Key Insights

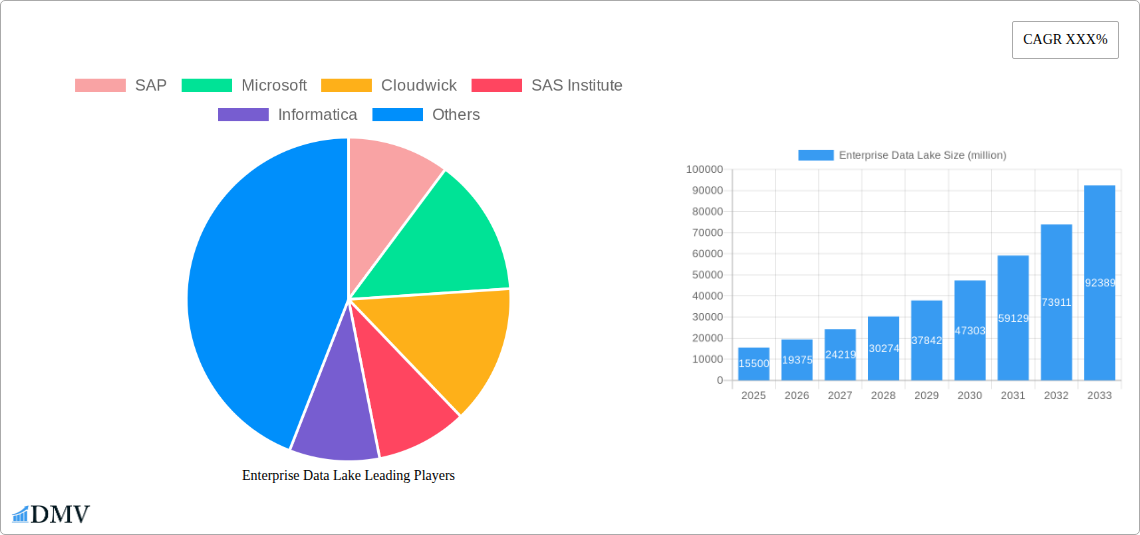

The Enterprise Data Lake market is poised for significant expansion, driven by the escalating volume of data generated across all industries and the growing imperative for businesses to leverage this data for strategic decision-making and operational efficiency. With an estimated market size of approximately USD 15,500 million in 2025, the sector is projected to witness a robust Compound Annual Growth Rate (CAGR) of around 25% through 2033. This impressive growth trajectory is underpinned by key drivers such as the increasing adoption of cloud-based data lake solutions, which offer scalability, flexibility, and cost-effectiveness, and the burgeoning demand for advanced analytics and Artificial Intelligence (AI) to extract actionable insights from raw data. Furthermore, the need for businesses to comply with stringent data governance regulations and enhance cybersecurity measures also fuels the adoption of comprehensive data lake platforms. The market's segmentation reveals a strong demand across all enterprise sizes, from small businesses to large corporations, with a significant inclination towards software and integrated services. Leading players like SAP, Microsoft, Oracle, and Snowflake Computing are at the forefront, investing heavily in innovation and expanding their offerings to cater to diverse enterprise needs.

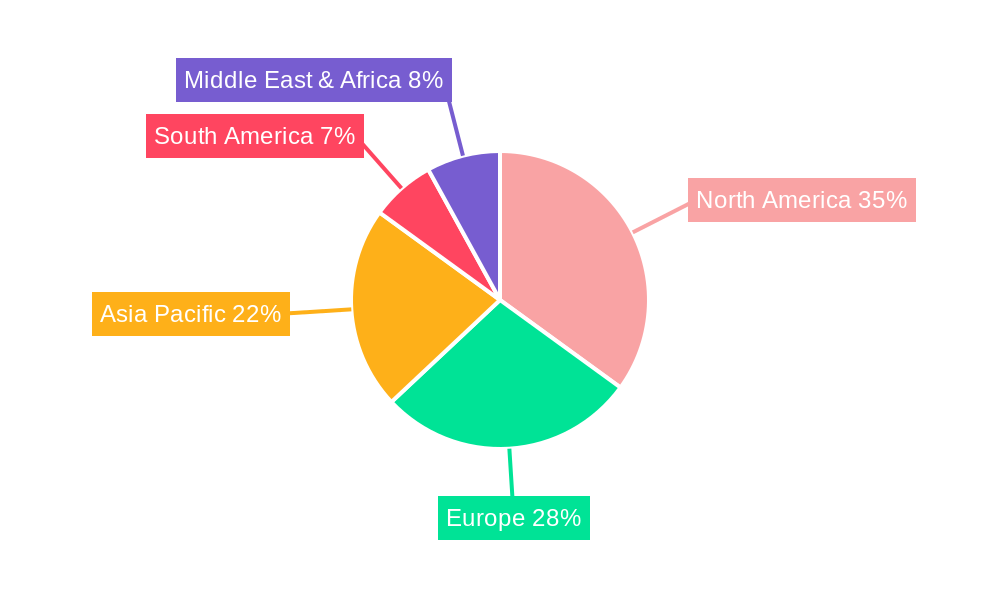

The Enterprise Data Lake landscape is characterized by several dominant trends and some moderating factors. The convergence of data lakes with data warehouses, leading to the rise of "lakehouse" architectures, is a significant trend, offering the best of both worlds: the flexibility of data lakes and the structure of data warehouses. Increased adoption of open-source technologies and the growing popularity of data democratization initiatives are also shaping the market. However, challenges such as data security concerns, the complexity of data integration and management, and the shortage of skilled data professionals could act as restraints. Despite these challenges, the market's intrinsic value proposition – enabling organizations to break down data silos, foster innovation, and gain a competitive edge – ensures its continued upward trajectory. Geographically, North America currently leads the market, fueled by early adoption and a mature technological ecosystem. However, the Asia Pacific region is expected to exhibit the fastest growth, driven by rapid digital transformation and increasing data volumes. The ongoing evolution of data management technologies and the strategic investments by key market participants will further accelerate the market's expansion in the coming years.

Enterprise Data Lake Market Report: Unlocking Value and Driving Innovation (2019-2033)

This comprehensive Enterprise Data Lake market report provides an in-depth analysis of the global data lake landscape, covering market composition, trends, industry evolution, regional dominance, product innovations, growth drivers, obstacles, future opportunities, key players, and strategic forecasts. Designed for stakeholders, decision-makers, and industry professionals, this report utilizes high-ranking SEO keywords and actionable insights to offer a clear roadmap for navigating this rapidly expanding market. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, building upon historical data from 2019-2024.

Enterprise Data Lake Market Composition & Trends

The Enterprise Data Lake market is characterized by a dynamic interplay of innovation, evolving regulatory frameworks, and strategic mergers and acquisitions. Market concentration varies across segments, with a notable shift towards cloud-native solutions. Key innovation catalysts include advancements in AI/ML for data analytics, enhanced data governance tools, and increased demand for real-time data processing. Regulatory landscapes, particularly around data privacy and security (e.g., GDPR, CCPA), are increasingly influencing data lake architecture and implementation strategies. Substitute products, such as traditional data warehouses and data marts, are gradually being integrated or augmented by data lake capabilities, rather than being entirely replaced. End-user profiles are diverse, encompassing Small Enterprise, Medium Enterprise, and Large Enterprise segments, each with distinct adoption patterns and requirements for Software and Services. Mergers and acquisitions (M&A) are significant drivers of market consolidation and technological integration, with estimated M&A deal values in the tens of billions of dollars annually. The market share distribution shows a growing dominance of cloud providers and specialized data lake platform vendors.

Enterprise Data Lake Industry Evolution

The Enterprise Data Lake industry has witnessed a transformative evolution, driven by an insatiable demand for data-driven decision-making and the exponential growth of unstructured and semi-structured data. Early adoption was primarily concentrated among large enterprises seeking to consolidate vast amounts of disparate data sources, often overcoming the limitations of traditional relational databases. The initial focus was on enabling raw data storage and exploration, laying the groundwork for advanced analytics. Technological advancements have been pivotal in this evolution, with the maturation of distributed computing frameworks like Hadoop and Spark, and the subsequent rise of cloud-based data lake solutions offered by major players such as Microsoft Azure Data Lake Storage and Amazon S3. These cloud platforms have democratized access to data lake technology, significantly reducing the infrastructure burden for businesses of all sizes.

The increasing sophistication of data governance tools and data cataloging solutions has addressed critical challenges related to data discovery, quality, and security, making data lakes more manageable and trustworthy for enterprise-wide use. The industry has also seen a significant shift from a purely infrastructural focus to a more application-centric approach, where data lakes are increasingly viewed as the foundational layer for a wide array of business intelligence, machine learning, and AI initiatives. Consumer demands have evolved from simply storing data to actively extracting actionable insights, leading to the proliferation of self-service analytics tools and the integration of data lakes with advanced visualization platforms. Growth rates have been consistently robust, with projections indicating a compound annual growth rate (CAGR) of approximately 25% over the forecast period. Adoption metrics are soaring, with over 70% of large enterprises already having implemented or in the process of implementing data lake solutions, and a rapidly increasing adoption rate among medium-sized businesses, estimated to reach 50% by 2028. The industry's trajectory is marked by continuous innovation in areas like data virtualization, data fabric architectures, and specialized data lakehouse solutions that combine the benefits of data lakes and data warehouses.

Leading Regions, Countries, or Segments in Enterprise Data Lake

The Enterprise Data Lake market exhibits distinct regional and segmental leadership, driven by a confluence of economic, technological, and regulatory factors. North America, particularly the United States, stands as the dominant region, fueled by a mature technology ecosystem, substantial investment in AI and Big Data initiatives, and the presence of numerous leading technology companies. Strong regulatory support for data innovation, coupled with a high adoption rate across all enterprise segments, further solidifies its leadership. In terms of Application, Large Enterprises are currently the primary drivers of Enterprise Data Lake adoption, leveraging these platforms for complex data integration, advanced analytics, and large-scale operational efficiency. Their significant data volumes and complex business needs necessitate the scalable and flexible architecture that data lakes provide. However, the Medium Enterprise segment is experiencing the most rapid growth, driven by increased cloud adoption and the availability of more accessible, cost-effective data lake solutions. Small Enterprises, while still nascent in their adoption, are increasingly exploring data lake solutions to gain competitive insights from their growing data sets.

Regarding Type, the Software segment commands a significant market share, encompassing data ingestion tools, data processing engines, data cataloging solutions, and data governance platforms. Major software vendors like Informatica, SAS Institute, and Oracle are instrumental in shaping this segment. The Services segment, including implementation, consulting, and managed services, is also crucial and growing at a healthy pace, with companies like Capgemini and Atos providing critical expertise in deploying and optimizing data lake environments. Key drivers for this dominance include substantial R&D investments in data analytics and AI within North America, favorable government initiatives promoting digital transformation, and the presence of a highly skilled workforce capable of managing and leveraging complex data infrastructures. The competitive landscape in North America is intense, fostering continuous innovation and driving down costs, making data lake solutions more attractive across a broader spectrum of businesses.

Enterprise Data Lake Product Innovations

Recent Enterprise Data Lake product innovations have focused on enhancing usability, accelerating insights, and bolstering data governance. Key advancements include the development of intelligent data cataloging tools that leverage AI for automated metadata discovery and lineage tracking, significantly improving data discoverability and trust. Furthermore, the integration of real-time streaming capabilities allows for immediate data ingestion and analysis, enabling businesses to respond to market changes with unprecedented agility. Performance metrics are continuously improving, with optimized query engines and data compression techniques leading to faster data retrieval and reduced storage costs. Unique selling propositions now emphasize self-service data preparation, robust security features, and seamless integration with existing cloud ecosystems, making data lake solutions more accessible and valuable for a wider range of users.

Propelling Factors for Enterprise Data Lake Growth

The Enterprise Data Lake market is propelled by several key factors. Technologically, the maturation of cloud computing, advanced analytics, and AI/ML algorithms provides the essential infrastructure and capabilities for effective data lake utilization. Economically, the increasing recognition of data as a strategic asset, driving business intelligence, operational efficiency, and new revenue streams, fuels significant investment. Regulatory influences, while sometimes posing challenges, also drive demand for robust data governance and compliance features inherent in modern data lake solutions. The growing volume and variety of data generated by digital transformation initiatives across industries further necessitate scalable and flexible storage and processing solutions.

Obstacles in the Enterprise Data Lake Market

Despite the growth, the Enterprise Data Lake market faces several obstacles. Regulatory challenges, particularly around data privacy and cross-border data transfer, can complicate global implementations, leading to an estimated 10-15% increase in implementation complexity and cost in certain regions. Supply chain disruptions, though less direct, can impact the availability and cost of underlying hardware and cloud infrastructure. Competitive pressures, while driving innovation, can also lead to market fragmentation and challenges for smaller vendors. Furthermore, the technical expertise required for effective data lake management and the potential for data swamps if not properly governed remain significant barriers for some organizations, representing an estimated 5-10% slower adoption rate in organizations lacking specialized skills.

Future Opportunities in Enterprise Data Lake

Emerging opportunities in the Enterprise Data Lake market are abundant. The expansion of edge computing and IoT devices will generate massive new data streams, creating a demand for distributed and federated data lake architectures. The growing adoption of data fabric and data mesh concepts promises more decentralized and accessible data management paradigms, leveraging data lakes as a core component. Furthermore, the increasing focus on data democratization and citizen data scientists will drive the demand for more intuitive, self-service data lake platforms. The convergence of data lakes with data warehouses in "data lakehouse" architectures presents a significant opportunity for unified data analytics.

Major Players in the Enterprise Data Lake Ecosystem

- SAP

- Microsoft

- Cloudwick

- SAS Institute

- Informatica

- Teradata

- Oracle

- HVR Software

- IBM

- Podium Data

- Zaloni

- Snowflake Computing

- Capgemini

- EMC

- Hitachi

- Atos

Key Developments in Enterprise Data Lake Industry

- January 2024: Snowflake Computing announces major enhancements to its cloud data platform, focusing on data governance and real-time analytics capabilities, further solidifying its position in the enterprise data lake market.

- October 2023: Microsoft launches a new suite of AI-powered data management tools for Azure Data Lake Storage, aimed at simplifying data discovery and preparation for business users.

- July 2023: Informatica introduces its next-generation data cataloging solution, leveraging advanced AI to automate metadata management and improve data lineage tracking across hybrid and multi-cloud environments.

- March 2023: Capgemini acquires a leading data analytics consultancy, expanding its service offerings in data lake implementation and managed services for large enterprises.

- December 2022: Oracle announces deeper integration of its cloud data lake solutions with its enterprise application suite, offering a more unified data experience for Oracle customers.

- September 2022: IBM releases a new version of its hybrid cloud data platform, enhancing its data lake capabilities with improved performance and security features for enterprise deployments.

- May 2021: Cloudwick launches a new managed data lake service for the AWS ecosystem, simplifying data lake deployment and management for small and medium-sized enterprises.

- February 2020: SAS Institute announces expanded partnerships with cloud providers, offering enhanced integration of its analytics platform with major cloud data lake services.

- November 2019: Teradata introduces its cloud-native data lake platform, designed to address the growing demand for scalable and cost-effective data analytics solutions.

Strategic Enterprise Data Lake Market Forecast

The strategic Enterprise Data Lake market forecast indicates sustained robust growth, driven by the escalating need for comprehensive data management and advanced analytics across all business segments. Key growth catalysts include the pervasive digital transformation initiatives, the exponential rise of AI and machine learning applications, and the ongoing cloud migration trends. Emerging technologies like data fabric and the increasing adoption of data lakehouse architectures are poised to unlock new levels of data accessibility and analytical power. The market potential is immense, with organizations increasingly recognizing data lakes as the foundational element for driving competitive advantage, fostering innovation, and achieving operational excellence in the coming years.

Enterprise Data Lake Segmentation

-

1. Application

- 1.1. Small Enterprise

- 1.2. Medium Enterprise

- 1.3. Large Enterprise

-

2. Type

- 2.1. Software

- 2.2. Services

Enterprise Data Lake Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Enterprise Data Lake REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Enterprise Data Lake Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Small Enterprise

- 5.1.2. Medium Enterprise

- 5.1.3. Large Enterprise

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Software

- 5.2.2. Services

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Enterprise Data Lake Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Small Enterprise

- 6.1.2. Medium Enterprise

- 6.1.3. Large Enterprise

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Software

- 6.2.2. Services

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Enterprise Data Lake Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Small Enterprise

- 7.1.2. Medium Enterprise

- 7.1.3. Large Enterprise

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Software

- 7.2.2. Services

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Enterprise Data Lake Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Small Enterprise

- 8.1.2. Medium Enterprise

- 8.1.3. Large Enterprise

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Software

- 8.2.2. Services

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Enterprise Data Lake Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Small Enterprise

- 9.1.2. Medium Enterprise

- 9.1.3. Large Enterprise

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Software

- 9.2.2. Services

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Enterprise Data Lake Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Small Enterprise

- 10.1.2. Medium Enterprise

- 10.1.3. Large Enterprise

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Software

- 10.2.2. Services

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 SAP

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Microsoft

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Cloudwick

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SAS Institute

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Informatica

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Teradata

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Oracle

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 HVR Software

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 IBM

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Podium Data

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zaloni

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Snowflake Computing

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Capgemini

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 EMC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Hitachi

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Atos

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 SAP

List of Figures

- Figure 1: Global Enterprise Data Lake Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Enterprise Data Lake Revenue (million), by Application 2024 & 2032

- Figure 3: North America Enterprise Data Lake Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Enterprise Data Lake Revenue (million), by Type 2024 & 2032

- Figure 5: North America Enterprise Data Lake Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Enterprise Data Lake Revenue (million), by Country 2024 & 2032

- Figure 7: North America Enterprise Data Lake Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Enterprise Data Lake Revenue (million), by Application 2024 & 2032

- Figure 9: South America Enterprise Data Lake Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Enterprise Data Lake Revenue (million), by Type 2024 & 2032

- Figure 11: South America Enterprise Data Lake Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Enterprise Data Lake Revenue (million), by Country 2024 & 2032

- Figure 13: South America Enterprise Data Lake Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Enterprise Data Lake Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Enterprise Data Lake Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Enterprise Data Lake Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Enterprise Data Lake Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Enterprise Data Lake Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Enterprise Data Lake Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Enterprise Data Lake Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Enterprise Data Lake Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Enterprise Data Lake Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Enterprise Data Lake Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Enterprise Data Lake Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Enterprise Data Lake Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Enterprise Data Lake Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Enterprise Data Lake Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Enterprise Data Lake Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Enterprise Data Lake Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Enterprise Data Lake Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Enterprise Data Lake Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Enterprise Data Lake Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Enterprise Data Lake Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Enterprise Data Lake Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Enterprise Data Lake Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Enterprise Data Lake Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Enterprise Data Lake Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Enterprise Data Lake Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Enterprise Data Lake Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Enterprise Data Lake Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Enterprise Data Lake Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Enterprise Data Lake Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Enterprise Data Lake Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Enterprise Data Lake Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Enterprise Data Lake Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Enterprise Data Lake Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Enterprise Data Lake Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Enterprise Data Lake Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Enterprise Data Lake Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Enterprise Data Lake Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Enterprise Data Lake Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Enterprise Data Lake?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Enterprise Data Lake?

Key companies in the market include SAP, Microsoft, Cloudwick, SAS Institute, Informatica, Teradata, Oracle, HVR Software, IBM, Podium Data, Zaloni, Snowflake Computing, Capgemini, EMC, Hitachi, Atos.

3. What are the main segments of the Enterprise Data Lake?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Enterprise Data Lake," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Enterprise Data Lake report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Enterprise Data Lake?

To stay informed about further developments, trends, and reports in the Enterprise Data Lake, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence