Key Insights

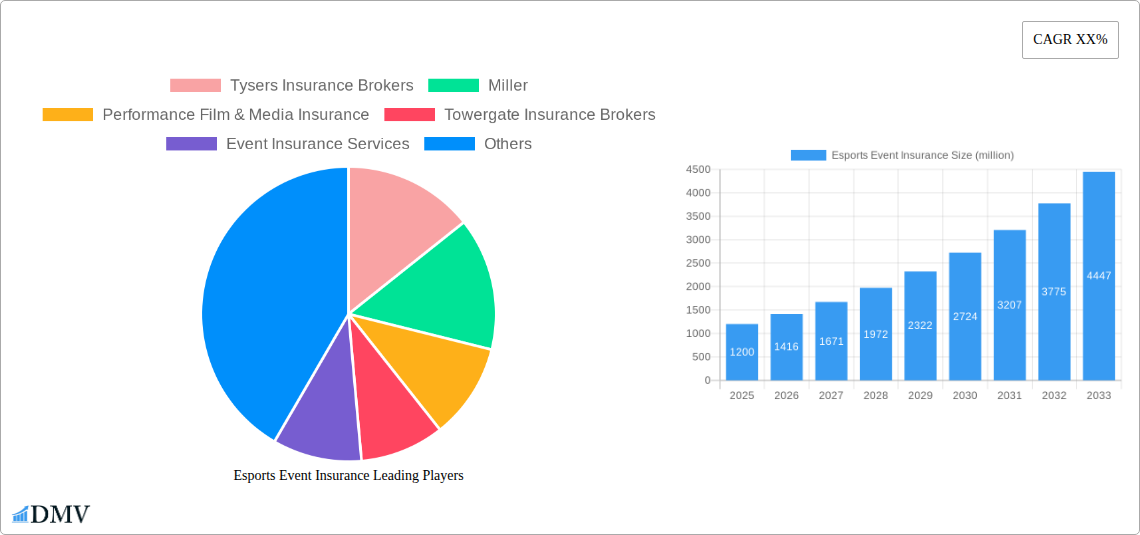

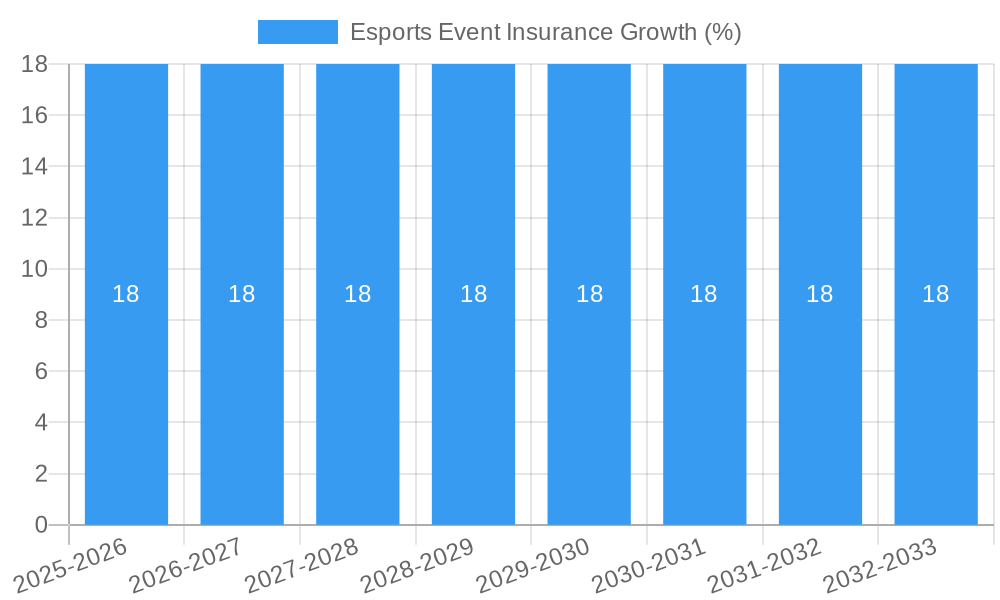

The global Esports Event Insurance market is experiencing significant growth, driven by the burgeoning esports industry's increasing scale and professionalization. With a projected market size of approximately $1.2 billion in 2025, and an estimated Compound Annual Growth Rate (CAGR) of 18% between 2025 and 2033, this sector is poised for substantial expansion. This rapid ascent is fueled by several key drivers, including the escalating prize pools and investment in major esports tournaments, the increasing number of professional esports players and teams seeking to mitigate risks, and the growing recognition of potential liabilities associated with large-scale event operations. The market is segmented into various insurance types, with Personal Accident Insurance and Equipment Loss or Damage Insurance holding significant demand, as these directly address the core concerns of participants and organizers. Furthermore, Event Cancellation or Postponement Insurance is gaining traction due to the inherent unpredictability of large gatherings, from logistical challenges to unforeseen global events.

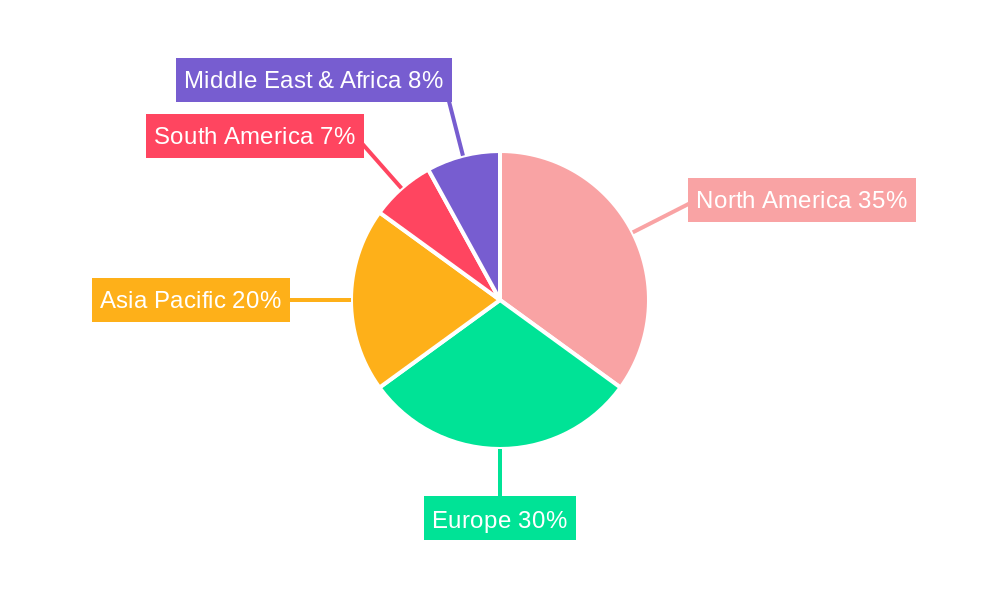

The landscape of esports event insurance is characterized by dynamic trends that are shaping its future. One prominent trend is the increasing demand for bespoke insurance solutions tailored to the unique risks of esports, moving beyond traditional event insurance models. Leading companies like Tysers Insurance Brokers, Miller, and Performance Film & Media Insurance are actively innovating in this space, offering specialized policies. Geographically, North America and Europe currently dominate the market, owing to their mature esports ecosystems and established insurance infrastructures. However, the Asia Pacific region, particularly China, India, and South Korea, is emerging as a high-growth area, mirroring the rapid expansion of esports within these territories. While the market's growth is robust, potential restraints include a lack of widespread awareness and understanding of esports-specific insurance products among smaller organizers and emerging players, and the evolving regulatory landscape for esports globally, which could introduce new risk factors. Overcoming these challenges will be crucial for unlocking the full potential of this evolving insurance segment.

This in-depth market research report provides a detailed overview of the Esports Event Insurance market, meticulously analyzing its composition, trends, and future trajectory. Covering the Study Period of 2019–2033, with the Base Year and Estimated Year at 2025, and a Forecast Period from 2025–2033, this report offers invaluable insights for stakeholders in the rapidly expanding esports ecosystem. We delve into market concentration, key players, product innovations, growth drivers, and future opportunities, equipping you with the strategic intelligence needed to navigate this dynamic industry. This report includes analysis on Professional Gamers, Tournament Organizers, and Esports Teams or Organizations, and examines Personal Accident Insurance, Equipment Loss or Damage Insurance, Event Cancellation or Postponement Insurance, and Others.

Esports Event Insurance Market Composition & Trends

The Esports Event Insurance market exhibits a dynamic composition characterized by increasing specialization and a growing awareness of risk management within the booming esports industry. Market concentration is moderate, with a significant number of niche providers alongside larger, established insurance brokers adapting their offerings. Innovation catalysts include the increasing scale and financial stakes of esports tournaments, the professionalization of player careers, and the rise of complex broadcasting and streaming technologies, all necessitating bespoke insurance solutions. The regulatory landscape is gradually evolving, with a growing recognition of the need for standardized player protection and event security measures. Substitute products, while limited, can include self-insurance for smaller events or reliance on general liability policies, though these often lack the specific coverage esports demands. End-user profiles range from individual professional gamers seeking personal accident and income protection to large-scale tournament organizers requiring comprehensive event cancellation and liability coverage. Mergers and acquisitions (M&A) activities are expected to increase as larger insurance firms seek to capture market share and smaller, specialized providers are acquired for their expertise and client base. M&A deal values are projected to reach in the tens of millions by the forecast period.

- Market Share Distribution: Diverse, with specialized providers holding significant shares in niche segments.

- Innovation Catalysts: Increasing prize pools, professionalization of players, and technological advancements in broadcasting.

- Regulatory Landscape: Evolving, with a focus on player welfare and event integrity.

- End-User Profiles: Professional gamers, tournament organizers, esports teams, and broadcasters.

- M&A Activities: Expected to rise, consolidating the market and bringing in new capital.

Esports Event Insurance Industry Evolution

The Esports Event Insurance industry has witnessed a dramatic evolution driven by the exponential growth and increasing professionalization of the esports sector. During the Historical Period of 2019–2024, the market was nascent, with limited awareness and a fragmented offering of insurance products. Early adopters were primarily large tournament organizers seeking basic liability and cancellation coverage. However, as prize pools escalated into the tens of millions and player salaries became substantial, the demand for more sophisticated risk mitigation solutions surged. Technological advancements, such as sophisticated streaming platforms, online betting integration, and the use of cutting-edge gaming hardware, introduced new layers of risk, including cyber-attacks, equipment malfunction during live broadcasts, and player performance anomalies. Shifting consumer demands have seen a move from basic event protection to comprehensive policies that cover player health, career longevity, and even intellectual property related to unique in-game strategies. The market growth trajectory has been consistently upward, with compound annual growth rates (CAGRs) exceeding 20% in recent years. For instance, the adoption rate of specialized esports insurance products for professional teams has climbed from less than 5% in 2019 to over 30% by 2024. This evolution is further fueled by the increasing investment from traditional sports entities and venture capital, recognizing esports as a legitimate and lucrative entertainment industry requiring robust financial security. The industry's ability to adapt to new game titles, evolving competitive formats, and the global reach of esports events has been crucial in its ongoing development and increasing maturity.

Leading Regions, Countries, or Segments in Esports Event Insurance

The Esports Event Insurance market sees significant dominance stemming from key application segments and specific regions, driven by a confluence of investment, infrastructure, and regulatory support. North America, particularly the United States, and Asia-Pacific, spearheaded by China and South Korea, are leading regions due to their mature esports ecosystems, high viewership numbers, and substantial tournament investments, often in the hundreds of millions for major events. The Application: Tournament Organizers segment is a primary driver, accounting for a substantial portion of the market. This dominance is fueled by the sheer scale of events organized, the complexity of logistics involved, and the significant financial risks associated with potential disruptions. Major tournaments can attract millions in ticket sales and sponsorships, making Event Cancellation or Postponement Insurance a critical component of their risk management strategy. The value of such policies can easily reach tens of millions for flagship events.

- Dominant Application Segment: Tournament Organizers

- Key Driver: High financial stakes of large-scale events, including prize pools and sponsorship revenues, reaching tens of millions.

- Driving Factor: Need for comprehensive coverage against unforeseen disruptions, such as venue issues, natural disasters, or widespread illness, leading to significant revenue loss.

- Supporting Trend: Increasing investment in dedicated esports arenas and multi-day festivals, amplifying potential losses from cancellations.

- Dominant Insurance Type: Event Cancellation or Postponement Insurance

- Key Driver: Protection of substantial financial investments in event production, marketing, and talent acquisition.

- Driving Factor: The volatile nature of live events and the potential for widespread impact from localized issues.

- Supporting Trend: The increasing reliance on ticket sales and sponsorship revenue streams, making these highly susceptible to event interruptions.

- Leading Regions: North America and Asia-Pacific

- Key Driver: Established esports infrastructure, large fan bases, and significant tournament investments, often exceeding a hundred million dollars in prize pools and operational budgets.

- Driving Factor: Presence of major esports teams and leagues, attracting global attention and facilitating large-scale event hosting.

- Supporting Trend: Supportive government initiatives and private sector investment in developing esports hubs.

Esports Event Insurance Product Innovations

Esports event insurance is witnessing significant product innovation, moving beyond traditional risk coverage to address the unique vulnerabilities of the digital sports landscape. Innovations include bespoke Personal Accident Insurance policies tailored for professional gamers, covering career-ending injuries, performance-related illnesses, and even mental health support, with policy values reaching into the millions for star players. Equipment Loss or Damage Insurance now extends to high-value gaming rigs, custom peripherals, and broadcasting equipment, crucial for teams and event organizers. The development of Event Cancellation or Postponement Insurance with expanded clauses for cyber-attacks, power outages, and streaming platform failures is paramount, safeguarding against potential losses running into the tens of millions. Unique selling propositions lie in the granular understanding of esports-specific risks, offering coverage for issues like "rage quit" incidents leading to broadcast interruptions or the loss of critical data. Technological advancements in risk assessment, utilizing AI to predict event disruption probabilities, are also enhancing the performance and precision of these insurance products.

Propelling Factors for Esports Event Insurance Growth

The Esports Event Insurance market is propelled by several critical factors fostering sustained growth. The sheer economic expansion of the esports industry, with global revenues projected to surpass a hundred billion dollars, naturally increases the demand for risk mitigation services. Technological advancements, from sophisticated anti-cheat software to immersive virtual reality gaming, introduce new potential risks that require specialized insurance. Regulatory developments, as governing bodies increasingly focus on player welfare and fair competition, necessitate robust insurance frameworks. Furthermore, the growing professionalization of esports, with players earning millions and teams operating as sophisticated businesses, drives the need for comprehensive financial security. The increasing investment from traditional sports franchises and venture capitalists, injecting billions into the sector, further validates and expands the market.

- Economic Expansion: The multi-billion dollar valuation of the esports industry.

- Technological Advancements: New gaming technologies creating novel risks.

- Regulatory Focus: Increased emphasis on player protection and event integrity.

- Professionalization: Teams and players operating as significant businesses.

- Investment Influx: Billions in capital from traditional sports and VCs.

Obstacles in the Esports Event Insurance Market

Despite robust growth, the Esports Event Insurance market faces several obstacles. A primary challenge is the nasc-experience nature of many esports-specific risks, making it difficult for insurers to accurately price policies, leading to potential underwriting challenges and higher premiums. Regulatory inconsistencies across different countries and regions create complexity for global esports events. Supply chain disruptions, particularly for specialized gaming hardware, can impact event preparedness and necessitate insurance claims. Competitive pressures from a growing number of providers, while beneficial for consumers, can lead to price wars and reduced profitability for insurers. The perception of esports as a niche or high-risk venture by some traditional insurers can also limit the availability and affordability of comprehensive coverage.

- Nascent Risk Understanding: Difficulty in accurately assessing and pricing unique esports risks.

- Regulatory Fragmentation: Inconsistent insurance regulations across global markets.

- Supply Chain Volatility: Potential for disruptions affecting event readiness.

- Intense Competition: Price wars impacting insurer profitability.

- Perception Challenges: Traditional insurers' hesitation to fully embrace esports risks.

Future Opportunities in Esports Event Insurance

The future of Esports Event Insurance is brimming with opportunities. The expansion of esports into emerging markets, particularly in Southeast Asia and Latin America, presents vast untapped potential for tailored insurance solutions. Technological advancements, such as blockchain for secure betting and decentralized autonomous organizations (DAOs) in esports, will create new risk landscapes requiring innovative insurance products, potentially involving coverage in the tens of millions for intellectual property and digital asset protection. The growing popularity of mobile esports and casual gaming tournaments offers a broader consumer base for accessible and affordable insurance options. Furthermore, the increasing integration of esports with traditional sports and entertainment verticals will drive demand for comprehensive event and talent insurance packages, valued in the millions.

- Emerging Market Expansion: Tapping into new geographic regions with growing esports interest.

- New Technology Integration: Insuring risks associated with blockchain, VR, and AI in esports.

- Mobile and Casual Gaming: Expanding coverage to a wider participant base.

- Cross-Industry Integration: Bundling esports insurance with traditional entertainment and sports offerings.

Major Players in the Esports Event Insurance Ecosystem

- Tysers Insurance Brokers

- Miller

- Performance Film & Media Insurance

- Towergate Insurance Brokers

- Event Insurance Services

- Founder Shield

- eSportsInsurance

- MFE Insurance Brokerage

- Netsurance Canada

- Fullsteam Insurance

- Esport Insure

- GG Insurance Services

- Miller Insurance

Key Developments in Esports Event Insurance Industry

- 2023: Launch of specialized Personal Accident Insurance for professional esports athletes, offering coverage up to millions for career-ending injuries.

- 2024: Increased adoption of Event Cancellation or Postponement Insurance by major tournament organizers to cover risks associated with streaming platform failures, with policy values in the tens of millions.

- 2024: Performance Film & Media Insurance and other leading brokers expand their offerings to include Equipment Loss or Damage Insurance for high-value gaming peripherals and broadcasting equipment.

- 2025 (Estimated): Emergence of niche providers focusing on cyber insurance specifically for esports organizations, addressing threats like DDoS attacks and data breaches, with potential liability coverage in the millions.

- 2025–2033 (Forecast): Anticipated M&A activity as larger insurance groups acquire specialized esports insurance providers to capitalize on market growth.

Strategic Esports Event Insurance Market Forecast

The Esports Event Insurance market is poised for substantial growth, driven by the insatiable expansion of the esports industry and the increasing recognition of its inherent risks. Future opportunities lie in catering to emerging markets, embracing technological advancements like blockchain and VR in insurance product development, and serving the burgeoning mobile esports segment. The ongoing professionalization of players and organizations, coupled with substantial investments, will continue to fuel the demand for comprehensive insurance solutions, with policy values reaching into the millions for high-profile entities and events. Strategic focus on innovative product design, robust risk assessment, and adaptable underwriting will be crucial for insurers to capitalize on this dynamic and lucrative market.

Esports Event Insurance Segmentation

-

1. Application

- 1.1. Professional Gamers

- 1.2. Tournament Organizers

- 1.3. Esports Teams or Organizations

-

2. Types

- 2.1. Personal Accident Insurance

- 2.2. Equipment Loss or Damage Insurance

- 2.3. Event Cancellation or Postponement Insurance

- 2.4. Others

Esports Event Insurance Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Esports Event Insurance REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Esports Event Insurance Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Professional Gamers

- 5.1.2. Tournament Organizers

- 5.1.3. Esports Teams or Organizations

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Personal Accident Insurance

- 5.2.2. Equipment Loss or Damage Insurance

- 5.2.3. Event Cancellation or Postponement Insurance

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Esports Event Insurance Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Professional Gamers

- 6.1.2. Tournament Organizers

- 6.1.3. Esports Teams or Organizations

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Personal Accident Insurance

- 6.2.2. Equipment Loss or Damage Insurance

- 6.2.3. Event Cancellation or Postponement Insurance

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Esports Event Insurance Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Professional Gamers

- 7.1.2. Tournament Organizers

- 7.1.3. Esports Teams or Organizations

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Personal Accident Insurance

- 7.2.2. Equipment Loss or Damage Insurance

- 7.2.3. Event Cancellation or Postponement Insurance

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Esports Event Insurance Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Professional Gamers

- 8.1.2. Tournament Organizers

- 8.1.3. Esports Teams or Organizations

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Personal Accident Insurance

- 8.2.2. Equipment Loss or Damage Insurance

- 8.2.3. Event Cancellation or Postponement Insurance

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Esports Event Insurance Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Professional Gamers

- 9.1.2. Tournament Organizers

- 9.1.3. Esports Teams or Organizations

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Personal Accident Insurance

- 9.2.2. Equipment Loss or Damage Insurance

- 9.2.3. Event Cancellation or Postponement Insurance

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Esports Event Insurance Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Professional Gamers

- 10.1.2. Tournament Organizers

- 10.1.3. Esports Teams or Organizations

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Personal Accident Insurance

- 10.2.2. Equipment Loss or Damage Insurance

- 10.2.3. Event Cancellation or Postponement Insurance

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Tysers Insurance Brokers

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Miller

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Performance Film & Media Insurance

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Towergate Insurance Brokers

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Event Insurance Services

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Founder Shield

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 eSportsInsurance

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 MFE Insurance Brokerage

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Netsurance Canada

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fullsteam Insurance

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Esport Insure

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 GG Insurance Services

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Miller Insurance

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Tysers Insurance Brokers

List of Figures

- Figure 1: Global Esports Event Insurance Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Esports Event Insurance Revenue (million), by Application 2024 & 2032

- Figure 3: North America Esports Event Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Esports Event Insurance Revenue (million), by Types 2024 & 2032

- Figure 5: North America Esports Event Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Esports Event Insurance Revenue (million), by Country 2024 & 2032

- Figure 7: North America Esports Event Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Esports Event Insurance Revenue (million), by Application 2024 & 2032

- Figure 9: South America Esports Event Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Esports Event Insurance Revenue (million), by Types 2024 & 2032

- Figure 11: South America Esports Event Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Esports Event Insurance Revenue (million), by Country 2024 & 2032

- Figure 13: South America Esports Event Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Esports Event Insurance Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Esports Event Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Esports Event Insurance Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Esports Event Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Esports Event Insurance Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Esports Event Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Esports Event Insurance Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Esports Event Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Esports Event Insurance Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Esports Event Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Esports Event Insurance Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Esports Event Insurance Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Esports Event Insurance Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Esports Event Insurance Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Esports Event Insurance Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Esports Event Insurance Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Esports Event Insurance Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Esports Event Insurance Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Esports Event Insurance Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Esports Event Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Esports Event Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Esports Event Insurance Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Esports Event Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Esports Event Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Esports Event Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Esports Event Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Esports Event Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Esports Event Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Esports Event Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Esports Event Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Esports Event Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Esports Event Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Esports Event Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Esports Event Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Esports Event Insurance Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Esports Event Insurance Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Esports Event Insurance Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Esports Event Insurance Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Esports Event Insurance?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Esports Event Insurance?

Key companies in the market include Tysers Insurance Brokers, Miller, Performance Film & Media Insurance, Towergate Insurance Brokers, Event Insurance Services, Founder Shield, eSportsInsurance, MFE Insurance Brokerage, Netsurance Canada, Fullsteam Insurance, Esport Insure, GG Insurance Services, Miller Insurance.

3. What are the main segments of the Esports Event Insurance?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Esports Event Insurance," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Esports Event Insurance report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Esports Event Insurance?

To stay informed about further developments, trends, and reports in the Esports Event Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence