Key Insights

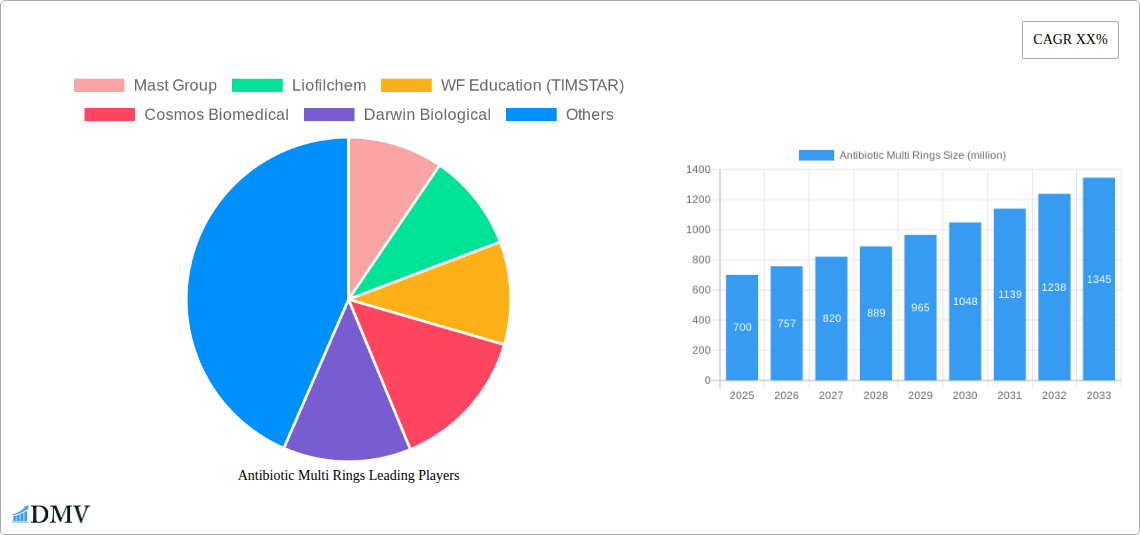

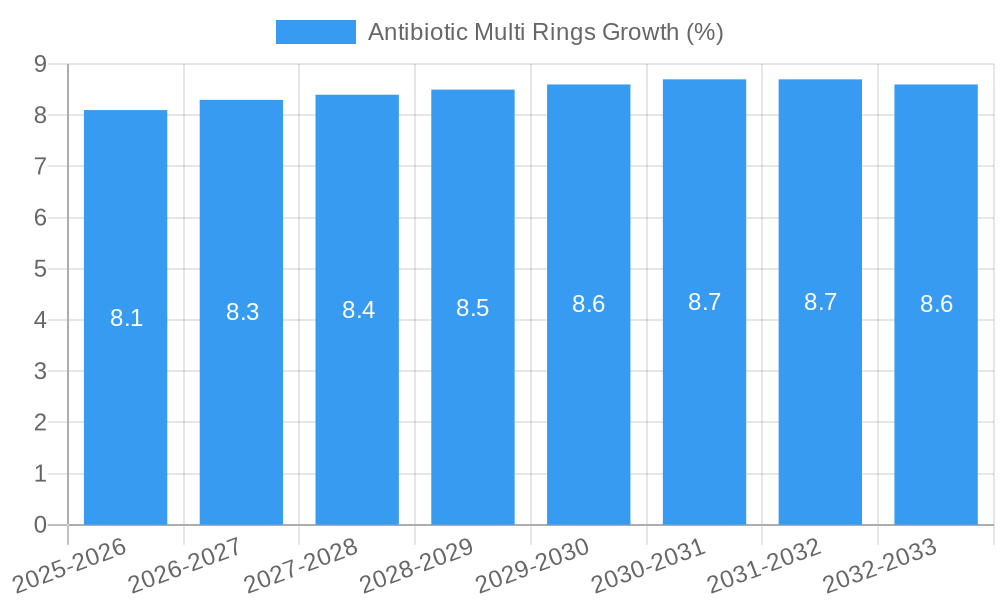

The global Antibiotic Multi Rings market is poised for significant expansion, estimated to reach approximately $700 million in 2025 and projected to grow at a robust Compound Annual Growth Rate (CAGR) of 8.5% through 2033. This substantial growth trajectory is primarily fueled by the escalating demand for effective antimicrobial susceptibility testing (AST) solutions across the biotechnology and pharmaceutical sectors. The increasing prevalence of antibiotic-resistant bacteria worldwide necessitates advanced diagnostic tools, positioning antibiotic multi rings as critical components in identifying appropriate treatment regimens. Research institutions are also a key driver, leveraging these products for crucial studies in antimicrobial discovery and resistance mechanisms.

Several factors are contributing to this optimistic market outlook. The continuous innovation in the development of novel antibiotic multi ring formulations, offering broader spectrum coverage and enhanced sensitivity, is a significant trend. Furthermore, the increasing global focus on combating infectious diseases and the subsequent rise in healthcare spending, particularly in emerging economies, are creating lucrative opportunities. However, the market is not without its challenges. Stringent regulatory approval processes for new diagnostic products and the high cost associated with advanced laboratory equipment can act as restraints. Nevertheless, the overwhelming need for accurate and rapid identification of bacterial pathogens and their antibiotic sensitivities will likely outweigh these limitations, ensuring sustained market growth.

Sure, here is an SEO-optimized, insightful report description for Antibiotic Multi Rings:

Antibiotic Multi Rings Market Composition & Trends

The global Antibiotic Multi Rings market, valued at an estimated $xx million in 2025, exhibits a moderate concentration with key players like Mast Group, Liofilchem, WF Education (TIMSTAR), Cosmos Biomedical, Darwin Biological, Blades Biological Ltd, Merck, HIMEDIA, Thermo Fisher Scientific, and Flinn Scientific driving innovation. The study period from 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, reveals a dynamic landscape shaped by advancements in biotechnology companies and pharmaceutical companies. Regulatory landscapes, particularly concerning antibiotic resistance and quality control, play a crucial role in market evolution. While substitute products exist in the broader antimicrobial testing space, the specificity and reliability of multi-rings for identifying a spectrum of antibiotics remain paramount. End-users, predominantly research institutions, are increasingly demanding standardized, cost-effective, and easy-to-use solutions. Merger and acquisition activities, though not extensively documented in terms of specific deal values for this niche segment, are expected to contribute to market consolidation and further innovation. The market share distribution, with an estimated $xx million in 2025, is influenced by the adoption rates of various antibiotic types, including Ampicillin, Chloramphenicol, Erythromycin, Cefoxitin, Penicillin, Streptomycin, Sulphafurazole, and Tetracycline.

- Market Concentration: Moderate, with a few prominent global suppliers.

- Innovation Catalysts: Growing need for rapid and accurate antibiotic susceptibility testing, coupled with advancements in microbiological techniques.

- Regulatory Landscapes: Stringent quality control measures and evolving guidelines for antibiotic use and testing.

- Substitute Products: Broader antimicrobial susceptibility testing methods, but multi-rings offer specific advantages for targeted antibiotic identification.

- End-User Profiles: Primarily research laboratories, quality control departments in pharmaceutical and biotech firms, and academic institutions.

- M&A Activities: Expected to influence market structure and drive technological integration.

Antibiotic Multi Rings Industry Evolution

The Antibiotic Multi Rings industry is poised for significant evolution between 2019 and 2033, with the base year of 2025 serving as a crucial benchmark for understanding current market dynamics and future trajectories. Throughout the historical period of 2019–2024, the market witnessed steady growth driven by an increasing global focus on combating antimicrobial resistance (AMR) and the persistent need for accurate identification of antibiotic effectiveness. This period saw incremental advancements in the manufacturing processes of antibiotic multi-rings, leading to improved stability, uniformity, and shelf-life. The adoption of these testing discs by biotechnology companies, pharmaceutical companies, and research institutions became more widespread as they recognized their value in drug discovery, quality assurance, and academic research. The market growth rate during this historical phase averaged around xx% annually, reflecting a stable demand from established sectors.

Looking ahead into the forecast period of 2025–2033, the Antibiotic Multi Rings market is projected to experience a more accelerated growth trajectory, estimated at an average annual growth rate of xx% from the 2025 base year value of $xx million. This enhanced growth is fueled by several key factors. Technological advancements are expected to play a pivotal role, with manufacturers investing in developing multi-rings with a broader spectrum of antibiotic combinations, enhanced sensitivity, and improved ease of use. This includes the integration of more precise manufacturing techniques to ensure consistent zone of inhibition and accurate interpretation for a wider array of antibiotics such as Ampicillin, Chloramphenicol, Erythromycin, Cefoxitin, Penicillin, Streptomycin, Sulphafurazole, and Tetracycline. Shifting consumer demands, particularly from research institutions and pharmaceutical R&D departments, are leaning towards more standardized, cost-effective, and high-throughput testing solutions. The rise in infectious diseases and the ever-present threat of drug-resistant pathogens will further necessitate the continuous development and application of reliable antibiotic susceptibility testing methods, making antibiotic multi-rings an indispensable tool. The increasing global health expenditure and the growing emphasis on evidence-based treatment protocols will also contribute significantly to the sustained demand for these essential diagnostic aids. Furthermore, the expansion of diagnostic capabilities in developing economies and the increasing accessibility of laboratory infrastructure in emerging markets are anticipated to open up new avenues for market penetration and growth. The consistent innovation from leading companies like Mast Group, Liofilchem, and Thermo Fisher Scientific will continue to shape the industry's evolution, ensuring that antibiotic multi-rings remain at the forefront of microbiological testing.

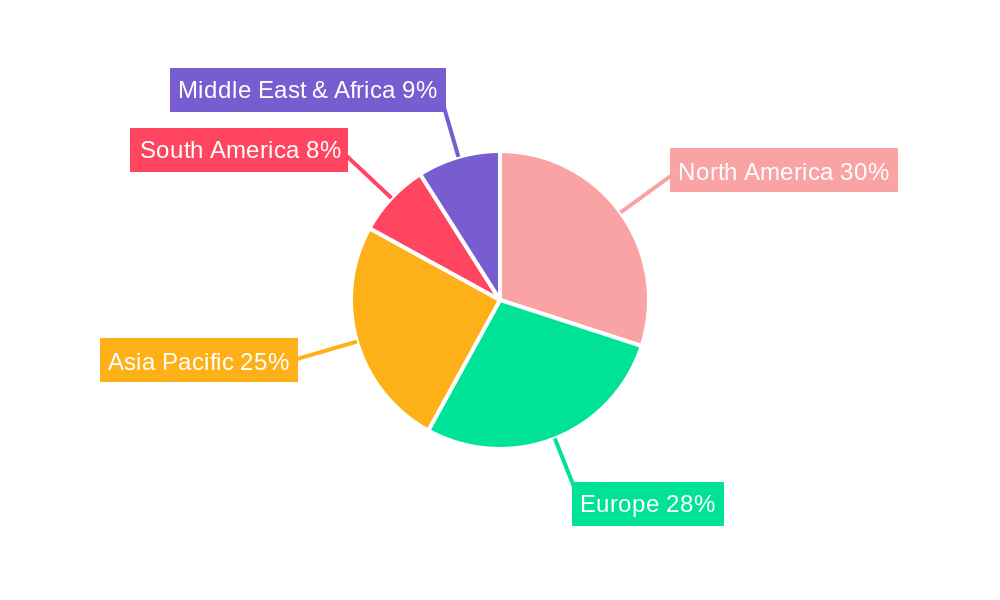

Leading Regions, Countries, or Segments in Antibiotic Multi Rings

The global Antibiotic Multi Rings market exhibits distinct regional dominance and segment preferences, with North America and Europe currently leading the charge, driven by robust pharmaceutical and biotechnology sectors and high research and development investments. These regions benefit from a strong presence of key application segments like Biotechnology Companies, Pharmaceutical Companies, and Research Institutions, all of which are significant consumers of antibiotic multi-rings for their extensive research, drug development, and quality control operations. The demand for specific antibiotic types such as Ampicillin, Chloramphenicol, Erythromycin, Cefoxitin, Penicillin, Streptomycin, Sulphafurazole, and Tetracycline is consistently high in these advanced economies due to the prevalence of various infectious diseases and the need for precise antibiotic susceptibility testing.

Key drivers contributing to the dominance of these regions include:

- Investment Trends: Significant government and private sector funding in life sciences research and pharmaceutical innovation, estimated in the billions of dollars annually, directly translates into increased demand for laboratory consumables like antibiotic multi-rings.

- Regulatory Support: Favorable regulatory environments and robust quality assurance frameworks in North America and Europe encourage the adoption of standardized and high-quality diagnostic tools.

- Technological Adoption: Early and widespread adoption of advanced laboratory equipment and methodologies by research institutions and pharmaceutical companies ensures a continuous demand for cutting-edge testing solutions.

- Prevalence of Infectious Diseases: A persistent challenge posed by various bacterial infections necessitates continuous monitoring and identification of effective antibiotic treatments.

Asia Pacific is emerging as a significant growth frontier, with countries like China and India showing substantial increases in pharmaceutical manufacturing and biotechnology research. Increased healthcare spending and a growing focus on public health initiatives are bolstering the demand for antibiotic testing solutions in this region. Latin America and the Middle East & Africa are also showing promising growth potential, albeit from a smaller base, as healthcare infrastructure develops and access to diagnostic tools improves. The Pharmaceutical Companies segment, in particular, is a major driver across all regions, relying on antibiotic multi-rings for critical antibiotic resistance profiling during drug development and post-market surveillance. Similarly, Research Institutions are pivotal, utilizing these discs for academic research into microbial pathogenesis, drug discovery, and the fundamental understanding of antibiotic mechanisms. Biotechnology Companies are increasingly integrating these tools into their workflows for the development of novel therapeutics and diagnostic platforms. The sustained demand for specific antibiotic types reflects their continued importance in clinical practice and research.

Antibiotic Multi Rings Product Innovations

Recent product innovations in Antibiotic Multi Rings are focused on enhancing diagnostic accuracy and user convenience. Manufacturers are developing multi-rings with a broader spectrum of antibiotics, offering more comprehensive susceptibility testing in a single disc. Advanced formulations ensure improved diffusion characteristics, leading to clearer and more reproducible zones of inhibition, crucial for accurate interpretation by research institutions and pharmaceutical companies. Furthermore, innovations are emerging in packaging to extend shelf-life and maintain product integrity, alongside the development of discs with specific antibiotic combinations tailored for emerging resistant strains. The incorporation of color-coding for enhanced identification and simplified workflow integration into automated laboratory systems are also key unique selling propositions.

Propelling Factors for Antibiotic Multi Rings Growth

The growth of the Antibiotic Multi Rings market is propelled by a confluence of critical factors. The escalating global concern over antimicrobial resistance (AMR) is a primary driver, necessitating robust and reliable methods for antibiotic susceptibility testing. Technological advancements in microbiological techniques and manufacturing processes allow for the creation of more accurate and standardized multi-rings. Economic factors, including increased healthcare expenditure in both developed and developing nations, contribute to greater accessibility of diagnostic tools for pharmaceutical companies and research institutions. Regulatory bodies worldwide are emphasizing stringent quality control and the judicious use of antibiotics, further boosting the demand for precise testing solutions.

Obstacles in the Antibiotic Multi Rings Market

Despite its growth potential, the Antibiotic Multi Rings market faces several obstacles. Stringent regulatory approval processes in various regions can delay the introduction of new products and variations. Supply chain disruptions, particularly those impacting the availability of raw materials or specialized manufacturing components, can lead to production bottlenecks and increased costs. Intense competition among a growing number of manufacturers, including established players like Mast Group and Thermo Fisher Scientific, can exert downward pressure on pricing. Furthermore, the increasing development of alternative, more automated antibiotic susceptibility testing methods could pose a competitive threat in the long term, although multi-rings currently offer a cost-effective and accessible solution for many applications.

Future Opportunities in Antibiotic Multi Rings

The future of the Antibiotic Multi Rings market is rich with opportunities. The emergence of novel antibiotic-resistant bacterial strains globally presents an ongoing need for an expanding array of antibiotic combinations on multi-rings. Expansion into emerging economies with developing healthcare infrastructure offers significant market penetration potential. Collaborations between manufacturers and biotechnology companies or research institutions can lead to the development of highly specialized multi-rings for niche research applications or the identification of specific pathogens. The growing emphasis on rapid point-of-care diagnostics could also spur innovation in creating user-friendly, quick-result multi-ring formats.

Major Players in the Antibiotic Multi Rings Ecosystem

- Mast Group

- Liofilchem

- WF Education (TIMSTAR)

- Cosmos Biomedical

- Darwin Biological

- Blades Biological Ltd

- Merck

- HIMEDIA

- Thermo Fisher Scientific

- Flinn Scientific

- Liofilchem S.r.l.

Key Developments in Antibiotic Multi Rings Industry

- 2023/Q4: Launch of enhanced multi-rings with broader spectrum antibiotic coverage by leading manufacturers.

- 2024/Q1: Increased investment in research for novel antibiotic combinations to combat emerging resistant pathogens.

- 2024/Q2: Collaborations between diagnostic companies and research institutions to develop customized multi-ring solutions for specific studies.

- 2024/Q3: Focus on improving the shelf-life and stability of antibiotic multi-rings through advanced packaging technologies.

Strategic Antibiotic Multi Rings Market Forecast

The strategic forecast for the Antibiotic Multi Rings market anticipates sustained growth driven by the relentless global battle against antimicrobial resistance. Key opportunities lie in the continuous development of novel antibiotic combinations to address evolving pathogens and the expansion of market reach into underserved regions. Innovations in user-friendliness and integration with digital laboratory workflows will be crucial for maintaining competitive advantage. The market's resilience is underpinned by its role as a fundamental tool for pharmaceutical companies, biotechnology companies, and research institutions, ensuring its continued relevance and expansion throughout the forecast period.

Antibiotic Multi Rings Segmentation

-

1. Application

- 1.1. Biotechnology Companies

- 1.2. Pharmaceutical Companies

- 1.3. Research Institutions

-

2. Types

- 2.1. Ampicillin

- 2.2. Chloramphenicol

- 2.3. Erythromycin

- 2.4. Cefoxitin

- 2.5. Penicillin

- 2.6. Streptomycin

- 2.7. Sulphafurazole

- 2.8. Tetracycline

Antibiotic Multi Rings Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Antibiotic Multi Rings REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Antibiotic Multi Rings Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Biotechnology Companies

- 5.1.2. Pharmaceutical Companies

- 5.1.3. Research Institutions

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Ampicillin

- 5.2.2. Chloramphenicol

- 5.2.3. Erythromycin

- 5.2.4. Cefoxitin

- 5.2.5. Penicillin

- 5.2.6. Streptomycin

- 5.2.7. Sulphafurazole

- 5.2.8. Tetracycline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Antibiotic Multi Rings Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Biotechnology Companies

- 6.1.2. Pharmaceutical Companies

- 6.1.3. Research Institutions

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Ampicillin

- 6.2.2. Chloramphenicol

- 6.2.3. Erythromycin

- 6.2.4. Cefoxitin

- 6.2.5. Penicillin

- 6.2.6. Streptomycin

- 6.2.7. Sulphafurazole

- 6.2.8. Tetracycline

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Antibiotic Multi Rings Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Biotechnology Companies

- 7.1.2. Pharmaceutical Companies

- 7.1.3. Research Institutions

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Ampicillin

- 7.2.2. Chloramphenicol

- 7.2.3. Erythromycin

- 7.2.4. Cefoxitin

- 7.2.5. Penicillin

- 7.2.6. Streptomycin

- 7.2.7. Sulphafurazole

- 7.2.8. Tetracycline

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Antibiotic Multi Rings Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Biotechnology Companies

- 8.1.2. Pharmaceutical Companies

- 8.1.3. Research Institutions

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Ampicillin

- 8.2.2. Chloramphenicol

- 8.2.3. Erythromycin

- 8.2.4. Cefoxitin

- 8.2.5. Penicillin

- 8.2.6. Streptomycin

- 8.2.7. Sulphafurazole

- 8.2.8. Tetracycline

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Antibiotic Multi Rings Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Biotechnology Companies

- 9.1.2. Pharmaceutical Companies

- 9.1.3. Research Institutions

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Ampicillin

- 9.2.2. Chloramphenicol

- 9.2.3. Erythromycin

- 9.2.4. Cefoxitin

- 9.2.5. Penicillin

- 9.2.6. Streptomycin

- 9.2.7. Sulphafurazole

- 9.2.8. Tetracycline

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Antibiotic Multi Rings Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Biotechnology Companies

- 10.1.2. Pharmaceutical Companies

- 10.1.3. Research Institutions

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Ampicillin

- 10.2.2. Chloramphenicol

- 10.2.3. Erythromycin

- 10.2.4. Cefoxitin

- 10.2.5. Penicillin

- 10.2.6. Streptomycin

- 10.2.7. Sulphafurazole

- 10.2.8. Tetracycline

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Mast Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Liofilchem

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 WF Education (TIMSTAR)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cosmos Biomedical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Darwin Biological

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Blades Biological Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Merck

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 HIMEDIA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Thermo Fisher Scientific

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Flinn Scientific

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Liofilchem S.r.l.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Mast Group

List of Figures

- Figure 1: Global Antibiotic Multi Rings Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Antibiotic Multi Rings Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Antibiotic Multi Rings Revenue (million), by Application 2024 & 2032

- Figure 4: North America Antibiotic Multi Rings Volume (K), by Application 2024 & 2032

- Figure 5: North America Antibiotic Multi Rings Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Antibiotic Multi Rings Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Antibiotic Multi Rings Revenue (million), by Types 2024 & 2032

- Figure 8: North America Antibiotic Multi Rings Volume (K), by Types 2024 & 2032

- Figure 9: North America Antibiotic Multi Rings Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Antibiotic Multi Rings Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Antibiotic Multi Rings Revenue (million), by Country 2024 & 2032

- Figure 12: North America Antibiotic Multi Rings Volume (K), by Country 2024 & 2032

- Figure 13: North America Antibiotic Multi Rings Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Antibiotic Multi Rings Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Antibiotic Multi Rings Revenue (million), by Application 2024 & 2032

- Figure 16: South America Antibiotic Multi Rings Volume (K), by Application 2024 & 2032

- Figure 17: South America Antibiotic Multi Rings Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Antibiotic Multi Rings Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Antibiotic Multi Rings Revenue (million), by Types 2024 & 2032

- Figure 20: South America Antibiotic Multi Rings Volume (K), by Types 2024 & 2032

- Figure 21: South America Antibiotic Multi Rings Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Antibiotic Multi Rings Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Antibiotic Multi Rings Revenue (million), by Country 2024 & 2032

- Figure 24: South America Antibiotic Multi Rings Volume (K), by Country 2024 & 2032

- Figure 25: South America Antibiotic Multi Rings Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Antibiotic Multi Rings Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Antibiotic Multi Rings Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Antibiotic Multi Rings Volume (K), by Application 2024 & 2032

- Figure 29: Europe Antibiotic Multi Rings Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Antibiotic Multi Rings Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Antibiotic Multi Rings Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Antibiotic Multi Rings Volume (K), by Types 2024 & 2032

- Figure 33: Europe Antibiotic Multi Rings Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Antibiotic Multi Rings Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Antibiotic Multi Rings Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Antibiotic Multi Rings Volume (K), by Country 2024 & 2032

- Figure 37: Europe Antibiotic Multi Rings Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Antibiotic Multi Rings Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Antibiotic Multi Rings Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Antibiotic Multi Rings Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Antibiotic Multi Rings Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Antibiotic Multi Rings Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Antibiotic Multi Rings Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Antibiotic Multi Rings Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Antibiotic Multi Rings Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Antibiotic Multi Rings Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Antibiotic Multi Rings Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Antibiotic Multi Rings Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Antibiotic Multi Rings Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Antibiotic Multi Rings Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Antibiotic Multi Rings Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Antibiotic Multi Rings Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Antibiotic Multi Rings Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Antibiotic Multi Rings Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Antibiotic Multi Rings Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Antibiotic Multi Rings Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Antibiotic Multi Rings Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Antibiotic Multi Rings Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Antibiotic Multi Rings Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Antibiotic Multi Rings Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Antibiotic Multi Rings Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Antibiotic Multi Rings Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Antibiotic Multi Rings Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Antibiotic Multi Rings Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Antibiotic Multi Rings Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Antibiotic Multi Rings Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Antibiotic Multi Rings Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Antibiotic Multi Rings Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Antibiotic Multi Rings Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Antibiotic Multi Rings Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Antibiotic Multi Rings Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Antibiotic Multi Rings Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Antibiotic Multi Rings Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Antibiotic Multi Rings Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Antibiotic Multi Rings Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Antibiotic Multi Rings Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Antibiotic Multi Rings Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Antibiotic Multi Rings Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Antibiotic Multi Rings Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Antibiotic Multi Rings Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Antibiotic Multi Rings Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Antibiotic Multi Rings Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Antibiotic Multi Rings Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Antibiotic Multi Rings Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Antibiotic Multi Rings Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Antibiotic Multi Rings Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Antibiotic Multi Rings Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Antibiotic Multi Rings Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Antibiotic Multi Rings Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Antibiotic Multi Rings Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Antibiotic Multi Rings Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Antibiotic Multi Rings Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Antibiotic Multi Rings Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Antibiotic Multi Rings Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Antibiotic Multi Rings Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Antibiotic Multi Rings Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Antibiotic Multi Rings Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Antibiotic Multi Rings Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Antibiotic Multi Rings Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Antibiotic Multi Rings Volume K Forecast, by Country 2019 & 2032

- Table 81: China Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Antibiotic Multi Rings Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Antibiotic Multi Rings Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Antibiotic Multi Rings?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Antibiotic Multi Rings?

Key companies in the market include Mast Group, Liofilchem, WF Education (TIMSTAR), Cosmos Biomedical, Darwin Biological, Blades Biological Ltd, Merck, HIMEDIA, Thermo Fisher Scientific, Flinn Scientific, Liofilchem S.r.l..

3. What are the main segments of the Antibiotic Multi Rings?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Antibiotic Multi Rings," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Antibiotic Multi Rings report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Antibiotic Multi Rings?

To stay informed about further developments, trends, and reports in the Antibiotic Multi Rings, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence