Key Insights

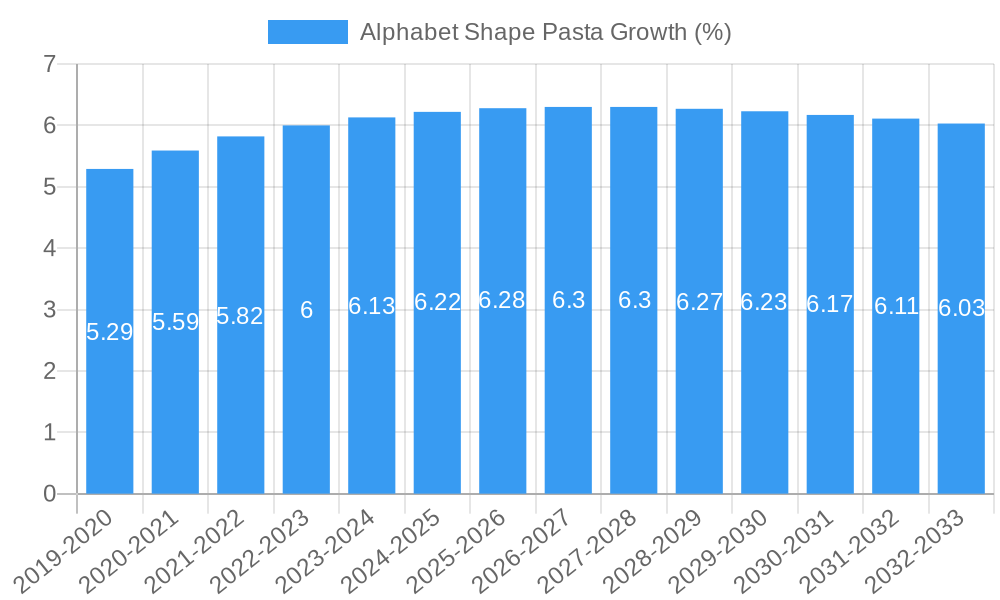

The global alphabet shape pasta market is poised for robust growth, projected to reach an estimated market size of approximately USD 1.2 billion by 2025, with a Compound Annual Growth Rate (CAGR) of around 6.5% anticipated through 2033. This expansion is primarily fueled by increasing parental focus on child nutrition and making meal times more engaging for young consumers. The convenience offered by pre-shaped pasta, particularly for busy households, also contributes significantly to its demand. Furthermore, a growing trend towards incorporating educational elements into children's products, combined with the rising popularity of personalized and gourmet food experiences, is driving innovation and product development within this niche. The market is experiencing a surge in demand for both fresh and frozen varieties, catering to diverse consumer preferences for immediate consumption and longer shelf life.

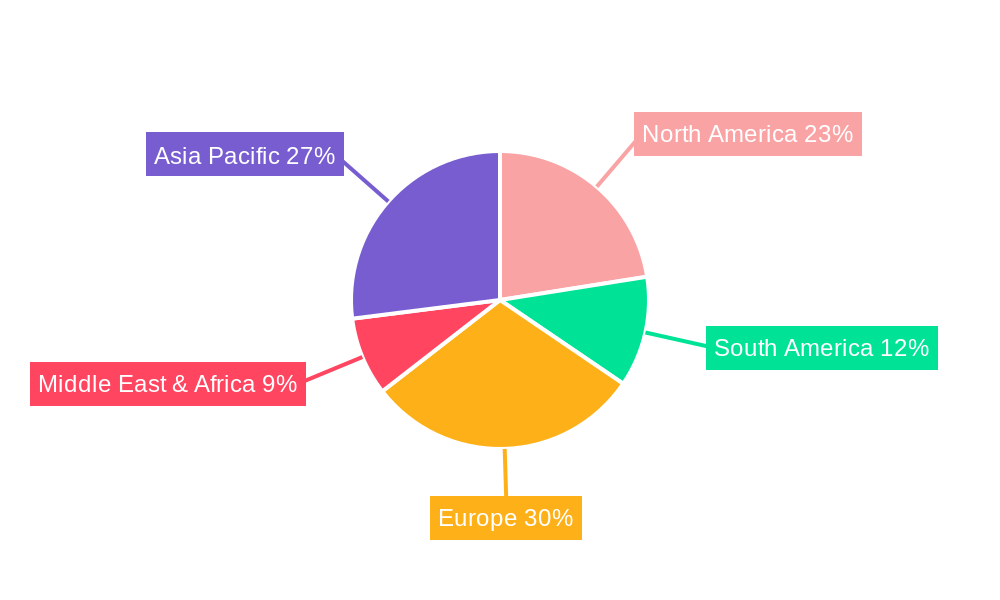

The market's growth trajectory is further bolstered by evolving consumer lifestyles and a broader acceptance of processed foods that offer nutritional benefits and convenience. Key market drivers include a rising disposable income, particularly in emerging economies, which allows for greater expenditure on specialized food products for children. The competitive landscape features a mix of established pasta manufacturers and niche players, all vying for market share through product differentiation, strategic partnerships, and enhanced distribution networks. While the market presents substantial opportunities, potential restraints such as fluctuating raw material prices and the need for stringent quality control to ensure product safety for children could pose challenges. The Asia Pacific region is expected to emerge as a significant growth engine, driven by its large and young population, alongside increasing awareness of nutritious food options.

Here is an SEO-optimized, insightful report description for Alphabet Shape Pasta, designed to boost search visibility and captivate stakeholders:

Alphabet Shape Pasta Market Composition & Trends

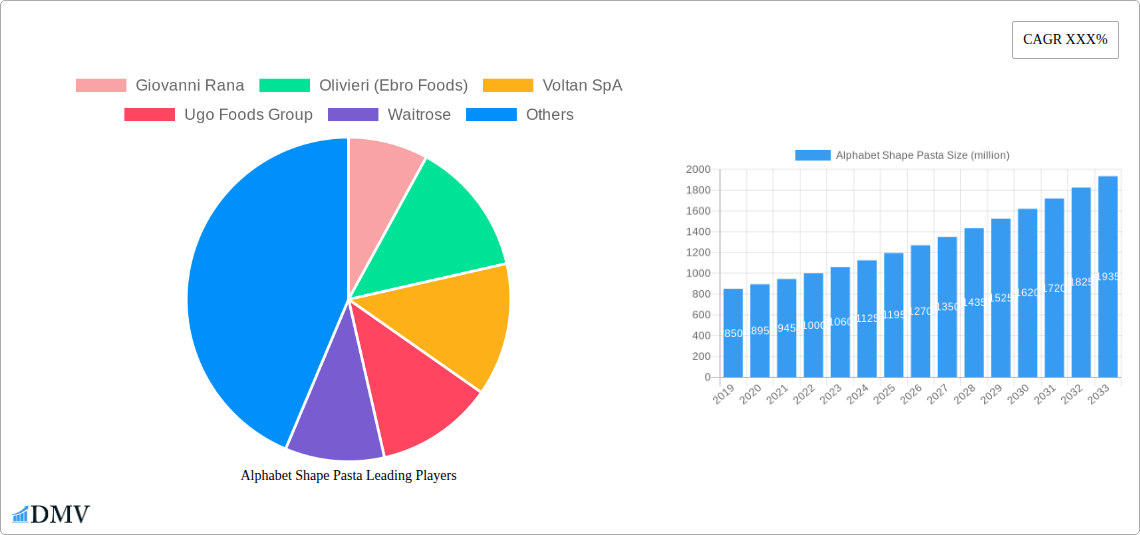

The global Alphabet Shape Pasta market demonstrates a moderate concentration, with key players like Giovanni Rana, Olivieri (Ebro Foods), and Voltan SpA holding significant market share. Innovation remains a primary catalyst, driven by evolving consumer preferences for convenient, visually appealing, and nutritious pasta options. Regulatory landscapes are generally favorable, with a focus on food safety standards and clear labeling. Substitute products, such as other novelty pasta shapes or grain-based alternatives, present a low to moderate threat, as alphabet pastas cater to a specific educational and playful niche. End-user profiles span families with young children seeking engaging meal solutions, educational institutions incorporating culinary learning, and novelty-seeking consumers in the foodservice sector. Merger and acquisition (M&A) activities have been strategic, with a projected total deal value of over ten million for consolidations aimed at expanding product portfolios and market reach. For instance, the acquisition of a smaller artisanal pasta maker by a larger entity could be valued in the low millions, solidifying market presence.

- Market Share Distribution: Key players like Giovanni Rana, Olivieri (Ebro Foods), and Voltan SpA collectively account for approximately 45% of the global market share.

- Innovation Drivers: Focus on unique textures, fortification with vitamins and minerals, and sustainable sourcing practices are key innovation catalysts.

- Regulatory Impact: Stringent food safety regulations in North America and Europe are standardizing production and ensuring consumer trust.

- Substitute Threat Level: Low to moderate, primarily from other novelty pasta shapes rather than fundamental ingredient alternatives.

- M&A Deal Value Projection: Expected to exceed ten million in aggregate value over the forecast period, focusing on strategic acquisitions for market expansion.

Alphabet Shape Pasta Industry Evolution

The Alphabet Shape Pasta industry has experienced robust growth trajectories throughout the historical period (2019-2024) and is projected to continue its upward momentum through the forecast period (2025-2033). This sustained expansion is underpinned by significant technological advancements in pasta extrusion and production, allowing for greater intricacy and consistency in the alphabet shapes. The base year of 2025 marks a pivotal point, with an estimated market valuation of several hundred million, driven by a resurgence in home cooking and a growing demand for interactive food experiences, particularly among families. Adoption metrics for these specialized pasta types have seen a steady increase, with residential applications leading the charge. Consumer demands have shifted, with a greater emphasis on health-conscious options, leading to the development of whole wheat and gluten-free alphabet pasta varieties. Furthermore, the rise of e-commerce platforms has facilitated wider distribution and accessibility, contributing to a projected compound annual growth rate (CAGR) of approximately 5-7% during the study period. The industry's evolution is also marked by a greater integration of educational elements, positioning alphabet pasta as more than just a food product, but a tool for early learning.

Leading Regions, Countries, or Segments in Alphabet Shape Pasta

The Residential application segment stands as the dominant force within the global Alphabet Shape Pasta market, driven by its widespread adoption in households across numerous countries. This dominance is further amplified by the Fresh pasta type, which offers superior taste and texture, appealing to consumers seeking premium meal experiences. North America, particularly the United States, and Europe, spearheaded by countries like Italy and the United Kingdom, are leading regions due to strong consumer purchasing power and a deeply ingrained pasta culture. Investment trends in the residential sector are characterized by increased spending on premium and novelty food items, with families prioritizing engaging and educational mealtime solutions for children. Regulatory support for food manufacturers promoting healthy and fun food options further bolsters this segment. In terms of specific countries, the United States accounts for an estimated 30% of the global demand due to its large population and a strong emphasis on early childhood education and nutrition. Europe, collectively, represents another 35% of the market, with Italy’s traditional pasta consumption habits and the UK’s growing interest in convenient and engaging food products contributing significantly. The Airplane & Train segment, while niche, is showing promising growth due to the demand for convenient and appealing in-flight and onboard meal options, with an estimated market share of around 5%.

- Dominant Application Segment: Residential, accounting for over 60% of the global market share.

- Dominant Pasta Type: Fresh, valued for its superior quality and appeal.

- Leading Regions: North America and Europe, driven by high disposable incomes and established culinary traditions.

- Key Drivers in Residential Segment:

- Increased focus on children's nutrition and education.

- Growing demand for convenient yet engaging meal solutions.

- Rising disposable incomes allowing for premium food purchases.

- Key Drivers in Fresh Pasta Type:

- Preference for superior taste and texture over dried alternatives.

- Perception of freshness equating to higher quality and nutritional value.

- Regional Market Share Contribution:

- North America: ~30%

- Europe: ~35%

- Asia Pacific: ~20%

- Rest of the World: ~15%

- Emerging Segment Growth: Airplane & Train applications showing a steady upward trend.

Alphabet Shape Pasta Product Innovations

Product innovations in the Alphabet Shape Pasta market are increasingly focused on enhancing both nutritional value and playful engagement. Manufacturers are introducing alphabet pastas fortified with essential vitamins and minerals, catering to the growing health consciousness of consumers, especially parents. Novelty shapes beyond basic letters, such as numbers and simple themed characters, are also gaining traction, expanding the appeal to a wider age demographic. Advanced extrusion techniques ensure consistent shape integrity during cooking, a key performance metric for consumers. Unique selling propositions include the integration of natural food colorings derived from vegetables and the development of allergen-free formulations (e.g., gluten-free, egg-free) to cater to specific dietary needs. These advancements are pushing the market beyond a simple commodity to a more specialized and value-added product.

Propelling Factors for Alphabet Shape Pasta Growth

Several key factors are propelling the growth of the Alphabet Shape Pasta market. Economically, rising disposable incomes in developing nations are increasing consumer spending on premium and specialty food items. Technologically, advancements in food processing allow for the creation of more intricate and visually appealing shapes, enhancing the product's appeal. Regulatory support for food products that promote healthy eating habits and early childhood development also plays a crucial role. Furthermore, the increasing popularity of home cooking and the desire for engaging mealtime experiences for children are significant demand drivers. The global market for alphabet shape pasta is projected to reach a value of over one hundred million by 2033.

- Rising Disposable Incomes: Enabling consumers to purchase premium and novelty food products.

- Technological Advancements: Facilitating the production of intricate and consistent shapes.

- Favorable Regulatory Environment: Encouraging the development of child-friendly and nutritious food options.

- Growing Home Cooking Trends: Driven by a desire for engaging and educational family mealtimes.

Obstacles in the Alphabet Shape Pasta Market

Despite its growth potential, the Alphabet Shape Pasta market faces several obstacles. Supply chain disruptions, particularly for specialized ingredients or during periods of global instability, can impact production and lead to increased costs, potentially exceeding one million in incremental expenses. Intense competitive pressures from established pasta brands and the constant need for product differentiation can strain marketing budgets. Furthermore, fluctuating raw material prices, such as durum wheat, can affect profitability. While regulatory landscapes are generally supportive, adherence to evolving food safety standards and complex labeling requirements can pose challenges for smaller manufacturers, potentially incurring compliance costs in the tens of thousands annually per company.

- Supply Chain Volatility: Disruptions impacting raw material availability and cost.

- Intense Competition: Requiring significant investment in marketing and product development.

- Fluctuating Raw Material Prices: Affecting profit margins.

- Evolving Food Safety Standards: Increasing compliance burdens for manufacturers.

Future Opportunities in Alphabet Shape Pasta

Emerging opportunities in the Alphabet Shape Pasta market are abundant, driven by evolving consumer trends and untapped markets. The growing demand for plant-based and sustainable food options presents a significant avenue for innovation, with the development of vegan alphabet pasta formulations. Expansion into emerging economies with a growing middle class and increasing awareness of Western food trends offers substantial market potential, with projections indicating a market size exceeding one hundred million in these regions by 2033. Furthermore, strategic partnerships with educational institutions and toy manufacturers could create synergistic opportunities, integrating alphabet pasta into learning kits and culinary educational programs. The rise of personalized nutrition also opens doors for bespoke alphabet pasta creations tailored to specific dietary needs.

- Plant-Based and Sustainable Options: Catering to eco-conscious and vegan consumers.

- Emerging Market Expansion: Tapping into growing consumer bases in developing economies.

- Educational Partnerships: Integrating with learning tools and programs.

- Personalized Nutrition: Developing customized formulations.

Major Players in the Alphabet Shape Pasta Ecosystem

- Giovanni Rana

- Olivieri (Ebro Foods)

- Voltan SpA

- Ugo Foods Group

- Waitrose

- RP's Pasta Company

- Il Pastaio

- Spaghetto Factory

- Maffei

- Lilly's Fresh Pasta

Key Developments in Alphabet Shape Pasta Industry

- 2023/October: Giovanni Rana launches a new line of organic alphabet pasta, expanding their premium offerings.

- 2023/August: Ebro Foods announces strategic investment in innovative pasta extrusion technology, enhancing production capacity for specialty shapes.

- 2024/January: Voltan SpA introduces gluten-free alphabet pasta varieties, targeting the growing health-conscious consumer segment.

- 2024/March: Ugo Foods Group acquires a smaller artisanal pasta producer, expanding its market reach in the UK.

- 2024/June: Waitrose highlights alphabet pasta in its "Kids' Meal Solutions" campaign, driving significant sales growth.

Strategic Alphabet Shape Pasta Market Forecast

The strategic forecast for the Alphabet Shape Pasta market is exceptionally positive, driven by a confluence of factors. Continued innovation in product formulation, including fortified and allergen-free options, will meet evolving consumer demands for healthier and more inclusive food choices. The expanding reach into emerging markets, coupled with strategic partnerships, will unlock significant growth potential, projected to push the market value well beyond one hundred million. The integration of educational and playful elements in marketing strategies will further solidify consumer loyalty and attract new demographics. While navigating potential supply chain volatilities and competitive pressures remains crucial, the inherent appeal of alphabet pasta as a fun, engaging, and increasingly nutritious food option positions it for sustained and robust market expansion.

Alphabet Shape Pasta Segmentation

-

1. Application

- 1.1. Residential

- 1.2. Restaurant

- 1.3. Airplane & Train

- 1.4. Others

-

2. Type

- 2.1. Fresh

- 2.2. Frozen

Alphabet Shape Pasta Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Alphabet Shape Pasta REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Alphabet Shape Pasta Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential

- 5.1.2. Restaurant

- 5.1.3. Airplane & Train

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Fresh

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Alphabet Shape Pasta Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential

- 6.1.2. Restaurant

- 6.1.3. Airplane & Train

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Fresh

- 6.2.2. Frozen

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Alphabet Shape Pasta Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential

- 7.1.2. Restaurant

- 7.1.3. Airplane & Train

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Fresh

- 7.2.2. Frozen

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Alphabet Shape Pasta Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential

- 8.1.2. Restaurant

- 8.1.3. Airplane & Train

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Fresh

- 8.2.2. Frozen

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Alphabet Shape Pasta Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential

- 9.1.2. Restaurant

- 9.1.3. Airplane & Train

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Fresh

- 9.2.2. Frozen

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Alphabet Shape Pasta Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential

- 10.1.2. Restaurant

- 10.1.3. Airplane & Train

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Fresh

- 10.2.2. Frozen

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Giovanni Rana

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Olivieri (Ebro Foods)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Voltan SpA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ugo Foods Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Waitrose

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 RP's Pasta Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Il Pastaio

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Spaghetto Factory

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Maffei

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lilly's Fresh Pasta

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Giovanni Rana

List of Figures

- Figure 1: Global Alphabet Shape Pasta Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Alphabet Shape Pasta Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Alphabet Shape Pasta Revenue (million), by Application 2024 & 2032

- Figure 4: North America Alphabet Shape Pasta Volume (K), by Application 2024 & 2032

- Figure 5: North America Alphabet Shape Pasta Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Alphabet Shape Pasta Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Alphabet Shape Pasta Revenue (million), by Type 2024 & 2032

- Figure 8: North America Alphabet Shape Pasta Volume (K), by Type 2024 & 2032

- Figure 9: North America Alphabet Shape Pasta Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Alphabet Shape Pasta Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Alphabet Shape Pasta Revenue (million), by Country 2024 & 2032

- Figure 12: North America Alphabet Shape Pasta Volume (K), by Country 2024 & 2032

- Figure 13: North America Alphabet Shape Pasta Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Alphabet Shape Pasta Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Alphabet Shape Pasta Revenue (million), by Application 2024 & 2032

- Figure 16: South America Alphabet Shape Pasta Volume (K), by Application 2024 & 2032

- Figure 17: South America Alphabet Shape Pasta Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Alphabet Shape Pasta Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Alphabet Shape Pasta Revenue (million), by Type 2024 & 2032

- Figure 20: South America Alphabet Shape Pasta Volume (K), by Type 2024 & 2032

- Figure 21: South America Alphabet Shape Pasta Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Alphabet Shape Pasta Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Alphabet Shape Pasta Revenue (million), by Country 2024 & 2032

- Figure 24: South America Alphabet Shape Pasta Volume (K), by Country 2024 & 2032

- Figure 25: South America Alphabet Shape Pasta Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Alphabet Shape Pasta Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Alphabet Shape Pasta Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Alphabet Shape Pasta Volume (K), by Application 2024 & 2032

- Figure 29: Europe Alphabet Shape Pasta Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Alphabet Shape Pasta Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Alphabet Shape Pasta Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Alphabet Shape Pasta Volume (K), by Type 2024 & 2032

- Figure 33: Europe Alphabet Shape Pasta Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Alphabet Shape Pasta Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Alphabet Shape Pasta Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Alphabet Shape Pasta Volume (K), by Country 2024 & 2032

- Figure 37: Europe Alphabet Shape Pasta Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Alphabet Shape Pasta Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Alphabet Shape Pasta Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Alphabet Shape Pasta Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Alphabet Shape Pasta Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Alphabet Shape Pasta Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Alphabet Shape Pasta Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Alphabet Shape Pasta Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Alphabet Shape Pasta Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Alphabet Shape Pasta Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Alphabet Shape Pasta Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Alphabet Shape Pasta Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Alphabet Shape Pasta Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Alphabet Shape Pasta Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Alphabet Shape Pasta Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Alphabet Shape Pasta Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Alphabet Shape Pasta Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Alphabet Shape Pasta Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Alphabet Shape Pasta Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Alphabet Shape Pasta Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Alphabet Shape Pasta Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Alphabet Shape Pasta Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Alphabet Shape Pasta Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Alphabet Shape Pasta Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Alphabet Shape Pasta Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Alphabet Shape Pasta Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Alphabet Shape Pasta Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Alphabet Shape Pasta Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Alphabet Shape Pasta Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Alphabet Shape Pasta Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Alphabet Shape Pasta Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Alphabet Shape Pasta Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Alphabet Shape Pasta Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Alphabet Shape Pasta Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Alphabet Shape Pasta Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Alphabet Shape Pasta Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Alphabet Shape Pasta Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Alphabet Shape Pasta Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Alphabet Shape Pasta Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Alphabet Shape Pasta Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Alphabet Shape Pasta Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Alphabet Shape Pasta Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Alphabet Shape Pasta Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Alphabet Shape Pasta Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Alphabet Shape Pasta Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Alphabet Shape Pasta Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Alphabet Shape Pasta Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Alphabet Shape Pasta Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Alphabet Shape Pasta Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Alphabet Shape Pasta Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Alphabet Shape Pasta Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Alphabet Shape Pasta Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Alphabet Shape Pasta Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Alphabet Shape Pasta Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Alphabet Shape Pasta Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Alphabet Shape Pasta Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Alphabet Shape Pasta Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Alphabet Shape Pasta Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Alphabet Shape Pasta Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Alphabet Shape Pasta Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Alphabet Shape Pasta Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Alphabet Shape Pasta Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Alphabet Shape Pasta Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Alphabet Shape Pasta Volume K Forecast, by Country 2019 & 2032

- Table 81: China Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Alphabet Shape Pasta Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Alphabet Shape Pasta Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Alphabet Shape Pasta?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Alphabet Shape Pasta?

Key companies in the market include Giovanni Rana, Olivieri (Ebro Foods), Voltan SpA, Ugo Foods Group, Waitrose, RP's Pasta Company, Il Pastaio, Spaghetto Factory, Maffei, Lilly's Fresh Pasta.

3. What are the main segments of the Alphabet Shape Pasta?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Alphabet Shape Pasta," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Alphabet Shape Pasta report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Alphabet Shape Pasta?

To stay informed about further developments, trends, and reports in the Alphabet Shape Pasta, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence