Key Insights

The global Application Processors and System-on-Chip (SoC) market is poised for robust expansion, projected to reach an estimated $XXX million by 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% through 2033. This impressive trajectory is primarily fueled by the escalating demand across a diverse range of applications, including consumer electronics, industrial control systems, medical devices, and advanced communication equipment. The relentless innovation in mobile devices, smart home technology, and the burgeoning Internet of Things (IoT) ecosystem are significant drivers, pushing the need for more powerful, energy-efficient, and integrated processing solutions. Furthermore, the increasing complexity of modern electronics necessitates SoCs that can consolidate multiple functionalities onto a single chip, thereby reducing size, power consumption, and manufacturing costs. Emerging markets and the continuous digital transformation across industries are expected to further accelerate this growth, creating substantial opportunities for market players.

The market's dynamism is further shaped by key trends such as the growing adoption of AI and machine learning capabilities directly on edge devices, demanding specialized processing units within SoCs. The proliferation of 5G networks and the subsequent surge in data traffic are also critical catalysts, requiring sophisticated SoCs capable of handling high-speed connectivity and complex signal processing. While the market presents immense opportunities, certain restraints, such as the high research and development costs associated with advanced chip design and the intricate global supply chain, particularly in the face of geopolitical uncertainties, could pose challenges. However, the continuous innovation in semiconductor manufacturing and the strategic focus on developing specialized SoCs tailored to specific industry needs are expected to mitigate these restraints, ensuring sustained market vitality and growth throughout the forecast period.

This comprehensive report offers a deep dive into the dynamic global Application Processors and SOCs market, forecasting significant growth from 2025 to 2033 with a base year of 2025. Covering a historical period from 2019 to 2024, this analysis is indispensable for stakeholders seeking to understand the intricate landscape of high-performance integrated circuits that power modern electronic devices. We meticulously examine market trends, technological innovations, regional dominance, and the strategic initiatives of key players.

Application Processors and SOCs Market Composition & Trends

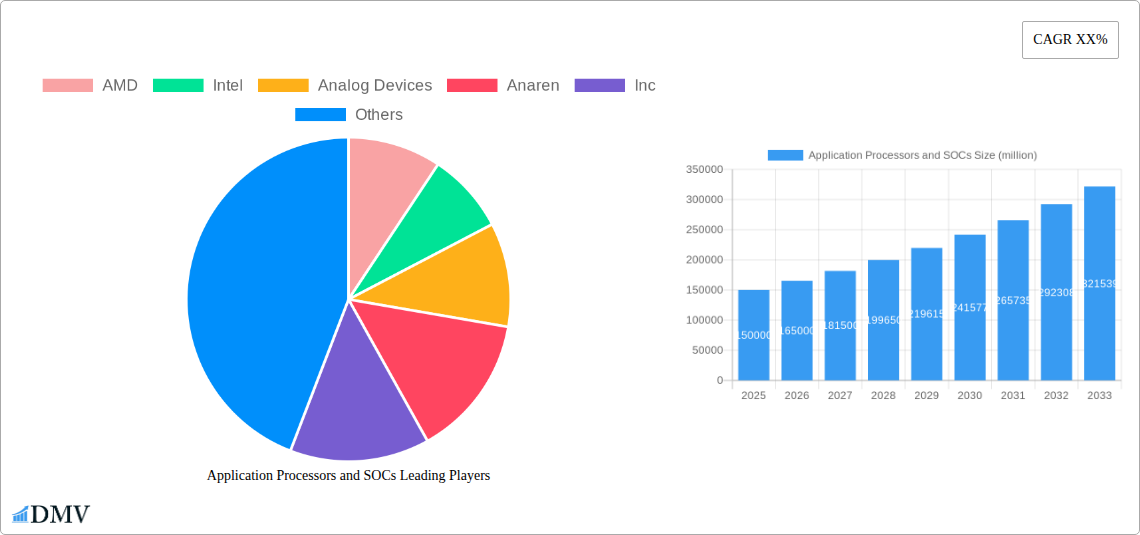

The Application Processors and SOCs market is characterized by a moderately concentrated landscape, with a few dominant players holding substantial market share, estimated at over 500 million units shipped annually. Innovation remains a key differentiator, driven by the relentless pursuit of enhanced processing power, reduced energy consumption, and specialized functionalities. Catalysts for this innovation include the burgeoning Internet of Things (IoT), the exponential growth of Artificial Intelligence (AI) and Machine Learning (ML), and the increasing demand for sophisticated Consumer Electronics and Communication Equipment.

Regulatory landscapes, while generally fostering innovation, also introduce compliance hurdles, particularly concerning power efficiency standards and data security. Substitute products, such as discrete component solutions, are gradually losing ground to the integrated power and cost-effectiveness of SOCs. End-user profiles are diverse, ranging from high-volume Consumer Electronics manufacturers requiring cost-effective yet powerful processors, to specialized sectors like Medical Electronics demanding ultra-low power and high reliability.

Mergers and acquisitions (M&A) are significant market shapers, with major deals valued in the billions of dollars frequently occurring as companies consolidate their portfolios and expand their technological capabilities. For instance, acquisitions in the embedded systems and connectivity segments are prevalent.

- Market Share Distribution: Leading companies account for an estimated 70% of the total market revenue.

- M&A Deal Values: Recent M&A activities have seen transactions ranging from 500 million to over 10 billion dollars, reflecting strategic consolidation.

- Innovation Catalysts: AI/ML integration, edge computing, 5G deployment, and the metaverse are driving R&D investments.

- Key End-User Segments: Consumer electronics represent the largest segment, followed by industrial and communication equipment.

Application Processors and SOCs Industry Evolution

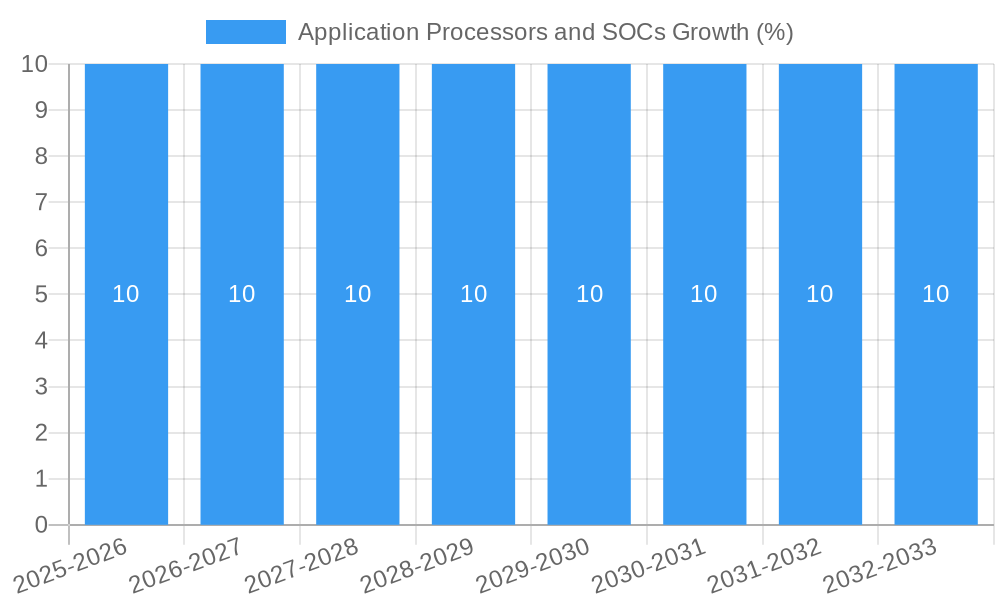

The Application Processors and SOCs industry has witnessed a remarkable evolution driven by technological advancements and shifting consumer demands. Over the historical period (2019-2024), we observed an average annual growth rate of approximately 8%, fueled by the widespread adoption of smartphones, tablets, and wearables. The forecast period (2025–2033) is projected to maintain a robust Compound Annual Growth Rate (CAGR) of around 7.5%, reaching an estimated market size of over 2 trillion dollars by 2033.

Technological advancements have been the primary engine of this growth. The transition to smaller process nodes, such as 7nm and 5nm, has enabled unprecedented levels of integration, higher clock speeds, and significant power efficiency improvements. This has paved the way for the proliferation of more powerful and feature-rich devices across all segments. Furthermore, the integration of dedicated hardware accelerators for AI and graphics processing has become a standard feature, catering to the increasing demand for intelligent and immersive user experiences.

Shifting consumer demands have also played a pivotal role. Consumers now expect their devices to be more connected, intelligent, and energy-efficient. This has driven the demand for Application Processors and SOCs that can support advanced connectivity standards like Wi-Fi 6/6E and 5G, process complex data locally (edge computing), and deliver extended battery life. The rise of the Internet of Things (IoT) has created a vast new market for specialized low-power SOCs designed for smart home devices, industrial sensors, and wearable technology.

The Industrial Control Electronics segment is experiencing rapid growth due to the increasing automation of manufacturing processes and the adoption of Industry 4.0 technologies. In Medical Electronics, the demand for highly integrated and reliable SOCs is driven by advancements in portable diagnostic equipment, remote patient monitoring systems, and implantable devices, where power consumption and miniaturization are critical.

- Market Growth Trajectory: Historical CAGR of 8%, projected CAGR of 7.5% (2025-2033).

- Technological Advancements: Transition to 5nm and 3nm process nodes, integration of AI/ML accelerators, improved power management units (PMUs).

- Consumer Demand Shifts: Increased demand for connectivity, AI capabilities, energy efficiency, and personalized user experiences.

- Adoption Metrics: Smartphone penetration at over 80%, IoT device shipments projected to exceed 50 billion by 2030.

Leading Regions, Countries, or Segments in Application Processors and SOCs

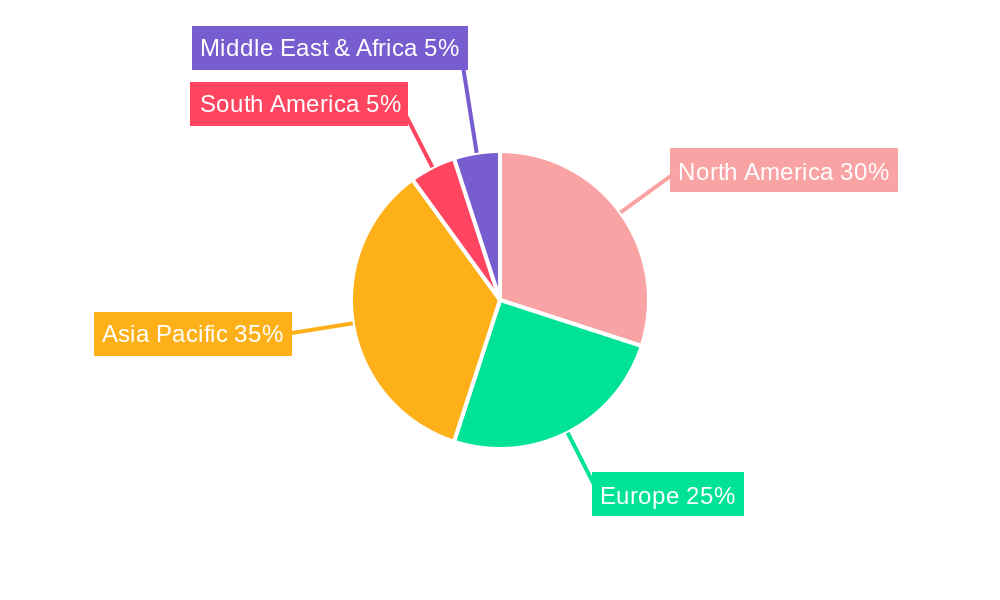

The Application Processors and SOCs market exhibits distinct regional and segment leadership driven by a confluence of investment, regulatory support, and end-user demand. Asia-Pacific stands as the dominant region, accounting for an estimated 55% of the global market share. This dominance is fueled by its robust manufacturing ecosystem, particularly in China and Taiwan, which are home to major foundries and assembly facilities, and its massive consumer electronics market.

Within the Application segments, Consumer Electronics continues to lead, driven by the ubiquitous demand for smartphones, laptops, and smart home devices. However, Industrial Control Electronics and Communication Equipment are exhibiting faster growth rates. The increasing adoption of automation in factories and the rollout of 5G infrastructure are key drivers for these segments, respectively. In the Types of SOCs, Flash memory-based solutions remain dominant due to their versatility and widespread use in embedded systems, but advancements in embedded RAM technologies are also significant.

North America and Europe represent significant markets, with strong demand for high-performance SOCs in advanced Medical Electronics and sophisticated Communication Equipment, including telecommunications infrastructure. The emphasis on innovation and stringent regulatory frameworks in these regions encourages the development of cutting-edge solutions.

- Dominant Region: Asia-Pacific, driven by manufacturing prowess and a massive consumer base.

- Leading Application Segment: Consumer Electronics, followed by Industrial Control Electronics and Communication Equipment.

- Key Type: Flash Memory SOCs, with growing importance of RREM for specific applications.

- North American & European Markets: Strong in Medical Electronics and advanced Communication Equipment, with a focus on innovation and regulatory compliance.

Application Processors and SOCs Product Innovations

Recent product innovations in Application Processors and SOCs are focused on enhancing performance-per-watt and integrating advanced functionalities. We are seeing a significant trend towards heterogeneous computing architectures, combining high-performance CPU cores with specialized accelerators for AI, graphics, and signal processing. For instance, new SOCs are incorporating dedicated neural processing units (NPUs) capable of performing billions of operations per second for on-device AI inferencing, enabling features like real-time object recognition and advanced voice assistants.

Furthermore, there's a strong emphasis on improving power management capabilities, with SOCs designed for ultra-low power consumption in battery-operated devices. Advanced power gating techniques and dynamic voltage and frequency scaling (DVFS) are becoming standard. Connectivity innovations include integrated support for the latest Wi-Fi and Bluetooth standards, as well as dedicated modems for 5G and future cellular technologies.

- Heterogeneous Computing: Integration of CPUs, GPUs, and dedicated AI/ML accelerators for enhanced performance.

- Power Efficiency: Advanced power management techniques and ultra-low power modes for extended battery life.

- Connectivity: Integrated support for Wi-Fi 6/6E, Bluetooth 5.x, and 5G/6G cellular technologies.

Propelling Factors for Application Processors and SOCs Growth

The Application Processors and SOCs market is propelled by several key factors. Technologically, the relentless miniaturization of semiconductor manufacturing processes (e.g., 3nm and below) enables greater integration density, leading to more powerful and feature-rich SOCs at competitive price points. The increasing demand for AI and ML capabilities at the edge, driven by applications in autonomous driving, smart cities, and predictive maintenance, is a significant growth catalyst. Economic factors, such as the growing middle class in emerging economies and the increasing disposable income available for consumer electronics, also contribute to market expansion.

Regulatory influences, while sometimes posing challenges, can also drive growth by mandating energy efficiency standards, which encourage the development of more power-optimized SOCs. The proliferation of the Internet of Things (IoT) ecosystem, with billions of connected devices requiring intelligent processing, is a fundamental driver.

- Semiconductor Advancements: Continued progress in process node technology (e.g., sub-7nm) allowing for greater integration and performance.

- AI & ML Adoption: Escalating demand for on-device AI processing across consumer, industrial, and automotive sectors.

- IoT Expansion: Exponential growth in connected devices necessitating embedded intelligence.

- Emerging Market Growth: Increasing consumer spending on electronic devices in developing economies.

Obstacles in the Application Processors and SOCs Market

Despite robust growth, the Application Processors and SOCs market faces several obstacles. Supply chain disruptions, particularly semiconductor shortages, have significantly impacted production volumes and led to price volatility, with some critical components experiencing lead times of over 50 weeks. Geopolitical tensions and trade disputes can create uncertainty and affect global manufacturing and distribution networks, potentially increasing the cost of raw materials by up to 15%.

Intense competition among established players and emerging entrants leads to price pressures, squeezing profit margins for some product categories. The high cost of research and development (R&D) for cutting-edge silicon manufacturing can be a barrier to entry for smaller companies. Furthermore, increasingly stringent environmental regulations concerning manufacturing waste and energy consumption add to operational costs.

- Semiconductor Shortages: Persistent supply chain bottlenecks impacting production capacity.

- Geopolitical Instability: Trade wars and international relations creating market uncertainty.

- High R&D Costs: Significant investments required for advanced chip design and manufacturing.

- Regulatory Hurdles: Evolving environmental and safety standards increasing compliance burdens.

Future Opportunities in Application Processors and SOCs

The future of the Application Processors and SOCs market is rife with opportunities. The burgeoning fields of Extended Reality (XR), including augmented reality (AR) and virtual reality (VR), will demand highly specialized SOCs capable of rendering complex graphics and processing vast amounts of sensor data in real-time, creating a market estimated to grow by over 30% annually. The widespread adoption of autonomous vehicles will drive demand for powerful and secure SOCs with advanced sensor fusion and AI capabilities, expected to reach a market value exceeding 100 billion dollars by 2030.

The continued expansion of the IoT, particularly in industrial automation (Industry 4.0) and smart healthcare, will create sustained demand for low-power, high-reliability SOCs. Furthermore, the development of next-generation communication networks (6G) will necessitate new generations of SOCs with enhanced processing and connectivity features. The increasing focus on sustainability will also drive demand for energy-efficient SOCs.

- Extended Reality (XR): Demand for high-performance SOCs for AR/VR applications.

- Autonomous Systems: Growth in automotive, robotics, and drones requiring advanced AI and sensor processing.

- Smart Healthcare: Increased demand for wearable health monitors and remote diagnostics.

- 6G Communication: Development of new SOCs to support next-generation wireless technologies.

Major Players in the Application Processors and SOCs Ecosystem

- AMD

- Intel

- Analog Devices

- Anaren, Inc.

- Arrow Development Tools

- Cypress Semiconductor

- Digi International

- Infineon Technologies AG

- Intersil

- Lantronix

- Lattice Semiconductor

- MaxLinear, Inc.

- MediaTek

- Microchip Technology

- Nordic Semiconductor

Key Developments in Application Processors and SOCs Industry

- 2023/Q4: Qualcomm announces Snapdragon X Elite, a new line of ARM-based processors for Windows PCs, promising significant performance gains.

- 2024/Q1: NVIDIA unveils new AI-focused SOCs for edge computing applications, enhancing its presence in the industrial and automotive sectors.

- 2024/Q2: Intel introduces its next-generation mobile processors with improved integrated graphics and AI acceleration capabilities.

- 2024/Q3: MediaTek expands its portfolio of 5G modems and chipsets for smartphones and IoT devices.

- 2024/Q4: Analog Devices acquires a specialized power management company, strengthening its integrated SOC offerings.

Strategic Application Processors and SOCs Market Forecast

- 2023/Q4: Qualcomm announces Snapdragon X Elite, a new line of ARM-based processors for Windows PCs, promising significant performance gains.

- 2024/Q1: NVIDIA unveils new AI-focused SOCs for edge computing applications, enhancing its presence in the industrial and automotive sectors.

- 2024/Q2: Intel introduces its next-generation mobile processors with improved integrated graphics and AI acceleration capabilities.

- 2024/Q3: MediaTek expands its portfolio of 5G modems and chipsets for smartphones and IoT devices.

- 2024/Q4: Analog Devices acquires a specialized power management company, strengthening its integrated SOC offerings.

Strategic Application Processors and SOCs Market Forecast

The strategic Application Processors and SOCs market forecast indicates sustained robust growth, driven by ongoing technological innovation and expanding application domains. The increasing integration of AI and machine learning at the edge, coupled with the continuous advancements in process technology, will fuel the development of more powerful, energy-efficient, and feature-rich SOCs. Emerging markets and new applications such as Extended Reality and autonomous systems present significant untapped potential. Companies that can effectively navigate supply chain challenges and focus on delivering differentiated solutions with a strong emphasis on power efficiency and specialized functionalities will be well-positioned for success in the coming years, with the market projected to exceed 2 trillion dollars in value.

Application Processors and SOCs Segmentation

-

1. Application

- 1.1. Consumer Electronics

- 1.2. Industrial Control Electronics

- 1.3. Medical Electronics

- 1.4. Communication Equipment

- 1.5. Other

-

2. Types

- 2.1. EEPROM

- 2.2. Flash

- 2.3. ROM

- 2.4. ROMLESS

- 2.5. RREM

Application Processors and SOCs Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Application Processors and SOCs REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Application Processors and SOCs Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Consumer Electronics

- 5.1.2. Industrial Control Electronics

- 5.1.3. Medical Electronics

- 5.1.4. Communication Equipment

- 5.1.5. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. EEPROM

- 5.2.2. Flash

- 5.2.3. ROM

- 5.2.4. ROMLESS

- 5.2.5. RREM

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Application Processors and SOCs Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Consumer Electronics

- 6.1.2. Industrial Control Electronics

- 6.1.3. Medical Electronics

- 6.1.4. Communication Equipment

- 6.1.5. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. EEPROM

- 6.2.2. Flash

- 6.2.3. ROM

- 6.2.4. ROMLESS

- 6.2.5. RREM

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Application Processors and SOCs Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Consumer Electronics

- 7.1.2. Industrial Control Electronics

- 7.1.3. Medical Electronics

- 7.1.4. Communication Equipment

- 7.1.5. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. EEPROM

- 7.2.2. Flash

- 7.2.3. ROM

- 7.2.4. ROMLESS

- 7.2.5. RREM

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Application Processors and SOCs Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Consumer Electronics

- 8.1.2. Industrial Control Electronics

- 8.1.3. Medical Electronics

- 8.1.4. Communication Equipment

- 8.1.5. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. EEPROM

- 8.2.2. Flash

- 8.2.3. ROM

- 8.2.4. ROMLESS

- 8.2.5. RREM

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Application Processors and SOCs Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Consumer Electronics

- 9.1.2. Industrial Control Electronics

- 9.1.3. Medical Electronics

- 9.1.4. Communication Equipment

- 9.1.5. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. EEPROM

- 9.2.2. Flash

- 9.2.3. ROM

- 9.2.4. ROMLESS

- 9.2.5. RREM

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Application Processors and SOCs Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Consumer Electronics

- 10.1.2. Industrial Control Electronics

- 10.1.3. Medical Electronics

- 10.1.4. Communication Equipment

- 10.1.5. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. EEPROM

- 10.2.2. Flash

- 10.2.3. ROM

- 10.2.4. ROMLESS

- 10.2.5. RREM

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 AMD

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Intel

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Analog Devices

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Anaren

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ArrowDevelopment Tools

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CypressSemiconductor

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Digi Internationa

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 infineonTechnologies AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Intersil

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Lantronix

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LatticeSemiconductor

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Maxlinear

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Mediatek

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Microchipechnology

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 NordicSemiconductor

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 AMD

List of Figures

- Figure 1: Global Application Processors and SOCs Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Application Processors and SOCs Revenue (million), by Application 2024 & 2032

- Figure 3: North America Application Processors and SOCs Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Application Processors and SOCs Revenue (million), by Types 2024 & 2032

- Figure 5: North America Application Processors and SOCs Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Application Processors and SOCs Revenue (million), by Country 2024 & 2032

- Figure 7: North America Application Processors and SOCs Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Application Processors and SOCs Revenue (million), by Application 2024 & 2032

- Figure 9: South America Application Processors and SOCs Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Application Processors and SOCs Revenue (million), by Types 2024 & 2032

- Figure 11: South America Application Processors and SOCs Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Application Processors and SOCs Revenue (million), by Country 2024 & 2032

- Figure 13: South America Application Processors and SOCs Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Application Processors and SOCs Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Application Processors and SOCs Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Application Processors and SOCs Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Application Processors and SOCs Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Application Processors and SOCs Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Application Processors and SOCs Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Application Processors and SOCs Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Application Processors and SOCs Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Application Processors and SOCs Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Application Processors and SOCs Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Application Processors and SOCs Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Application Processors and SOCs Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Application Processors and SOCs Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Application Processors and SOCs Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Application Processors and SOCs Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Application Processors and SOCs Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Application Processors and SOCs Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Application Processors and SOCs Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Application Processors and SOCs Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Application Processors and SOCs Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Application Processors and SOCs Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Application Processors and SOCs Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Application Processors and SOCs Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Application Processors and SOCs Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Application Processors and SOCs Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Application Processors and SOCs Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Application Processors and SOCs Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Application Processors and SOCs Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Application Processors and SOCs Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Application Processors and SOCs Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Application Processors and SOCs Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Application Processors and SOCs Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Application Processors and SOCs Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Application Processors and SOCs Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Application Processors and SOCs Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Application Processors and SOCs Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Application Processors and SOCs Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Application Processors and SOCs Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Application Processors and SOCs?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Application Processors and SOCs?

Key companies in the market include AMD, Intel, Analog Devices, Anaren, Inc, ArrowDevelopment Tools, CypressSemiconductor, Digi Internationa, infineonTechnologies AG, Intersil, Lantronix, LatticeSemiconductor, Maxlinear, Inc, Mediatek, Microchipechnology, NordicSemiconductor.

3. What are the main segments of the Application Processors and SOCs?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Application Processors and SOCs," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Application Processors and SOCs report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Application Processors and SOCs?

To stay informed about further developments, trends, and reports in the Application Processors and SOCs, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence