Key Insights

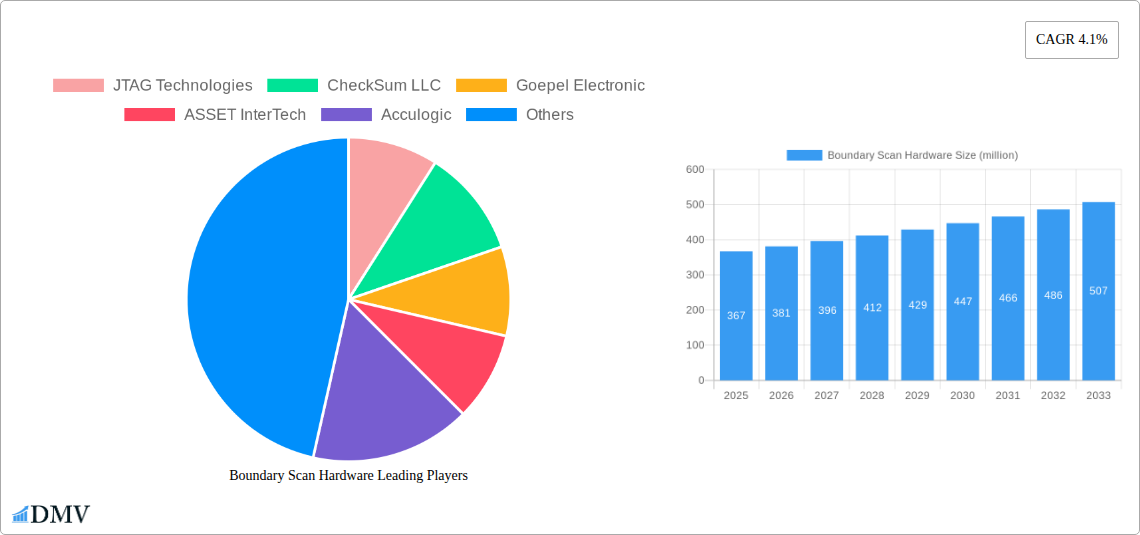

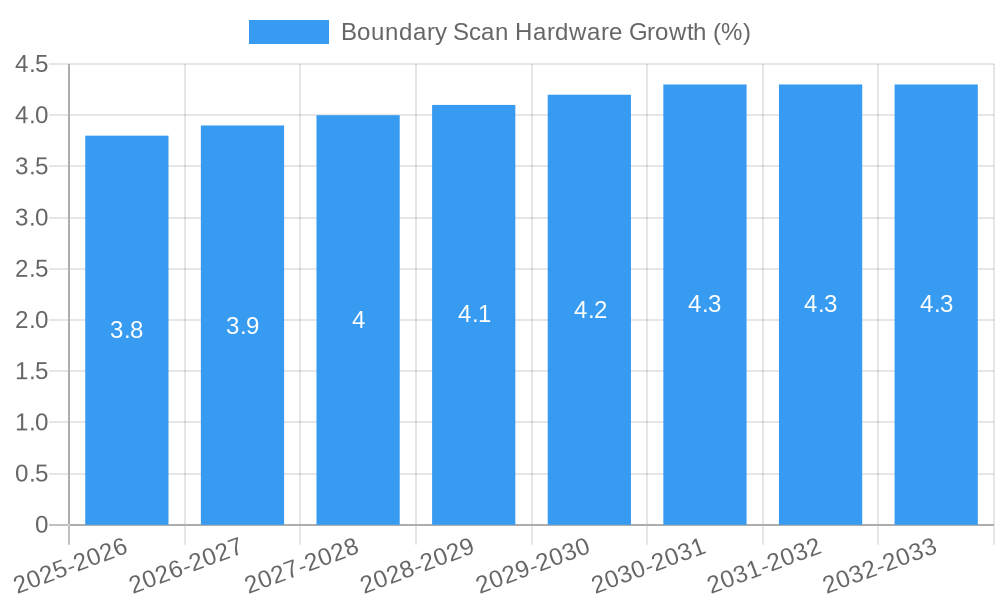

The global Boundary Scan Hardware market is poised for steady expansion, projected to reach an estimated \$367 million in 2025 and grow at a Compound Annual Growth Rate (CAGR) of 4.1% through 2033. This growth is propelled by the increasing complexity of electronic devices and the imperative for robust testing and debugging solutions across various industries. The demand for efficient and automated testing methods to ensure product quality and reduce manufacturing defects is a significant driver. In the IT & Telecom and Consumer Electronics sectors, where rapid product cycles and miniaturization are prevalent, boundary scan technology offers a critical advantage in simplifying diagnostics and accelerating time-to-market. The Automotive Electronics segment is also a key contributor, driven by the proliferation of sophisticated electronic control units (ECUs) and advanced driver-assistance systems (ADAS), all of which require meticulous testing.

Further fueling this market are emerging trends such as the integration of boundary scan into System-on-Chip (SoC) designs, enabling more comprehensive in-system programming and testing. The growing adoption of Industry 4.0 principles and smart manufacturing further amplifies the need for automated testing solutions like boundary scan to ensure seamless production lines and high-yield manufacturing. While the market experiences robust growth, certain restraints might emerge, such as the initial investment cost for advanced boundary scan equipment and the need for specialized skilled personnel for implementation and operation. However, the long-term benefits of improved product reliability, reduced warranty costs, and enhanced testing efficiency are expected to outweigh these challenges, solidifying boundary scan hardware's indispensable role in modern electronics manufacturing.

Boundary Scan Hardware Market Composition & Trends

The global Boundary Scan Hardware market, valued at over XXX million in 2023 and projected to reach over XXX million by 2033, exhibits a moderate concentration with key players like JTAG Technologies, CheckSum LLC, Goepel Electronic, ASSET InterTech, Acculogic, Flynn Systems, XJTAG Limited, EWA Technologies, Keysight Technologies, and Teradyne holding significant market share. The market is driven by continuous innovation, particularly in automotive electronics and defense sectors, demanding robust and reliable electronic testing solutions. Regulatory landscapes, such as stringent quality control mandates in medical devices and automotive safety standards, further propel the adoption of boundary scan hardware. Substitute products, while emerging, largely fail to offer the comprehensive in-circuit testing capabilities and diagnostic depth that boundary scan provides for complex PCBs and integrated circuits. End-user profiles span across critical industries, including IT & Telecom, Consumer Electronics, Medical, Automotive Electronics, and Defense, each with unique testing requirements and reliability expectations. Mergers and acquisitions, with recent deal values estimated to be in the hundreds of millions, are reshaping the competitive landscape, consolidating expertise and expanding product portfolios. The market share distribution is dynamic, with established vendors strategically acquiring smaller innovators to enhance their technological offerings and broaden their geographical reach.

- Market Concentration: Moderate, with a few dominant players.

- Innovation Catalysts: Demand for high reliability, miniaturization, and complex circuit testing.

- Regulatory Landscapes: Stringent quality standards in automotive, medical, and defense sectors.

- Substitute Products: Limited substitutes offer comparable depth of in-circuit testing.

- End-User Profiles: Diverse, from high-volume consumer electronics to critical defense systems.

- M&A Activities: Ongoing, focused on technology acquisition and market expansion.

Boundary Scan Hardware Industry Evolution

The Boundary Scan Hardware industry has undergone a significant evolution over the study period (2019–2033), marked by consistent growth trajectories and profound technological advancements. The historical period (2019–2024) witnessed an average annual growth rate of approximately 7.5%, driven by the increasing complexity of electronic devices and the growing demand for efficient and cost-effective testing methodologies. As the base year (2025) approaches, the market is poised for accelerated expansion, with the forecast period (2025–2033) anticipating an average Compound Annual Growth Rate (CAGR) of over 8.8%. This robust growth is underpinned by several key factors.

Technological advancements have been central to this evolution. The transition from traditional functional testing to more comprehensive Design-for-Testability (DFT) strategies has made boundary scan an indispensable tool. Innovations in hardware capabilities, such as increased test speed, higher pin counts, and enhanced diagnostic accuracy, have been crucial. The integration of boundary scan with other testing techniques like Automated Optical Inspection (AOI) and in-circuit testing (ICT) has further optimized testing workflows, reducing test times and improving fault detection rates. Software advancements, including more intelligent test pattern generation and fault diagnosis algorithms, have also played a pivotal role, making boundary scan solutions more user-friendly and powerful.

Shifting consumer demands, particularly for more sophisticated and reliable electronic products across all segments, have also been a significant propellant. The automotive industry's embrace of advanced driver-assistance systems (ADAS) and electric vehicle (EV) technologies, the proliferation of complex consumer electronics, and the critical nature of defense and medical electronics all necessitate rigorous testing to ensure product performance and safety. The increasing prevalence of System-in-Package (SiP) and multi-chip modules (MCMs) further amplifies the need for boundary scan's unique ability to test internal connections within these complex assemblies. Furthermore, the push towards Industry 4.0 and the Internet of Things (IoT) is driving the demand for interconnected devices, which require advanced testing to ensure their reliability and security, thus directly benefiting the boundary scan hardware market. Adoption metrics show a steady increase, with over 70% of manufacturers now integrating boundary scan into their product development and manufacturing processes by 2024, a figure expected to climb above 85% by 2033.

Leading Regions, Countries, or Segments in Boundary Scan Hardware

The global Boundary Scan Hardware market exhibits distinct regional and segmental dominance, driven by a confluence of technological adoption, industrial investment, and regulatory frameworks. Among the application segments, Automotive Electronics stands out as a leading driver of market growth. This dominance is propelled by the relentless innovation and stringent safety requirements inherent in the automotive industry. Modern vehicles are increasingly reliant on complex electronic control units (ECUs) for everything from powertrain management and infotainment to advanced driver-assistance systems (ADAS) and autonomous driving capabilities. The sheer volume and criticality of these electronic components necessitate highly sophisticated testing solutions like boundary scan to ensure fault-free operation and road safety.

Key drivers within the Automotive Electronics segment include:

- Stringent Safety Regulations: Global automotive safety standards, such as ISO 26262, mandate rigorous testing and validation of electronic systems to prevent failures that could compromise safety. Boundary scan hardware is instrumental in meeting these compliance requirements by enabling thorough in-circuit testing of PCBs and integrated circuits within ECUs.

- Electrification and Autonomous Driving Trends: The rapid growth of electric vehicles (EVs) and the ongoing development of autonomous driving technologies are introducing an unprecedented level of electronic complexity. Battery management systems, power electronics, sensor fusion, and advanced processing units all require comprehensive testing to ensure reliability and performance under diverse operating conditions.

- High Investment in R&D: Automotive manufacturers and their Tier 1 suppliers are investing heavily in research and development to bring next-generation vehicles to market. This sustained investment fuels the demand for advanced testing equipment to support rapid prototyping, design validation, and mass production of complex electronic modules.

- Long Product Lifecycles and Reliability Demands: The extended lifecycle of automotive components and the critical need for reliability in transportation systems place a premium on thorough testing. Boundary scan's ability to detect manufacturing defects and analyze potential failure points early in the production process is highly valued.

The Automatic type of boundary scan hardware also holds a significant lead over semi-automatic solutions, particularly in high-volume manufacturing environments within automotive and consumer electronics. Automatic boundary scan systems offer unparalleled efficiency, speed, and repeatability, which are essential for meeting the production demands of these industries. The ability to integrate seamlessly into automated production lines and perform tests with minimal human intervention reduces labor costs and minimizes the risk of human error.

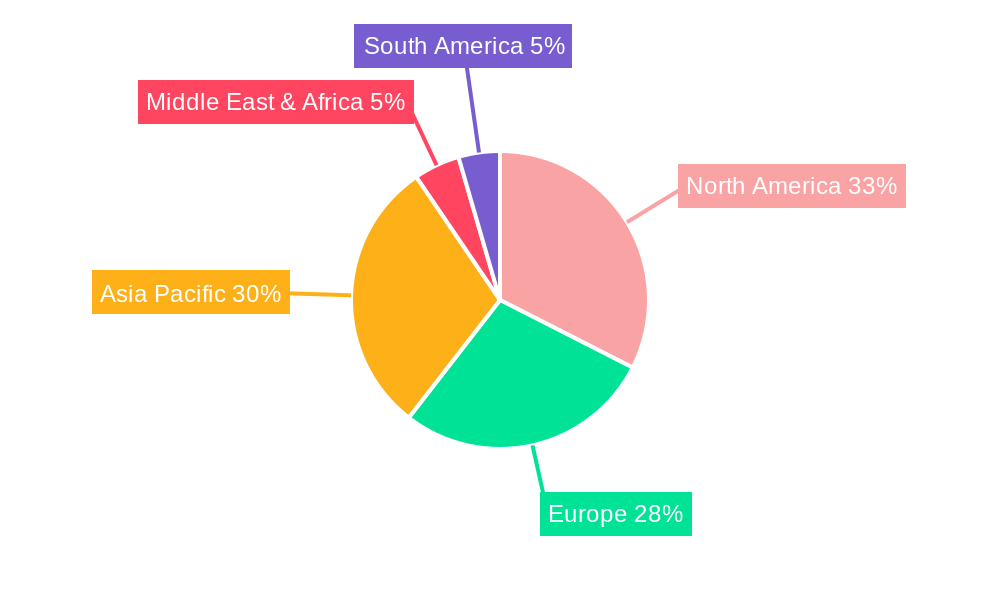

In-depth analysis of dominance factors reveals that the convergence of these technological demands and regulatory imperatives creates a fertile ground for boundary scan adoption in automotive electronics. Countries with strong automotive manufacturing bases, such as Germany, Japan, South Korea, and the United States, are major consumers of boundary scan hardware. The increasing complexity of automotive electronic architectures, including the integration of multiple microcontrollers, FPGAs, and power management ICs, makes traditional testing methods insufficient. Boundary scan, with its ability to access internal nodes and test complex interconnections, provides a critical solution for validating the integrity of these intricate designs. The push towards connected car technologies and the associated cybersecurity concerns further underscore the importance of robust testing throughout the vehicle's electronic systems.

Boundary Scan Hardware Product Innovations

Recent product innovations in boundary scan hardware focus on enhancing test coverage, speed, and integration capabilities. Companies are introducing advanced systems with higher pin counts and faster data transfer rates, enabling the testing of more complex and densely populated printed circuit boards (PCBs) with greater efficiency. Unique selling propositions often lie in the seamless integration of boundary scan with other testing methodologies, such as JTAG, SPI, I2C, and even functional testing, within a single platform. For instance, newer hardware offers sophisticated diagnostic engines that can pinpoint faults with unprecedented accuracy, significantly reducing debugging time. Performance metrics are being pushed with reduced test cycle times, often by several orders of magnitude for certain tests, and improved fault detection rates exceeding 99%. The development of compact, modular hardware solutions further enhances flexibility and scalability for diverse manufacturing environments.

Propelling Factors for Boundary Scan Hardware Growth

The growth of the Boundary Scan Hardware market is propelled by several interconnected factors. Technological Advancements in semiconductor design, leading to increasingly complex PCBs and integrated circuits, necessitate advanced testing solutions. The rising demand for High Reliability and Quality in sectors like Automotive Electronics, Medical Devices, and Defense further drives adoption, as boundary scan ensures robust in-circuit testing and fault detection. Stringent Regulatory Compliance across these industries mandates thorough testing to meet safety and performance standards. Cost Reduction in Manufacturing is another key driver, as boundary scan optimizes test processes, reduces debugging time, and minimizes rework, ultimately lowering overall production costs. The increasing complexity of interconnected devices within the Internet of Things (IoT) ecosystem also demands reliable testing, creating new avenues for growth.

Obstacles in the Boundary Scan Hardware Market

Despite robust growth, the Boundary Scan Hardware market faces several obstacles. Initial Investment Costs for advanced boundary scan systems can be substantial, posing a barrier for smaller manufacturers or those with limited capital. Complexity of Implementation and Test Generation for highly intricate designs requires specialized expertise, which may not be readily available. Lack of Skilled Workforce in boundary scan technologies can hinder efficient deployment and utilization. Rapid Technological Obsolescence can also be a concern, requiring continuous investment in updated hardware and software. Furthermore, Supply Chain Disruptions, as experienced globally in recent years, can impact the availability of key components and finished products, potentially delaying implementations and increasing costs.

Future Opportunities in Boundary Scan Hardware

Emerging opportunities in the Boundary Scan Hardware market are diverse and promising. The rapid expansion of the 5G and IoT infrastructure creates a significant demand for testing complex communication modules and network equipment. The growing adoption of Artificial Intelligence (AI) and Machine Learning (ML) in product development and manufacturing presents opportunities for integrating AI-driven diagnostic capabilities within boundary scan platforms to further enhance fault prediction and root cause analysis. The increasing demand for advanced medical devices and wearables will necessitate highly reliable and miniaturized electronic testing solutions. Furthermore, the ongoing miniaturization of electronic components and the rise of System-in-Package (SiP) technologies will continue to drive the need for boundary scan's unique capabilities in testing interconnected internal components. The expansion into emerging markets with growing electronics manufacturing sectors also represents a significant growth avenue.

Major Players in the Boundary Scan Hardware Ecosystem

- JTAG Technologies

- CheckSum LLC

- Goepel Electronic

- ASSET InterTech

- Acculogic

- Flynn Systems

- XJTAG Limited

- EWA Technologies

- Keysight Technologies

- Teradyne

Key Developments in Boundary Scan Hardware Industry

- 2023 January: JTAG Technologies launches a new generation of boundary scan controllers with enhanced speed and pin count, catering to the increasing complexity of automotive ECUs.

- 2022 October: Keysight Technologies announces integration of advanced AI algorithms into its boundary scan test solutions, significantly improving fault diagnosis accuracy.

- 2022 July: Goepel Electronic showcases a new modular boundary scan platform designed for increased flexibility and scalability in high-volume manufacturing environments.

- 2021 December: ASSET InterTech unveils a cloud-based boundary scan test management system, enabling remote test execution and data analysis.

- 2021 May: CheckSum LLC introduces enhanced DFT advisor tools to assist engineers in designing for testability earlier in the product development cycle.

- 2020 November: Acculogic announces a strategic partnership with a leading semiconductor manufacturer to co-develop next-generation boundary scan solutions for advanced chip packages.

- 2020 February: XJTAG Limited releases updated software with improved support for testing embedded systems and FPGAs.

Strategic Boundary Scan Hardware Market Forecast

The strategic forecast for the Boundary Scan Hardware market anticipates sustained and robust growth driven by technological integration and the persistent demand for reliability. Future opportunities lie in the convergence of boundary scan with AI and ML for predictive diagnostics, the expansion into emerging markets with burgeoning electronics manufacturing, and the continuous need to test increasingly complex and miniaturized electronic components. The increasing emphasis on connected devices, autonomous systems, and stringent regulatory compliance across critical sectors will ensure boundary scan's indispensable role in product development and manufacturing, solidifying its market potential.

Boundary Scan Hardware Segmentation

-

1. Application

- 1.1. Medical

- 1.2. IT & Telecom

- 1.3. Consumer Electronics

- 1.4. Automotive Electronics

- 1.5. Defense

- 1.6. Others

-

2. Type

- 2.1. Automatic

- 2.2. Semi-automatic

Boundary Scan Hardware Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Boundary Scan Hardware REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.1% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Boundary Scan Hardware Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Medical

- 5.1.2. IT & Telecom

- 5.1.3. Consumer Electronics

- 5.1.4. Automotive Electronics

- 5.1.5. Defense

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Automatic

- 5.2.2. Semi-automatic

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Boundary Scan Hardware Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Medical

- 6.1.2. IT & Telecom

- 6.1.3. Consumer Electronics

- 6.1.4. Automotive Electronics

- 6.1.5. Defense

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Automatic

- 6.2.2. Semi-automatic

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Boundary Scan Hardware Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Medical

- 7.1.2. IT & Telecom

- 7.1.3. Consumer Electronics

- 7.1.4. Automotive Electronics

- 7.1.5. Defense

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Automatic

- 7.2.2. Semi-automatic

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Boundary Scan Hardware Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Medical

- 8.1.2. IT & Telecom

- 8.1.3. Consumer Electronics

- 8.1.4. Automotive Electronics

- 8.1.5. Defense

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Automatic

- 8.2.2. Semi-automatic

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Boundary Scan Hardware Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Medical

- 9.1.2. IT & Telecom

- 9.1.3. Consumer Electronics

- 9.1.4. Automotive Electronics

- 9.1.5. Defense

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Automatic

- 9.2.2. Semi-automatic

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Boundary Scan Hardware Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Medical

- 10.1.2. IT & Telecom

- 10.1.3. Consumer Electronics

- 10.1.4. Automotive Electronics

- 10.1.5. Defense

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Automatic

- 10.2.2. Semi-automatic

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 JTAG Technologies

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CheckSum LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Goepel Electronic

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ASSET InterTech

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Acculogic

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Flynn Systems

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 XJTAG Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 EWA Technologies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Keysight Technologies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Teradyne

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 JTAG Technologies

List of Figures

- Figure 1: Global Boundary Scan Hardware Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Boundary Scan Hardware Revenue (million), by Application 2024 & 2032

- Figure 3: North America Boundary Scan Hardware Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Boundary Scan Hardware Revenue (million), by Type 2024 & 2032

- Figure 5: North America Boundary Scan Hardware Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Boundary Scan Hardware Revenue (million), by Country 2024 & 2032

- Figure 7: North America Boundary Scan Hardware Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Boundary Scan Hardware Revenue (million), by Application 2024 & 2032

- Figure 9: South America Boundary Scan Hardware Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Boundary Scan Hardware Revenue (million), by Type 2024 & 2032

- Figure 11: South America Boundary Scan Hardware Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Boundary Scan Hardware Revenue (million), by Country 2024 & 2032

- Figure 13: South America Boundary Scan Hardware Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Boundary Scan Hardware Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Boundary Scan Hardware Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Boundary Scan Hardware Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Boundary Scan Hardware Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Boundary Scan Hardware Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Boundary Scan Hardware Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Boundary Scan Hardware Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Boundary Scan Hardware Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Boundary Scan Hardware Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Boundary Scan Hardware Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Boundary Scan Hardware Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Boundary Scan Hardware Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Boundary Scan Hardware Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Boundary Scan Hardware Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Boundary Scan Hardware Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Boundary Scan Hardware Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Boundary Scan Hardware Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Boundary Scan Hardware Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Boundary Scan Hardware Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Boundary Scan Hardware Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Boundary Scan Hardware Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Boundary Scan Hardware Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Boundary Scan Hardware Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Boundary Scan Hardware Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Boundary Scan Hardware Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Boundary Scan Hardware Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Boundary Scan Hardware Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Boundary Scan Hardware Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Boundary Scan Hardware Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Boundary Scan Hardware Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Boundary Scan Hardware Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Boundary Scan Hardware Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Boundary Scan Hardware Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Boundary Scan Hardware Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Boundary Scan Hardware Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Boundary Scan Hardware Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Boundary Scan Hardware Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Boundary Scan Hardware Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Boundary Scan Hardware?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Boundary Scan Hardware?

Key companies in the market include JTAG Technologies, CheckSum LLC, Goepel Electronic, ASSET InterTech, Acculogic, Flynn Systems, XJTAG Limited, EWA Technologies, Keysight Technologies, Teradyne.

3. What are the main segments of the Boundary Scan Hardware?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 367 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Boundary Scan Hardware," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Boundary Scan Hardware report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Boundary Scan Hardware?

To stay informed about further developments, trends, and reports in the Boundary Scan Hardware, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence