Key Insights

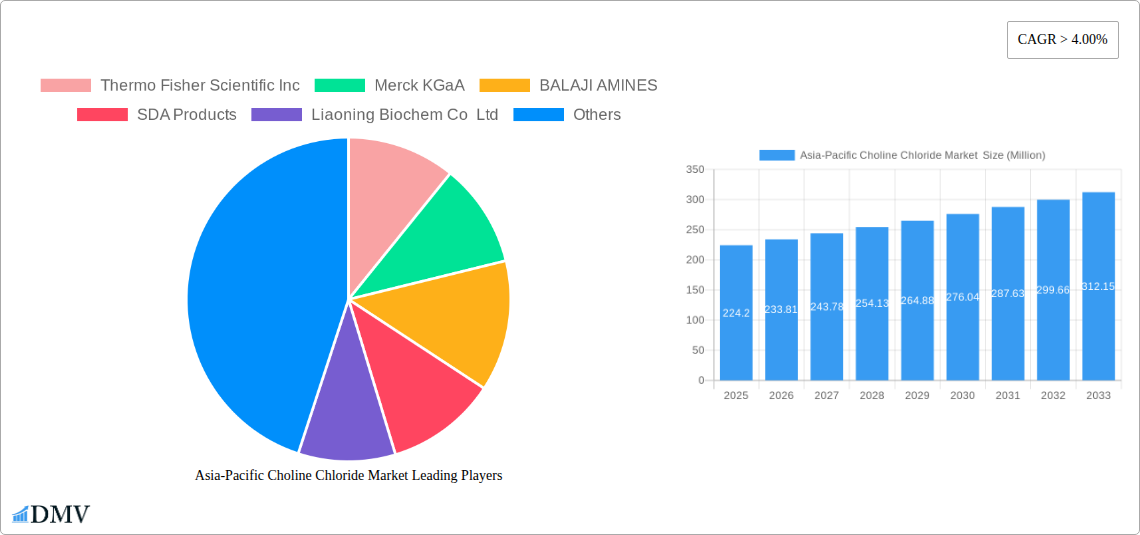

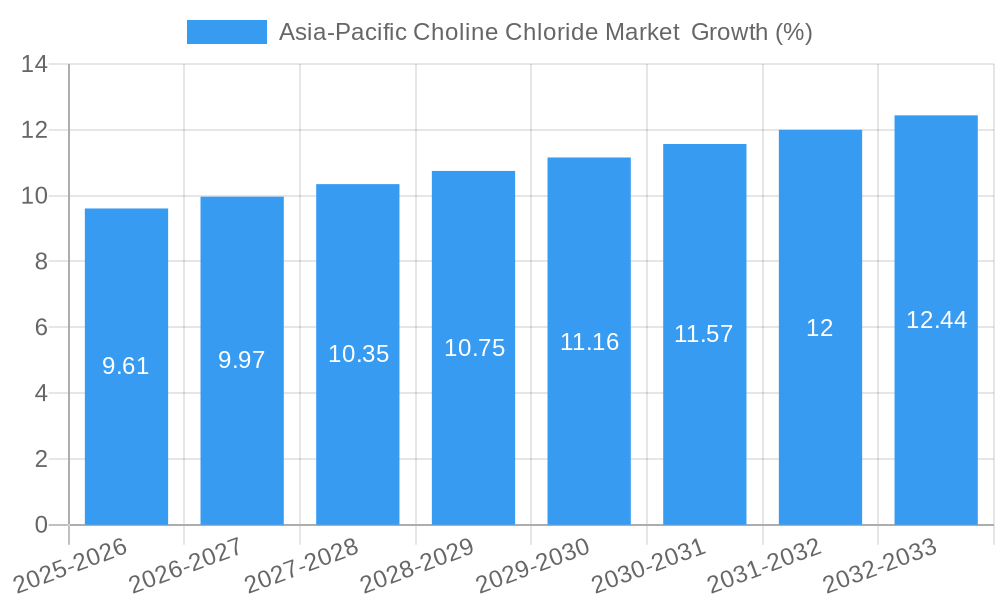

The Asia-Pacific choline chloride market, valued at $224.20 million in 2025, is projected to experience robust growth, exceeding a 4.00% CAGR from 2025 to 2033. This expansion is driven primarily by the burgeoning demand for animal feed, particularly in poultry and swine production, across the rapidly developing economies within the region. Increasing consumer awareness of animal welfare and the resulting focus on improved feed efficiency and animal health contribute significantly to market growth. Furthermore, the expanding pet food sector fuels additional demand for choline chloride as a vital nutrient in pet diets. The market also benefits from the growing human nutrition segment, where choline chloride is increasingly recognized for its role in cognitive function and liver health. Key players like Thermo Fisher Scientific, Merck KGaA, and BASF SE are strategically expanding their presence in the region to cater to this increasing demand, driving competition and innovation within the market. While regulatory hurdles and price fluctuations in raw materials pose potential challenges, the overall market outlook remains positive, driven by sustained growth across major application segments and increasing adoption across the Asia-Pacific region.

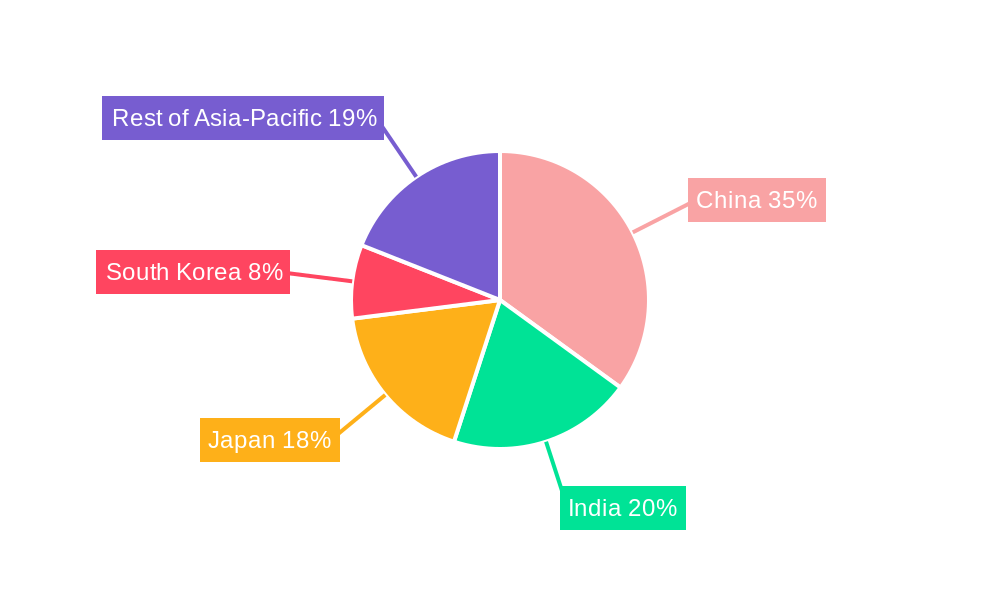

The significant growth potential within the Asia-Pacific market stems from factors like rising disposable incomes, changing dietary habits leading to higher meat consumption, and increasing investments in advanced animal farming techniques. China, India, and Japan are major contributors to the regional market size, with robust growth anticipated in emerging economies such as South Korea and Taiwan. The increasing focus on sustainable and efficient animal feed production, coupled with the rising demand for high-quality animal protein, further strengthens the market's positive trajectory. Continued research and development efforts focused on improving the efficacy and delivery methods of choline chloride are expected to further enhance market growth in the coming years. The presence of a diverse range of established and emerging players indicates a competitive yet dynamic market landscape ripe for further expansion.

Asia-Pacific Choline Chloride Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia-Pacific choline chloride market, offering valuable insights for stakeholders seeking to navigate this dynamic landscape. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report is meticulously crafted, incorporating comprehensive market sizing, growth forecasts, and competitive analysis, providing a 360° view of this crucial industry. The market is projected to reach xx Million by 2033, presenting significant opportunities for investment and growth.

Asia-Pacific Choline Chloride Market Composition & Trends

This section delves into the intricate composition of the Asia-Pacific choline chloride market, examining key trends shaping its trajectory. We analyze market concentration, identifying the leading players and their respective market shares. The report further explores innovation catalysts driving product development and application expansion, including advancements in feed formulation and bioprocessing technologies. A detailed assessment of the regulatory landscape, including variations across different countries in the Asia-Pacific region, is also included. The impact of substitute products and their potential to disrupt market share is thoroughly evaluated. End-user profiles are characterized, highlighting the distinct needs and preferences of various segments, from poultry and swine feed to human nutrition and other industrial applications. Finally, the report analyzes the landscape of mergers and acquisitions (M&A) within the industry, detailing significant deals and their influence on market consolidation and competitive dynamics. Market share distribution is analyzed, revealing concentration levels and dominant players. M&A deal values are also quantified where data is available. For example, in 2024, xx Million was invested in M&A activities.

- Market Concentration: High/Medium/Low (Specify based on data analysis) with top 5 players holding xx% market share.

- Innovation Catalysts: Advancements in feed formulation, bioprocessing, and sustainable production methods.

- Regulatory Landscape: Variations in regulations across different Asian countries impacting market access and product development.

- Substitute Products: Impact of alternative nutrient sources on market demand and growth projections.

- End-User Profiles: Detailed analysis of needs and purchasing behavior across diverse applications.

- M&A Activities: Overview of significant transactions and their impact on market structure.

Asia-Pacific Choline Chloride Market Industry Evolution

This section charts the evolution of the Asia-Pacific choline chloride market, tracing its growth trajectory and technological advancements over the study period (2019-2033). We analyze the historical period (2019-2024) and project market growth rates for the forecast period (2025-2033). The report pinpoints key technological advancements that have impacted production efficiency, product quality, and application diversification. Further, we analyze the shifting consumer demands and preferences, including the increasing focus on animal health, sustainable farming practices, and the growing demand for functional foods enriched with choline. The analysis incorporates specific data points on growth rates, adoption rates of new technologies, and shifts in end-user preferences, illustrating the market's dynamic evolution. For instance, the market exhibited a Compound Annual Growth Rate (CAGR) of xx% between 2019 and 2024, driven primarily by increased demand from the poultry feed segment. This growth is expected to continue, albeit at a potentially moderated pace, throughout the forecast period.

Leading Regions, Countries, or Segments in Asia-Pacific Choline Chloride Market

This section identifies the dominant region, country, and application segment within the Asia-Pacific choline chloride market. The detailed analysis evaluates factors contributing to the dominance of each leading segment.

- Poultry Feed: This segment is expected to be the largest due to the rapid growth of poultry farming in countries like China and India.

- Key Drivers: Rising poultry consumption, increasing disposable incomes, supportive government policies promoting livestock farming.

- Swine Feed: Strong demand driven by growing pork consumption and intensification of swine farming.

- Key Drivers: Increasing demand for pork, government support for the swine industry, advancements in swine feed formulations.

- Other dominant segments: (Analysis for Pet Feed, Human Nutrition, Oil and Gas, and Other Applications will be included here with similar structure)

(Detailed paragraph analysis for each segment's dominance factors will follow bullet points)

Asia-Pacific Choline Chloride Market Product Innovations

Recent product innovations have focused on enhancing the bioavailability, stability, and efficacy of choline chloride. Formulations offering improved delivery systems and enhanced nutritional value have gained traction. These advancements contribute to improved animal health, enhanced feed efficiency, and optimized production outcomes. Technological innovations such as microencapsulation and novel delivery systems are enhancing the efficacy and stability of choline chloride, leading to improved performance metrics in various applications.

Propelling Factors for Asia-Pacific Choline Chloride Market Growth

The Asia-Pacific choline chloride market is experiencing robust growth propelled by several key factors. Technological advancements in feed formulation and production processes are enhancing product quality and efficiency. Economic factors such as rising disposable incomes in several Asian countries drive increased consumption of animal products, fueling demand for choline chloride. Supportive government policies aimed at boosting livestock production and food security further contribute to market expansion. For instance, the Chinese government's initiatives to modernize its agricultural sector have significantly spurred demand for choline chloride in animal feed.

Obstacles in the Asia-Pacific Choline Chloride Market

Despite its strong growth potential, the Asia-Pacific choline chloride market faces several challenges. Fluctuations in raw material prices and supply chain disruptions pose a significant threat, potentially impacting production costs and market stability. Stricter environmental regulations in some countries may also limit production capacity and increase compliance costs. Intense competition among established and emerging players can lead to price wars and pressure profit margins.

Future Opportunities in Asia-Pacific Choline Chloride Market

The Asia-Pacific choline chloride market presents several promising opportunities for future growth. Expanding into new markets with growing livestock populations, such as Southeast Asian countries, presents significant potential. The development of novel choline chloride formulations with enhanced functionalities, such as improved bioavailability or targeted delivery, opens avenues for premium product offerings. Increasing consumer awareness of the health benefits of choline in human nutrition may also drive demand in the functional food and dietary supplement sectors.

Major Players in the Asia-Pacific Choline Chloride Market Ecosystem

- Thermo Fisher Scientific Inc

- Merck KGaA

- BALAJI AMINES

- SDA Products

- Liaoning Biochem Co Ltd

- Spectrum Chemical

- BASF SE

- NB Group Co Ltd

- IMPERIAL GROUP LIMITED

- Eastman Chemical Company

- Impextraco NV

- Tokyo Chemical Industry

- Kemin Industries Inc

- Balchem Inc

- Muby Chemicals Group

- Jubilant Life Sciences Limited

- GHW International

Key Developments in Asia-Pacific Choline Chloride Market Industry

- December 2022: Kemin Industries expands its production capacity for encapsulation ingredients with two new facilities and pilot plants, strengthening its position in the market. This development signals a significant investment in the choline chloride market and a focus on product innovation. The subsequent global customer event further highlights Kemin's commitment to the industry and its customer relationships.

Strategic Asia-Pacific Choline Chloride Market Forecast

The Asia-Pacific choline chloride market is poised for continued growth, driven by robust demand from the animal feed industry and expanding applications in human nutrition. Technological advancements and supportive government policies will further fuel market expansion. The market is expected to experience a CAGR of xx% during the forecast period (2025-2033), presenting significant opportunities for both established players and new entrants. Strategic investments in production capacity, product innovation, and market expansion will be crucial for success in this dynamic market.

Asia-Pacific Choline Chloride Market Segmentation

-

1. Application

- 1.1. Poultry Feed

- 1.2. Swine Feed

- 1.3. Pet Feed

- 1.4. Human Nutrition

- 1.5. Oil and Gas

- 1.6. Others

Asia-Pacific Choline Chloride Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia-Pacific Choline Chloride Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Growing Demand from the Poultry Industry; Increased Intake of Human Nutritional Supplements; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Outbreak of Animal Diseases; Other Restraints

- 3.4. Market Trends

- 3.4.1. Poultry Feed Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Choline Chloride Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Poultry Feed

- 5.1.2. Swine Feed

- 5.1.3. Pet Feed

- 5.1.4. Human Nutrition

- 5.1.5. Oil and Gas

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.2.2. India

- 5.2.3. Japan

- 5.2.4. South Korea

- 5.2.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. China Asia-Pacific Choline Chloride Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Poultry Feed

- 6.1.2. Swine Feed

- 6.1.3. Pet Feed

- 6.1.4. Human Nutrition

- 6.1.5. Oil and Gas

- 6.1.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. India Asia-Pacific Choline Chloride Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Poultry Feed

- 7.1.2. Swine Feed

- 7.1.3. Pet Feed

- 7.1.4. Human Nutrition

- 7.1.5. Oil and Gas

- 7.1.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Japan Asia-Pacific Choline Chloride Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Poultry Feed

- 8.1.2. Swine Feed

- 8.1.3. Pet Feed

- 8.1.4. Human Nutrition

- 8.1.5. Oil and Gas

- 8.1.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South Korea Asia-Pacific Choline Chloride Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Poultry Feed

- 9.1.2. Swine Feed

- 9.1.3. Pet Feed

- 9.1.4. Human Nutrition

- 9.1.5. Oil and Gas

- 9.1.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Rest of Asia Pacific Asia-Pacific Choline Chloride Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Poultry Feed

- 10.1.2. Swine Feed

- 10.1.3. Pet Feed

- 10.1.4. Human Nutrition

- 10.1.5. Oil and Gas

- 10.1.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. China Asia-Pacific Choline Chloride Market Analysis, Insights and Forecast, 2019-2031

- 12. Japan Asia-Pacific Choline Chloride Market Analysis, Insights and Forecast, 2019-2031

- 13. India Asia-Pacific Choline Chloride Market Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Asia-Pacific Choline Chloride Market Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Asia-Pacific Choline Chloride Market Analysis, Insights and Forecast, 2019-2031

- 16. Australia Asia-Pacific Choline Chloride Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Asia-Pacific Choline Chloride Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Thermo Fisher Scientific Inc

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Merck KGaA

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 BALAJI AMINES

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 SDA Products

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Liaoning Biochem Co Ltd

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Spectrum Chemical

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 BASF SE

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 NB Group Co Ltd

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 IMPERIAL GROUP LIMITED

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Eastman Chemical Company

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Impextraco NV

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.12 Tokyo Chemical Industry

- 18.2.12.1. Overview

- 18.2.12.2. Products

- 18.2.12.3. SWOT Analysis

- 18.2.12.4. Recent Developments

- 18.2.12.5. Financials (Based on Availability)

- 18.2.13 Kemin Industries Inc

- 18.2.13.1. Overview

- 18.2.13.2. Products

- 18.2.13.3. SWOT Analysis

- 18.2.13.4. Recent Developments

- 18.2.13.5. Financials (Based on Availability)

- 18.2.14 Balchem Inc

- 18.2.14.1. Overview

- 18.2.14.2. Products

- 18.2.14.3. SWOT Analysis

- 18.2.14.4. Recent Developments

- 18.2.14.5. Financials (Based on Availability)

- 18.2.15 Muby Chemicals Group

- 18.2.15.1. Overview

- 18.2.15.2. Products

- 18.2.15.3. SWOT Analysis

- 18.2.15.4. Recent Developments

- 18.2.15.5. Financials (Based on Availability)

- 18.2.16 Jubilant Life Sciences Limited

- 18.2.16.1. Overview

- 18.2.16.2. Products

- 18.2.16.3. SWOT Analysis

- 18.2.16.4. Recent Developments

- 18.2.16.5. Financials (Based on Availability)

- 18.2.17 GHW International

- 18.2.17.1. Overview

- 18.2.17.2. Products

- 18.2.17.3. SWOT Analysis

- 18.2.17.4. Recent Developments

- 18.2.17.5. Financials (Based on Availability)

- 18.2.1 Thermo Fisher Scientific Inc

List of Figures

- Figure 1: Asia-Pacific Choline Chloride Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Choline Chloride Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Choline Chloride Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Choline Chloride Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Choline Chloride Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Asia-Pacific Choline Chloride Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 5: Asia-Pacific Choline Chloride Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Choline Chloride Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 7: Asia-Pacific Choline Chloride Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Asia-Pacific Choline Chloride Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 9: China Asia-Pacific Choline Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: China Asia-Pacific Choline Chloride Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 11: Japan Asia-Pacific Choline Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Japan Asia-Pacific Choline Chloride Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: India Asia-Pacific Choline Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: India Asia-Pacific Choline Chloride Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: South Korea Asia-Pacific Choline Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South Korea Asia-Pacific Choline Chloride Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Taiwan Asia-Pacific Choline Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Taiwan Asia-Pacific Choline Chloride Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Australia Asia-Pacific Choline Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia-Pacific Choline Chloride Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia-Pacific Asia-Pacific Choline Chloride Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia-Pacific Asia-Pacific Choline Chloride Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Asia-Pacific Choline Chloride Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Asia-Pacific Choline Chloride Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 25: Asia-Pacific Choline Chloride Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Asia-Pacific Choline Chloride Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 27: Asia-Pacific Choline Chloride Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Asia-Pacific Choline Chloride Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 29: Asia-Pacific Choline Chloride Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Choline Chloride Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 31: Asia-Pacific Choline Chloride Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Asia-Pacific Choline Chloride Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 33: Asia-Pacific Choline Chloride Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Asia-Pacific Choline Chloride Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 35: Asia-Pacific Choline Chloride Market Revenue Million Forecast, by Application 2019 & 2032

- Table 36: Asia-Pacific Choline Chloride Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 37: Asia-Pacific Choline Chloride Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Asia-Pacific Choline Chloride Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 39: Asia-Pacific Choline Chloride Market Revenue Million Forecast, by Application 2019 & 2032

- Table 40: Asia-Pacific Choline Chloride Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 41: Asia-Pacific Choline Chloride Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Asia-Pacific Choline Chloride Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Choline Chloride Market ?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Asia-Pacific Choline Chloride Market ?

Key companies in the market include Thermo Fisher Scientific Inc, Merck KGaA, BALAJI AMINES, SDA Products, Liaoning Biochem Co Ltd, Spectrum Chemical, BASF SE, NB Group Co Ltd, IMPERIAL GROUP LIMITED, Eastman Chemical Company, Impextraco NV, Tokyo Chemical Industry, Kemin Industries Inc, Balchem Inc, Muby Chemicals Group, Jubilant Life Sciences Limited, GHW International.

3. What are the main segments of the Asia-Pacific Choline Chloride Market ?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 224.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Growing Demand from the Poultry Industry; Increased Intake of Human Nutritional Supplements; Other Drivers.

6. What are the notable trends driving market growth?

Poultry Feed Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Outbreak of Animal Diseases; Other Restraints.

8. Can you provide examples of recent developments in the market?

December 2022: Kemin Industries increased its production of encapsulation ingredients with two new facilities and added pilot plants for product development. Kemin Animal Nutrition and Health – EMENA (Europe, Middle East, North Africa) hosted a global customer event to inaugurate the new manufacturing plants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Choline Chloride Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Choline Chloride Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Choline Chloride Market ?

To stay informed about further developments, trends, and reports in the Asia-Pacific Choline Chloride Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence