Key Insights

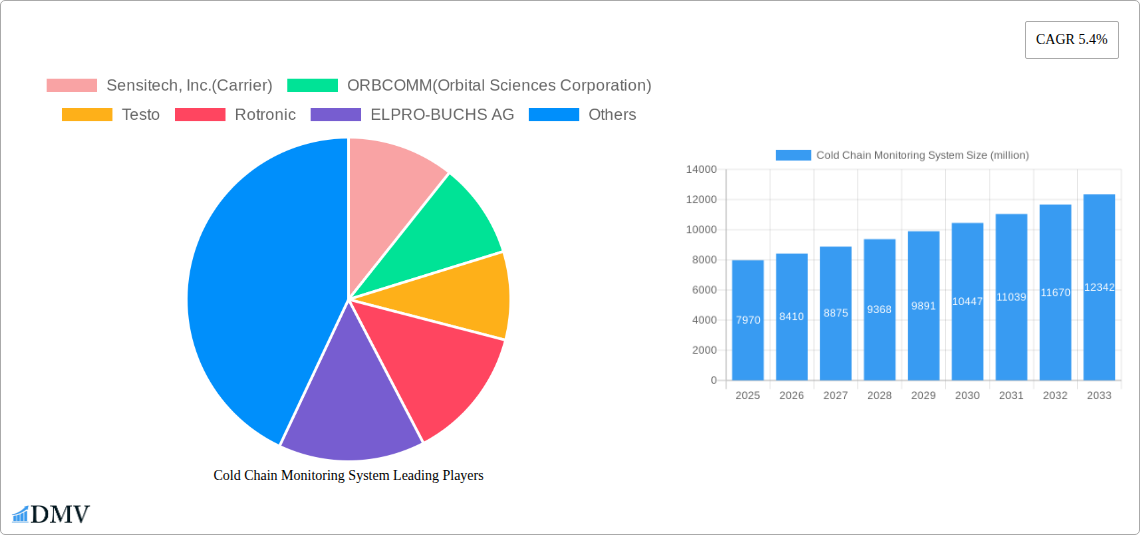

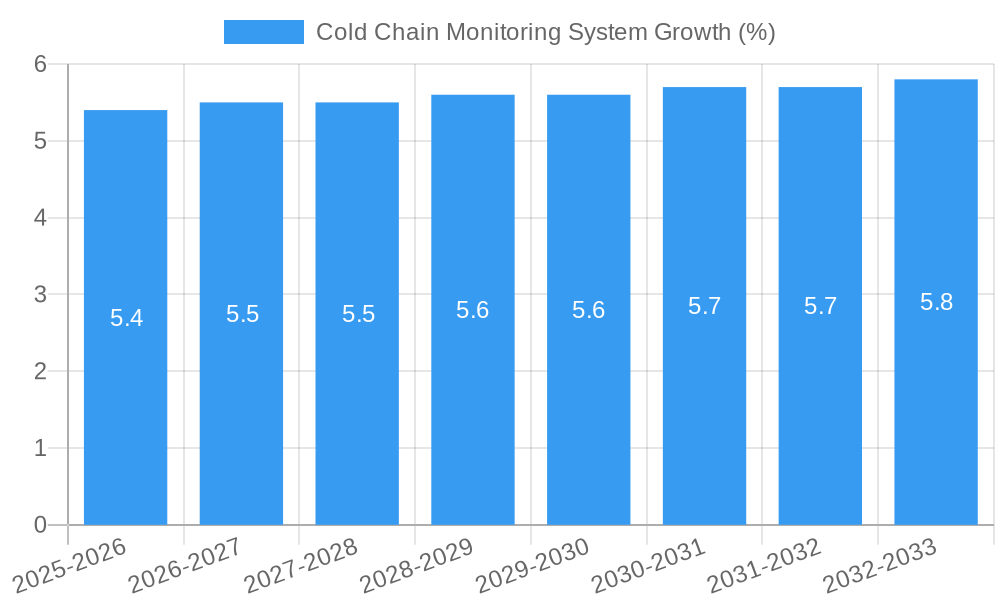

The global Cold Chain Monitoring System market is poised for substantial growth, projected to reach approximately $7,970 million in value by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.4% anticipated throughout the forecast period of 2025-2033. This expansion is primarily driven by the increasing demand for stringent temperature control across various sensitive industries, most notably pharmaceuticals and healthcare. The critical need to ensure the efficacy and safety of temperature-sensitive vaccines, biologics, and medications, coupled with growing regulatory compliance requirements, forms the bedrock of this market's upward trajectory. Furthermore, the burgeoning food and beverage sector, particularly fresh produce and frozen goods, is increasingly adopting these systems to minimize spoilage, maintain quality, and meet evolving consumer expectations for traceability and safety. The market's advancement is also fueled by technological innovations, including the integration of IoT sensors, cloud-based data management, and advanced analytics, which enhance real-time monitoring, predictive maintenance, and overall supply chain efficiency.

The market landscape is characterized by a dynamic interplay of hardware and software solutions, with both segments contributing significantly to overall market value. Hardware components, such as temperature loggers, data loggers, and sensors, are essential for capturing real-time data, while sophisticated software platforms enable data analysis, reporting, and alert management. The competitive environment is vibrant, featuring a mix of established players and emerging innovators, all striving to offer comprehensive and cost-effective solutions. Key industry trends include the growing adoption of wireless monitoring solutions for enhanced flexibility and reduced installation costs, the increasing demand for end-to-end visibility across the cold chain, and a heightened focus on cybersecurity to protect sensitive supply chain data. Despite the positive outlook, potential restraints such as the initial high cost of implementation for some advanced systems and the need for specialized technical expertise in certain regions could present challenges. However, the overarching benefits of reduced product loss, improved compliance, and enhanced brand reputation are expected to outweigh these concerns, driving sustained market expansion.

Report Description: Global Cold Chain Monitoring System Market Outlook 2025-2033

This comprehensive Cold Chain Monitoring System Market report offers a deep dive into the global landscape, providing actionable insights for stakeholders navigating this critical sector. Covering the historical period of 2019–2024 and projecting trends through 2033, with a base and estimated year of 2025, this analysis delves into market dynamics, technological advancements, regional dominance, and future growth trajectories. We meticulously examine the evolving needs of Pharma and Healthcare and Food and Beverage industries, alongside other applications, and analyze the interplay between Hardware and Software solutions. This report is an essential resource for understanding market concentration, innovation, regulatory impact, and the strategic imperatives driving the cold chain logistics and temperature-controlled supply chain sectors.

Cold Chain Monitoring System Market Composition & Trends

The global cold chain monitoring system market exhibits a dynamic composition, characterized by increasing market concentration driven by strategic acquisitions and technological integration. Innovation catalysts are largely fueled by the stringent regulatory demands of the pharmaceutical and healthcare sectors, demanding robust cold chain solutions to ensure product integrity and patient safety. The expanding reach of e-commerce for perishable goods also acts as a significant driver, necessitating reliable cold chain management. Regulatory landscapes, particularly regarding Good Distribution Practices (GDP) and Food Safety Modernization Act (FSMA) compliance, are shaping product development and market entry strategies. Substitute products, primarily manual logging methods, are rapidly being phased out by advanced electronic temperature monitoring devices and integrated IoT cold chain solutions. End-user profiles range from large pharmaceutical manufacturers and global food distributors to smaller niche producers, all seeking to mitigate the risks associated with temperature excursions. Mergers and acquisitions (M&A) are prevalent, with significant deal values aimed at consolidating market share and expanding technological capabilities. For instance, M&A activities within the past study period (2019-2024) are estimated to have reached hundreds of millions in value, reflecting a robust consolidation trend. Market share distribution is increasingly favoring integrated cold chain tracking and monitoring providers.

Cold Chain Monitoring System Industry Evolution

The cold chain monitoring system industry has undergone a significant evolution, marked by consistent market growth trajectories and rapid technological advancements. From 2019 to 2024, the market witnessed an average annual growth rate of approximately 7-9%, a trend expected to accelerate in the coming years. This expansion is intrinsically linked to the increasing global demand for temperature-sensitive products, particularly in the pharmaceutical and healthcare and food and beverage sectors. The advent of the Internet of Things (IoT) has been a pivotal technological advancement, transforming passive temperature monitoring into active, real-time cold chain visibility. This has enabled predictive analytics for potential temperature excursions, significantly reducing product spoilage and waste, estimated to save billions globally in lost goods annually. Shifting consumer demands, particularly a heightened awareness of food safety and the efficacy of medicines, have further propelled the adoption of sophisticated cold chain solutions. Early adoption metrics show a dramatic increase in the deployment of real-time logistics monitoring systems, with over 50% of pharmaceutical companies now utilizing advanced digital solutions. The integration of cloud-based cold chain platforms has also revolutionized data management and accessibility, allowing for seamless compliance reporting and operational efficiency improvements. The industry is moving beyond simple data logging to comprehensive supply chain intelligence platforms that offer end-to-end cold chain traceability. This continuous innovation cycle, driven by the need for enhanced reliability, efficiency, and compliance, underpins the robust growth witnessed and projected for the cold chain monitoring market. The market size is projected to reach tens of billions by 2030.

Leading Regions, Countries, or Segments in Cold Chain Monitoring System

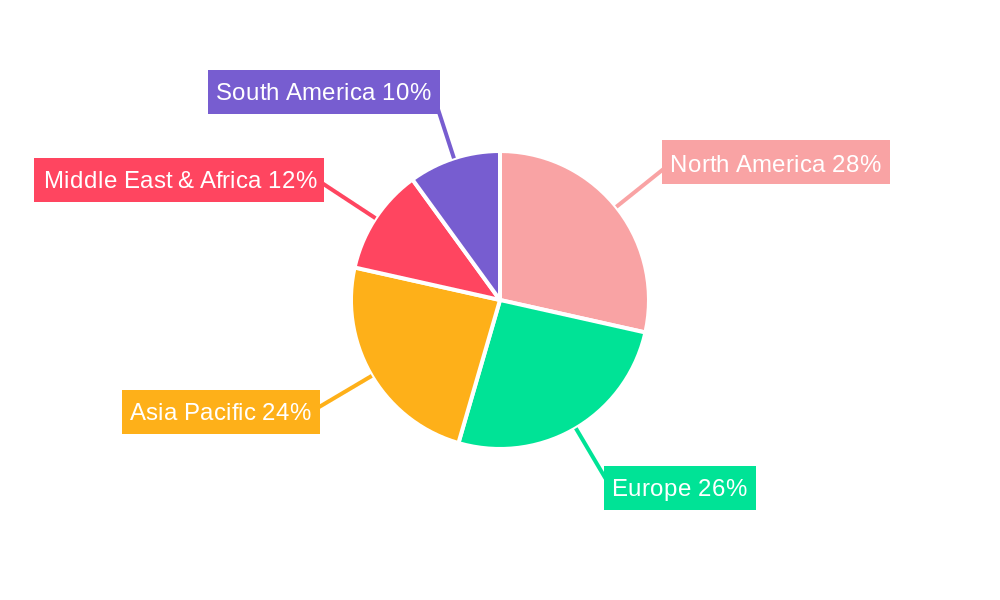

The Cold Chain Monitoring System market is dominated by North America and Europe, driven by robust regulatory frameworks, advanced technological adoption, and a high concentration of pharmaceutical and healthcare and food and beverage industries. Within these regions, the Pharma and Healthcare segment stands out as the leading application, accounting for an estimated 40-50% of the total market share. This dominance is fueled by the critical need for unwavering product integrity for vaccines, biologics, and temperature-sensitive medications, where even minor temperature deviations can render products ineffective or dangerous. Investment trends in these regions are significant, with hundreds of millions invested annually in enhancing cold chain infrastructure and monitoring technology.

- Key Drivers for Pharma and Healthcare Dominance:

- Stringent Regulatory Compliance: Global regulations like Good Distribution Practices (GDP) mandate precise temperature control throughout the pharmaceutical supply chain, making advanced monitoring systems indispensable.

- High Value of Products: The high monetary value of pharmaceutical products necessitates robust protection against spoilage and loss, justifying substantial investments in reliable cold chain solutions.

- Technological Advancements: The integration of IoT, AI, and cloud computing into cold chain monitoring offers real-time data, predictive analytics, and enhanced traceability, crucial for the pharmaceutical sector.

- Growing Biologics Market: The expanding market for biologics and vaccines, which are particularly sensitive to temperature fluctuations, directly drives the demand for sophisticated cold chain monitoring systems.

In terms of Type, the Hardware segment, encompassing temperature loggers, sensors, and data loggers, currently holds a larger market share, estimated at around 60-70%. However, the Software segment, which provides data analytics, reporting tools, and cloud-based platforms for cold chain management, is experiencing a significantly higher growth rate, projected to outpace hardware expansion in the coming years. This indicates a shift towards integrated, data-driven cold chain solutions.

Cold Chain Monitoring System Product Innovations

Recent product innovations in the cold chain monitoring system market are transforming operational efficiency and product safety. Advancements include the development of real-time, cloud-connected IoT temperature loggers that offer continuous cold chain visibility, enabling immediate alerts for any temperature deviations. Furthermore, miniaturized and highly accurate sensors are being integrated into packaging, providing granular temperature data throughout the entire supply chain journey. Innovations in AI-powered analytics are also gaining traction, allowing for predictive maintenance of refrigerated transport and proactive identification of potential risks. Performance metrics are seeing significant improvements, with devices offering extended battery life, enhanced data storage capacity, and superior accuracy within a broader temperature range, thereby minimizing product spoilage and ensuring compliance with stringent cold chain regulations.

Propelling Factors for Cold Chain Monitoring System Growth

The cold chain monitoring system market is propelled by a confluence of technological, economic, and regulatory influences. Technologically, the widespread adoption of IoT and AI is revolutionizing cold chain management by enabling real-time data, predictive analytics, and enhanced traceability. Economically, the increasing value of temperature-sensitive goods, particularly in the pharmaceutical and food & beverage industries, necessitates robust monitoring solutions to minimize product loss and associated financial risks. Regulatory mandates, such as Good Distribution Practices (GDP) and various food safety standards, are increasingly requiring stringent temperature monitoring, thereby driving demand for advanced systems. The growing global demand for vaccines and biologics further fuels this expansion.

Obstacles in the Cold Chain Monitoring System Market

Despite robust growth, the cold chain monitoring system market faces several obstacles. Regulatory challenges can arise from the varying compliance standards across different regions, necessitating complex and costly adaptations for global operations. Supply chain disruptions, exacerbated by geopolitical events and climate change, can impact the consistent operation of cold chain infrastructure and the reliability of monitoring data. Competitive pressures from established players and new entrants offering increasingly sophisticated yet affordable cold chain solutions can also put pressure on pricing and market share. Furthermore, the initial investment cost for comprehensive cold chain monitoring systems, particularly for smaller businesses, can be a significant barrier.

Future Opportunities in Cold Chain Monitoring System

Emerging opportunities in the cold chain monitoring system market are vast and varied. The expansion of the global vaccine and biologics market presents a significant growth avenue, demanding highly specialized cold chain logistics and monitoring. The increasing consumer demand for fresh, high-quality food and beverage products, particularly those requiring frozen or chilled transport, will continue to drive adoption. Technological advancements, such as the integration of blockchain for enhanced cold chain traceability and the development of more energy-efficient refrigeration technologies, offer new avenues for innovation and market differentiation. Furthermore, the growing emphasis on sustainability within supply chains presents an opportunity for cold chain monitoring systems that can optimize energy consumption and reduce waste.

Major Players in the Cold Chain Monitoring System Ecosystem

- Sensitech, Inc. (Carrier)

- ORBCOMM (Orbital Sciences Corporation)

- Testo

- Rotronic

- ELPRO-BUCHS AG

- Emerson

- Nietzsche Enterprise

- NXP Semiconductors

- Signatrol

- Haier Biomedical

- Monnit Corporation

- Berlinger & Co AG

- Cold Chain Technologies

- LogTag Recorders Ltd

- Omega

- Dickson

- ZeDA Instruments

- Oceasoft

- The IMC Group Ltd

- Controlant Ehf

- Gemalto (Thales)

- Infratab, Inc.

- Zest Labs, Inc.

- Jucsan

- Maven Systems Pvt.Ltd.

Key Developments in Cold Chain Monitoring System Industry

- 2023/2024: Increased integration of AI and machine learning for predictive analytics in cold chain monitoring, enabling proactive risk management.

- 2023: Launch of advanced, long-duration battery-powered IoT loggers offering continuous, real-time data transmission for extended cold chain shipments.

- 2023: Growing adoption of cloud-based cold chain management platforms for enhanced data accessibility, reporting, and compliance.

- 2022/2023: Significant M&A activity, with larger players acquiring innovative startups to expand their IoT cold chain portfolios and market reach.

- 2022: Advancements in sensor technology leading to smaller, more accurate, and wider-range temperature monitoring devices.

- 2021/2022: Increased focus on sustainability, with a drive towards energy-efficient refrigeration and monitoring solutions.

- 2020/2021: Accelerated deployment of real-time cold chain monitoring solutions driven by the demands of vaccine distribution during the global pandemic.

Strategic Cold Chain Monitoring System Market Forecast

The Cold Chain Monitoring System market is poised for substantial growth, driven by escalating demand for pharmaceutical and perishable food products, coupled with stringent regulatory requirements worldwide. The continued integration of advanced technologies like IoT, AI, and blockchain will be pivotal in enhancing cold chain visibility, ensuring product integrity, and reducing waste. Strategic investments in R&D for innovative temperature monitoring solutions and the expansion of cloud-based data analytics platforms will further solidify market expansion. Emerging economies are expected to represent significant growth opportunities as their cold chain infrastructure develops. The forecast anticipates sustained double-digit growth, fueled by both technological advancements and an increasing global emphasis on supply chain resilience and product safety.

Cold Chain Monitoring System Segmentation

-

1. Application

- 1.1. Pharma and Healthcare

- 1.2. Food and Beverage

- 1.3. Others

-

2. Type

- 2.1. Hardware

- 2.2. Software

Cold Chain Monitoring System Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cold Chain Monitoring System REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.4% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cold Chain Monitoring System Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pharma and Healthcare

- 5.1.2. Food and Beverage

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Hardware

- 5.2.2. Software

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Cold Chain Monitoring System Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pharma and Healthcare

- 6.1.2. Food and Beverage

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Hardware

- 6.2.2. Software

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Cold Chain Monitoring System Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pharma and Healthcare

- 7.1.2. Food and Beverage

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Hardware

- 7.2.2. Software

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Cold Chain Monitoring System Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pharma and Healthcare

- 8.1.2. Food and Beverage

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Hardware

- 8.2.2. Software

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Cold Chain Monitoring System Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pharma and Healthcare

- 9.1.2. Food and Beverage

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Hardware

- 9.2.2. Software

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Cold Chain Monitoring System Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pharma and Healthcare

- 10.1.2. Food and Beverage

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Hardware

- 10.2.2. Software

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sensitech Inc.(Carrier)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ORBCOMM(Orbital Sciences Corporation)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Testo

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Rotronic

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ELPRO-BUCHS AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Emerson

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nietzsche Enterprise

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NXP Semiconductors

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Signatrol

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Haier Biomedical

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Monnit Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Berlinger & Co AG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Cold Chain Technologies

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 LogTag Recorders Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Omega

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Dickson

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 ZeDA Instruments

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Oceasoft

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 The IMC Group Ltd

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Controlant Ehf

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Gemalto(Thales)

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Infratab Inc.

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Zest Labs Inc.

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Jucsan

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Maven Systems Pvt.Ltd.

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.1 Sensitech Inc.(Carrier)

List of Figures

- Figure 1: Global Cold Chain Monitoring System Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Cold Chain Monitoring System Revenue (million), by Application 2024 & 2032

- Figure 3: North America Cold Chain Monitoring System Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Cold Chain Monitoring System Revenue (million), by Type 2024 & 2032

- Figure 5: North America Cold Chain Monitoring System Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Cold Chain Monitoring System Revenue (million), by Country 2024 & 2032

- Figure 7: North America Cold Chain Monitoring System Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Cold Chain Monitoring System Revenue (million), by Application 2024 & 2032

- Figure 9: South America Cold Chain Monitoring System Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Cold Chain Monitoring System Revenue (million), by Type 2024 & 2032

- Figure 11: South America Cold Chain Monitoring System Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Cold Chain Monitoring System Revenue (million), by Country 2024 & 2032

- Figure 13: South America Cold Chain Monitoring System Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Cold Chain Monitoring System Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Cold Chain Monitoring System Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Cold Chain Monitoring System Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Cold Chain Monitoring System Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Cold Chain Monitoring System Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Cold Chain Monitoring System Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Cold Chain Monitoring System Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Cold Chain Monitoring System Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Cold Chain Monitoring System Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Cold Chain Monitoring System Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Cold Chain Monitoring System Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Cold Chain Monitoring System Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Cold Chain Monitoring System Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Cold Chain Monitoring System Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Cold Chain Monitoring System Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Cold Chain Monitoring System Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Cold Chain Monitoring System Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Cold Chain Monitoring System Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cold Chain Monitoring System Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Cold Chain Monitoring System Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Cold Chain Monitoring System Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Cold Chain Monitoring System Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Cold Chain Monitoring System Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Cold Chain Monitoring System Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Cold Chain Monitoring System Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Cold Chain Monitoring System Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Cold Chain Monitoring System Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Cold Chain Monitoring System Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Cold Chain Monitoring System Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Cold Chain Monitoring System Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Cold Chain Monitoring System Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Cold Chain Monitoring System Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Cold Chain Monitoring System Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Cold Chain Monitoring System Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Cold Chain Monitoring System Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Cold Chain Monitoring System Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Cold Chain Monitoring System Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Cold Chain Monitoring System Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cold Chain Monitoring System?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Cold Chain Monitoring System?

Key companies in the market include Sensitech, Inc.(Carrier), ORBCOMM(Orbital Sciences Corporation), Testo, Rotronic, ELPRO-BUCHS AG, Emerson, Nietzsche Enterprise, NXP Semiconductors, Signatrol, Haier Biomedical, Monnit Corporation, Berlinger & Co AG, Cold Chain Technologies, LogTag Recorders Ltd, Omega, Dickson, ZeDA Instruments, Oceasoft, The IMC Group Ltd, Controlant Ehf, Gemalto(Thales), Infratab, Inc., Zest Labs, Inc., Jucsan, Maven Systems Pvt.Ltd..

3. What are the main segments of the Cold Chain Monitoring System?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7970 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cold Chain Monitoring System," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cold Chain Monitoring System report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cold Chain Monitoring System?

To stay informed about further developments, trends, and reports in the Cold Chain Monitoring System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence