Key Insights

India's Waste-to-Energy market is poised for substantial expansion, driven by rapid urbanization, robust environmental regulations, and the urgent need for sustainable waste management. The market, valued at approximately $1.2 billion in 2024, is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.2% from 2024 to 2033. This growth is underpinned by the escalating volumes of municipal solid waste, industrial waste, and agricultural residues, creating a strong demand for efficient and eco-friendly waste disposal and energy generation solutions. Key growth catalysts include government incentives for renewable energy, mounting concerns over landfill capacity, and advancements in waste-to-energy technologies such as anaerobic digestion and gasification. The market segmentation includes gasification technology (biochemical, others), disposal methods (landfill, waste processing, recycling), and specific technologies (thermal), offering a detailed view of market dynamics. Despite potential growth inhibitors like high initial capital expenditure for facilities and limited stakeholder awareness, the market's long-term outlook remains highly positive due to escalating environmental imperatives and supportive government policies.

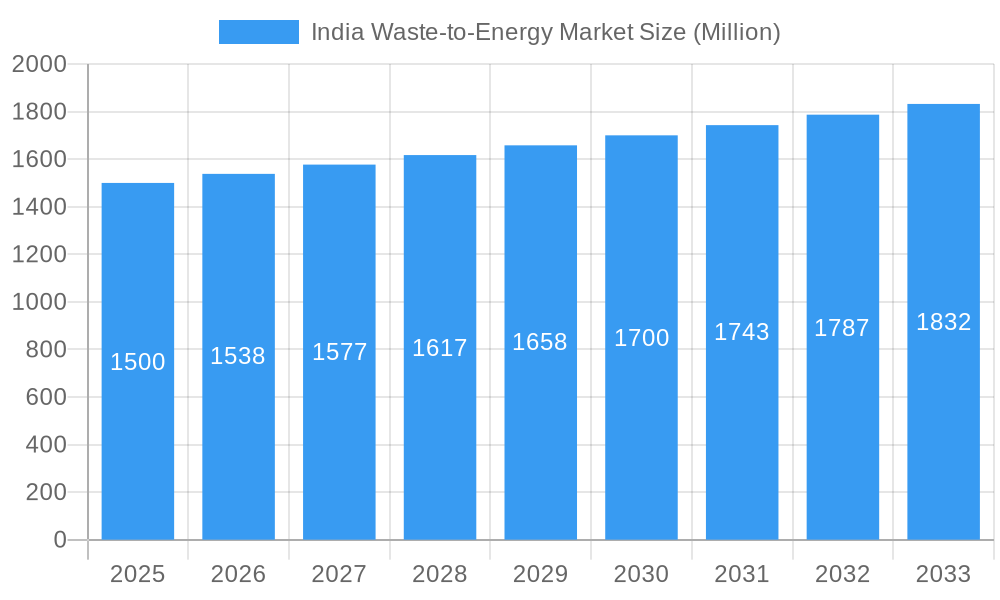

India Waste-to-Energy Market Market Size (In Billion)

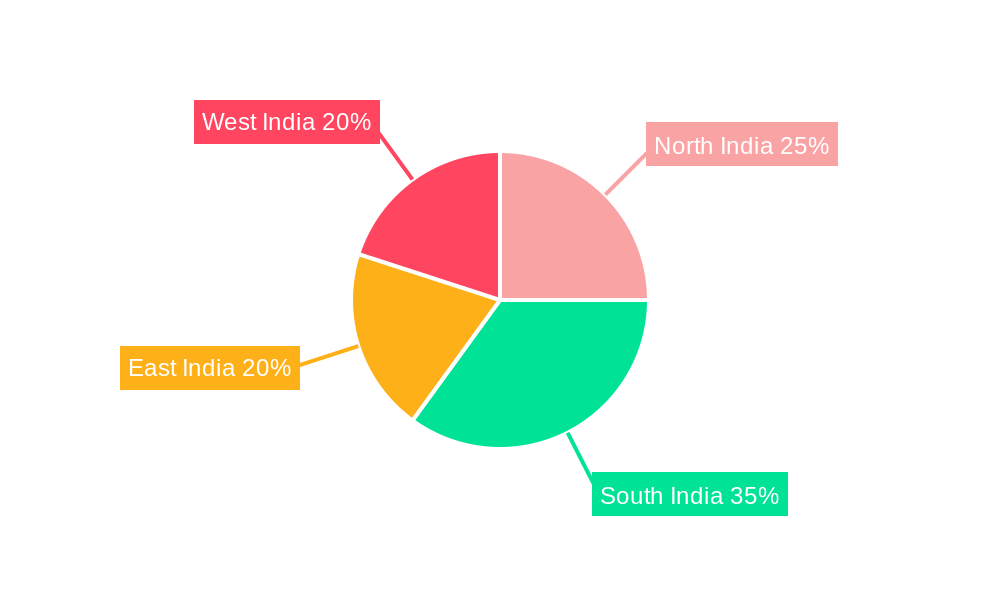

Geographically, market growth correlates with regional infrastructure development and waste generation patterns. Southern and Western India are expected to lead growth due to higher urbanization and industrialization, outpacing Eastern and Northern regions. Leading players, including Ramky Enviro Engineers, IL&FS Environmental Infrastructure, and Suez Group, are instrumental in market development through project execution, technological innovation, and strategic alliances. The increasing reliance on Public-Private Partnerships (PPPs) is significantly boosting investment and accelerating market expansion. Future growth hinges on the successful implementation of government initiatives promoting waste segregation, enhancing waste collection infrastructure, and raising public consciousness about sustainable waste management practices. The development of cost-effective and efficient waste-to-energy technologies is paramount to realizing the market's full potential and supporting India's sustainable development objectives.

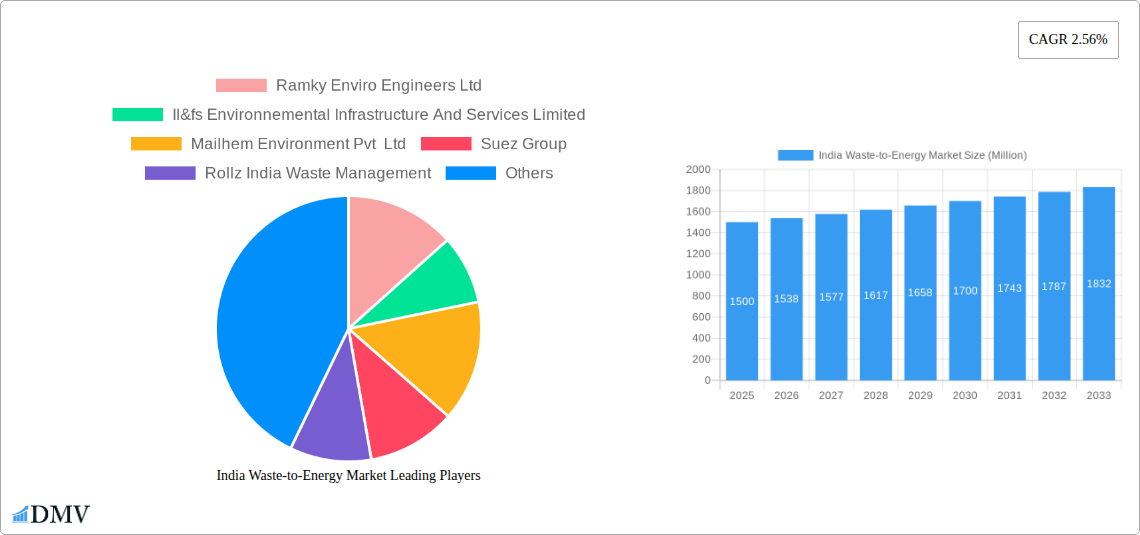

India Waste-to-Energy Market Company Market Share

India Waste-to-Energy Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning India Waste-to-Energy market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to navigate this dynamic sector. The market is projected to reach xx Million by 2033, driven by factors detailed within.

India Waste-to-Energy Market Market Composition & Trends

This section dives deep into the competitive landscape, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities within the Indian waste-to-energy market.

Market Concentration & Share Distribution: The Indian waste-to-energy market exhibits a moderately concentrated structure, with a few large players holding significant market share. Ramky Enviro Engineers Ltd, Veolia Environnement SA, and Suez Group are among the leading players, commanding a combined xx% market share in 2024. Smaller players such as Mailhem Environment Pvt Ltd and Ecogreen Energy Pvt Ltd are also actively contributing to the market's growth, though their individual shares are significantly smaller. The market is expected to witness further consolidation through M&A activities in the coming years.

Innovation Catalysts & Regulatory Landscape: Government initiatives promoting renewable energy and waste management are significant catalysts for innovation. Stringent regulations on landfill waste disposal are driving the adoption of waste-to-energy technologies. The increasing focus on circular economy principles is further encouraging the development of advanced waste processing and recycling techniques.

Substitute Products & End-User Profiles: Landfilling remains a prevalent substitute, but its environmental drawbacks are pushing a shift towards waste-to-energy solutions. Key end-users include municipal corporations, industrial facilities, and independent power producers.

M&A Activities: The past five years have witnessed a moderate level of M&A activity, with deal values totaling approximately xx Million. These transactions reflect a growing interest in consolidating market share and expanding operational capabilities within the sector.

India Waste-to-Energy Market Industry Evolution

This section analyzes the historical and projected growth trajectories of the Indian waste-to-energy market, focusing on technological advancements and evolving consumer demands. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). The forecast period (2025-2033) projects a CAGR of xx%, driven by increasing waste generation, supportive government policies, and technological improvements.

Technological advancements, such as the adoption of advanced gasification technologies and improved energy recovery systems, are playing a crucial role in enhancing the efficiency and cost-effectiveness of waste-to-energy plants. Furthermore, the increasing awareness of environmental concerns among consumers is driving the demand for sustainable waste management solutions, bolstering the growth of the waste-to-energy sector. The shift towards decentralized waste-to-energy solutions, closer to waste generation points, is also expected to fuel market expansion. The increasing adoption of thermal technologies is contributing to the market's growth, but there is also a growing interest in exploring bio-chemical gasification and other innovative technologies.

Leading Regions, Countries, or Segments in India Waste-to-Energy Market

This section identifies the dominant regions, countries, or segments within the Indian waste-to-energy market.

Key Drivers:

- Technological Advancements: The development of advanced technologies such as plasma gasification and anaerobic digestion is enhancing the efficiency and cost-effectiveness of waste-to-energy plants.

- Government Support: Favorable government policies and financial incentives are driving investments in waste-to-energy projects.

- Rising Waste Generation: The increasing volume of municipal solid waste in urban areas is creating a pressing need for efficient waste management solutions.

Dominant Segment Analysis: The Thermal technology segment currently dominates the market due to its established technology and relative maturity. However, the Bio-Chemical Gasification segment is expected to witness significant growth due to its potential for higher energy efficiency and reduced greenhouse gas emissions. While Landfill disposal remains a significant part of waste management, the growth is primarily driven by Waste Processing and Recycling, as these are essential pre-processing steps before utilizing waste-to-energy technologies.

India Waste-to-Energy Market Product Innovations

Recent innovations have focused on improving energy conversion efficiency, reducing greenhouse gas emissions, and enhancing the overall sustainability of waste-to-energy plants. Advancements include the integration of advanced gasification technologies with combined heat and power (CHP) systems, resulting in higher energy yields and reduced operational costs. The development of innovative waste pre-processing techniques, such as advanced sorting and separation technologies, is improving the quality of feedstock for waste-to-energy plants, thereby enhancing their efficiency. These innovations are creating unique selling propositions centered on improved environmental performance and reduced operational expenses.

Propelling Factors for India Waste-to-Energy Market Growth

The market is propelled by several factors: increasing urbanization leading to higher waste generation; government initiatives promoting renewable energy and sustainable waste management (e.g., Swachh Bharat Abhiyan); and declining costs of waste-to-energy technologies. The push for a circular economy, aiming to minimize waste and maximize resource recovery, also significantly boosts market growth.

Obstacles in the India Waste-to-Energy Market Market

Challenges include the high initial capital investment required for setting up waste-to-energy plants; the complexities associated with securing necessary environmental clearances and land acquisition; and the need for robust waste collection and transportation infrastructure. Competition from other waste management technologies and inconsistent waste composition also pose significant hurdles.

Future Opportunities in India Waste-to-Energy Market

Future opportunities lie in exploring advanced gasification technologies, focusing on renewable energy integration within waste-to-energy plants; expanding into rural areas with less developed waste management infrastructure; and developing innovative financial models to attract private sector investments. The potential for creating biofuels and other valuable byproducts from waste offers lucrative opportunities for growth.

Major Players in the India Waste-to-Energy Market Ecosystem

- Ramky Enviro Engineers Ltd

- Il&fs Environmental Infrastructure And Services Limited

- Mailhem Environment Pvt Ltd

- Suez Group

- Rollz India Waste Management

- Veolia Environnement SA

- Abellon Clean Energy Ltd

- Hitachi Zosen Inova

- A2z Group

- Ecogreen Energy Pvt Ltd

- Hydroair Techtonics (pcd) Limited

- Gj Eco Power Pvt Ltd

- Jitf Urban Infrastructure Limited

Key Developments in India Waste-to-Energy Market Industry

March 2022: The WASTE-TO-ENERGY Recycling Plant in Visakhapatnam commenced operations, generating 9.90 MW (initially) and projected to reach 15 MW daily, highlighting the potential for large-scale waste-to-energy projects. The plant's capacity increase to 15 MW demonstrates the potential for scaling up these initiatives. The plan to transport waste from nearby municipalities indicates a growing interest in regional waste management solutions.

January 2022: The Brihanmumbai Municipal Corporation's proposal for a 600-metric-tonne-per-day waste-to-energy plant in Mumbai underscores the significant investments being made in urban waste management infrastructure. The INR 5.04 billion investment signifies the significant capital required but also the return on investment potential.

Strategic India Waste-to-Energy Market Forecast

The Indian waste-to-energy market is poised for robust growth, driven by supportive government policies, technological advancements, and increasing environmental awareness. The rising volume of municipal solid waste coupled with the need for sustainable waste management solutions will continue to fuel demand. The market's expansion will be further facilitated by technological innovations, leading to improved efficiency and reduced costs. This favorable outlook presents significant opportunities for both established and emerging players in the waste-to-energy sector.

India Waste-to-Energy Market Segmentation

-

1. Technology

-

1.1. Thermal

- 1.1.1. Incineration

- 1.1.2. Pyrolysis

- 1.1.3. Gasification

- 1.2. Bio-Chemical

- 1.3. Other Technologies

-

1.1. Thermal

-

2. Disposal Method

- 2.1. Landfill

- 2.2. Waste Processing

- 2.3. Recycling

India Waste-to-Energy Market Segmentation By Geography

- 1. India

India Waste-to-Energy Market Regional Market Share

Geographic Coverage of India Waste-to-Energy Market

India Waste-to-Energy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Energy Demand4.; Increasing Export Opportunities

- 3.3. Market Restrains

- 3.3.1 Establishing WTE facilities requires substantial initial investment

- 3.3.2 which can be a barrier for many stakeholders. The high upfront costs may deter potential investors and slow market expansion

- 3.4. Market Trends

- 3.4.1 The adoption of advanced technologies

- 3.4.2 such as gasification and pyrolysis

- 3.4.3 is enhancing the efficiency and environmental performance of WTE plants. These technologies offer cleaner and more efficient energy recovery from waste

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Waste-to-Energy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Thermal

- 5.1.1.1. Incineration

- 5.1.1.2. Pyrolysis

- 5.1.1.3. Gasification

- 5.1.2. Bio-Chemical

- 5.1.3. Other Technologies

- 5.1.1. Thermal

- 5.2. Market Analysis, Insights and Forecast - by Disposal Method

- 5.2.1. Landfill

- 5.2.2. Waste Processing

- 5.2.3. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ramky Enviro Engineers Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Il&fs Environnemental Infrastructure And Services Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mailhem Environment Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Suez Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rollz India Waste Management

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Veolia Environnement SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Abellon Clean Energy Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hitachi Zosen Inova

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 A2z Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ecogreen Energy Pvt Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hydroair Techtonics (pcd) Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Gj Eco Power Pvt Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Jitf Urban Infrastructure Limited

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Ramky Enviro Engineers Ltd

List of Figures

- Figure 1: India Waste-to-Energy Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Waste-to-Energy Market Share (%) by Company 2025

List of Tables

- Table 1: India Waste-to-Energy Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: India Waste-to-Energy Market Revenue billion Forecast, by Disposal Method 2020 & 2033

- Table 3: India Waste-to-Energy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Waste-to-Energy Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 5: India Waste-to-Energy Market Revenue billion Forecast, by Disposal Method 2020 & 2033

- Table 6: India Waste-to-Energy Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Waste-to-Energy Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the India Waste-to-Energy Market?

Key companies in the market include Ramky Enviro Engineers Ltd, Il&fs Environnemental Infrastructure And Services Limited, Mailhem Environment Pvt Ltd, Suez Group, Rollz India Waste Management, Veolia Environnement SA, Abellon Clean Energy Ltd, Hitachi Zosen Inova, A2z Group, Ecogreen Energy Pvt Ltd, Hydroair Techtonics (pcd) Limited, Gj Eco Power Pvt Ltd, Jitf Urban Infrastructure Limited.

3. What are the main segments of the India Waste-to-Energy Market?

The market segments include Technology, Disposal Method.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Energy Demand4.; Increasing Export Opportunities.

6. What are the notable trends driving market growth?

The adoption of advanced technologies. such as gasification and pyrolysis. is enhancing the efficiency and environmental performance of WTE plants. These technologies offer cleaner and more efficient energy recovery from waste.

7. Are there any restraints impacting market growth?

Establishing WTE facilities requires substantial initial investment. which can be a barrier for many stakeholders. The high upfront costs may deter potential investors and slow market expansion.

8. Can you provide examples of recent developments in the market?

March 2022: The WASTE-TO-ENERGY Recycling Plant, a flagship project of the Greater Visakhapatnam Municipal Corporation (GVMC), commenced operating at Kapuluppada in Visakhapatnam. The plant generates about 9.90 MW of power per day using one boiler. According to the agreement between Jindal Group and the GVMC, the recycling plant will generate about 15 MW of electricity daily. To generate 15 MW of power, GVMC focused on providing about 1,200 tones of waste per day. The corporation is mulling to transport 260 tones of garbage from Srikakulam, Vizianagaram, and Nellimarla municipalities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Waste-to-Energy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Waste-to-Energy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Waste-to-Energy Market?

To stay informed about further developments, trends, and reports in the India Waste-to-Energy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence