Key Insights

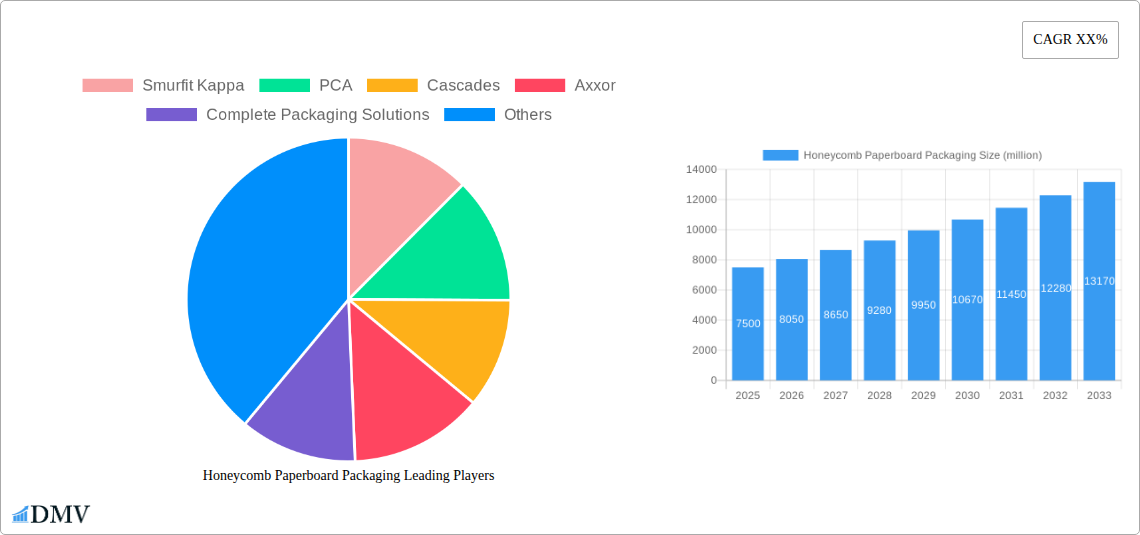

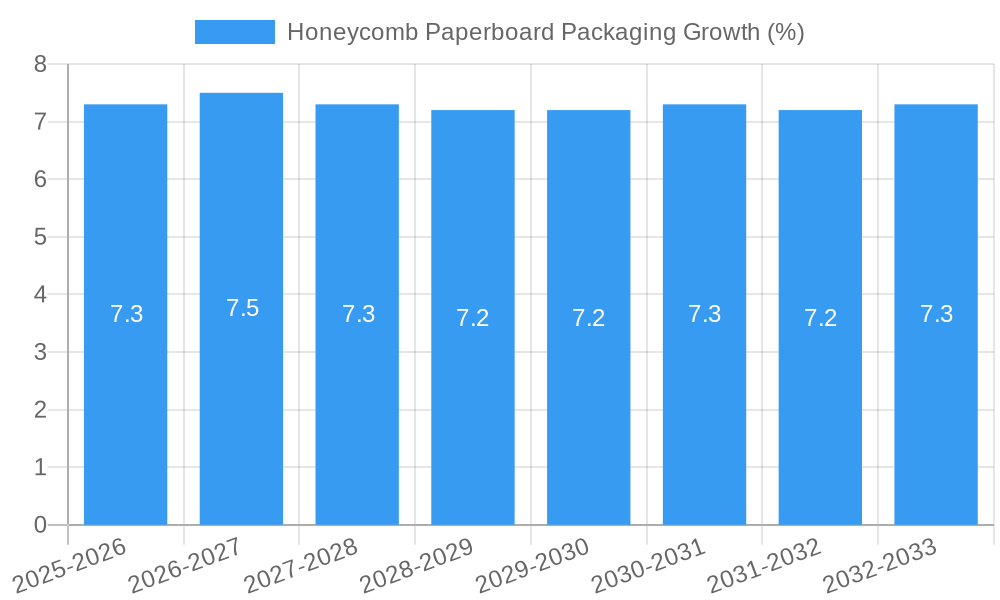

The global Honeycomb Paperboard Packaging market is poised for significant expansion, projected to reach an estimated market size of approximately $7,500 million by 2025. Driven by a robust Compound Annual Growth Rate (CAGR) of around 7.5%, the market is anticipated to grow steadily throughout the forecast period of 2025-2033. This growth is primarily fueled by increasing consumer and industrial demand for sustainable and eco-friendly packaging solutions. Growing environmental awareness, coupled with stringent regulations favoring recyclable and biodegradable materials, is compelling businesses across various sectors to adopt honeycomb paperboard as a viable alternative to traditional plastic and foam packaging. Its lightweight yet exceptionally strong nature makes it ideal for a wide range of applications, from protective interior and exterior packaging to specialized uses like bracing, cradling, and void filling.

Key market drivers include the expanding e-commerce sector, which necessitates durable and cost-effective shipping solutions, and the automotive industry's increasing reliance on lightweight materials for enhanced fuel efficiency. The packaging sector is also witnessing a surge in demand for custom-designed solutions, and honeycomb paperboard’s adaptability in terms of shape, thickness, and cushioning properties perfectly aligns with these evolving needs. While the market enjoys strong tailwinds from sustainability trends and diverse application potential, potential restraints such as the initial investment costs for specialized manufacturing equipment and the availability of raw materials could pose challenges. However, ongoing technological advancements in paper recycling and pulp processing are expected to mitigate these concerns, ensuring a consistent supply and competitive pricing, further solidifying the market's upward trajectory.

Honeycomb Paperboard Packaging Market Composition & Trends

The global Honeycomb Paperboard Packaging market is characterized by a dynamic landscape, with key players actively shaping its evolution. Market concentration is moderate, with leading companies like Smurfit Kappa, PCA, and Cascades holding significant shares. Innovation catalysts such as the increasing demand for sustainable packaging solutions and the drive for lightweight yet robust materials are fueling market growth. Regulatory landscapes, particularly those favoring eco-friendly alternatives to plastics, are also playing a crucial role. Substitute products, while present in the form of traditional corrugated cardboard and molded pulp, are increasingly being outperformed by the superior strength-to-weight ratio and shock absorption capabilities of honeycomb paperboard. End-user profiles range from the automotive and electronics industries, requiring high-performance protective packaging, to the e-commerce sector, seeking sustainable void fill and interior protection. Mergers and acquisitions (M&A) activities are on the rise, with recent deals valued in the tens of millions, indicating consolidation and strategic expansion within the industry. For instance, the acquisition of a key supplier by a major packaging manufacturer in late 2023, valued at approximately $50 million, signifies a move to secure supply chains and expand product offerings. Market share distribution indicates that interior packaging applications account for an estimated 60% of the market value, followed by exterior packaging at 30%, and others at 10%.

Honeycomb Paperboard Packaging Industry Evolution

The Honeycomb Paperboard Packaging industry has witnessed remarkable evolution over the historical period of 2019–2024, driven by a confluence of technological advancements and shifting consumer demands towards sustainability. Initially, the market, valued at approximately $2,500 million in 2019, was primarily utilized for basic protective applications. However, as awareness regarding environmental impact grew, the demand for eco-friendly packaging solutions surged, propelling the industry forward. Technological advancements in manufacturing processes, such as automated production lines and the development of specialized adhesive technologies, have significantly improved the strength, versatility, and cost-effectiveness of honeycomb paperboard. This has enabled its application in more demanding sectors. For example, the adoption of advanced cutting techniques and the integration of water-resistant coatings have expanded its utility in moisture-sensitive environments, contributing to a projected market growth rate of 7.5% annually. Consumer preferences have also become a pivotal factor. Shoppers are increasingly scrutinizing product packaging for its environmental footprint, leading businesses to invest in sustainable materials like honeycomb paperboard. This shift is evident in the growing preference for recyclable and biodegradable packaging options. The e-commerce boom has further amplified this trend, with businesses seeking protective yet lightweight packaging solutions to minimize shipping costs and reduce waste. The market value is estimated to reach approximately $4,000 million in the base year of 2025, with a projected growth to $7,000 million by 2033. This trajectory is supported by increasing investments in research and development focused on enhancing the performance characteristics of honeycomb paperboard, such as improved impact resistance and customizability for intricate product shapes.

Leading Regions, Countries, or Segments in Honeycomb Paperboard Packaging

The Cushion application segment is currently exhibiting dominant growth and market penetration within the global Honeycomb Paperboard Packaging industry. This dominance is fueled by a multifaceted set of drivers, with investment trends in the electronics and fragile goods sectors playing a particularly significant role. Companies are increasingly prioritizing the protection of high-value, sensitive items during transit, making advanced cushioning solutions a critical component of their supply chains. Regulatory support, though not always direct, indirectly favors honeycomb paperboard's eco-friendly attributes, aligning with global sustainability mandates.

- Key Drivers for Cushion Dominance:

- E-commerce Expansion: The exponential growth of online retail necessitates robust and lightweight packaging to protect a wide array of products, from delicate glassware to sensitive electronics, during extensive shipping networks. Honeycomb paperboard's superior shock absorption and customizable nature make it an ideal solution for void filling and intricate cradling.

- Electronics Industry Demand: The proliferation of consumer electronics, which are often prone to damage during transit, has led to a significant demand for protective packaging that can withstand drops and impacts. Honeycomb paperboard's energy-absorbing properties are crucial for this sector, ensuring product integrity and reducing return rates, which can represent millions in lost revenue.

- Automotive Components Protection: The automotive industry relies heavily on specialized packaging to protect delicate parts like shock absorbers and interior components. Honeycomb paperboard's ability to be molded into precise shapes offers excellent bracing and cradling solutions, minimizing damage and associated costs, estimated in the millions of dollars annually.

- Sustainability Initiatives: Growing environmental consciousness among consumers and stringent regulations are pushing manufacturers away from traditional plastic-based packaging. Honeycomb paperboard, being a renewable and recyclable material, offers a compelling sustainable alternative, aligning with corporate social responsibility goals and enhancing brand image, contributing to market share gains valued at hundreds of millions.

- Technological Advancements: Innovations in honeycomb paperboard manufacturing, including enhanced strength, moisture resistance, and printable surfaces, have broadened its applicability, making it a viable and often superior option compared to older packaging materials for cushioning purposes.

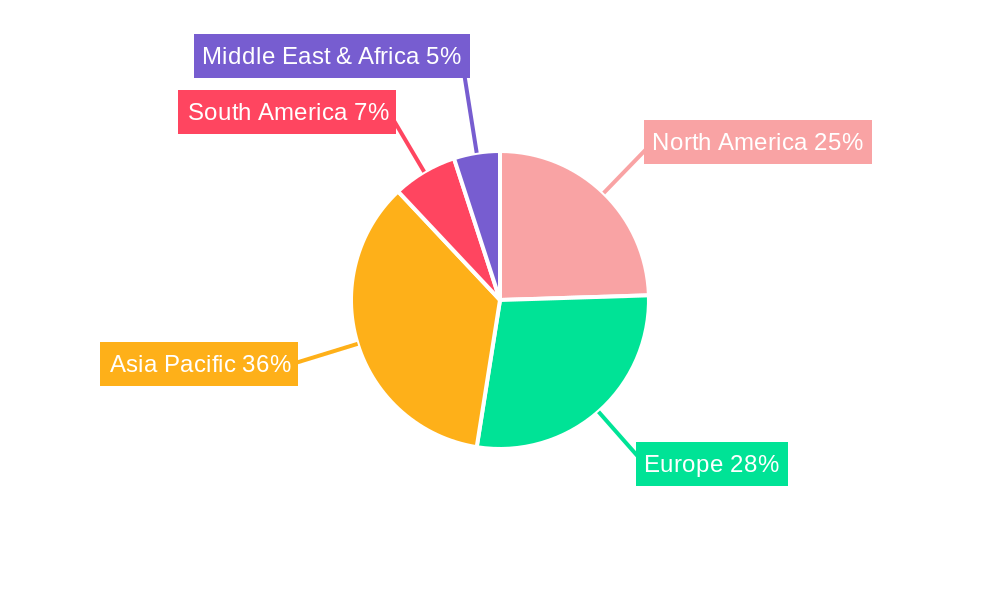

North America and Europe currently represent the largest regional markets for honeycomb paperboard packaging, driven by established industries and strong consumer demand for sustainable products. Within these regions, the United States and Germany are leading countries. The Interior Packaging type further amplifies the dominance of the cushion application, as a vast majority of cushioning solutions are integrated within the interior of larger shipping containers.

Honeycomb Paperboard Packaging Product Innovations

Recent product innovations in Honeycomb Paperboard Packaging are centered around enhanced performance and expanded applications. Manufacturers are developing advanced formulations with improved moisture resistance and greater load-bearing capacities, allowing for their use in more demanding environments and for heavier items. For example, HonECOre has introduced a new generation of honeycomb paperboard with enhanced fire-retardant properties, a significant USP for industries with stringent safety regulations. Dufaylite Developments has also unveiled printable honeycomb solutions, enabling brands to integrate their messaging directly onto the protective packaging, thereby reducing the need for additional labeling and enhancing brand visibility. These advancements are driving adoption in sectors previously reliant on less sustainable or less performant materials, with performance metrics like improved crush resistance exceeding traditional corrugated by an estimated 20%.

Propelling Factors for Honeycomb Paperboard Packaging Growth

The Honeycomb Paperboard Packaging market is propelled by several key factors. The undeniable growing global demand for sustainable packaging solutions is paramount, driven by increasing environmental awareness and stricter regulations aimed at reducing plastic waste. This trend favors renewable and recyclable materials like honeycomb paperboard, positioning it as a preferred alternative. Furthermore, advancements in manufacturing technology have made honeycomb paperboard more cost-effective and versatile, improving its strength-to-weight ratio and enabling customizability for a wide range of applications. The expansion of the e-commerce sector significantly contributes, as online retailers require lightweight, protective, and eco-friendly packaging to minimize shipping costs and environmental impact. Finally, the automotive and electronics industries' need for high-performance protective packaging to safeguard delicate components during transit further fuels growth, with these sectors investing millions in robust packaging solutions.

Obstacles in the Honeycomb Paperboard Packaging Market

Despite robust growth, the Honeycomb Paperboard Packaging market faces several obstacles. Supply chain disruptions, as experienced globally in recent years, can impact the availability and cost of raw materials like paper pulp, leading to production delays and increased expenses, potentially affecting millions in inventory. Competition from established packaging materials, particularly traditional corrugated cardboard, remains a challenge, especially in price-sensitive segments where the perceived value proposition of honeycomb paperboard needs to be clearly communicated. Limited awareness and understanding of its benefits among some end-users can also hinder adoption, requiring increased marketing and educational efforts to highlight its superior protective qualities and sustainability advantages. Furthermore, investment in new manufacturing capabilities can be substantial, posing a barrier to entry for smaller players.

Future Opportunities in Honeycomb Paperboard Packaging

Emerging opportunities in the Honeycomb Paperboard Packaging market are diverse and promising. The increasing focus on circular economy principles presents a significant avenue, with innovations in biodegradable and compostable honeycomb paperboard formulations gaining traction. The growth of the pharmaceutical and medical device packaging sector, where sterile and protective packaging is paramount, offers substantial potential, especially for specialized, tamper-evident honeycomb solutions. Furthermore, the development of smart packaging functionalities, such as integrated sensors or tracking capabilities within honeycomb structures, represents a futuristic opportunity to add value beyond basic protection. Finally, the expansion of developing economies and their increasing adoption of sustainable practices will unlock new markets and demand for environmentally friendly packaging solutions.

Major Players in the Honeycomb Paperboard Packaging Ecosystem

- Smurfit Kappa

- PCA

- Cascades

- Axxor

- Complete Packaging Solutions

- Dufaylite Developments

- HonECOre

- Multi-Wall Packaging

- Rebul Custom Packaging

- Yoj Pack-Kraft

Key Developments in Honeycomb Paperboard Packaging Industry

- 2023 - Q3: Smurfit Kappa announces significant investment in expanding its honeycomb paperboard production capacity to meet growing e-commerce demand.

- 2023 - Q4: Dufaylite Developments launches a new range of custom-printed honeycomb solutions, enabling enhanced branding opportunities for clients.

- 2024 - Q1: PCA acquires a smaller competitor, expanding its market share and geographical reach in North America.

- 2024 - Q2: HonECOre showcases its latest fire-retardant honeycomb paperboard at an industry trade show, receiving considerable interest from the construction and transportation sectors.

- 2024 - Q3: Axxor introduces a more sustainable adhesive technology for its honeycomb products, reducing VOC emissions.

Strategic Honeycomb Paperboard Packaging Market Forecast

The strategic Honeycomb Paperboard Packaging market forecast indicates continued robust growth driven by an unwavering commitment to sustainability and innovation. The increasing adoption of e-commerce, coupled with stringent environmental regulations, will continue to propel demand for eco-friendly alternatives like honeycomb paperboard, which offers superior protection and a lighter footprint. Future opportunities lie in developing specialized, high-performance variants catering to niche industries such as pharmaceuticals and electronics, further enhancing the material's versatility and market penetration. Strategic investments in advanced manufacturing technologies and a focus on expanding into emerging markets will be crucial for stakeholders to capitalize on the projected market potential, estimated to reach over $7,000 million by 2033.

Honeycomb Paperboard Packaging Segmentation

-

1. Application

- 1.1. Shock Absorber

- 1.2. Bracing

- 1.3. Cradling

- 1.4. Void Fillers

- 1.5. Cushion

-

2. Types

- 2.1. Interior Packaging

- 2.2. Exterior Packaging

- 2.3. Others

Honeycomb Paperboard Packaging Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Honeycomb Paperboard Packaging REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Honeycomb Paperboard Packaging Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Shock Absorber

- 5.1.2. Bracing

- 5.1.3. Cradling

- 5.1.4. Void Fillers

- 5.1.5. Cushion

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Interior Packaging

- 5.2.2. Exterior Packaging

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Honeycomb Paperboard Packaging Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Shock Absorber

- 6.1.2. Bracing

- 6.1.3. Cradling

- 6.1.4. Void Fillers

- 6.1.5. Cushion

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Interior Packaging

- 6.2.2. Exterior Packaging

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Honeycomb Paperboard Packaging Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Shock Absorber

- 7.1.2. Bracing

- 7.1.3. Cradling

- 7.1.4. Void Fillers

- 7.1.5. Cushion

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Interior Packaging

- 7.2.2. Exterior Packaging

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Honeycomb Paperboard Packaging Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Shock Absorber

- 8.1.2. Bracing

- 8.1.3. Cradling

- 8.1.4. Void Fillers

- 8.1.5. Cushion

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Interior Packaging

- 8.2.2. Exterior Packaging

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Honeycomb Paperboard Packaging Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Shock Absorber

- 9.1.2. Bracing

- 9.1.3. Cradling

- 9.1.4. Void Fillers

- 9.1.5. Cushion

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Interior Packaging

- 9.2.2. Exterior Packaging

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Honeycomb Paperboard Packaging Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Shock Absorber

- 10.1.2. Bracing

- 10.1.3. Cradling

- 10.1.4. Void Fillers

- 10.1.5. Cushion

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Interior Packaging

- 10.2.2. Exterior Packaging

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Smurfit Kappa

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PCA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cascades

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Axxor

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Complete Packaging Solutions

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dufaylite Developments

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 HonECOre

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Multi-Wall Packaging

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rebul Custom Packaging

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Yoj Pack-Kraft

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Smurfit Kappa

List of Figures

- Figure 1: Global Honeycomb Paperboard Packaging Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Honeycomb Paperboard Packaging Revenue (million), by Application 2024 & 2032

- Figure 3: North America Honeycomb Paperboard Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Honeycomb Paperboard Packaging Revenue (million), by Types 2024 & 2032

- Figure 5: North America Honeycomb Paperboard Packaging Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Honeycomb Paperboard Packaging Revenue (million), by Country 2024 & 2032

- Figure 7: North America Honeycomb Paperboard Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Honeycomb Paperboard Packaging Revenue (million), by Application 2024 & 2032

- Figure 9: South America Honeycomb Paperboard Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Honeycomb Paperboard Packaging Revenue (million), by Types 2024 & 2032

- Figure 11: South America Honeycomb Paperboard Packaging Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Honeycomb Paperboard Packaging Revenue (million), by Country 2024 & 2032

- Figure 13: South America Honeycomb Paperboard Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Honeycomb Paperboard Packaging Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Honeycomb Paperboard Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Honeycomb Paperboard Packaging Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Honeycomb Paperboard Packaging Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Honeycomb Paperboard Packaging Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Honeycomb Paperboard Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Honeycomb Paperboard Packaging Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Honeycomb Paperboard Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Honeycomb Paperboard Packaging Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Honeycomb Paperboard Packaging Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Honeycomb Paperboard Packaging Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Honeycomb Paperboard Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Honeycomb Paperboard Packaging Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Honeycomb Paperboard Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Honeycomb Paperboard Packaging Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Honeycomb Paperboard Packaging Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Honeycomb Paperboard Packaging Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Honeycomb Paperboard Packaging Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Honeycomb Paperboard Packaging Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Honeycomb Paperboard Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Honeycomb Paperboard Packaging Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Honeycomb Paperboard Packaging Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Honeycomb Paperboard Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Honeycomb Paperboard Packaging Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Honeycomb Paperboard Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Honeycomb Paperboard Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Honeycomb Paperboard Packaging Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Honeycomb Paperboard Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Honeycomb Paperboard Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Honeycomb Paperboard Packaging Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Honeycomb Paperboard Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Honeycomb Paperboard Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Honeycomb Paperboard Packaging Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Honeycomb Paperboard Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Honeycomb Paperboard Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Honeycomb Paperboard Packaging Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Honeycomb Paperboard Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Honeycomb Paperboard Packaging Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Honeycomb Paperboard Packaging?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Honeycomb Paperboard Packaging?

Key companies in the market include Smurfit Kappa, PCA, Cascades, Axxor, Complete Packaging Solutions, Dufaylite Developments, HonECOre, Multi-Wall Packaging, Rebul Custom Packaging, Yoj Pack-Kraft.

3. What are the main segments of the Honeycomb Paperboard Packaging?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Honeycomb Paperboard Packaging," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Honeycomb Paperboard Packaging report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Honeycomb Paperboard Packaging?

To stay informed about further developments, trends, and reports in the Honeycomb Paperboard Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence