced portability. Regulatory landscapes, including safety standards and environmental regulations, significantly impact market growth. Substitute products like digital radiography (DR) are posing competitive pressure, although ICR retains advantages in specific applications. End-users, primarily from Oil and Gas, Petrochemical and Chemical, Foundries, and Aerospace & Defense sectors, heavily influence market demand.

- Market Share Distribution (2024 Estimate): Baker Hughes (xx%), Fujifilm Corporation (xx%), Rigaku Corporation (xx%), Others (xx%).

- M&A Activity (2019-2024): xx deals valued at approximately xx Million.

- Innovation Catalysts: Improved image quality, faster processing, portability.

- Regulatory Landscape: Stringent safety and environmental standards.

- Substitute Products: Digital Radiography (DR)

Industrial Computed Radiography Market Industry Evolution

The Industrial Computed Radiography market has experienced a steady growth trajectory since 2019, fueled by increasing demand from diverse industries. Technological advancements, particularly in detector technology and image processing algorithms, have significantly enhanced image quality and efficiency. The market growth rate during the historical period (2019-2024) averaged approximately xx%, while the forecast period (2025-2033) projects a compound annual growth rate (CAGR) of xx%. This growth reflects shifting consumer demands towards higher-quality, faster, and more cost-effective non-destructive testing (NDT) solutions. Adoption rates are particularly high in regions with stringent quality control regulations and extensive industrial infrastructure. The transition from traditional film-based radiography to digital ICR continues to be a key driver of market expansion. Furthermore, rising investments in infrastructure development, particularly in developing economies, contribute positively to the market's growth momentum.

Leading Regions, Countries, or Segments in Industrial Computed Radiography Market

The Oil and Gas sector currently dominates the Industrial Computed Radiography market, driven by stringent regulatory requirements for pipeline inspection and equipment maintenance. This segment is expected to maintain its leading position throughout the forecast period.

- Key Drivers for Oil and Gas Dominance:

- Stringent safety and quality regulations.

- Extensive pipeline networks requiring regular inspection.

- High investments in oil and gas exploration and production.

- Other Significant Segments: Petrochemical and Chemical, Foundries, Aerospace and Defense industries show considerable growth potential due to the increasing need for quality control and safety measures. These segments benefit from technological advancements in ICR, enabling higher efficiency and better defect detection.

The regions exhibiting the strongest market growth include North America, Europe, and Asia-Pacific, with significant contributions from key countries such as the USA, Germany, China, and Japan. These regions benefit from advanced industrial infrastructure, substantial investment in NDT technologies, and increasing demand from diverse sectors.

Industrial Computed Radiography Market Product Innovations

Recent innovations in Industrial Computed Radiography focus on enhancing image quality, increasing speed, and improving portability. New detectors offer improved spatial resolution and sensitivity, resulting in clearer and more detailed images. Advanced software algorithms enable faster processing and automated defect detection, improving efficiency and reducing analysis time. The development of more portable and user-friendly systems makes ICR technology accessible to a wider range of users and applications. These innovations cater to the growing demand for cost-effective and efficient non-destructive testing solutions.

Propelling Factors for Industrial Computed Radiography Market Growth

Technological advancements, such as the development of more sensitive and high-resolution detectors and sophisticated image processing software, are pivotal to market growth. Stringent regulations and safety standards across various industries drive adoption, while economic factors, particularly investment in infrastructure development, contribute substantially to market expansion. The increasing demand for efficient and reliable non-destructive testing methods in sectors such as oil and gas and aerospace fuels this growth.

Obstacles in the Industrial Computed Radiography Market

The high initial investment cost associated with ICR systems presents a significant barrier to entry for smaller companies. Supply chain disruptions and fluctuations in raw material prices can impact production costs and market availability. Furthermore, intense competition from established players and the emergence of alternative NDT techniques pose challenges to market growth. Regulatory compliance and stringent safety standards can also increase operational costs.

Future Opportunities in Industrial Computed Radiography Market

Emerging markets in developing economies present significant opportunities for expansion. Advancements in artificial intelligence (AI) and machine learning (ML) hold potential for automating defect detection and improving diagnostic accuracy. The integration of ICR with other NDT methods, such as ultrasound and magnetic particle inspection, creates further opportunities for comprehensive material assessment. The development of more environmentally friendly and sustainable ICR solutions will also attract increased market interest.

Major Players in the Industrial Computed Radiography Market Ecosystem

- Baker Hughes

- Virtual Media Integration

- Fujifilm Corporation

- Shawcor Ltd

- Acuren

- Applus Services Sa

- Bluestar Limited

- Durr Ndt Gmbh & Co Kg

- Rigaku Corporation

Key Developments in Industrial Computed Radiography Market Industry

- February 2022: Carestream Health India launched the DRX Compass digital radiology solution, enhancing efficiency in radiology facilities. This indirectly impacts the ICR market by showcasing technological advancements in the broader radiology field.

- March 2022: Blue Star's release of new air conditioning models is not directly relevant to the Industrial Computed Radiography market.

Strategic Industrial Computed Radiography Market Forecast

The Industrial Computed Radiography market is poised for significant growth driven by technological advancements, increasing demand from diverse industries, and rising investments in infrastructure development. The forecast period (2025-2033) anticipates substantial market expansion, with opportunities in emerging markets and innovative applications. The continuous development of higher-resolution detectors, advanced software, and portable systems will further drive market growth and adoption across various sectors.

Industrial Computed Radiography Market Segmentation

-

1. Applications

- 1.1. Oil and Gas

- 1.2. Petrochemical and Chemical

- 1.3. Foundries

- 1.4. Aerospace and Defense

- 1.5. Other Applications

Industrial Computed Radiography Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Industrial Computed Radiography Market Regional Market Share

Geographic Coverage of Industrial Computed Radiography Market

Industrial Computed Radiography Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increasing Demand for Decreasing the Exposure to Radiation; Growing Need for Nondestructive Testing

- 3.3. Market Restrains

- 3.3.1. High Installation Costs

- 3.4. Market Trends

- 3.4.1. Nondestructive Testing Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Computed Radiography Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Applications

- 5.1.1. Oil and Gas

- 5.1.2. Petrochemical and Chemical

- 5.1.3. Foundries

- 5.1.4. Aerospace and Defense

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Applications

- 6. North America Industrial Computed Radiography Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Applications

- 6.1.1. Oil and Gas

- 6.1.2. Petrochemical and Chemical

- 6.1.3. Foundries

- 6.1.4. Aerospace and Defense

- 6.1.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Applications

- 7. Europe Industrial Computed Radiography Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Applications

- 7.1.1. Oil and Gas

- 7.1.2. Petrochemical and Chemical

- 7.1.3. Foundries

- 7.1.4. Aerospace and Defense

- 7.1.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Applications

- 8. Asia Pacific Industrial Computed Radiography Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Applications

- 8.1.1. Oil and Gas

- 8.1.2. Petrochemical and Chemical

- 8.1.3. Foundries

- 8.1.4. Aerospace and Defense

- 8.1.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Applications

- 9. Rest of the World Industrial Computed Radiography Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Applications

- 9.1.1. Oil and Gas

- 9.1.2. Petrochemical and Chemical

- 9.1.3. Foundries

- 9.1.4. Aerospace and Defense

- 9.1.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Applications

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Baker Hughes

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Virtual Media Integration

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Fujifilm Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Shawcor Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Acuren

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Applus Services Sa

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Bluestar Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Durr Ndt Gmbh & Co Kg

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Rigaku Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Baker Hughes

List of Figures

- Figure 1: Global Industrial Computed Radiography Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Industrial Computed Radiography Market Revenue (Million), by Applications 2025 & 2033

- Figure 3: North America Industrial Computed Radiography Market Revenue Share (%), by Applications 2025 & 2033

- Figure 4: North America Industrial Computed Radiography Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Industrial Computed Radiography Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Industrial Computed Radiography Market Revenue (Million), by Applications 2025 & 2033

- Figure 7: Europe Industrial Computed Radiography Market Revenue Share (%), by Applications 2025 & 2033

- Figure 8: Europe Industrial Computed Radiography Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Industrial Computed Radiography Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Industrial Computed Radiography Market Revenue (Million), by Applications 2025 & 2033

- Figure 11: Asia Pacific Industrial Computed Radiography Market Revenue Share (%), by Applications 2025 & 2033

- Figure 12: Asia Pacific Industrial Computed Radiography Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Industrial Computed Radiography Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Industrial Computed Radiography Market Revenue (Million), by Applications 2025 & 2033

- Figure 15: Rest of the World Industrial Computed Radiography Market Revenue Share (%), by Applications 2025 & 2033

- Figure 16: Rest of the World Industrial Computed Radiography Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Industrial Computed Radiography Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Computed Radiography Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 2: Global Industrial Computed Radiography Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Industrial Computed Radiography Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 4: Global Industrial Computed Radiography Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Industrial Computed Radiography Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 6: Global Industrial Computed Radiography Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Industrial Computed Radiography Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 8: Global Industrial Computed Radiography Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Industrial Computed Radiography Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 10: Global Industrial Computed Radiography Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Computed Radiography Market?

The projected CAGR is approximately 6.93%.

2. Which companies are prominent players in the Industrial Computed Radiography Market?

Key companies in the market include Baker Hughes, Virtual Media Integration, Fujifilm Corporation, Shawcor Ltd, Acuren, Applus Services Sa, Bluestar Limited, Durr Ndt Gmbh & Co Kg, Rigaku Corporation.

3. What are the main segments of the Industrial Computed Radiography Market?

The market segments include Applications.

4. Can you provide details about the market size?

The market size is estimated to be USD 409.87 Million as of 2022.

5. What are some drivers contributing to market growth?

The Increasing Demand for Decreasing the Exposure to Radiation; Growing Need for Nondestructive Testing.

6. What are the notable trends driving market growth?

Nondestructive Testing Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Installation Costs.

8. Can you provide examples of recent developments in the market?

March 2022 - Blue Star, India's premier air conditioning brand, released cheap yet best-in-class distinctive' split ACs. The company has released over 50 models in the inverter, fixed speed, and window AC categories.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Computed Radiography Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Computed Radiography Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Computed Radiography Market?

To stay informed about further developments, trends, and reports in the Industrial Computed Radiography Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence