Key Insights

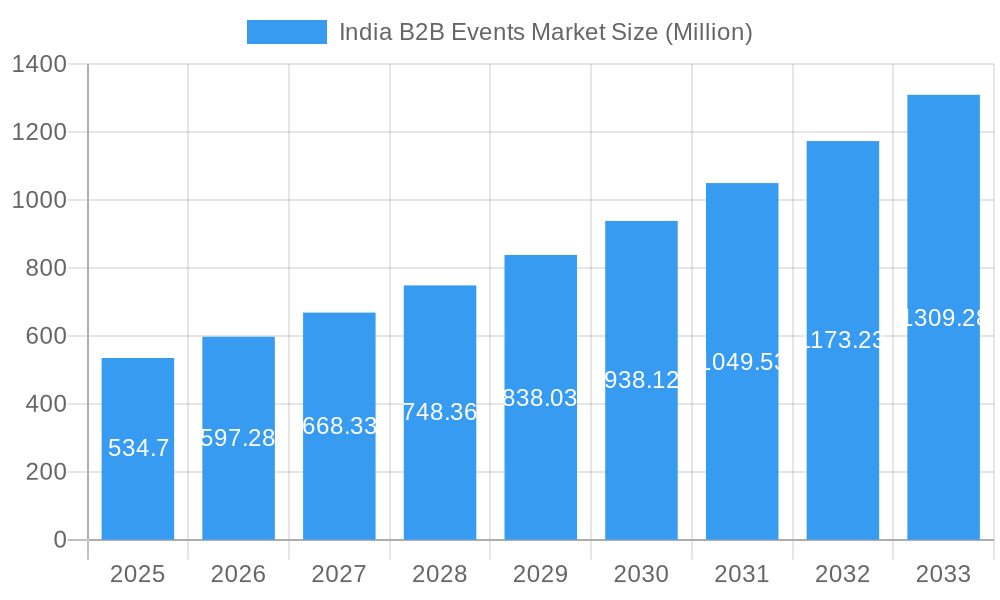

The India B2B events market, valued at ₹534.70 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.72% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing adoption of hybrid event formats (combining physical and virtual elements) caters to a broader audience and enhances accessibility. Furthermore, the burgeoning sectors of BFSI (Banking, Financial Services, and Insurance), FMCG (Fast-Moving Consumer Goods), and technology are significantly contributing to event demand, necessitating networking opportunities and knowledge sharing. Government initiatives promoting ease of doing business and increased foreign investment also positively impact the market. However, economic fluctuations and potential infrastructural challenges in certain regions could act as restraints. The market is segmented by platform (physical and virtual events) and end-user verticals (Food & Beverage, PSU, Luxury, BFSI, FMCG, Retail, Healthcare, Automotive, and Others), allowing for targeted event planning and marketing strategies. Regional variations exist, with North and West India expected to lead market growth, given the concentration of businesses and industrial hubs in these regions. The competitive landscape is diverse, featuring both established players and emerging event management companies vying for market share, offering specialized services and catering to specific industry needs. This competition fosters innovation and drives the market's overall development.

India B2B Events Market Market Size (In Million)

The forecast period (2025-2033) presents lucrative opportunities for businesses involved in event planning, technology, and related services. Strategic partnerships between event management firms and technology providers are crucial for offering seamless hybrid event experiences. Focusing on niche segments and leveraging digital marketing for targeted outreach will prove vital for success. Moreover, adapting to evolving consumer preferences and incorporating sustainable practices will be essential for long-term growth and market leadership. Regular market monitoring and analysis of emerging trends will allow companies to proactively adjust strategies and capitalize on new opportunities within the dynamic Indian B2B events landscape. Understanding specific regional needs and preferences will allow companies to tailor their offerings to resonate with a wider customer base, ensuring robust market penetration.

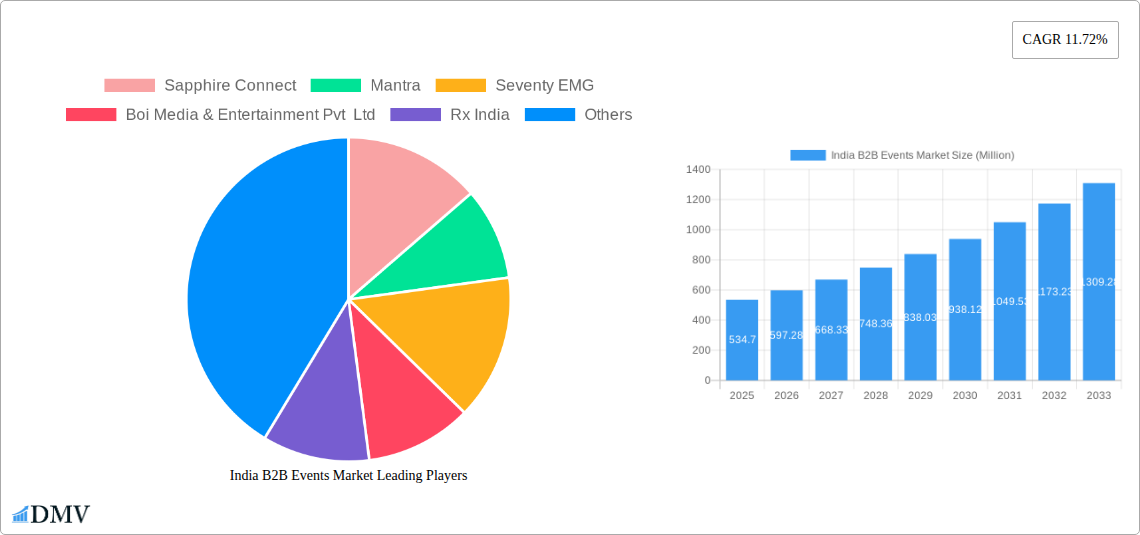

India B2B Events Market Company Market Share

India B2B Events Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning India B2B Events Market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. Spanning the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, leading players, and future growth opportunities, providing a crucial roadmap for success. The market is projected to reach xx Million by 2033, showcasing substantial growth potential.

India B2B Events Market Composition & Trends

This section delves into the intricate structure of the India B2B Events Market, evaluating key aspects that shape its trajectory. The market exhibits a moderately concentrated landscape, with a few major players holding significant market share, while numerous smaller players contribute to the overall vibrancy. Innovation is a powerful catalyst, driven by technological advancements in virtual event platforms and experiential marketing techniques. The regulatory landscape, while largely supportive of the industry's growth, presents certain challenges regarding licensing and permits. Substitute products, such as online webinars and digital marketing campaigns, exert a degree of competitive pressure. End-user profiles are diverse, encompassing a wide range of industries, from BFSI and FMCG to healthcare and automotive. M&A activity has been moderate, with deal values ranging from xx Million to xx Million in recent years.

- Market Share Distribution (2024): Top 5 players hold approximately 40% of the market share. Remaining share distributed among numerous smaller players.

- M&A Deal Values (2019-2024): Average deal value approximately xx Million. Highest value transaction recorded at xx Million.

India B2B Events Market Industry Evolution

The India B2B Events Market has witnessed significant evolution since 2019. The historical period (2019-2024) saw consistent growth, albeit with fluctuations influenced by economic cycles and global events. The market has demonstrated resilience, with growth rates averaging xx% annually during this period. Technological advancements, particularly the rise of virtual event platforms, have reshaped the landscape, providing flexibility and cost-effectiveness. Shifting consumer demands towards personalized and engaging experiences have pushed event organizers to innovate and deliver high-impact events. The forecast period (2025-2033) anticipates continued growth, driven by increasing adoption of hybrid event formats and a growing preference for industry-specific B2B events. The projected Compound Annual Growth Rate (CAGR) for the forecast period is estimated at xx%.

- Adoption of Virtual Event Platforms (2024): xx% of B2B events incorporated virtual elements.

- Growth Rate (2019-2024): Average annual growth rate of xx%.

- Projected CAGR (2025-2033): xx%

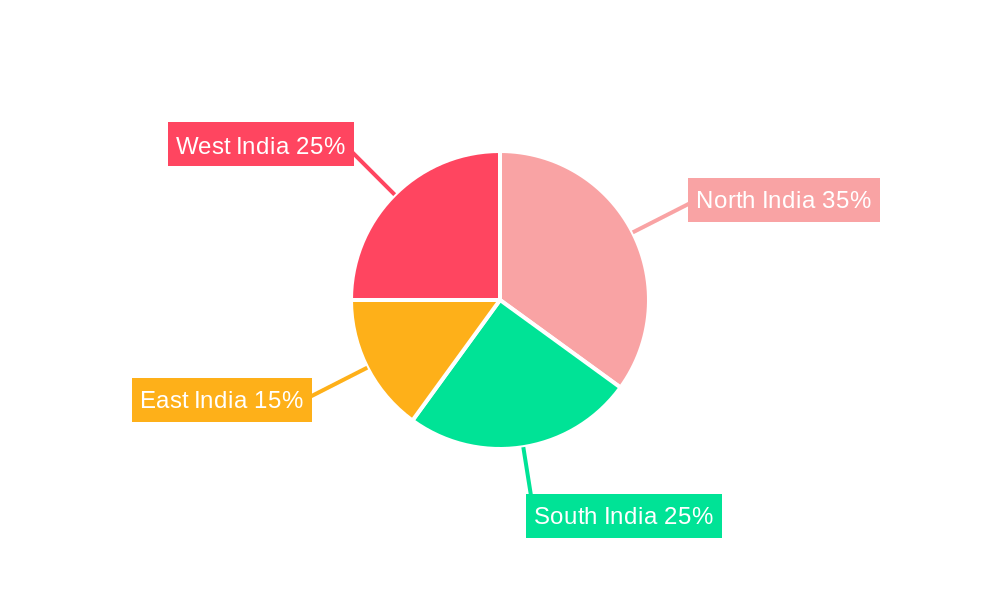

Leading Regions, Countries, or Segments in India B2B Events Market

The India B2B Events Market demonstrates regional disparities in growth and adoption. The North region currently holds the largest market share, driven by a high concentration of businesses and a well-established infrastructure. However, other regions, particularly the South and West, are experiencing rapid growth. The BFSI and FMCG sectors are leading end-user verticals, showing significant participation in B2B events. Physical events still dominate the market, but the virtual event segment is rapidly gaining traction.

- Key Drivers (North Region): Strong industrial base, established event infrastructure, high concentration of businesses.

- Key Drivers (BFSI Sector): Regulatory compliance needs, networking opportunities, product launches.

- Key Drivers (FMCG Sector): New product launches, distribution network development, market trend analysis.

- Key Drivers (Physical Events): Networking opportunities, face-to-face interaction, enhanced brand building.

- Key Drivers (Virtual Events): Cost-effectiveness, wider reach, flexibility.

India B2B Events Market Product Innovations

Recent innovations include hybrid event formats blending physical and virtual elements, AI-powered event management tools for enhanced personalization, and immersive technologies like virtual reality (VR) and augmented reality (AR) for creating engaging experiences. These innovations provide unique selling propositions through enhanced audience engagement, data analytics for improved ROI, and cost-effective scalability. Furthermore, these advancements enable more efficient resource allocation and enhanced logistical management.

Propelling Factors for India B2B Events Market Growth

Several factors contribute to the robust growth of the India B2B Events Market. Firstly, a burgeoning economy fuels investment in industry-specific events. Secondly, government initiatives promoting trade and investment are creating a favorable environment for B2B events. Finally, technological advancements, such as the development of user-friendly virtual event platforms, facilitate broader reach and cost-effectiveness.

Obstacles in the India B2B Events Market

Challenges include logistical complexities associated with large-scale physical events, competition from substitute products like online marketing, and potential regulatory hurdles. These factors can impact event profitability and hinder wider market penetration.

Future Opportunities in India B2B Events Market

Emerging opportunities include the expansion of niche B2B events targeting specific industries, the adoption of sustainable event practices, and the integration of advanced technologies such as AI and big data analytics for better event management and ROI.

Major Players in the India B2B Events Market Ecosystem

- Sapphire Connect

- Mantra

- Seventy EMG

- Boi Media & Entertainment Pvt Ltd

- Rx India

- TechnologyCounter

- CAB

- Hexagon Events Private Limited

- Wizcraft Entertainment Agency Pvt Lt

- Neoniche Integrated Solutions Pvt Ltd

- CraftworldEvents Management Company

- Seventy Seven Entertainment Pvt Ltd

- Experiential Marketing Solutions Pvt Ltd (Collective Heads)

- Toast

- Blackboard Communications

- Laqshya Group(Event Capital)

- XP&D (XP and Land)

Key Developments in India B2B Events Market Industry

- March 2024: Bharat Tex 2024, a massive textile event in Delhi, showcased India’s end-to-end textile capabilities, attracting 100,000 visitors and 3,500 exhibitors. This event highlighted the potential for large-scale B2B events in specialized sectors.

- November 2023: A mega B2B food event in Delhi attracted significant participation from domestic and international stakeholders, underscoring the growing importance of food processing and related industries. The event, involving ten ministries, six commodities commissions, and 25 states, demonstrated the potential for government collaboration in promoting B2B events.

Strategic India B2B Events Market Forecast

The India B2B Events Market is poised for sustained growth, driven by economic expansion, government support, and technological advancements. The increasing adoption of hybrid event formats and the rise of specialized B2B events will further fuel market expansion. The forecast period is expected to witness a significant increase in both the number and scale of B2B events, creating lucrative opportunities for industry players.

India B2B Events Market Segmentation

-

1. Platform

- 1.1. Physical Events

- 1.2. Virtual Events

-

2. End-user Verticals

- 2.1. Food and Beverage

- 2.2. PSU

- 2.3. Luxury

- 2.4. BFSI

- 2.5. FMCG

- 2.6. Retail

- 2.7. Healthcare

- 2.8. Automotive

- 2.9. Other End-user Verticals

India B2B Events Market Segmentation By Geography

- 1. India

India B2B Events Market Regional Market Share

Geographic Coverage of India B2B Events Market

India B2B Events Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Mobile e-commerce to be the fastest-growing retailing channel due to proliferation of mobile apps and convenience; Retailers develop mobile-friendly strategies to attract young and tech-savvy consumers

- 3.3. Market Restrains

- 3.3.1. ; Lack of Awareness Among Government Organizations About New Technologies

- 3.4. Market Trends

- 3.4.1. Retail Sector to be the Largest End User

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India B2B Events Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Physical Events

- 5.1.2. Virtual Events

- 5.2. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.2.1. Food and Beverage

- 5.2.2. PSU

- 5.2.3. Luxury

- 5.2.4. BFSI

- 5.2.5. FMCG

- 5.2.6. Retail

- 5.2.7. Healthcare

- 5.2.8. Automotive

- 5.2.9. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sapphire Connect

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mantra

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Seventy EMG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Boi Media & Entertainment Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rx India

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TechnologyCounter

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CAB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hexagon Events Private Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Wizcraft Entertainment Agency Pvt Lt

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Neoniche Integrated Solutions Pvt Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CraftworldEvents Management Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Seventy Seven Entertainment Pvt Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Experential Marketing Solutions Pvt Ltd (Collective Heads)

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Toast

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Blackboard Communications

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Laqshya Group(Event Capital)

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 XP&D (XP and Land)

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Sapphire Connect

List of Figures

- Figure 1: India B2B Events Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India B2B Events Market Share (%) by Company 2025

List of Tables

- Table 1: India B2B Events Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: India B2B Events Market Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 3: India B2B Events Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India B2B Events Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 5: India B2B Events Market Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 6: India B2B Events Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India B2B Events Market?

The projected CAGR is approximately 11.72%.

2. Which companies are prominent players in the India B2B Events Market?

Key companies in the market include Sapphire Connect, Mantra, Seventy EMG, Boi Media & Entertainment Pvt Ltd, Rx India, TechnologyCounter, CAB, Hexagon Events Private Limited, Wizcraft Entertainment Agency Pvt Lt, Neoniche Integrated Solutions Pvt Ltd, CraftworldEvents Management Company, Seventy Seven Entertainment Pvt Ltd, Experential Marketing Solutions Pvt Ltd (Collective Heads), Toast, Blackboard Communications, Laqshya Group(Event Capital), XP&D (XP and Land).

3. What are the main segments of the India B2B Events Market?

The market segments include Platform, End-user Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 534.70 Million as of 2022.

5. What are some drivers contributing to market growth?

Mobile e-commerce to be the fastest-growing retailing channel due to proliferation of mobile apps and convenience; Retailers develop mobile-friendly strategies to attract young and tech-savvy consumers.

6. What are the notable trends driving market growth?

Retail Sector to be the Largest End User.

7. Are there any restraints impacting market growth?

; Lack of Awareness Among Government Organizations About New Technologies.

8. Can you provide examples of recent developments in the market?

In March 2024, by bringing together 3,500 exhibitors from across the entire value chain under one roof for the first time, the theme of Bharat Tex 2024 emphasized India’s capability to provide end-to-end textile solutions. Spread across nearly two million square feet and attracting 100,000 visitors, this huge event, staged in New Delhi, was organized by a consortium of 11 textile export promotion councils and sponsored by the country’s Ministry of Textile.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India B2B Events Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India B2B Events Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India B2B Events Market?

To stay informed about further developments, trends, and reports in the India B2B Events Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence