Key Insights

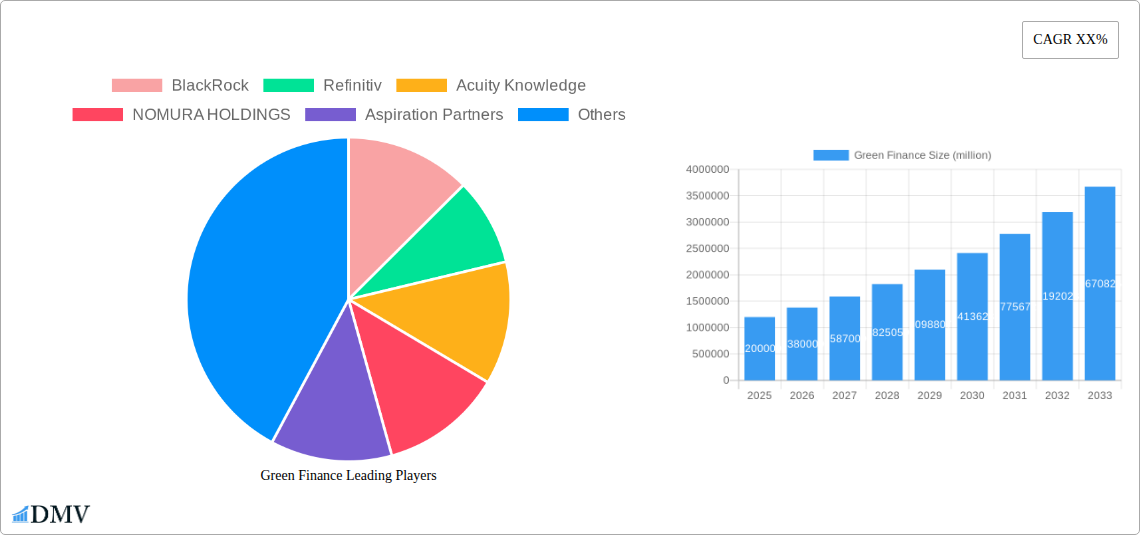

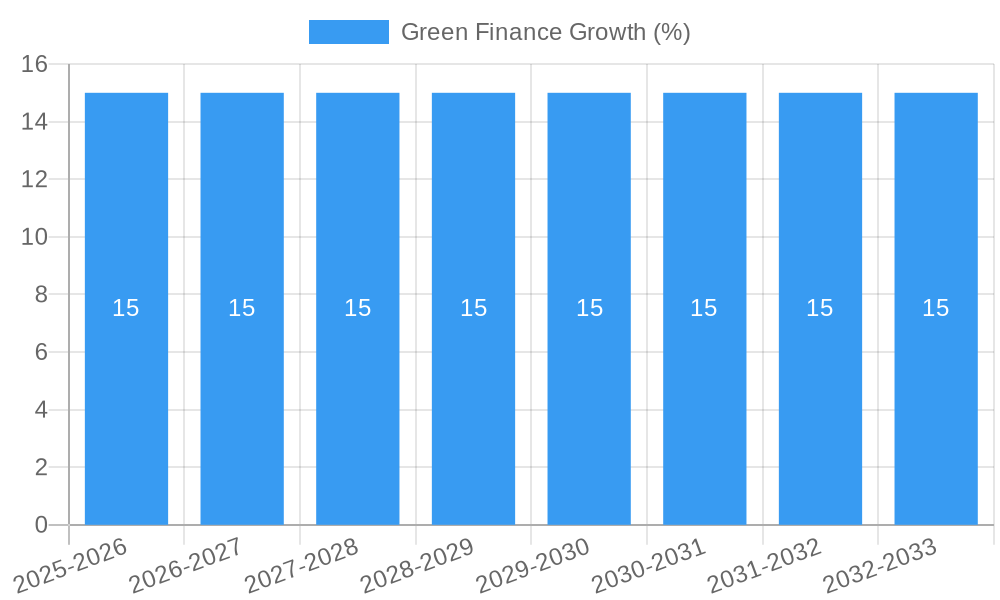

The global Green Finance market is projected to experience robust growth, with a current market size estimated at USD 1.2 trillion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of approximately 15% through 2033. This expansion is fueled by a growing imperative for sustainable development and a significant shift in investor preferences towards environmentally responsible assets. Key drivers include increasing regulatory support for green initiatives worldwide, such as carbon pricing mechanisms and disclosure requirements, which are making green bonds and sustainable investments more attractive and accessible. Furthermore, heightened awareness of climate change risks and the economic opportunities presented by the transition to a low-carbon economy are compelling corporations and financial institutions to channel capital into green projects. The burgeoning demand for sustainable solutions across various sectors, particularly in logistics and transportation aiming for reduced emissions, and the food and beverage industry focusing on sustainable sourcing and packaging, are significant contributors to this market's upward trajectory.

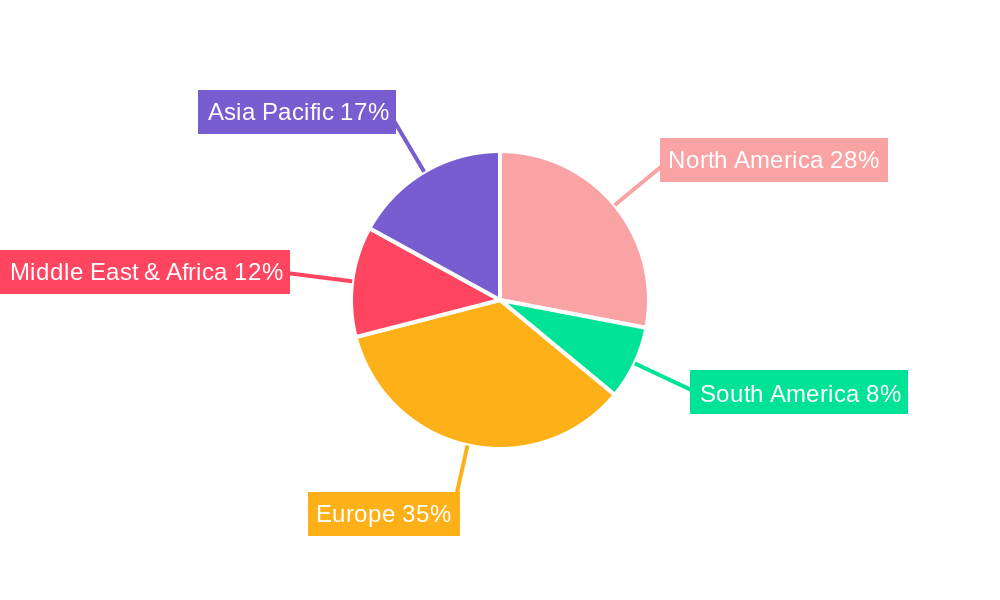

The market is characterized by a dynamic interplay of innovative financial instruments and evolving investor mandates. Green Bonds, a cornerstone of green finance, continue to dominate the landscape, offering a structured way for entities to fund environmentally beneficial projects. Sustainable Bonds, which encompass a broader range of environmental, social, and governance (ESG) considerations, are also gaining considerable traction. While the market is buoyed by strong growth drivers, certain restraints, such as a lack of standardized definitions and reporting frameworks for green projects, and potential greenwashing concerns, can pose challenges. However, leading financial institutions like BlackRock, BNP Paribas, and Goldman Sachs, alongside specialized entities like South Pole and Refinitiv, are actively developing and promoting green finance products and services, addressing these challenges through enhanced transparency and innovative solutions. The Asia Pacific region, particularly China and India, is emerging as a significant growth hub, driven by substantial investments in renewable energy and sustainable infrastructure, complementing established markets in North America and Europe.

This comprehensive Green Finance market research report delves into the rapidly evolving landscape of sustainable investing, providing critical insights for stakeholders across the financial industry. Covering the study period of 2019–2033, with a base year of 2025 and an extensive forecast period of 2025–2033, this report offers an in-depth analysis of market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and future opportunities. Leveraging high-ranking keywords like "green bonds," "sustainable bonds," "ESG investing," "climate finance," "sustainable development goals (SDGs)," and "impact investing," this report is designed to boost search visibility and captivate financial institutions, asset managers, corporations, and policymakers.

The report meticulously examines the Application segments including Logistics Transportation, Food and Beverage, and Others, alongside key Types such as Green Bonds, Sustainable Bonds, and Others. Industry developments are analyzed through the lens of leading companies including BlackRock, Refinitiv, Acuity Knowledge, NOMURA HOLDINGS, Aspiration Partners, Bank of America, BNP Paribas, Goldman Sachs, HSBC Group, KPMG International, South Pole, Deutsche Bank, Tred Earth, and Triodos Bank.

Green Finance Market Composition & Trends

The Green Finance market exhibits a dynamic concentration, with innovative catalysts continuously reshaping its trajectory. Regulatory landscapes are becoming increasingly stringent yet supportive, driving demand for sustainable finance instruments. Substitute products are emerging, but green bonds and sustainable bonds continue to dominate. End-user profiles are diversifying, with a growing appetite from institutional investors seeking to align portfolios with ESG (Environmental, Social, and Governance) principles. Mergers and acquisitions (M&A) activity is on the rise, indicating consolidation and strategic expansion within the sustainable investment sector. During the historical period (2019-2024), market share distribution for key players has seen fluctuations, with major financial institutions like BlackRock and Bank of America consistently holding significant positions. M&A deal values in the green finance space have seen a substantial increase, reaching an estimated XXX million during the forecast period.

- Market Concentration: Moderate to high, with a few dominant players and a growing number of specialized firms.

- Innovation Catalysts: Regulatory push for decarbonization, technological advancements in data analytics for ESG reporting, and increasing investor awareness.

- Regulatory Landscapes: Evolving frameworks in Europe (e.g., EU Taxonomy) and North America are shaping market practices and product development.

- Substitute Products: While other impact-focused investments exist, the clarity and standardization of green bonds maintain their lead.

- End-User Profiles: Institutional investors, pension funds, sovereign wealth funds, and increasingly, retail investors through specialized ETFs and funds.

- M&A Activities: Strategic acquisitions to gain market share, acquire new technologies, or expand service offerings in sustainable finance.

Green Finance Industry Evolution

The Green Finance industry has witnessed remarkable evolution, driven by a confluence of factors including increasing global awareness of climate change, evolving regulatory frameworks, and a growing demand for ESG-compliant investments. The market growth trajectories have been consistently upward, with significant surges observed in the issuance of green bonds and sustainable bonds over the historical period (2019–2024). Technological advancements, particularly in data analytics and reporting platforms provided by companies like Refinitiv, have been instrumental in enhancing transparency and trust in green finance. Shifting consumer demands, coupled with corporate commitment to Sustainable Development Goals (SDGs), have further propelled the adoption of sustainable finance solutions. The estimated year (2025) is projected to see a continued expansion, with an anticipated market growth rate of approximately XX% year-on-year.

The forecast period (2025–2033) is poised for even more robust growth, fueled by escalating climate-related risks and opportunities. Investment in renewable energy projects, sustainable infrastructure, and circular economy initiatives are expected to be key beneficiaries of this growth. The increasing integration of ESG factors into mainstream investment decision-making by institutions like Goldman Sachs and HSBC Group signifies a fundamental shift in financial markets. Furthermore, the development of innovative green finance products, such as transition bonds and social bonds, is expanding the scope of sustainable investing beyond traditional green bonds. The influence of international bodies and government initiatives aimed at mobilizing private capital for climate action is also a significant contributor to this industry evolution.

Companies like Acuity Knowledge are playing a crucial role in providing the analytical tools and expertise necessary for effective ESG integration. NOMURA HOLDINGS and Bank of America are actively developing their green finance offerings, catering to a broader client base. The rise of specialized entities like Aspiration Partners and Tred Earth underscores the growing niche for impact-focused financial services. The proactive stance of European banks such as BNP Paribas, Deutsche Bank, and Triodos Bank in leading the green finance agenda further solidifies its importance on the global stage. The study period's extensive timeline allows for a detailed examination of how these trends have unfolded and are projected to shape the market's future.

Leading Regions, Countries, or Segments in Green Finance

The Green Finance market is witnessing significant dominance from specific regions, countries, and segments, driven by robust investment trends and proactive regulatory support. Europe, particularly the European Union, continues to lead in the issuance and adoption of green bonds and sustainable bonds, propelled by ambitious climate targets and comprehensive policy frameworks like the EU Taxonomy for Sustainable Activities. Countries like Germany, France, and the Netherlands have been at the forefront of this movement, with substantial investments directed towards renewable energy, energy efficiency, and sustainable infrastructure. The Application segment of Logistics Transportation is experiencing a surge in green finance demand as companies invest in electric vehicles, sustainable supply chains, and efficient logistics networks to reduce their carbon footprint.

- Dominant Region: Europe, characterized by strong regulatory support and a mature market for sustainable investments.

- Key Country: Germany, a leader in renewable energy adoption and green bond issuance, consistently investing in sustainable infrastructure.

- Dominant Application Segment: Logistics Transportation, driven by the imperative to decarbonize supply chains and invest in low-emission transport solutions. The Food and Beverage sector is also showing increasing interest in sustainable practices and green finance for eco-friendly packaging and responsible sourcing.

- Dominant Type: Green Bonds remain the most prominent instrument due to their established market and clear use of proceeds for environmental projects. However, the market for Sustainable Bonds is rapidly growing, offering more flexibility in their application.

- Investment Trends: Significant capital allocation towards renewable energy infrastructure, green building projects, sustainable agriculture, and circular economy initiatives.

- Regulatory Support: Mandates and incentives for carbon reduction, transparent reporting requirements, and the development of sustainable finance taxonomies are key drivers.

The United States is also emerging as a significant player, with increasing issuance of green bonds and growing investor demand for ESG-aligned investments. The growing awareness of climate risks among corporations and financial institutions, coupled with policy shifts, is contributing to this upward trend. The Other application segment encompasses a wide range of industries, from sustainable technology and waste management to water conservation and biodiversity projects, all of which are increasingly tapping into green finance to fund their initiatives. The proactive role of organizations like South Pole in developing and verifying green projects further strengthens the credibility and growth of these diverse applications. The interplay between these segments and the types of financial instruments employed is crucial for understanding the overall market dynamics and future growth potential.

Green Finance Product Innovations

Green finance product innovations are rapidly expanding the scope and accessibility of sustainable investments. Beyond traditional green bonds, we are seeing the emergence of sustainability-linked bonds (SLBs), which tie interest rates to the issuer's achievement of specific environmental or social targets. This innovation incentivizes real-world performance improvements and aligns financial goals with sustainability objectives. Furthermore, the development of transition bonds is crucial for supporting industries undergoing decarbonization, offering a pathway for high-emitting sectors to finance their shift towards greener operations. Companies like Tred Earth are at the forefront of developing novel financial instruments that directly address climate action and biodiversity conservation. The integration of advanced data analytics and blockchain technology is enhancing the transparency, traceability, and efficiency of these products, ensuring greater accountability and impact. These advancements are making green finance more attractive to a wider range of investors, from institutional powerhouses like BlackRock to individual impact-driven savers.

Propelling Factors for Green Finance Growth

The growth of the Green Finance market is propelled by a confluence of powerful factors.

- Regulatory Push: Governments worldwide are implementing stricter environmental regulations and offering incentives for sustainable practices, creating a favorable climate for green investments. For instance, carbon pricing mechanisms and renewable energy mandates directly drive demand for green finance.

- Investor Demand: A rapidly growing segment of investors, including institutional asset managers and retail investors, are increasingly prioritizing ESG (Environmental, Social, and Governance) criteria in their investment decisions, seeking to align their portfolios with ethical values and long-term sustainability.

- Corporate Sustainability Commitments: A growing number of corporations are setting ambitious Net Zero targets and embedding sustainability into their core business strategies, leading to increased issuance of green bonds and other sustainable financial instruments to fund these initiatives.

- Technological Advancements: Innovations in renewable energy technologies, energy efficiency solutions, and sustainable materials are creating new investment opportunities that are attractive to green finance.

- Awareness and Education: Increased public awareness of climate change and its impacts, coupled with greater availability of information on sustainable investing, is empowering individuals and institutions to participate in the green finance ecosystem.

Obstacles in the Green Finance Market

Despite its robust growth, the Green Finance market faces several significant obstacles.

- Greenwashing Concerns: The risk of "greenwashing"—companies misrepresenting their environmental credentials—remains a concern, potentially eroding investor trust and hindering genuine sustainable investments. This necessitates robust verification and disclosure mechanisms.

- Standardization and Taxonomy Development: While progress is being made, a lack of universal standards and taxonomies for defining and classifying green financial products can lead to confusion and inconsistencies across different markets.

- Data Availability and Quality: Access to reliable and standardized ESG data can be challenging, impacting the ability of investors and issuers to accurately assess and report on the environmental performance of investments.

- Limited Market Liquidity: For some niche green financial products, market liquidity can be a concern, potentially deterring larger institutional investors.

- Perceived Higher Costs: In some instances, the initial investment in green technologies or projects may be perceived as having higher upfront costs, requiring strong long-term financial incentives and risk mitigation strategies.

Future Opportunities in Green Finance

The future of Green Finance is replete with promising opportunities.

- Emerging Markets: Developing economies present vast untapped potential for green finance as they strive for sustainable development and invest in climate resilience.

- Innovative Financial Instruments: The continued development of sophisticated financial instruments, such as blended finance structures and green securitization, will unlock new avenues for funding sustainable projects.

- Technological Integration: The application of AI, big data, and IoT will enhance the precision and impact of green finance, enabling better risk assessment and performance monitoring.

- Circular Economy Financing: The growing emphasis on circular economy principles opens significant opportunities for financing waste management, recycling, and sustainable resource utilization.

- Biodiversity and Nature-Based Solutions: Increasing recognition of the importance of biodiversity is creating a new frontier for impact investing, with opportunities in conservation finance and nature-based solutions.

Major Players in the Green Finance Ecosystem

- BlackRock

- Refinitiv

- Acuity Knowledge

- NOMURA HOLDINGS

- Aspiration Partners

- Bank of America

- BNP Paribas

- Goldman Sachs

- HSBC Group

- KPMG International

- South Pole

- Deutsche Bank

- Tred Earth

- Triodos Bank

Key Developments in Green Finance Industry

- 2023/Q4: Launch of a new green bond issuance by a major utility company to fund renewable energy expansion.

- 2024/Q1: Regulatory announcement of updated ESG disclosure requirements for listed companies in key European markets.

- 2024/Q2: A leading investment bank expands its sustainable finance advisory services to support smaller businesses in accessing green capital.

- 2024/Q3: Significant increase in the issuance of sustainability-linked bonds across various sectors, demonstrating growing investor confidence in outcome-based financing.

- 2025/Q1 (Projected): Expected introduction of new taxonomies for social finance and biodiversity-related investments to broaden the scope of sustainable finance.

Strategic Green Finance Market Forecast

- 2023/Q4: Launch of a new green bond issuance by a major utility company to fund renewable energy expansion.

- 2024/Q1: Regulatory announcement of updated ESG disclosure requirements for listed companies in key European markets.

- 2024/Q2: A leading investment bank expands its sustainable finance advisory services to support smaller businesses in accessing green capital.

- 2024/Q3: Significant increase in the issuance of sustainability-linked bonds across various sectors, demonstrating growing investor confidence in outcome-based financing.

- 2025/Q1 (Projected): Expected introduction of new taxonomies for social finance and biodiversity-related investments to broaden the scope of sustainable finance.

Strategic Green Finance Market Forecast

The Green Finance market is projected for sustained and accelerated growth, driven by an unwavering global commitment to sustainability and decarbonization. The forecast period (2025–2033) will witness an exponential rise in the issuance of green bonds, sustainable bonds, and innovative financial instruments designed to finance climate mitigation and adaptation efforts. This expansion will be underpinned by increasingly stringent environmental regulations, a growing demand for ESG investing from both institutional and retail investors, and the strategic integration of sustainability into corporate business models. Key sectors like Logistics Transportation and Food and Beverage will see significant green finance deployment for transition and innovation. The continuous evolution of green finance products and the increasing sophistication of risk assessment and impact measurement will further solidify its position as a cornerstone of the global financial system, paving the way for a more sustainable and resilient future.

Green Finance Segmentation

-

1. Application

- 1.1. Logistics Transportation

- 1.2. Food and Beverage

- 1.3. Others

-

2. Types

- 2.1. Green Bonds

- 2.2. Sustainable Bonds

- 2.3. Others

Green Finance Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Green Finance REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Green Finance Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Logistics Transportation

- 5.1.2. Food and Beverage

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Green Bonds

- 5.2.2. Sustainable Bonds

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Green Finance Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Logistics Transportation

- 6.1.2. Food and Beverage

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Green Bonds

- 6.2.2. Sustainable Bonds

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Green Finance Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Logistics Transportation

- 7.1.2. Food and Beverage

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Green Bonds

- 7.2.2. Sustainable Bonds

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Green Finance Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Logistics Transportation

- 8.1.2. Food and Beverage

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Green Bonds

- 8.2.2. Sustainable Bonds

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Green Finance Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Logistics Transportation

- 9.1.2. Food and Beverage

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Green Bonds

- 9.2.2. Sustainable Bonds

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Green Finance Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Logistics Transportation

- 10.1.2. Food and Beverage

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Green Bonds

- 10.2.2. Sustainable Bonds

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BlackRock

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Refinitiv

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Acuity Knowledge

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 NOMURA HOLDINGS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aspiration Partners

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bank of America

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BNP Paribas

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Goldman Sachs

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 HSBC Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 KPMG International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 South Pole

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Deutsche Bank

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Tred Earth

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Triodos Bank

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 BlackRock

List of Figures

- Figure 1: Global Green Finance Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Green Finance Revenue (million), by Application 2024 & 2032

- Figure 3: North America Green Finance Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Green Finance Revenue (million), by Types 2024 & 2032

- Figure 5: North America Green Finance Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Green Finance Revenue (million), by Country 2024 & 2032

- Figure 7: North America Green Finance Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Green Finance Revenue (million), by Application 2024 & 2032

- Figure 9: South America Green Finance Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Green Finance Revenue (million), by Types 2024 & 2032

- Figure 11: South America Green Finance Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Green Finance Revenue (million), by Country 2024 & 2032

- Figure 13: South America Green Finance Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Green Finance Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Green Finance Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Green Finance Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Green Finance Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Green Finance Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Green Finance Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Green Finance Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Green Finance Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Green Finance Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Green Finance Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Green Finance Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Green Finance Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Green Finance Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Green Finance Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Green Finance Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Green Finance Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Green Finance Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Green Finance Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Green Finance Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Green Finance Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Green Finance Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Green Finance Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Green Finance Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Green Finance Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Green Finance Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Green Finance Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Green Finance Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Green Finance Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Green Finance Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Green Finance Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Green Finance Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Green Finance Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Green Finance Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Green Finance Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Green Finance Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Green Finance Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Green Finance Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Green Finance Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Green Finance Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Green Finance?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Green Finance?

Key companies in the market include BlackRock, Refinitiv, Acuity Knowledge, NOMURA HOLDINGS, Aspiration Partners, Bank of America, BNP Paribas, Goldman Sachs, HSBC Group, KPMG International, South Pole, Deutsche Bank, Tred Earth, Triodos Bank.

3. What are the main segments of the Green Finance?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Green Finance," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Green Finance report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Green Finance?

To stay informed about further developments, trends, and reports in the Green Finance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence