Key Insights

The global high-end audio market is poised for substantial growth, projected to reach an estimated market size of $12,500 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 8.5% anticipated throughout the forecast period of 2025-2033. This expansion is fundamentally driven by an increasing consumer demand for superior audio experiences, fueled by a growing disposable income among affluent demographics and a heightened appreciation for nuanced sound quality. The market is segmented by application into home and professional use, with home applications leading the charge due to the proliferation of smart homes and a desire for immersive entertainment within residential spaces. Within the product type segment, soundbars and home theater systems are expected to dominate, reflecting a trend towards integrated, high-fidelity audio solutions for both music listening and cinematic experiences.

Key trends shaping the high-end audio landscape include the integration of advanced digital signal processing (DSP) technologies, the rise of wireless connectivity options that don't compromise on audio fidelity, and the growing popularity of audiophile-grade portable devices. Manufacturers are increasingly focusing on premium materials, bespoke craftsmanship, and sophisticated design to appeal to a discerning customer base. However, the market faces certain restraints, such as the high cost of premium audio equipment, which can limit accessibility for a broader consumer base, and the complexity of setup and calibration for some high-performance systems. Despite these challenges, the relentless pursuit of audio perfection by leading companies like HARMAN, Bose, Sony, and Yamaha, alongside specialized brands such as Bowers & Wilkins and KEF, ensures continuous innovation and a vibrant market environment.

High End Audio Market Composition & Trends

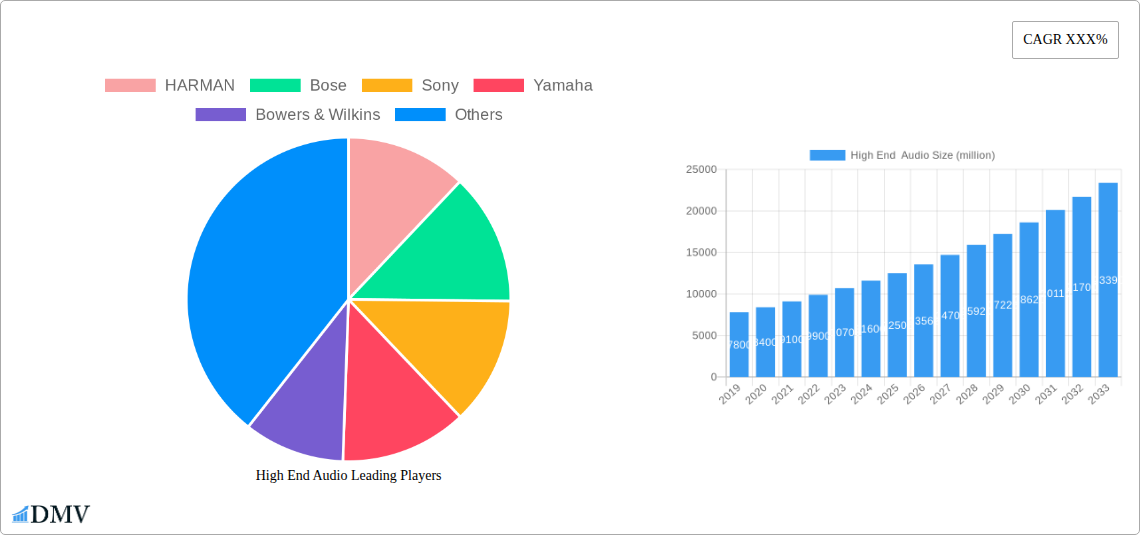

The global high end audio market, valued at approximately $15,000 million in the base year 2025, exhibits a dynamic composition driven by intense innovation and evolving consumer preferences. Market concentration remains moderately fragmented, with key players such as HARMAN, Bose, Sony, Yamaha, Bowers & Wilkins, Dynaudio, Burmester, Focal-JM Lab, Harbeth, TANNOY, DALI, KEF, Jamo, ELAC, and Klipsch holding significant but distinct market shares. Innovation catalysts include advancements in digital signal processing (DSP), lossless audio codecs, and the integration of smart technologies. The regulatory landscape, while generally supportive of consumer electronics, occasionally introduces hurdles related to emissions standards and import/export tariffs. Substitute products, primarily found in the mid-range audio segment and streaming services with less emphasis on fidelity, pose a constant challenge, necessitating a clear value proposition for premium sound. End-user profiles are increasingly diverse, encompassing audiophiles, discerning homeowners seeking immersive entertainment experiences, and professional studios prioritizing sonic accuracy. Mergers and acquisition (M&A) activities, with an estimated $500 million in deal values over the historical period (2019-2024), reflect consolidation and strategic expansion.

- Market Share Distribution (Estimated 2025):

- HARMAN: ~15%

- Bose: ~12%

- Sony: ~10%

- Yamaha: ~9%

- Bowers & Wilkins: ~7%

- Dynaudio: ~5%

- Burmester: ~4%

- Focal-JM Lab: ~4%

- Others: ~44%

- M&A Deal Values (Historical Period 2019-2024): Approximately $500 million

- Innovation Catalysts: DSP advancements, lossless audio codecs, smart home integration.

- Substitute Products: Mid-range audio systems, compressed audio formats.

High End Audio Industry Evolution

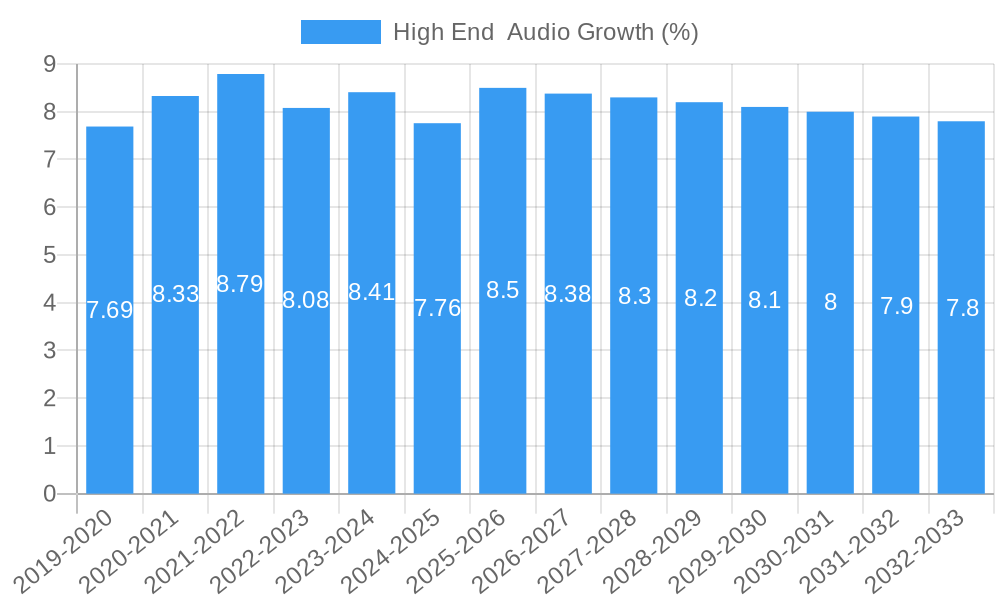

The high end audio industry is experiencing a robust growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033, reaching an estimated market size of $25,000 million by the end of the forecast period. This expansion is fueled by a confluence of technological advancements, shifting consumer demands, and a growing appreciation for premium audio experiences. The historical period (2019-2024) witnessed significant investments in research and development, leading to the introduction of groundbreaking technologies that redefine sonic fidelity. Digital signal processing (DSP) has become increasingly sophisticated, enabling manufacturers to achieve unprecedented levels of audio clarity, spatialization, and dynamic range. The adoption of lossless audio codecs, such as FLAC and ALAC, has become a standard expectation for high end audio equipment, allowing consumers to experience music as the artist intended.

Furthermore, the integration of smart technologies and wireless connectivity has revolutionized the user experience, offering seamless streaming, multi-room audio capabilities, and voice control integration. This has broadened the appeal of high end audio beyond traditional audiophiles to a wider demographic seeking both exceptional sound quality and modern convenience. The industry has also seen a resurgence in demand for analog components, such as high-fidelity turntables and tube amplifiers, catering to a segment of consumers who value the warmth and character of analog sound. The rise of immersive audio formats like Dolby Atmos and DTS:X has further propelled the growth of home theater systems, creating a demand for sophisticated multi-channel setups that deliver a cinematic listening experience.

Consumer demand is increasingly driven by a desire for personalized and immersive entertainment. This translates into a preference for high-quality soundbars that offer a significant upgrade over built-in TV speakers, as well as sophisticated home theater systems that transform living spaces into personal concert halls or cinemas. The portability segment within high end audio is also evolving, with manufacturers developing premium portable speakers and headphones that deliver exceptional sound on the go without compromising on audio fidelity. The industry's ability to adapt to these evolving preferences, while consistently pushing the boundaries of audio technology, is a key factor in its sustained growth and future potential.

- Market Growth Trajectory (2025-2033): ~7.5% CAGR

- Estimated Market Size (2033): ~ $25,000 million

- Technological Advancements: Sophisticated DSP, lossless audio codecs, smart home integration, advanced wireless connectivity.

- Consumer Demand Shifts: Desire for immersive, personalized entertainment, increased appreciation for analog sound.

- Adoption Metrics: High adoption rates for lossless audio codecs, growing demand for immersive audio formats (Dolby Atmos, DTS:X).

Leading Regions, Countries, or Segments in High End Audio

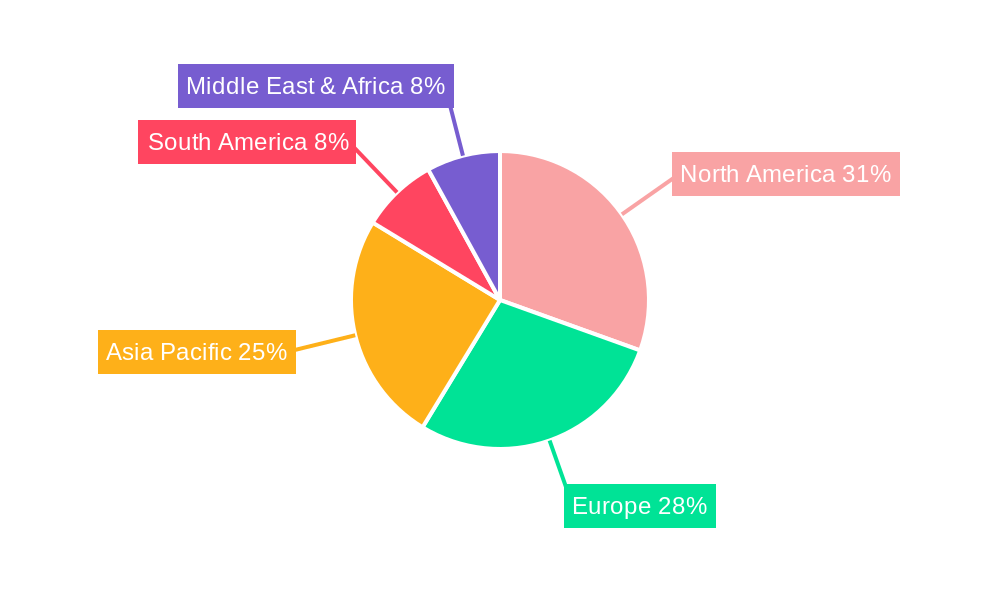

The Home application segment is emerging as the dominant force within the high end audio market, particularly driven by North America and Europe. Within this segment, Home Theater Systems are experiencing exceptional growth, becoming the cornerstone of modern living room entertainment. This dominance is attributed to several key drivers, including rising disposable incomes, a growing interest in home entertainment, and the increasing availability of high-quality content in immersive audio formats.

North America, spearheaded by the United States, consistently leads the high end audio market due to its mature consumer electronics market, strong purchasing power, and a deeply ingrained culture of valuing premium audio experiences. The region benefits from a high density of audiophiles, a robust retail infrastructure for high-fidelity equipment, and a significant number of early adopters of new audio technologies. Investment trends in the United States show a consistent allocation towards home entertainment upgrades, with a substantial portion directed towards sophisticated audio solutions.

In Europe, countries like Germany, the UK, and France are significant contributors, driven by a long-standing appreciation for audio craftsmanship and a growing segment of affluent consumers. Regulatory support in these regions has historically favored innovation and product quality, fostering a competitive environment that benefits high end audio manufacturers. The demand for meticulously engineered products and the resurgence of interest in vinyl further bolster the European market.

The Home Theater Systems segment within the Home application is the primary driver of this regional dominance. Consumers are increasingly investing in creating cinematic experiences within their homes, leading to a surge in demand for multi-channel speaker systems, advanced AV receivers, and high-resolution soundbars. The proliferation of streaming services offering 4K content and immersive audio soundtracks further amplifies this trend. While Professional applications also contribute to the market, the sheer volume and discretionary spending power of the home consumer segment solidify its leading position. The continuous innovation in soundbar technology, offering increasingly sophisticated soundscapes and space-saving designs, also contributes to their widespread adoption in homes, bridging the gap between convenience and audiophile quality.

- Dominant Application: Home

- Leading Segments: Home Theater Systems, Soundbars

- Dominant Regions: North America (USA), Europe (Germany, UK, France)

- Key Drivers in Dominant Regions/Segments:

- North America: High disposable income, strong audiophile culture, early technology adoption.

- Europe: Appreciation for audio craftsmanship, affluent consumer base, regulatory support for quality.

- Home Theater Systems/Soundbars: Rising disposable incomes, growth of home entertainment, immersive audio content availability, convenience of soundbars.

- Investment Trends: Consistent allocation towards home entertainment upgrades in North America.

- Regulatory Support: Historically favored innovation and product quality in Europe.

High End Audio Product Innovations

Recent product innovations in the high end audio market are redefining sonic excellence and user experience. Manufacturers are pushing the boundaries with advancements in material science for speaker drivers, leading to enhanced accuracy and reduced distortion. The integration of advanced Digital Signal Processing (DSP) algorithms allows for personalized sound profiles, adaptive room correction, and immersive 3D audio experiences, even from stereo sources. Wireless connectivity has evolved beyond basic Bluetooth, with support for high-resolution, lossless streaming protocols and seamless multi-room synchronization, offering unparalleled convenience. Furthermore, the re-emergence of high-fidelity analog components, meticulously engineered for superior warmth and detail, caters to a dedicated segment of audiophiles seeking a purist listening experience. Unique selling propositions often lie in proprietary driver technologies, bespoke amplification circuits, and refined aesthetic designs that blend seamlessly into luxurious living spaces.

Propelling Factors for High End Audio Growth

The high end audio market is propelled by several interconnected factors. Technologically, continuous innovation in digital signal processing (DSP), the widespread adoption of lossless audio codecs, and advancements in wireless streaming technologies are creating increasingly immersive and pristine listening experiences. Economically, rising disposable incomes in developed and emerging economies are enabling a growing segment of consumers to invest in premium audio solutions for their homes. Regulatory environments, generally supportive of consumer electronics and intellectual property protection, foster an environment conducive to innovation and market stability. The increasing demand for sophisticated home entertainment systems, driven by the popularity of high-definition content and streaming services, further fuels growth.

Obstacles in the High End Audio Market

Despite robust growth, the high end audio market faces several obstacles. Regulatory challenges, while generally favorable, can sometimes involve complex import/export tariffs and compliance standards that add to production costs. Supply chain disruptions, exacerbated by geopolitical events and semiconductor shortages, have historically led to production delays and increased component costs, impacting product availability and pricing. Competitive pressures from the mid-range audio segment, which offers increasingly capable sound at lower price points, necessitate a constant demonstration of superior value and performance. Furthermore, the complexity of some high-end systems can be a barrier for less technically inclined consumers, requiring extensive user education and support.

Future Opportunities in High End Audio

Emerging opportunities in the high end audio market are abundant. The expansion of high-resolution audio streaming services presents a significant avenue for growth, requiring compatible playback equipment. The increasing integration of AI in audio processing offers potential for highly personalized and adaptive sound experiences, going beyond current DSP capabilities. Emerging markets in Asia and South America, with their growing affluent populations, represent untapped potential for premium audio products. The continued evolution of smart home ecosystems creates opportunities for seamless integration of high-end audio into connected living spaces, offering enhanced convenience and functionality. There is also an opportunity to bridge the gap between professional studio quality and home listening through innovative product design.

Major Players in the High End Audio Ecosystem

- HARMAN

- Bose

- Sony

- Yamaha

- Bowers & Wilkins

- Dynaudio

- Burmester

- Focal-JM Lab

- Harbeth

- TANNOY

- DALI

- KEF

- Jamo

- ELAC

- Klipsch

Key Developments in High End Audio Industry

- 2019: Introduction of advanced AI-powered audio processing in select high-end receivers, enhancing room correction and spatial audio.

- 2020: Widespread adoption of Wi-Fi 6 and Bluetooth 5.0 in portable high-end audio devices, improving connectivity and range.

- 2021: Increased focus on sustainable materials and manufacturing processes by several premium brands.

- 2022: Launch of new soundbar technologies offering virtualized surround sound with higher channel counts and improved bass response.

- 2023: Significant investment in R&D for next-generation lossless audio codecs and immersive audio decoding.

- 2024: Mergers and acquisitions aimed at consolidating market share and expanding product portfolios in the premium audio sector.

- 2025 (Estimated): Further integration of voice control assistants and smart home platform compatibility across high-end audio systems.

Strategic High End Audio Market Forecast

The strategic forecast for the high end audio market indicates continued robust growth, driven by a potent combination of technological innovation and evolving consumer aspirations. Future opportunities lie in the deeper integration of artificial intelligence for personalized audio, the expansion of high-resolution streaming compatibility, and the penetration of emerging markets with increasing disposable incomes. The demand for immersive home theater experiences and sophisticated, yet user-friendly, soundbars will remain a key growth catalyst. Continued investment in research and development, particularly in areas like advanced DSP, material science for drivers, and sustainable manufacturing, will be crucial for sustained market leadership and capturing the predicted market expansion.

High End Audio Segmentation

-

1. Application

- 1.1. Home

- 1.2. Professional

-

2. Type

- 2.1. Soundbars

- 2.2. Portable

- 2.3. Home Theater Systems

High End Audio Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

High End Audio REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High End Audio Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Home

- 5.1.2. Professional

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Soundbars

- 5.2.2. Portable

- 5.2.3. Home Theater Systems

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America High End Audio Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Home

- 6.1.2. Professional

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Soundbars

- 6.2.2. Portable

- 6.2.3. Home Theater Systems

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America High End Audio Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Home

- 7.1.2. Professional

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Soundbars

- 7.2.2. Portable

- 7.2.3. Home Theater Systems

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe High End Audio Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Home

- 8.1.2. Professional

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Soundbars

- 8.2.2. Portable

- 8.2.3. Home Theater Systems

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa High End Audio Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Home

- 9.1.2. Professional

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Soundbars

- 9.2.2. Portable

- 9.2.3. Home Theater Systems

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific High End Audio Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Home

- 10.1.2. Professional

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Soundbars

- 10.2.2. Portable

- 10.2.3. Home Theater Systems

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 HARMAN

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bose

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sony

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Yamaha

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bowers & Wilkins

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dynaudio

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Burmester

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Focal-JM Lab

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Harbeth

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TANNOY

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 DALI

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 KEF

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Jamo

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ELAC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Klipsch

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 HARMAN

List of Figures

- Figure 1: Global High End Audio Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America High End Audio Revenue (million), by Application 2024 & 2032

- Figure 3: North America High End Audio Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America High End Audio Revenue (million), by Type 2024 & 2032

- Figure 5: North America High End Audio Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America High End Audio Revenue (million), by Country 2024 & 2032

- Figure 7: North America High End Audio Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America High End Audio Revenue (million), by Application 2024 & 2032

- Figure 9: South America High End Audio Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America High End Audio Revenue (million), by Type 2024 & 2032

- Figure 11: South America High End Audio Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America High End Audio Revenue (million), by Country 2024 & 2032

- Figure 13: South America High End Audio Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe High End Audio Revenue (million), by Application 2024 & 2032

- Figure 15: Europe High End Audio Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe High End Audio Revenue (million), by Type 2024 & 2032

- Figure 17: Europe High End Audio Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe High End Audio Revenue (million), by Country 2024 & 2032

- Figure 19: Europe High End Audio Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa High End Audio Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa High End Audio Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa High End Audio Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa High End Audio Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa High End Audio Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa High End Audio Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific High End Audio Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific High End Audio Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific High End Audio Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific High End Audio Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific High End Audio Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific High End Audio Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global High End Audio Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global High End Audio Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global High End Audio Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global High End Audio Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global High End Audio Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global High End Audio Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global High End Audio Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global High End Audio Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global High End Audio Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global High End Audio Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global High End Audio Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global High End Audio Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global High End Audio Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global High End Audio Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global High End Audio Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global High End Audio Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global High End Audio Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global High End Audio Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global High End Audio Revenue million Forecast, by Country 2019 & 2032

- Table 41: China High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania High End Audio Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific High End Audio Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High End Audio?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the High End Audio?

Key companies in the market include HARMAN, Bose, Sony, Yamaha, Bowers & Wilkins, Dynaudio, Burmester, Focal-JM Lab, Harbeth, TANNOY, DALI, KEF, Jamo, ELAC, Klipsch.

3. What are the main segments of the High End Audio?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High End Audio," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High End Audio report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High End Audio?

To stay informed about further developments, trends, and reports in the High End Audio, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence