Key Insights

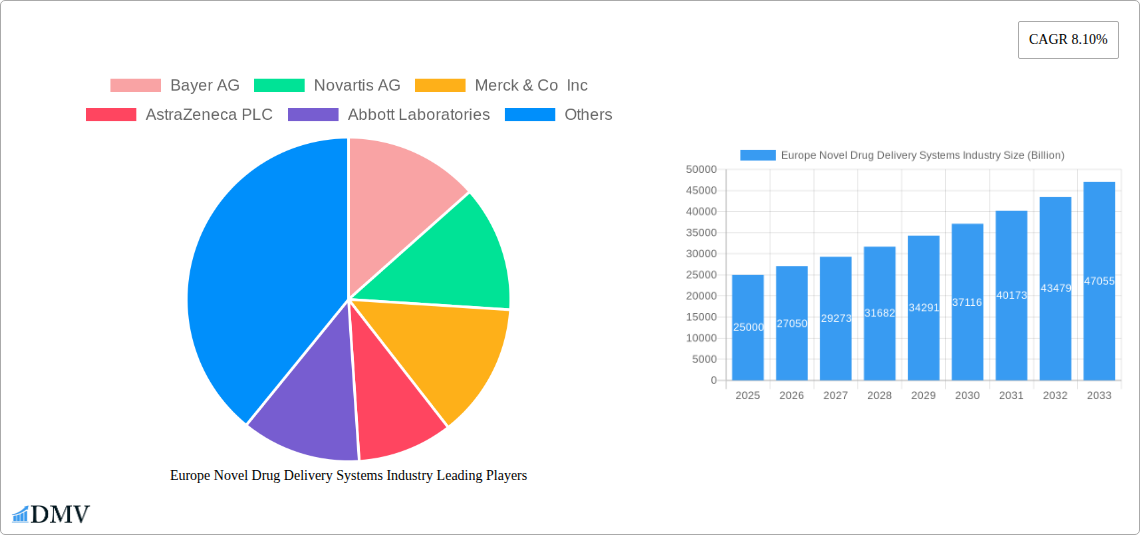

The European novel drug delivery systems (NDDS) market is experiencing robust growth, driven by a confluence of factors. The increasing prevalence of chronic diseases like cancer, diabetes, and autoimmune disorders fuels demand for advanced drug delivery technologies that offer improved efficacy, reduced side effects, and enhanced patient compliance. Technological advancements in areas such as targeted drug delivery, controlled release formulations, and innovative administration routes (e.g., pulmonary and transdermal) are further propelling market expansion. The significant investments by major pharmaceutical companies like Bayer, Novartis, and Pfizer underscore the industry's potential. The market's segmentation reflects this diversity, with oral drug delivery systems currently holding a substantial share, followed by injectables. However, targeted and controlled drug delivery systems are projected to witness the fastest growth due to their ability to precisely deliver therapeutic agents to target sites, minimizing off-target effects. The presence of established pharmaceutical players and a supportive regulatory environment in major European markets like Germany, the UK, and France contributes to the market’s overall health.

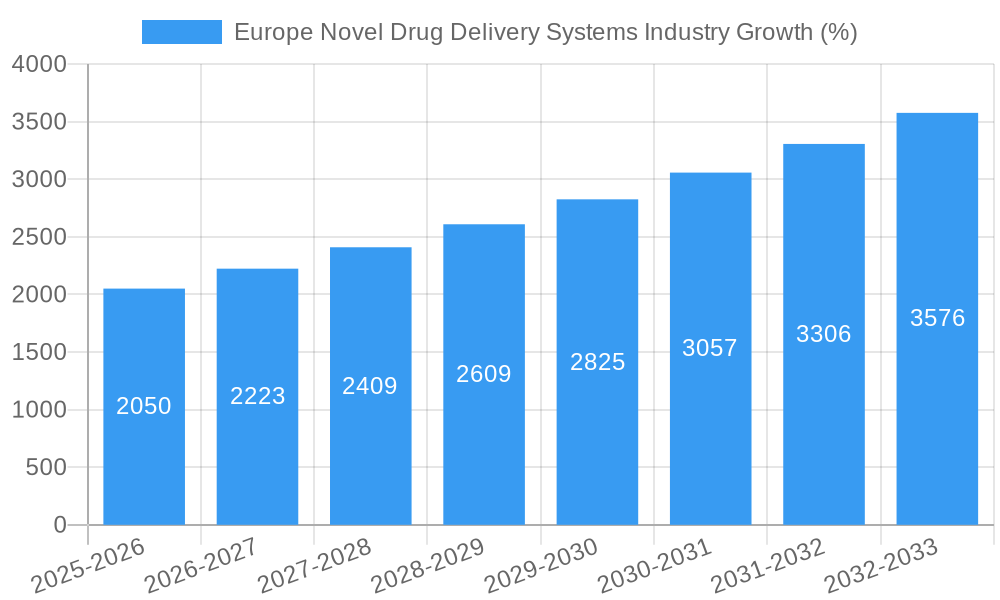

Over the forecast period (2025-2033), the European NDDS market is expected to maintain a strong growth trajectory, primarily driven by the continued innovation in NDDS technologies and increased adoption of personalized medicine. The aging population across Europe presents a significant opportunity for NDDS, as these systems are particularly beneficial for managing age-related chronic conditions. Furthermore, growing research and development activities focused on enhancing the efficacy and safety of NDDS will continue to contribute to market expansion. While regulatory hurdles and high development costs pose some challenges, the overall market outlook remains positive, with consistent growth projected across all major segments and regions within Europe. Considering a base year market size in the billions and a CAGR of 8.10%, the market is poised for considerable expansion.

Europe Novel Drug Delivery Systems Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the Europe Novel Drug Delivery Systems (NDDS) industry, offering a detailed overview of market dynamics, growth drivers, challenges, and future opportunities. The report covers the period from 2019 to 2033, with 2025 as the base year and a forecast period extending to 2033. The European NDDS market is projected to reach a value exceeding xx Billion by 2033, driven by technological advancements and increasing demand for improved drug therapies. This report is invaluable for stakeholders seeking to understand the current landscape and future potential of this rapidly evolving market.

Europe Novel Drug Delivery Systems Industry Market Composition & Trends

The European Novel Drug Delivery Systems market exhibits a moderately concentrated landscape, with key players like Bayer AG, Novartis AG, Merck & Co Inc, AstraZeneca PLC, Abbott Laboratories, F Hoffmann-La Roche AG, Sanofi SA, Johnson & Johnson, GlaxoSmithKline PLC, and Pfizer Inc holding significant market shares. However, the market also accommodates several smaller, specialized companies. Market share distribution fluctuates based on innovative product launches and successful clinical trials. Innovation in areas such as targeted drug delivery and nanotechnology is a key catalyst for growth. The regulatory landscape in Europe is stringent, requiring extensive testing and approvals, thus impacting market entry for new players. Substitute products, including traditional drug delivery methods, present competition, while the increasing prevalence of chronic diseases drives demand for advanced NDDS. M&A activities are prevalent, with deal values exceeding xx Billion in the historical period (2019-2024), reflecting the industry's dynamic nature. End-users primarily comprise pharmaceutical companies, research institutions, and healthcare providers.

- Market Concentration: Moderately Concentrated

- Top 5 Players Market Share: xx%

- M&A Deal Value (2019-2024): > xx Billion

- Key Innovation Drivers: Targeted drug delivery, Nanotechnology

Europe Novel Drug Delivery Systems Industry Industry Evolution

The European NDDS market has witnessed substantial growth throughout the historical period (2019-2024), exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth trajectory is projected to continue during the forecast period (2025-2033), with a projected CAGR of xx%, driven by several factors. Technological advancements, such as the development of biodegradable polymers and advanced nanocarriers, have significantly improved drug efficacy and patient compliance. Furthermore, shifting consumer demands for personalized medicine and minimally invasive therapies have fueled the adoption of NDDS. The rising prevalence of chronic diseases, including cancer, diabetes, and cardiovascular diseases, has further increased the demand for innovative drug delivery solutions. The increased investment in R&D by pharmaceutical companies and government initiatives promoting the development of novel therapeutics has also significantly contributed to market growth. Adoption rates for various NDDS technologies are steadily increasing, with oral drug delivery systems maintaining a significant market share. However, the adoption of targeted and controlled drug delivery systems is also accelerating due to their improved therapeutic benefits.

Leading Regions, Countries, or Segments in Europe Novel Drug Delivery Systems Industry

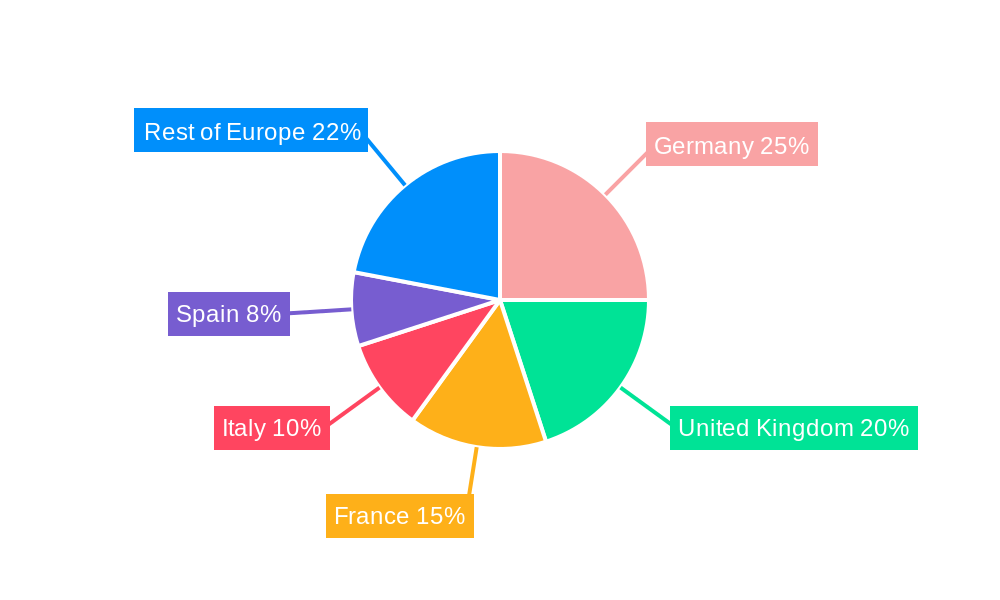

Within Europe, Germany, France, and the UK are the leading markets for NDDS, driven by strong pharmaceutical industries and robust healthcare infrastructures.

By Route of Administration:

- Oral Drug Delivery Systems: Dominates the market due to ease of administration and patient preference. Key drivers include growing investments in oral controlled-release formulations and advancements in absorption-enhancing technologies.

- Injectable Drug Delivery Systems: Significant market share due to efficacy in delivering macromolecules and targeting specific sites. Technological advancements in sustained-release injectables and biosimilar development are driving growth.

- Pulmonary Drug Delivery Systems: Growing market segment propelled by the increasing prevalence of respiratory diseases and the development of inhalers with improved design and functionality.

- Transdermal Drug Delivery Systems: Steady growth driven by increasing demand for convenient and non-invasive drug delivery methods. Advances in patch technology are enhancing drug permeation and patient comfort.

- Other Routes of Administration: Includes ophthalmic, nasal, and rectal drug delivery systems, each showcasing niche growth fueled by specific therapeutic needs.

By Mode of NDDS:

- Targeted Drug Delivery Systems: Rapid growth driven by the ability to deliver drugs specifically to the target site, minimizing side effects. Nanotechnology plays a crucial role in this segment.

- Controlled Drug Delivery Systems: Significant market share, offering sustained drug release and improved therapeutic efficacy. Advancements in polymer chemistry are driving innovation.

- Modulated Drug Delivery Systems: Emerging market segment focusing on on-demand drug release, triggered by specific stimuli, providing personalized and targeted therapy.

Key drivers for leading segments include substantial investments in R&D, supportive regulatory frameworks, and increasing demand for improved therapeutic outcomes.

Europe Novel Drug Delivery Systems Industry Product Innovations

Recent innovations include the development of advanced biodegradable polymers for controlled drug release, novel nanocarriers for targeted drug delivery, and smart drug delivery systems incorporating sensors and actuators for personalized therapy. These advancements enhance drug efficacy, reduce side effects, and improve patient compliance. Unique selling propositions for these innovative products include enhanced bioavailability, reduced dosing frequency, and improved targeting capabilities. Nanotechnology-based drug delivery systems are gaining particular traction, offering precise drug targeting and sustained release profiles, thus overcoming limitations of conventional drug delivery methods.

Propelling Factors for Europe Novel Drug Delivery Systems Industry Growth

Several factors contribute to the robust growth of the European NDDS market. Technological advancements, particularly in nanotechnology and biomaterials, have enabled the development of sophisticated drug delivery systems. Favorable regulatory environments in several European countries encourage innovation and market entry for new products. The rising prevalence of chronic diseases necessitates more effective treatment options, driving demand for advanced NDDS. Furthermore, increasing investments in R&D by pharmaceutical companies are fueling innovation and expansion within this sector.

Obstacles in the Europe Novel Drug Delivery Systems Industry Market

The European NDDS market faces challenges including stringent regulatory approvals, which can significantly delay product launches and increase development costs. Supply chain disruptions can impact production and availability of key components for NDDS. Intense competition among established pharmaceutical players and emerging biotech companies puts pressure on margins and market share. The high cost of research and development associated with novel drug delivery technologies presents a significant barrier to market entry for smaller players.

Future Opportunities in Europe Novel Drug Delivery Systems Industry

Future opportunities lie in the development of personalized drug delivery systems tailored to individual patient needs and characteristics. Emerging technologies such as artificial intelligence and machine learning can be leveraged to optimize drug delivery strategies and improve treatment outcomes. Expansion into new therapeutic areas, such as gene therapy and immunotherapy, presents significant growth potential. Furthermore, collaborations between pharmaceutical companies and technology providers can foster innovation and accelerate the development of novel NDDS.

Major Players in the Europe Novel Drug Delivery Systems Industry Ecosystem

- Bayer AG

- Novartis AG

- Merck & Co Inc

- AstraZeneca PLC

- Abbott Laboratories

- F Hoffmann-La Roche AG

- Sanofi SA

- Johnson & Johnson

- GlaxoSmithKline PLC

- Pfizer Inc

Key Developments in Europe Novel Drug Delivery Systems Industry Industry

- 2024 Q4: Approval of a novel targeted drug delivery system for cancer treatment by the European Medicines Agency (EMA).

- 2023 Q2: Launch of a new biodegradable polymer-based sustained-release formulation by a major pharmaceutical company.

- 2022 Q3: Merger between two companies specializing in nanotechnology-based drug delivery systems.

These are just examples and further developments need to be added based on the current market data

Strategic Europe Novel Drug Delivery Systems Industry Market Forecast

The European NDDS market is poised for continued robust growth, driven by technological innovation, supportive regulatory frameworks, and the increasing demand for more effective and convenient drug delivery solutions. The market's future potential is significant, with a projected value exceeding xx Billion by 2033. Growth catalysts will include advancements in personalized medicine, expansion into new therapeutic areas, and collaborations between industry players. Targeted drug delivery systems, specifically those leveraging nanotechnology, are expected to drive a significant portion of this growth.

Europe Novel Drug Delivery Systems Industry Segmentation

-

1. Route of Administration

- 1.1. Oral Drug Delivery Systems

- 1.2. Injectable Drug Delivery Systems

- 1.3. Pulmonary Drug Delivery Systems

- 1.4. Transdermal Drug Delivery Systems

- 1.5. Other Routes of Administration

-

2. Mode of NDDS

- 2.1. Targeted Drug Delivery Systems

- 2.2. Controlled Drug Delivery Systems

- 2.3. Modulated Drug Delivery Systems

Europe Novel Drug Delivery Systems Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Rest of Europe

Europe Novel Drug Delivery Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Technological Advancements Promoting the Development of NDDS; Rising Need for the Controlled Release of Drugs

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulatory Guidelines; Stability Issues

- 3.4. Market Trends

- 3.4.1. Targeted Drug Delivery Systems Segment under Mode of NDDS is Expected to hold the Largest Market Share during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 5.1.1. Oral Drug Delivery Systems

- 5.1.2. Injectable Drug Delivery Systems

- 5.1.3. Pulmonary Drug Delivery Systems

- 5.1.4. Transdermal Drug Delivery Systems

- 5.1.5. Other Routes of Administration

- 5.2. Market Analysis, Insights and Forecast - by Mode of NDDS

- 5.2.1. Targeted Drug Delivery Systems

- 5.2.2. Controlled Drug Delivery Systems

- 5.2.3. Modulated Drug Delivery Systems

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6. Germany Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 7. United Kingdom Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 8. France Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 9. Italy Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 10. Spain Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Europe Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Bayer AG

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Novartis AG

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Merck & Co Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 AstraZeneca PLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Abbott Laboratories

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 F Hoffmann-La Roche AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Sanofi SA*List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Johnson & Johnson

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 GlaxoSmithKline PLC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Pfizer Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Bayer AG

List of Figures

- Figure 1: Europe Novel Drug Delivery Systems Industry Revenue Breakdown (Billion, %) by Product 2024 & 2032

- Figure 2: Europe Novel Drug Delivery Systems Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Route of Administration 2019 & 2032

- Table 3: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Mode of NDDS 2019 & 2032

- Table 4: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Region 2019 & 2032

- Table 5: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 7: United Kingdom Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 8: France Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 10: Spain Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 12: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Route of Administration 2019 & 2032

- Table 13: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Mode of NDDS 2019 & 2032

- Table 14: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 15: United Kingdom Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 16: Germany Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 17: France Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 18: Italy Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 19: Spain Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Novel Drug Delivery Systems Industry?

The projected CAGR is approximately 8.10%.

2. Which companies are prominent players in the Europe Novel Drug Delivery Systems Industry?

Key companies in the market include Bayer AG, Novartis AG, Merck & Co Inc, AstraZeneca PLC, Abbott Laboratories, F Hoffmann-La Roche AG, Sanofi SA*List Not Exhaustive, Johnson & Johnson, GlaxoSmithKline PLC, Pfizer Inc.

3. What are the main segments of the Europe Novel Drug Delivery Systems Industry?

The market segments include Route of Administration, Mode of NDDS.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Billion as of 2022.

5. What are some drivers contributing to market growth?

; Technological Advancements Promoting the Development of NDDS; Rising Need for the Controlled Release of Drugs.

6. What are the notable trends driving market growth?

Targeted Drug Delivery Systems Segment under Mode of NDDS is Expected to hold the Largest Market Share during the Forecast Period.

7. Are there any restraints impacting market growth?

; Stringent Regulatory Guidelines; Stability Issues.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Novel Drug Delivery Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Novel Drug Delivery Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Novel Drug Delivery Systems Industry?

To stay informed about further developments, trends, and reports in the Europe Novel Drug Delivery Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence