Key Insights

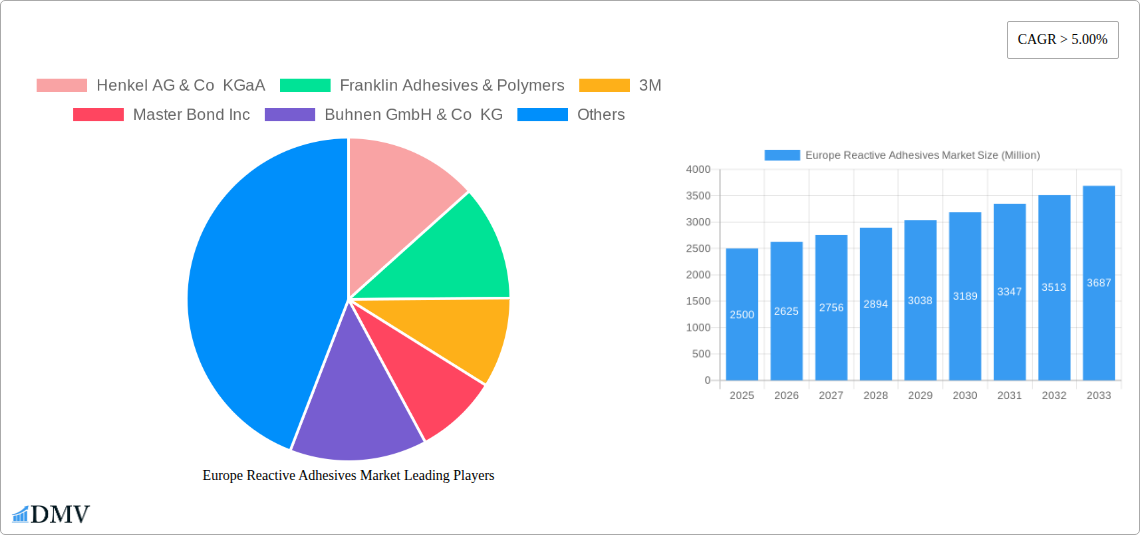

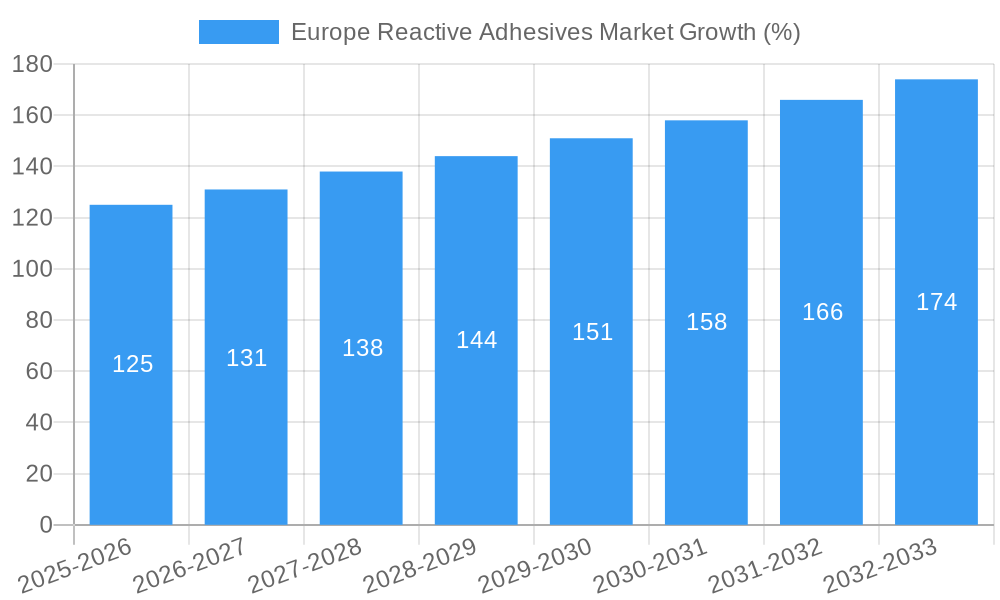

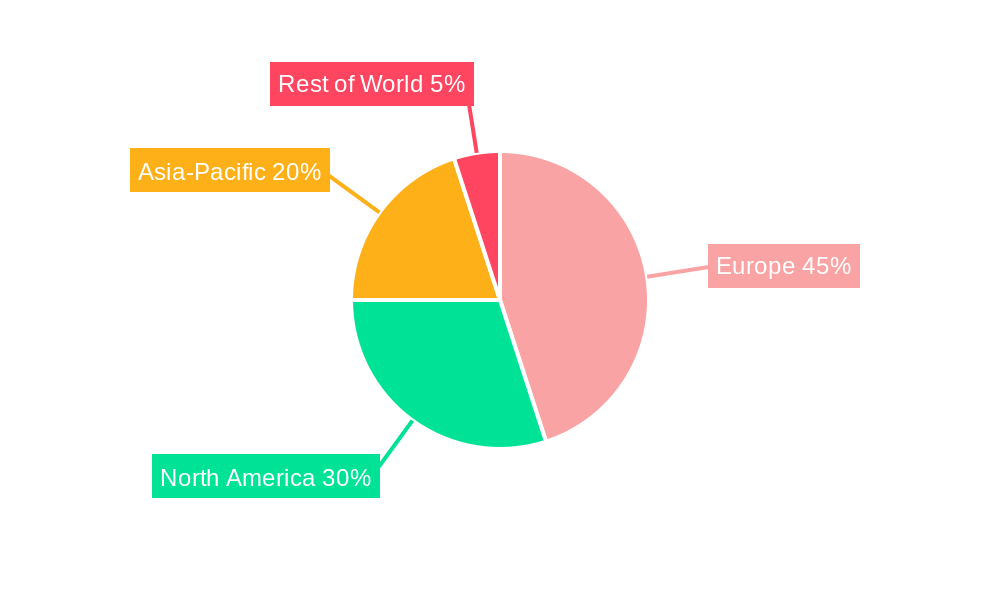

The European reactive adhesives market, valued at approximately €X billion in 2025, is poised for robust growth, exhibiting a compound annual growth rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning construction sector across Europe, particularly in infrastructure development and residential building, fuels strong demand for high-performance adhesives. Furthermore, the renewable energy sector's rapid growth, encompassing wind turbine construction and solar panel installations, contributes significantly to market expansion. The automotive and transportation industries also represent substantial drivers, leveraging reactive adhesives in lightweighting initiatives and advanced manufacturing processes. Technological advancements leading to improved adhesive properties, such as enhanced durability, faster curing times, and wider application versatility, are further stimulating market growth. Growth is also being seen within the healthcare sector due to the need for biocompatible and sterile adhesives for medical devices and pharmaceuticals. While potential restraints such as volatile raw material prices and environmental concerns regarding certain adhesive components exist, the overall market outlook remains positive, primarily due to the sustained growth in key end-use sectors and continuous innovation within the adhesives industry. Germany, France, and the UK currently dominate the European market, however other nations such as the Netherlands and Sweden are also showing significant growth potential.

The market segmentation reveals polyurethane and epoxy resins as the leading resin types, reflecting their widespread application across various industries. The building and construction sector remains the largest end-user industry, followed by the renewable energy and transportation sectors. Major players like Henkel, 3M, and Arkema are driving innovation and market penetration through strategic partnerships, product diversification, and acquisitions. The projected growth indicates substantial opportunities for market entrants and established players alike, particularly those focusing on sustainable and high-performance adhesive solutions tailored to specific industry needs. The forecast period (2025-2033) suggests a significant expansion in market size, driven by the factors mentioned above, offering considerable potential for investment and further market consolidation. Specific regional variations in growth rates are expected, driven by the unique economic and infrastructural developments within each country.

Europe Reactive Adhesives Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Reactive Adhesives Market, offering invaluable insights for stakeholders seeking to navigate this dynamic industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this comprehensive study unravels market trends, growth drivers, and future opportunities. The report encompasses a thorough examination of various resin types (Polyurethane, Epoxy, Cyanoacrylate, Modified Acrylic, Anaerobic, Silicone, and Others) and end-user industries (Building & Construction, Renewable Energy, Transportation, Healthcare, Electronics, Aerospace, Sports & Leisure, and Others), providing a granular understanding of market segmentation. The market size is estimated at XX Million in 2025 and is projected to reach XX Million by 2033.

Europe Reactive Adhesives Market Composition & Trends

The Europe Reactive Adhesives Market is characterized by a moderately concentrated landscape, with key players like Henkel AG & Co KGaA, 3M, and Sika AG holding significant market share. However, the presence of numerous smaller, specialized players contributes to a competitive environment. Innovation is driven by the increasing demand for high-performance adhesives in diverse applications, particularly in the renewable energy and electronics sectors. Stringent environmental regulations are shaping product development, pushing manufacturers toward more sustainable and eco-friendly solutions. The market is also witnessing increasing M&A activity, with deal values exceeding XX Million in recent years. Substitute products, such as mechanical fasteners, pose a competitive challenge, but the advantages of reactive adhesives in terms of bonding strength and ease of application maintain their dominance. End-users are increasingly demanding customized solutions and higher levels of technical support.

- Market Share Distribution (2025): Henkel AG & Co KGaA (XX%), 3M (XX%), Sika AG (XX%), Others (XX%).

- M&A Activity (2019-2024): Total deal value exceeding XX Million, with an average deal size of XX Million.

- Key Innovation Catalysts: Growing demand for high-performance adhesives in renewable energy and electronics; stringent environmental regulations; increasing demand for customized solutions.

Europe Reactive Adhesives Market Industry Evolution

The Europe Reactive Adhesives Market has experienced steady growth throughout the historical period (2019-2024), driven by robust demand across diverse end-user industries. The CAGR during this period is estimated at XX%. Technological advancements, particularly in formulating specialized adhesives for niche applications, are contributing to market expansion. Furthermore, shifting consumer preferences toward lightweight, high-strength materials, and sustainable solutions are influencing the demand for advanced reactive adhesives. The building and construction sector, driven by infrastructure development and renovation projects, remains a significant growth driver. The adoption of advanced adhesive technologies in the automotive and aerospace industries is also fueling market growth, with adoption rates increasing by an average of XX% annually during the forecast period. Future growth is projected to be fueled by increased investment in renewable energy infrastructure and technological advancements in the formulation of high-performance, eco-friendly adhesives.

Leading Regions, Countries, or Segments in Europe Reactive Adhesives Market

Germany and France are the leading countries in the Europe Reactive Adhesives Market, driven by strong industrial bases and significant construction activities. The Polyurethane segment holds the largest market share due to its versatility and cost-effectiveness, while the Building & Construction sector represents the highest demand.

Key Drivers:

- Germany & France: Strong industrial presence, substantial construction activity, high investments in renewable energy infrastructure.

- Polyurethane Segment: Versatility, cost-effectiveness, wide range of applications.

- Building & Construction Sector: Robust infrastructure development, renovation projects, rising demand for high-performance construction materials.

The dominance of these segments and regions stems from the high demand for reactive adhesives in construction projects, automotive manufacturing, and the increasing adoption of renewable energy technologies. Germany's robust automotive sector and France’s focus on infrastructure development further propel market growth within these countries. The versatile nature of polyurethane adhesives across diverse applications also contributes to the segment's leading position.

Europe Reactive Adhesives Market Product Innovations

Recent innovations include the development of adhesives with enhanced thermal stability, UV resistance, and improved bonding strength on challenging substrates. These advancements cater to the growing demand for high-performance adhesives in demanding applications such as aerospace and electronics. Manufacturers are focusing on developing sustainable adhesives with reduced environmental impact, featuring biodegradable components and lower VOC emissions. Unique selling propositions often involve superior bonding strength, faster curing times, and enhanced durability, tailored to specific end-user needs.

Propelling Factors for Europe Reactive Adhesives Market Growth

Technological advancements in adhesive formulations, coupled with increasing demand from key end-user sectors like renewable energy and electronics, are primary growth drivers. Government initiatives promoting sustainable construction and infrastructure development further stimulate market expansion. Economic growth and increasing disposable incomes are also contributing factors, fueling demand for higher-quality products across various applications. The growing demand for lightweight, high-strength materials in the automotive industry further fuels market growth.

Obstacles in the Europe Reactive Adhesives Market Market

Supply chain disruptions, particularly in raw material sourcing, pose a significant challenge to market growth. Fluctuating raw material prices can impact profitability and product pricing. Furthermore, stringent environmental regulations necessitate continuous innovation and investment in eco-friendly product development. Intense competition amongst established players and the emergence of new entrants add to the pressure on profit margins.

Future Opportunities in Europe Reactive Adhesives Market

The growing adoption of advanced manufacturing technologies, such as 3D printing and automation, presents significant opportunities. Demand for specialized adhesives in emerging sectors, such as electric vehicles and medical devices, is expected to rise. The development of bio-based and biodegradable adhesives presents a lucrative opportunity, catering to the growing emphasis on sustainability. Expansion into new markets in Eastern Europe and the development of innovative adhesive solutions for niche applications will further drive growth.

Major Players in the Europe Reactive Adhesives Market Ecosystem

- Henkel AG & Co KGaA

- Franklin Adhesives & Polymers

- 3M

- Master Bond Inc

- Buhnen GmbH & Co KG

- Arkema Group

- Huntsman International LLC

- Dow

- H B Fuller Company

- Avery Dennison Corporation

- Hexion

- Sika AG

- Collano AG

- Jowat SE

Key Developments in Europe Reactive Adhesives Market Industry

- Q1 2023: Henkel AG & Co KGaA launches a new line of sustainable adhesives for the construction industry.

- Q3 2022: 3M acquires a smaller adhesive manufacturer, expanding its product portfolio.

- Q4 2021: Sika AG invests in a new manufacturing facility in Germany, increasing production capacity. (Further developments can be added here)

Strategic Europe Reactive Adhesives Market Market Forecast

The Europe Reactive Adhesives Market is poised for significant growth, driven by technological advancements and expanding end-user applications. The increasing focus on sustainability and the growing demand for high-performance materials in key industries will fuel market expansion. Emerging sectors like renewable energy and electric vehicles will further propel the market's growth trajectory. Continuous innovation in adhesive formulations and the expansion of market presence in underpenetrated regions will contribute to the overall market expansion in the coming years.

Europe Reactive Adhesives Market Segmentation

-

1. Resin Type

- 1.1. Polyurethane

- 1.2. Epoxy

- 1.3. Cyanoacrylate

- 1.4. Modified Acrylic

- 1.5. Anaerobic

- 1.6. Silicone

- 1.7. Other Resin Types

-

2. End-user Industry

- 2.1. Building & Construction

- 2.2. Renewable Energy

- 2.3. Transportation

- 2.4. Healthcare

- 2.5. Electronics

- 2.6. Aerospace

- 2.7. Sports & Leisure

- 2.8. Other End-user Industries

Europe Reactive Adhesives Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Reactive Adhesives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Application in the construction of Wind Turbines; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Negative Effects of Epoxy and Acrylic Reactive Adhesives on Skin; Other Restraints

- 3.4. Market Trends

- 3.4.1. Renewable Energy Industry to Witness the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Reactive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Polyurethane

- 5.1.2. Epoxy

- 5.1.3. Cyanoacrylate

- 5.1.4. Modified Acrylic

- 5.1.5. Anaerobic

- 5.1.6. Silicone

- 5.1.7. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Building & Construction

- 5.2.2. Renewable Energy

- 5.2.3. Transportation

- 5.2.4. Healthcare

- 5.2.5. Electronics

- 5.2.6. Aerospace

- 5.2.7. Sports & Leisure

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Germany Europe Reactive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Polyurethane

- 6.1.2. Epoxy

- 6.1.3. Cyanoacrylate

- 6.1.4. Modified Acrylic

- 6.1.5. Anaerobic

- 6.1.6. Silicone

- 6.1.7. Other Resin Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Building & Construction

- 6.2.2. Renewable Energy

- 6.2.3. Transportation

- 6.2.4. Healthcare

- 6.2.5. Electronics

- 6.2.6. Aerospace

- 6.2.7. Sports & Leisure

- 6.2.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. United Kingdom Europe Reactive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Polyurethane

- 7.1.2. Epoxy

- 7.1.3. Cyanoacrylate

- 7.1.4. Modified Acrylic

- 7.1.5. Anaerobic

- 7.1.6. Silicone

- 7.1.7. Other Resin Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Building & Construction

- 7.2.2. Renewable Energy

- 7.2.3. Transportation

- 7.2.4. Healthcare

- 7.2.5. Electronics

- 7.2.6. Aerospace

- 7.2.7. Sports & Leisure

- 7.2.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. France Europe Reactive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Polyurethane

- 8.1.2. Epoxy

- 8.1.3. Cyanoacrylate

- 8.1.4. Modified Acrylic

- 8.1.5. Anaerobic

- 8.1.6. Silicone

- 8.1.7. Other Resin Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Building & Construction

- 8.2.2. Renewable Energy

- 8.2.3. Transportation

- 8.2.4. Healthcare

- 8.2.5. Electronics

- 8.2.6. Aerospace

- 8.2.7. Sports & Leisure

- 8.2.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. Italy Europe Reactive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. Polyurethane

- 9.1.2. Epoxy

- 9.1.3. Cyanoacrylate

- 9.1.4. Modified Acrylic

- 9.1.5. Anaerobic

- 9.1.6. Silicone

- 9.1.7. Other Resin Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Building & Construction

- 9.2.2. Renewable Energy

- 9.2.3. Transportation

- 9.2.4. Healthcare

- 9.2.5. Electronics

- 9.2.6. Aerospace

- 9.2.7. Sports & Leisure

- 9.2.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. Rest of Europe Europe Reactive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 10.1.1. Polyurethane

- 10.1.2. Epoxy

- 10.1.3. Cyanoacrylate

- 10.1.4. Modified Acrylic

- 10.1.5. Anaerobic

- 10.1.6. Silicone

- 10.1.7. Other Resin Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Building & Construction

- 10.2.2. Renewable Energy

- 10.2.3. Transportation

- 10.2.4. Healthcare

- 10.2.5. Electronics

- 10.2.6. Aerospace

- 10.2.7. Sports & Leisure

- 10.2.8. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 11. Germany Europe Reactive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 12. France Europe Reactive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 13. Italy Europe Reactive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Europe Reactive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Europe Reactive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Europe Reactive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Europe Reactive Adhesives Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Henkel AG & Co KGaA

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Franklin Adhesives & Polymers

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 3M

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Master Bond Inc

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Buhnen GmbH & Co KG

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Arkema Group

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Huntsman International LLC

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Dow

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 H B Fuller Company

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Avery Dennison Corporation

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Hexion

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Sika AG*List Not Exhaustive

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Collano AG

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 Jowat SE

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Europe Reactive Adhesives Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Reactive Adhesives Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Reactive Adhesives Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Reactive Adhesives Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 3: Europe Reactive Adhesives Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Europe Reactive Adhesives Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Reactive Adhesives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Reactive Adhesives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Reactive Adhesives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Reactive Adhesives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Reactive Adhesives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Reactive Adhesives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Reactive Adhesives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Reactive Adhesives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Reactive Adhesives Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 14: Europe Reactive Adhesives Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Europe Reactive Adhesives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Reactive Adhesives Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 17: Europe Reactive Adhesives Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 18: Europe Reactive Adhesives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Reactive Adhesives Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 20: Europe Reactive Adhesives Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Europe Reactive Adhesives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Reactive Adhesives Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 23: Europe Reactive Adhesives Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 24: Europe Reactive Adhesives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Reactive Adhesives Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 26: Europe Reactive Adhesives Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 27: Europe Reactive Adhesives Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Reactive Adhesives Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Europe Reactive Adhesives Market?

Key companies in the market include Henkel AG & Co KGaA, Franklin Adhesives & Polymers, 3M, Master Bond Inc, Buhnen GmbH & Co KG, Arkema Group, Huntsman International LLC, Dow, H B Fuller Company, Avery Dennison Corporation, Hexion, Sika AG*List Not Exhaustive, Collano AG, Jowat SE.

3. What are the main segments of the Europe Reactive Adhesives Market?

The market segments include Resin Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Application in the construction of Wind Turbines; Other Drivers.

6. What are the notable trends driving market growth?

Renewable Energy Industry to Witness the Highest Growth Rate.

7. Are there any restraints impacting market growth?

; Negative Effects of Epoxy and Acrylic Reactive Adhesives on Skin; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Reactive Adhesives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Reactive Adhesives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Reactive Adhesives Market?

To stay informed about further developments, trends, and reports in the Europe Reactive Adhesives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence