Key Insights

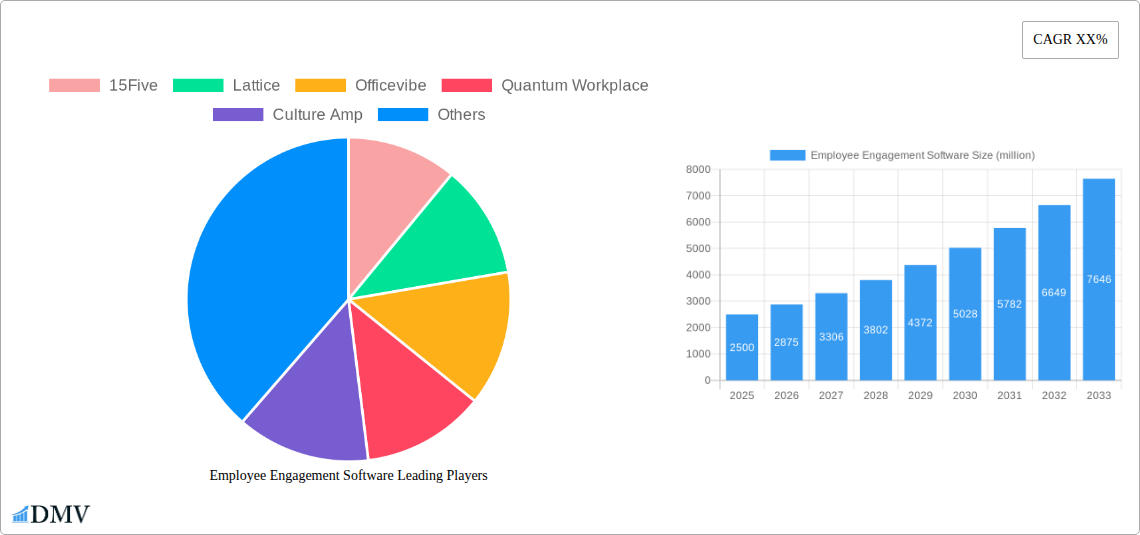

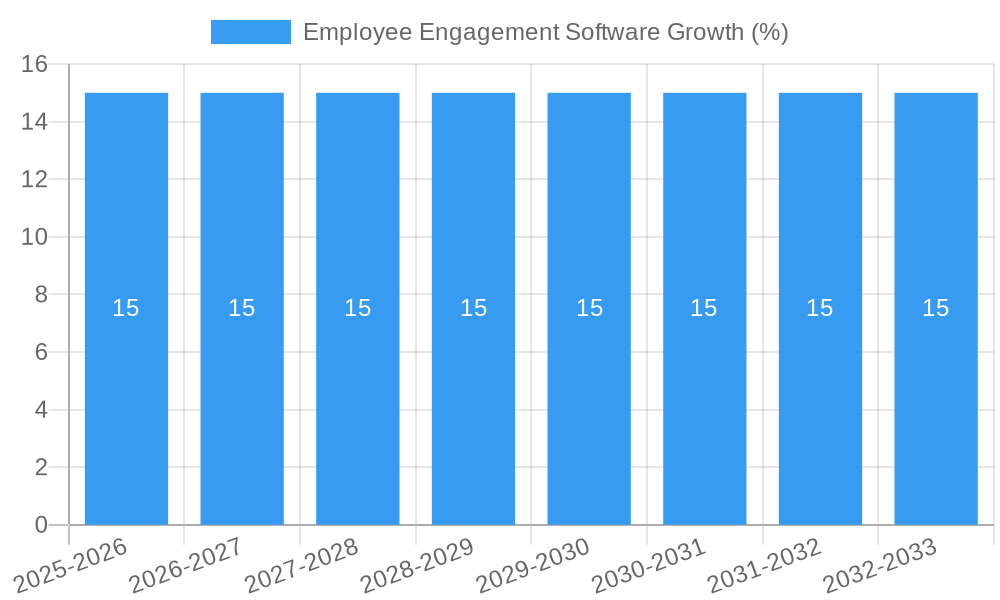

The global Employee Engagement Software market is experiencing robust expansion, projected to reach an estimated USD 2,500 million by 2025. This growth is fueled by a Compound Annual Growth Rate (CAGR) of 15% over the forecast period of 2025-2033. Organizations worldwide are increasingly recognizing the critical link between employee satisfaction, productivity, and overall business success. This has led to a surge in demand for sophisticated software solutions designed to measure, analyze, and improve employee sentiment, performance, and well-being. Key drivers include the growing emphasis on fostering a positive workplace culture, the need to retain top talent in competitive labor markets, and the adoption of hybrid and remote work models, which necessitate enhanced communication and engagement strategies. The rise of data analytics within HR functions further empowers businesses to make informed decisions regarding their workforce, directly impacting the adoption of these engagement platforms.

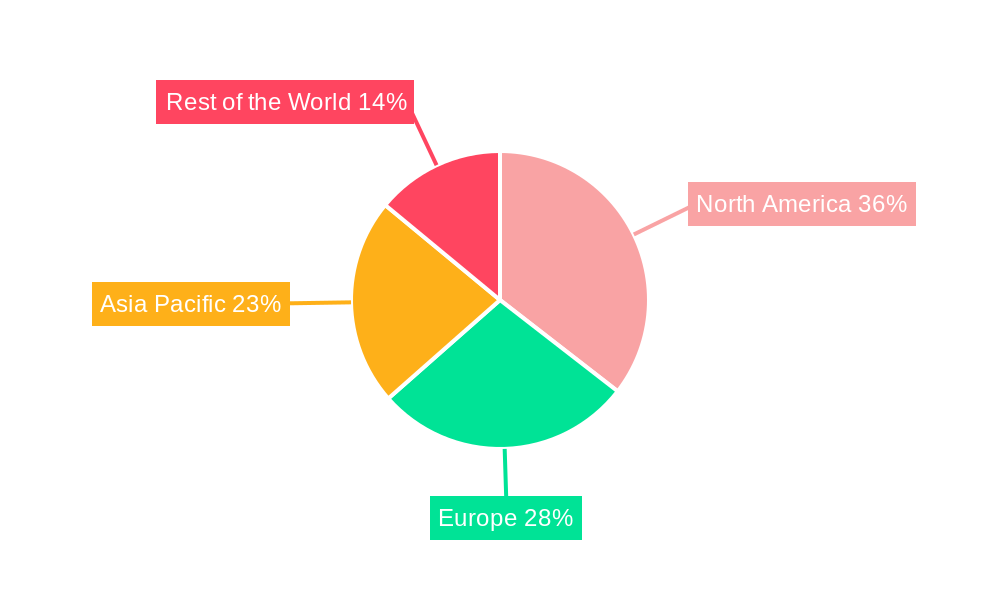

The market is segmented by application, with both Small and Medium-sized Enterprises (SMEs) and Large Enterprises demonstrating significant adoption. SMEs are leveraging cost-effective cloud-based solutions to level the playing field with larger organizations, while large enterprises are investing in comprehensive, often hybrid, solutions to manage their diverse workforces. Cloud-based deployment models dominate, offering scalability, accessibility, and lower upfront costs, appealing to a broad spectrum of businesses. The market landscape is characterized by a competitive array of players, including established providers like Lattice, Culture Amp, and 15Five, alongside emerging innovators. Geographically, North America currently leads the market, driven by a mature business environment and a strong focus on HR technology. However, the Asia Pacific region is poised for rapid growth, propelled by increasing digitalization and a growing awareness of employee engagement best practices in developing economies. Restraints, such as data security concerns and the initial cost of implementation for some advanced features, are being addressed through continuous software development and evolving pricing models.

Unlock Peak Performance: Comprehensive Employee Engagement Software Market Report (2019-2033)

This in-depth report provides an unparalleled deep dive into the dynamic Employee Engagement Software market, offering critical insights for stakeholders seeking to understand and capitalize on current trends and future trajectories. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis dissects market composition, industry evolution, leading segments, product innovations, growth drivers, obstacles, and future opportunities. With a meticulous examination of leading companies like 15Five, Lattice, Officevibe, Quantum Workplace, Culture Amp, TinyPulse, Weekdone, Impraise, Achievers, Reflektive, Peakon, Glint, Saba Software, ReviewSnap, Kudos, Citrix, and Motivosity, this report is an indispensable resource for strategic decision-making.

Employee Engagement Software Market Composition & Trends

The Employee Engagement Software market is characterized by a moderate level of concentration, with a blend of established players and innovative startups vying for market share. Innovation catalysts are primarily driven by the increasing demand for data-driven insights into workforce sentiment, the proliferation of remote and hybrid work models, and the growing recognition of employee well-being as a strategic imperative. Regulatory landscapes, while not overtly restrictive, are increasingly influenced by data privacy laws and the need for ethical AI implementation within HR technology. Substitute products, such as traditional HR management systems with limited engagement features or manual feedback mechanisms, are becoming less competitive as organizations prioritize specialized engagement solutions. End-user profiles span across all enterprise sizes, with a particular focus on Small and Medium Enterprises (SMEs) and Large Enterprises increasingly adopting these platforms to foster a positive company culture and improve retention rates, estimated at XXX million in total addressable market value. Mergers and Acquisitions (M&A) activities are on the rise, indicating market consolidation and strategic partnerships to enhance product offerings and expand global reach. The value of M&A deals in the historical period is estimated to have reached XXX million, with further substantial growth anticipated.

- Market Share Distribution: Detailed analysis of market share held by key vendors.

- Innovation Catalysts: Drivers such as AI-powered analytics, personalized employee experiences, and integration with other HR tech stacks.

- Substitute Products: Evolving landscape of alternatives and their limitations.

- M&A Activities: Significant transactions and their impact on market structure, valued at XXX million historically.

Employee Engagement Software Industry Evolution

The Employee Engagement Software industry has undergone a significant transformation, evolving from basic survey tools to sophisticated platforms offering a holistic approach to workforce management and development. Over the study period (2019–2033), market growth trajectories have been consistently upward, fueled by a profound shift in organizational priorities towards employee experience. Technological advancements have been pivotal, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) enabling predictive analytics, personalized feedback loops, and sentiment analysis, moving beyond reactive surveys to proactive engagement strategies. Adoption metrics show a dramatic increase, with an estimated XX% growth in software adoption by enterprises globally in the historical period alone. Shifting consumer demands, driven by a new generation of employees who prioritize purpose, growth, and well-being in their workplaces, have compelled companies to invest in tools that foster a connected and supportive environment. The market has witnessed a move towards continuous feedback, performance management integration, and recognition programs, moving beyond annual reviews to real-time engagement. The forecasted Compound Annual Growth Rate (CAGR) for the forecast period (2025–2033) is projected to be approximately XX%, signifying robust and sustained expansion. This evolution is further underscored by the increasing demand for cloud-based solutions, which offer scalability, accessibility, and cost-effectiveness, becoming the dominant deployment type. The ongoing digital transformation across industries has further accelerated the need for digital HR solutions, with employee engagement software at the forefront of this revolution. The industry's journey reflects a maturing understanding of the direct correlation between employee engagement and business outcomes, including productivity, innovation, and customer satisfaction, further solidifying its strategic importance in the modern corporate landscape. The estimated market size for the base year of 2025 is XXX million, with an anticipated growth to XXX million by the end of the forecast period in 2033.

Leading Regions, Countries, or Segments in Employee Engagement Software

The Employee Engagement Software market exhibits distinct leadership across various regions and segments, with Cloud-based solutions emerging as the dominant type, driven by their inherent flexibility, scalability, and cost-efficiency. The Large Enterprises segment also holds a significant leadership position, owing to their larger workforce size, greater budgetary allocations for HR technology, and the complex organizational structures that necessitate sophisticated engagement tools to maintain cohesion and productivity. North America consistently leads in terms of adoption and market value, propelled by a mature tech ecosystem, a strong emphasis on employee-centric work cultures, and a high concentration of innovative HR tech companies. The United States, in particular, is a powerhouse, demonstrating substantial investment trends in employee engagement solutions, with an estimated market value of XXX million in 2025. Regulatory support for workplace well-being initiatives and a proactive approach to talent management further bolster this leadership.

- Dominant Segment (Application): Large Enterprises, characterized by their comprehensive needs for talent management, retention strategies, and performance optimization. Their investment in employee engagement software is projected to reach XXX million by 2033.

- Dominant Segment (Type): Cloud-based solutions, offering seamless integration, real-time data analytics, and remote accessibility, are expected to capture a market share of over XX% by 2033.

- Leading Region: North America, with an estimated market size of XXX million in 2025, driven by technological adoption and a focus on employee experience.

- Key Drivers in North America: Strong presence of leading employee engagement software providers, significant R&D investments, and a highly competitive job market emphasizing employee retention.

- Growth Factors in Large Enterprises: Need for scalable solutions to manage diverse workforces, enhanced data analytics for strategic decision-making, and the drive to cultivate strong organizational cultures.

- Cloud-based Advantages: Lower upfront costs, automatic updates, enhanced security features, and superior accessibility for hybrid and remote workforces.

Employee Engagement Software Product Innovations

Recent product innovations in employee engagement software are centered on creating more personalized, proactive, and integrated employee experiences. These advancements include AI-driven sentiment analysis to identify potential disengagement early, gamified recognition platforms to boost morale and productivity, and continuous performance management modules that foster ongoing feedback and development conversations. Unique selling propositions now emphasize the ability to deliver actionable insights, not just data, enabling HR leaders to make informed decisions that directly impact employee satisfaction and business outcomes. Technological advancements such as natural language processing (NLP) for analyzing open-ended feedback and the integration of well-being modules are setting new benchmarks for comprehensive engagement solutions, with an estimated market impact of XXX million in added value through efficiency gains and improved retention.

Propelling Factors for Employee Engagement Software Growth

The growth of the employee engagement software market is propelled by a confluence of potent factors. Technologically, the increasing adoption of AI and ML for predictive analytics and personalized employee experiences is a major driver. Economically, the growing awareness of the direct correlation between employee engagement and organizational productivity, reduced turnover, and enhanced customer loyalty is fueling investment. Organizations are recognizing that a disengaged workforce translates into significant financial losses, estimated at XXX million annually due to reduced productivity. Regulatory influences, such as the increasing focus on workplace well-being and mental health support, are also pushing companies to adopt comprehensive engagement solutions. The shift towards remote and hybrid work models has further amplified the need for digital tools to maintain connection and foster a sense of belonging, making employee engagement software indispensable for modern businesses.

Obstacles in the Employee Engagement Software Market

Despite robust growth, the employee engagement software market faces several obstacles. Data privacy and security concerns remain paramount, with organizations hesitant to adopt platforms that may mishandle sensitive employee information, leading to potential fines estimated at XXX million for non-compliance. Implementation challenges, including resistance to change from employees and the complexity of integrating new software with existing HR systems, can hinder widespread adoption. The competitive pressure from a crowded market also presents a barrier, forcing vendors to constantly innovate and differentiate their offerings, impacting profit margins. Supply chain disruptions, though less directly impactful, can affect the availability of hardware components for on-premises solutions, indirectly influencing market dynamics for integrated systems. The perceived high cost of advanced features can also deter some smaller organizations from fully leveraging the capabilities of sophisticated engagement platforms.

Future Opportunities in Employee Engagement Software

Emerging opportunities in the employee engagement software market are vast and multifaceted. The expansion into untapped emerging markets, particularly in Asia-Pacific and Latin America, presents significant growth potential, with an estimated market expansion opportunity of XXX million by 2030. The development of more specialized AI-driven solutions for niche industries and specific workforce challenges, such as managing generational differences in engagement preferences, will unlock new revenue streams. Furthermore, the increasing integration of employee engagement platforms with broader HR technology stacks, creating a unified employee experience ecosystem, offers substantial cross-selling and up-selling opportunities. The growing trend of employee-led initiatives and the demand for tools that facilitate peer-to-peer recognition and collaboration are also paving the way for innovative features and market penetration. The focus on holistic employee well-being, encompassing mental, physical, and financial health, will drive demand for comprehensive platforms.

Major Players in the Employee Engagement Software Ecosystem

- 15Five

- Lattice

- Officevibe

- Quantum Workplace

- Culture Amp

- TinyPulse

- Weekdone

- Impraise

- Achievers

- Reflektive

- Peakon

- Glint

- Saba Software

- ReviewSnap

- Kudos

- Citrix

- Motivosity

Key Developments in Employee Engagement Software Industry

- 2023/08: Culture Amp announces acquisition of Rare, strengthening its talent analytics capabilities.

- 2023/07: Lattice launches new AI-powered performance management features, enhancing real-time feedback.

- 2023/06: Officevibe expands its platform with advanced survey customization options for enhanced feedback collection.

- 2023/05: Quantum Workplace introduces a new manager enablement module to drive team engagement.

- 2023/04: 15Five integrates with Slack and Microsoft Teams for seamless communication and feedback flow.

- 2023/03: TinyPulse rolls out enhanced recognition features to foster a culture of appreciation.

- 2023/02: Achievers acquires Engagement Multiplier, broadening its employee recognition and feedback offerings.

- 2023/01: Peakon (now Workday Peakon) enhances its continuous listening capabilities with more granular reporting.

- 2022/12: Glint (now part of LinkedIn) integrates with more HRIS systems to provide a holistic view of employee data.

- 2022/11: Saba Software (now Cornerstone OnDemand) focuses on integrating engagement with learning and development pathways.

- 2022/10: Reflektive refines its real-time feedback tools for improved performance management.

- 2022/09: Weekdone introduces new OKR-tracking features to align individual goals with company objectives.

- 2022/08: Impraise enhances its 360-degree feedback features for comprehensive performance reviews.

- 2022/07: ReviewSnap revamps its interface for a more user-friendly employee feedback experience.

- 2022/06: Kudos launches a new mobile-first engagement platform for enhanced accessibility.

- 2022/05: Citrix introduces new collaboration tools integrated with employee feedback mechanisms.

- 2022/04: Motivosity enhances its peer-to-peer recognition features to foster positive work environments.

Strategic Employee Engagement Software Market Forecast

The strategic forecast for the Employee Engagement Software market is overwhelmingly positive, driven by the persistent need for organizations to foster productive, satisfied, and resilient workforces. Future growth will be fueled by the increasing adoption of AI for personalized employee journeys, the expansion of cloud-based solutions catering to a global remote workforce, and the demand for integrated platforms that encompass well-being and performance management. The market potential lies in its ability to directly impact key business metrics such as talent retention, productivity, and innovation. As businesses continue to navigate complex economic landscapes and evolving employee expectations, strategic investments in robust employee engagement software will be paramount for sustained success and competitive advantage, with the market projected to reach XXX million by 2033.

Employee Engagement Software Segmentation

-

1. Application

- 1.1. Small and Medium Enterprises (SMEs)

- 1.2. Large Enterprises

-

2. Types

- 2.1. Cloud-based

- 2.2. On-premises

Employee Engagement Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Employee Engagement Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Employee Engagement Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Small and Medium Enterprises (SMEs)

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cloud-based

- 5.2.2. On-premises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Employee Engagement Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Small and Medium Enterprises (SMEs)

- 6.1.2. Large Enterprises

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cloud-based

- 6.2.2. On-premises

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Employee Engagement Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Small and Medium Enterprises (SMEs)

- 7.1.2. Large Enterprises

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cloud-based

- 7.2.2. On-premises

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Employee Engagement Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Small and Medium Enterprises (SMEs)

- 8.1.2. Large Enterprises

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cloud-based

- 8.2.2. On-premises

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Employee Engagement Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Small and Medium Enterprises (SMEs)

- 9.1.2. Large Enterprises

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cloud-based

- 9.2.2. On-premises

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Employee Engagement Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Small and Medium Enterprises (SMEs)

- 10.1.2. Large Enterprises

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cloud-based

- 10.2.2. On-premises

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 15Five

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lattice

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Officevibe

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Quantum Workplace

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Culture Amp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TinyPulse

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Weekdone

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Impraise

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Achievers

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Reflektive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Peakon

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Glint

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Saba Software

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ReviewSnap

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Kudos

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Citrix

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Motivosity

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 15Five

List of Figures

- Figure 1: Global Employee Engagement Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Employee Engagement Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Employee Engagement Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Employee Engagement Software Revenue (million), by Types 2024 & 2032

- Figure 5: North America Employee Engagement Software Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Employee Engagement Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Employee Engagement Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Employee Engagement Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Employee Engagement Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Employee Engagement Software Revenue (million), by Types 2024 & 2032

- Figure 11: South America Employee Engagement Software Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Employee Engagement Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Employee Engagement Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Employee Engagement Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Employee Engagement Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Employee Engagement Software Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Employee Engagement Software Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Employee Engagement Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Employee Engagement Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Employee Engagement Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Employee Engagement Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Employee Engagement Software Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Employee Engagement Software Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Employee Engagement Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Employee Engagement Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Employee Engagement Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Employee Engagement Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Employee Engagement Software Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Employee Engagement Software Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Employee Engagement Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Employee Engagement Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Employee Engagement Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Employee Engagement Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Employee Engagement Software Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Employee Engagement Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Employee Engagement Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Employee Engagement Software Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Employee Engagement Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Employee Engagement Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Employee Engagement Software Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Employee Engagement Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Employee Engagement Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Employee Engagement Software Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Employee Engagement Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Employee Engagement Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Employee Engagement Software Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Employee Engagement Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Employee Engagement Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Employee Engagement Software Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Employee Engagement Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Employee Engagement Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Employee Engagement Software?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Employee Engagement Software?

Key companies in the market include 15Five, Lattice, Officevibe, Quantum Workplace, Culture Amp, TinyPulse, Weekdone, Impraise, Achievers, Reflektive, Peakon, Glint, Saba Software, ReviewSnap, Kudos, Citrix, Motivosity.

3. What are the main segments of the Employee Engagement Software?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Employee Engagement Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Employee Engagement Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Employee Engagement Software?

To stay informed about further developments, trends, and reports in the Employee Engagement Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence