Key Insights

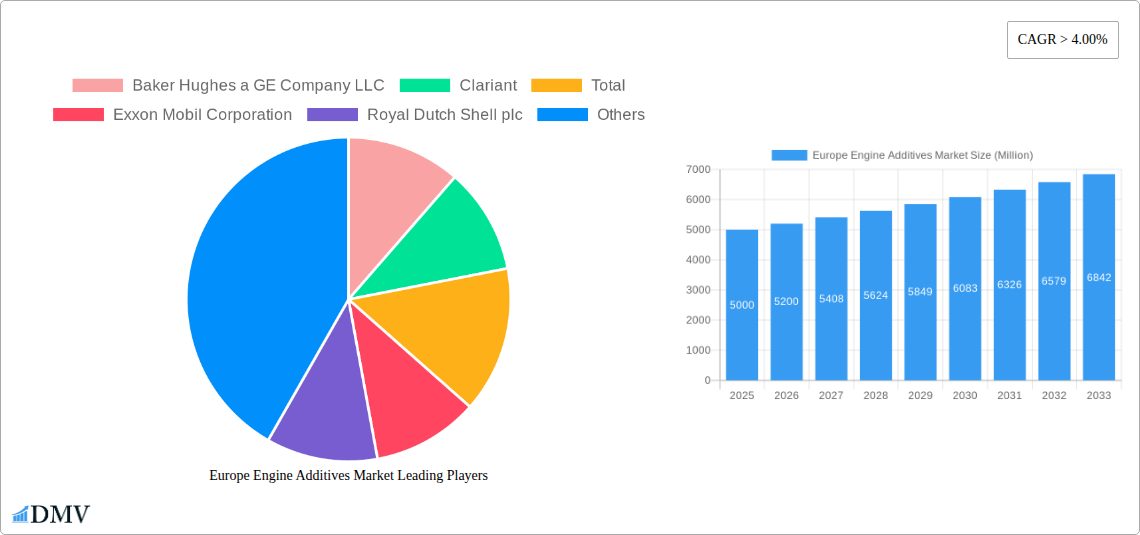

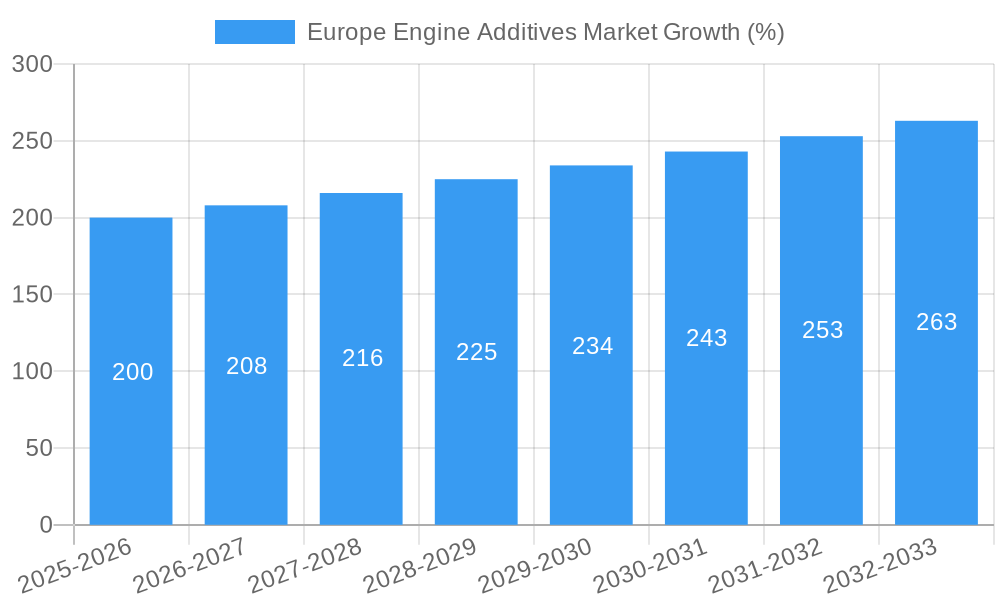

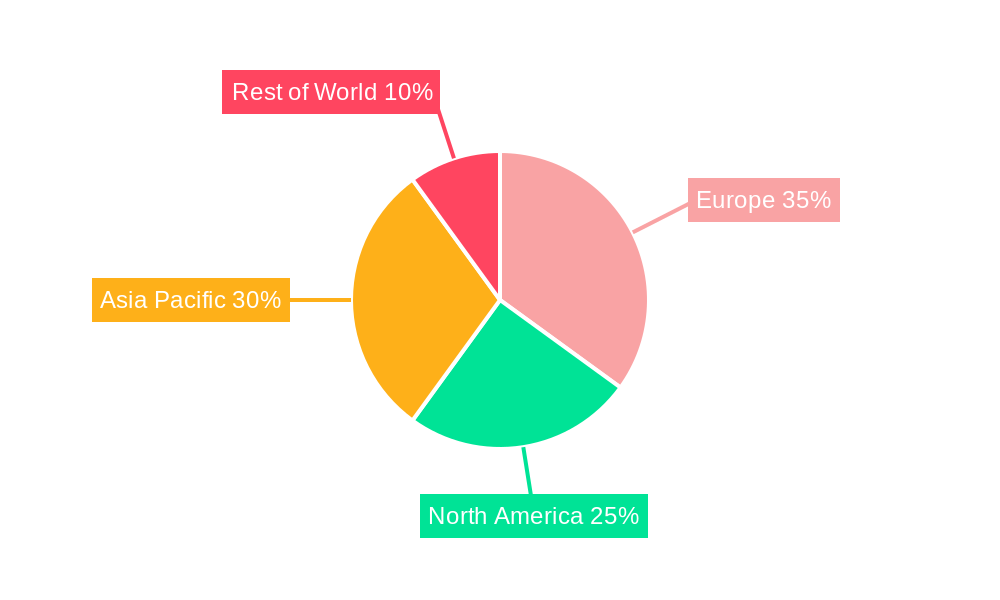

The European engine additives market is experiencing robust growth, driven by stringent emission regulations, the increasing demand for fuel efficiency, and the expanding automotive industry. With a Compound Annual Growth Rate (CAGR) exceeding 4%, the market is projected to reach significant value by 2033. The market is segmented by product type (deposit control, cetane improvers, lubricity additives, antioxidants, anticorrosion agents, cold flow improvers, antiknock agents, and others) and application (diesel, gasoline, and jet fuel). The dominance of diesel vehicles in Europe historically fueled demand for cetane improvers and lubricity additives. However, the shift towards gasoline vehicles and the growing adoption of hybrid and electric vehicles might slightly alter the product type dominance in the coming years. Germany, France, Italy, and the UK represent key market contributors within Europe, reflecting their established automotive manufacturing and transportation sectors. Major players such as BASF SE, Total, ExxonMobil, and Lubrizol Corporation are actively competing through research and development, expanding their product portfolios, and strategic partnerships to secure market share. The competitive landscape is characterized by a mix of large multinational corporations and specialized additive manufacturers. The market's growth trajectory is expected to continue, fueled by increasing vehicle production, particularly in emerging economies and the ongoing need to meet stringent environmental standards, although potential supply chain disruptions and fluctuations in raw material prices pose challenges to sustained growth.

The European engine additives market is characterized by a complex interplay of technological advancements, regulatory pressures, and economic factors. The introduction of advanced engine technologies and the push for cleaner fuels create opportunities for manufacturers to develop innovative additives that enhance performance, durability, and reduce emissions. However, the market's future growth will be influenced by the pace of adoption of alternative fuel vehicles and the impact of broader macroeconomic conditions on the automotive industry. Moreover, increasing focus on sustainability and reducing the environmental footprint of vehicle emissions is driving research and development efforts aimed at creating bio-based and more environmentally friendly engine additives. This shift toward sustainable solutions offers both challenges and opportunities for established players and new entrants alike. Successful companies will adapt by investing in research and development, forming strategic partnerships, and proactively addressing the sustainability challenges presented by the market.

Europe Engine Additives Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Engine Additives Market, offering a comprehensive overview of market dynamics, trends, and future prospects. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic sector. The market is estimated to be worth xx Million in 2025, with significant growth projected over the forecast period.

Europe Engine Additives Market Composition & Trends

This section delves into the intricate structure of the European engine additives market, examining its concentration, innovation drivers, regulatory environment, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market exhibits a moderately concentrated landscape, with key players such as Baker Hughes a GE Company LLC, Clariant, Total, Exxon Mobil Corporation, Royal Dutch Shell plc, Evonik Industries AG, VeryOne SaS (EURENCO), LANXESS, Croda International Plc, BASF SE, Chevron Corporation, The Lubrizol Corporation, Eni SpA, and Afton Chemical holding significant market share.

Market Share Distribution: The top 5 players collectively hold approximately 60% of the market share in 2025, with a gradual increase projected by 2033. Smaller players account for the remaining 40%, driven by niche product offerings and regional dominance.

Innovation Catalysts: Stringent emission regulations (Euro VII and beyond) are driving innovation towards advanced additives that enhance fuel efficiency and reduce harmful emissions.

Regulatory Landscape: The evolving regulatory framework in Europe significantly impacts the market, pushing for the development and adoption of eco-friendly additives.

Substitute Products: Bio-based and recycled additives are emerging as potential substitutes, although their market penetration remains limited as of 2025.

End-User Profiles: The major end-users include automotive manufacturers, fuel retailers, and independent blending companies.

M&A Activities: The market witnessed xx Million worth of M&A deals between 2019 and 2024, primarily focused on expanding product portfolios and geographical reach. The forecast for 2025-2033 predicts a further xx Million in M&A activity, driven by consolidation efforts.

Europe Engine Additives Market Industry Evolution

The European engine additives market has experienced significant growth over the past five years (2019-2024), driven by the increasing demand for improved fuel efficiency and emission reduction. Technological advancements, such as the development of nanotechnology-based additives, have further propelled market expansion. Consumer demand for higher-performing and environmentally friendly vehicles is shifting the focus toward advanced engine additive formulations. The market witnessed a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). The adoption rate of advanced additives like those incorporating nanotechnology is currently at xx% in 2025 and is expected to reach xx% by 2033. The rising adoption of electric vehicles (EVs) is expected to have a moderately negative impact on the market in the longer term; however, the need for additives in hybrid vehicles and the continued growth of the internal combustion engine (ICE) vehicle market in specific segments will partially offset this effect. Stringent emission norms, such as the implementation of Euro VII standards, are prompting the development and adoption of new engine additive formulations optimized for efficiency and emission control. This continuous drive for improvement in vehicle technology and environmental protection creates consistent demand for sophisticated engine additives.

Leading Regions, Countries, or Segments in Europe Engine Additives Market

The leading segments by product type and application are analyzed below:

Product Type:

Deposit Control: This segment dominates the market, driven by the growing demand for maintaining engine cleanliness and preventing performance degradation. Key drivers include increasing vehicle mileage and the need for extended engine life. Western European countries, particularly Germany and France, lead in this segment due to higher vehicle density and stringent emission regulations.

Cetane Improvers: This segment experiences steady growth, fueled by the continued use of diesel engines, particularly in commercial vehicles. Eastern European countries show higher growth rates due to a greater reliance on diesel fuel. Investment in refining infrastructure and supportive government policies are key drivers in this segment.

Other dominant segments: Lubricity Additives, Antioxidants, and Anticorrosion Additives also hold significant market shares, driven by their essential roles in engine performance and longevity.

Application:

Diesel: This application holds the largest market share, reflecting the widespread use of diesel engines in commercial transportation and agricultural sectors. Eastern European nations show particularly high consumption due to greater reliance on diesel-powered vehicles.

Gasoline: This segment shows steady growth driven by the prevalence of gasoline-powered passenger vehicles. Western European countries dominate this market segment due to higher passenger vehicle density.

Jet Fuel: This niche application is important, exhibiting moderate growth driven by the aviation industry's requirements for fuel efficiency and emission control. Growth is influenced by air travel trends and regulatory changes in the aviation sector.

Europe Engine Additives Market Product Innovations

Recent innovations focus on developing environmentally friendly, high-performance additives that enhance fuel economy, reduce emissions, and extend engine lifespan. The integration of nanotechnology and advanced chemical formulations allows for more effective control of deposit formation, friction reduction, and oxidation stability. Unique selling propositions include improved fuel efficiency claims, reduced emissions certifications, and extended warranty periods offered by original equipment manufacturers (OEMs).

Propelling Factors for Europe Engine Additives Market Growth

Several key factors contribute to the market's growth: Stringent emission regulations, such as Euro VII, are pushing for more efficient and environmentally friendly additives. The rising demand for fuel-efficient vehicles is another major driver. Technological advancements, like the development of advanced additive chemistries, lead to improved performance and longer engine lifespans. Furthermore, the growing vehicle population across Europe further fuels the demand for engine additives.

Obstacles in the Europe Engine Additives Market

Challenges include the increasing adoption of electric vehicles, potentially reducing the overall demand for engine additives in the long run. Fluctuations in crude oil prices impact the production costs and pricing strategies for additives. Stringent environmental regulations place greater pressure on manufacturers to develop and implement sustainable solutions. Intense competition among established players also creates price pressure and limits profit margins.

Future Opportunities in Europe Engine Additives Market

Emerging opportunities lie in developing bio-based and recycled additives to enhance sustainability. The growing demand for improved engine performance in heavy-duty vehicles presents a significant opportunity. Focus on developing additives tailored for hybrid and electric vehicle technologies to meet the evolving needs of this sector also presents high potential.

Major Players in the Europe Engine Additives Market Ecosystem

- Baker Hughes a GE Company LLC

- Clariant

- Total

- Exxon Mobil Corporation

- Royal Dutch Shell plc

- Evonik Industries AG

- VeryOne SaS (EURENCO)

- LANXESS

- Croda International Plc

- BASF SE

- Chevron Corporation

- The Lubrizol Corporation

- Eni SpA

- Afton Chemical

Key Developments in Europe Engine Additives Market Industry

- Jan 2023: Clariant launches a new bio-based engine additive.

- May 2022: Afton Chemical announces a strategic partnership with a major automotive manufacturer.

- Oct 2021: BASF SE invests in a new production facility for advanced engine additives. (Further details on specific developments would be included in the full report)

Strategic Europe Engine Additives Market Forecast

The Europe engine additives market is poised for continued growth, driven by technological advancements, stringent emission regulations, and the sustained demand for improved fuel efficiency and reduced emissions. While the rise of electric vehicles presents a long-term challenge, the market will continue to thrive due to its importance in the existing fleet of internal combustion engine vehicles and the continued expansion in certain vehicle segments. The focus on sustainable and high-performance additives will shape the future of the market, creating numerous growth opportunities for innovative players.

Europe Engine Additives Market Segmentation

-

1. Product Type

- 1.1. Deposit Control

- 1.2. Cetane Improvers

- 1.3. Lubricity Additives

- 1.4. Antioxidants

- 1.5. Anticorrosion

- 1.6. Cold Flow Improvers

- 1.7. Antiknock Agents

- 1.8. Other Product Types

-

2. Application

- 2.1. Diesel

- 2.2. Gasoline

- 2.3. Jet Fuel

- 2.4. Other Applications

Europe Engine Additives Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Italy

- 4. France

- 5. Rest of Europe

Europe Engine Additives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Enactment of Stringent Environmental Regulations; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Increasing Demand and Penetration of Battery Electric Vehicles (BEVs); High Costs of R&D Activities

- 3.4. Market Trends

- 3.4.1. Gasoline to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Deposit Control

- 5.1.2. Cetane Improvers

- 5.1.3. Lubricity Additives

- 5.1.4. Antioxidants

- 5.1.5. Anticorrosion

- 5.1.6. Cold Flow Improvers

- 5.1.7. Antiknock Agents

- 5.1.8. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Diesel

- 5.2.2. Gasoline

- 5.2.3. Jet Fuel

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. Italy

- 5.3.4. France

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Germany Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Deposit Control

- 6.1.2. Cetane Improvers

- 6.1.3. Lubricity Additives

- 6.1.4. Antioxidants

- 6.1.5. Anticorrosion

- 6.1.6. Cold Flow Improvers

- 6.1.7. Antiknock Agents

- 6.1.8. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Diesel

- 6.2.2. Gasoline

- 6.2.3. Jet Fuel

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Kingdom Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Deposit Control

- 7.1.2. Cetane Improvers

- 7.1.3. Lubricity Additives

- 7.1.4. Antioxidants

- 7.1.5. Anticorrosion

- 7.1.6. Cold Flow Improvers

- 7.1.7. Antiknock Agents

- 7.1.8. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Diesel

- 7.2.2. Gasoline

- 7.2.3. Jet Fuel

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Italy Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Deposit Control

- 8.1.2. Cetane Improvers

- 8.1.3. Lubricity Additives

- 8.1.4. Antioxidants

- 8.1.5. Anticorrosion

- 8.1.6. Cold Flow Improvers

- 8.1.7. Antiknock Agents

- 8.1.8. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Diesel

- 8.2.2. Gasoline

- 8.2.3. Jet Fuel

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. France Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Deposit Control

- 9.1.2. Cetane Improvers

- 9.1.3. Lubricity Additives

- 9.1.4. Antioxidants

- 9.1.5. Anticorrosion

- 9.1.6. Cold Flow Improvers

- 9.1.7. Antiknock Agents

- 9.1.8. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Diesel

- 9.2.2. Gasoline

- 9.2.3. Jet Fuel

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Europe Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Deposit Control

- 10.1.2. Cetane Improvers

- 10.1.3. Lubricity Additives

- 10.1.4. Antioxidants

- 10.1.5. Anticorrosion

- 10.1.6. Cold Flow Improvers

- 10.1.7. Antiknock Agents

- 10.1.8. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Diesel

- 10.2.2. Gasoline

- 10.2.3. Jet Fuel

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Germany Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 12. France Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 13. Italy Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Europe Engine Additives Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Baker Hughes a GE Company LLC

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Clariant

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Total

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Exxon Mobil Corporation

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Royal Dutch Shell plc

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Evonik Industries AG

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 VeryOne SaS (EURENCO)*List Not Exhaustive

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 LANXESS

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Croda International Plc

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 BASF SE

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Chevron Corporation

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 The Lubrizol Corporation

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Eni SpA

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 Afton Chemical

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.1 Baker Hughes a GE Company LLC

List of Figures

- Figure 1: Europe Engine Additives Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Engine Additives Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Engine Additives Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Engine Additives Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Europe Engine Additives Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Engine Additives Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Engine Additives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Engine Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Engine Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Engine Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Engine Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Engine Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Engine Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Engine Additives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Engine Additives Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Europe Engine Additives Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Europe Engine Additives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Engine Additives Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 17: Europe Engine Additives Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Europe Engine Additives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Europe Engine Additives Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Europe Engine Additives Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Europe Engine Additives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Engine Additives Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Europe Engine Additives Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Europe Engine Additives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Europe Engine Additives Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: Europe Engine Additives Market Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Europe Engine Additives Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Engine Additives Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Europe Engine Additives Market?

Key companies in the market include Baker Hughes a GE Company LLC, Clariant, Total, Exxon Mobil Corporation, Royal Dutch Shell plc, Evonik Industries AG, VeryOne SaS (EURENCO)*List Not Exhaustive, LANXESS, Croda International Plc, BASF SE, Chevron Corporation, The Lubrizol Corporation, Eni SpA, Afton Chemical.

3. What are the main segments of the Europe Engine Additives Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Enactment of Stringent Environmental Regulations; Other Drivers.

6. What are the notable trends driving market growth?

Gasoline to Dominate the Market.

7. Are there any restraints impacting market growth?

; Increasing Demand and Penetration of Battery Electric Vehicles (BEVs); High Costs of R&D Activities.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Engine Additives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Engine Additives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Engine Additives Market?

To stay informed about further developments, trends, and reports in the Europe Engine Additives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence