Key Insights

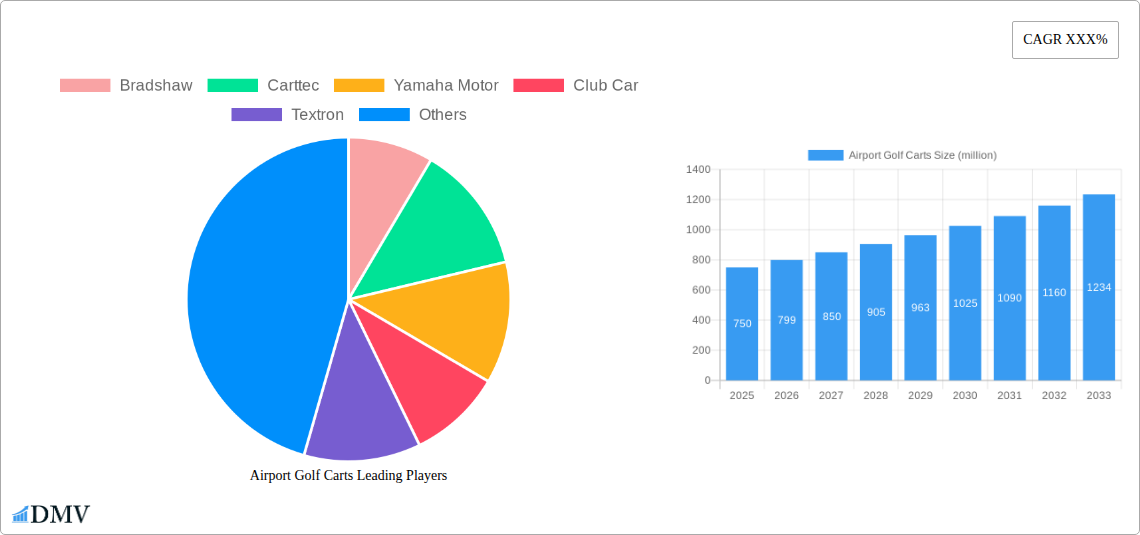

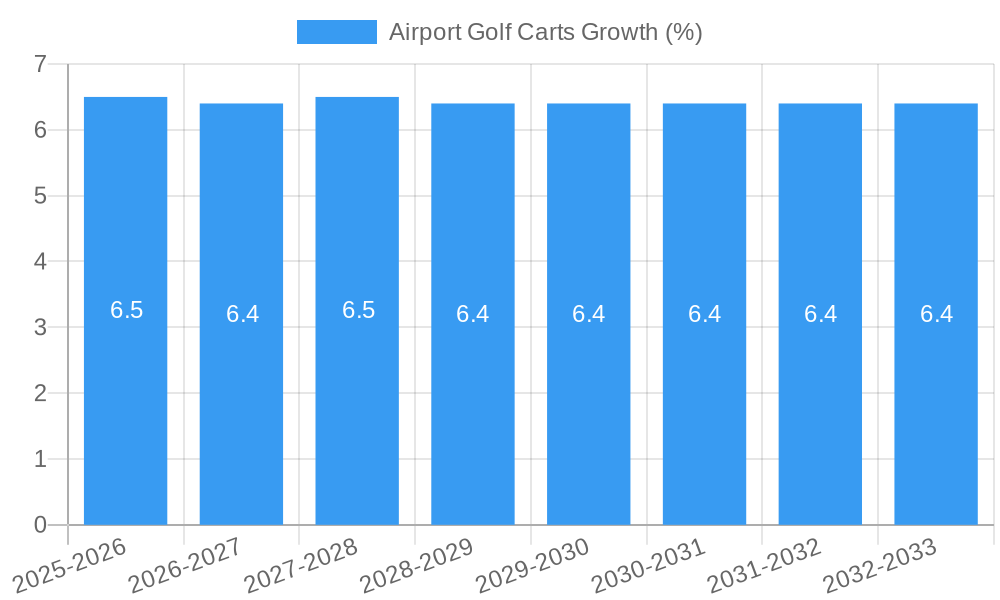

The global Airport Golf Carts market is poised for significant expansion, projected to reach an estimated USD 750 million by 2025, and is expected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 6.5% throughout the forecast period of 2025-2033. This growth is primarily fueled by the escalating demand for efficient and sustainable passenger and cargo movement within airports, coupled with the increasing number of airports worldwide and their continuous efforts to enhance operational efficiency and passenger experience. The surge in air travel, particularly post-pandemic, has placed greater emphasis on optimizing ground operations, where golf carts offer a versatile and cost-effective solution for transporting passengers, luggage, and smaller cargo loads. Furthermore, advancements in electric vehicle technology are making electric-powered golf carts increasingly attractive due to their lower operational costs, reduced emissions, and quieter operation, aligning with the growing global focus on environmental sustainability. The "Others" segment within the types, likely encompassing specialized utility vehicles and multi-purpose carts, is expected to see considerable growth as airports seek tailored solutions for diverse operational needs.

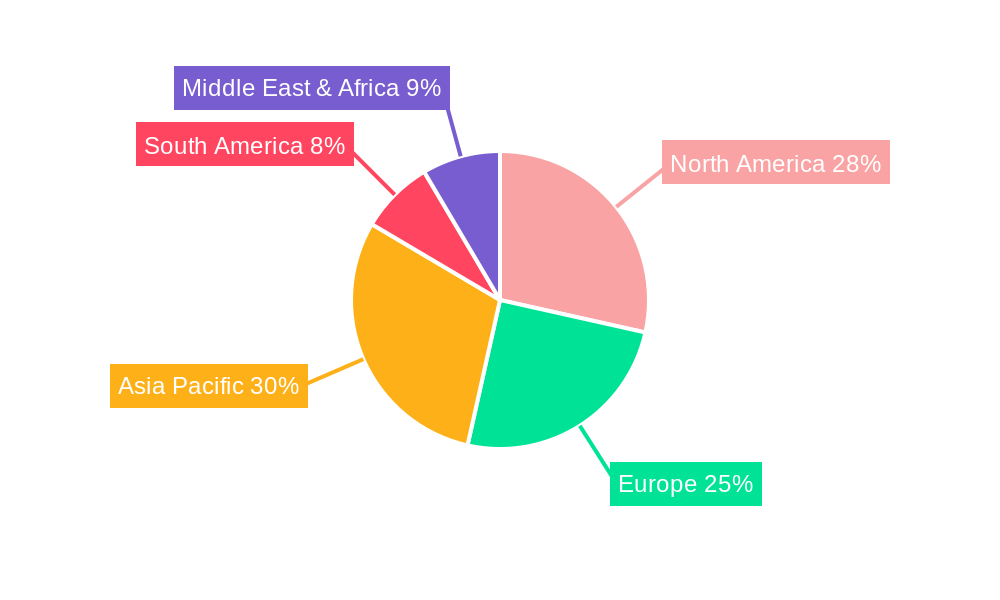

The market segmentation reveals distinct growth trajectories across applications and types. Civil airports, driven by high passenger traffic and the need for seamless transit, will continue to dominate the application segment. However, military airports are also emerging as a significant growth area, with an increasing adoption of golf carts for internal logistics and personnel movement. In terms of power type, electric power is anticipated to lead the market, benefiting from government incentives, decreasing battery costs, and a growing environmental consciousness. Gas-powered variants will likely see a steady but slower growth due to stricter emission regulations. Geographically, the Asia Pacific region, led by China and India, is expected to be the fastest-growing market, owing to rapid infrastructure development, increasing air passenger traffic, and government initiatives promoting sustainable transportation. North America and Europe, with their mature aviation sectors and early adoption of advanced technologies, will continue to be substantial markets. Key players like Textron, Yamaha Motor, and Club Car are expected to drive innovation and market penetration through product development and strategic collaborations.

Airport Golf Carts Market Composition & Trends

The airport golf cart market, valued at over 500 million in 2024, is characterized by a moderate level of concentration, with a few key players like Yamaha Motor, Club Car, and Textron holding significant market share. Innovation is primarily driven by advancements in battery technology for electric models and fuel efficiency for gas-powered variants, aiming to reduce operational costs and environmental impact. The regulatory landscape is evolving, with a growing emphasis on safety standards and emissions reduction, pushing manufacturers towards sustainable solutions. Substitute products, such as specialized electric shuttles and larger utility vehicles, pose a competitive threat, particularly for extensive airport grounds. End-user profiles range from individual airlines and airport authorities to ground handling services and private airport operators, each with distinct needs for efficiency and capacity. Mergers and acquisition (M&A) activities have been relatively limited in recent years, with total deal values estimated to be in the tens of millions, indicating a stable market structure. Emerging trends include the integration of IoT for fleet management and enhanced passenger experience through personalized cart services. The market is poised for steady growth, projected to reach over 800 million by 2033.

- Market Concentration: Moderate, with key players dominating market share.

- Innovation Catalysts: Battery technology, fuel efficiency, and IoT integration.

- Regulatory Landscape: Evolving focus on safety and emissions reduction.

- Substitute Products: Electric shuttles, utility vehicles.

- End-User Profiles: Airlines, airport authorities, ground handlers, private operators.

- M&A Activities: Limited recent activity, total deal values in the tens of millions.

Airport Golf Carts Industry Evolution

The airport golf carts industry has undergone a significant transformation over the historical period of 2019–2024, driven by a confluence of technological advancements, shifting operational demands, and an increasing global awareness of environmental sustainability. During this period, the market witnessed a discernible shift from traditional gasoline-powered models towards more eco-friendly and cost-effective electric golf carts. This evolution is intrinsically linked to the broader trends in the automotive and transportation sectors, where electric vehicle (EV) adoption has become a paramount objective for both private enterprises and governmental bodies. The base year of 2025 serves as a pivotal point, with the market estimated to be valued at approximately 550 million, reflecting sustained growth from the previous years.

Technological advancements have played a crucial role in this industry's evolution. Innovations in battery technology, including higher energy density and faster charging capabilities, have significantly improved the performance and practicality of electric airport golf carts, addressing range anxiety and downtime concerns. Simultaneously, advancements in motor efficiency and lightweight materials have contributed to enhanced operational performance and reduced energy consumption across both electric and, to a lesser extent, gas-powered segments. The introduction of smart features, such as GPS tracking, diagnostic capabilities, and fleet management systems, has also become increasingly prevalent, offering operators greater control, efficiency, and predictive maintenance solutions.

Consumer demand within the airport environment has also been a key driver. Airports, striving to enhance passenger experience and streamline operations, are increasingly seeking efficient, quiet, and emissions-free transportation solutions for passengers with reduced mobility, airline staff, and cargo handling. The demand for compact, maneuverable vehicles that can navigate busy airport aprons and terminals with ease has also grown. This has led to the development of specialized airport golf cart models designed for specific applications, such as baggage towing, security patrols, and passenger transport. The forecast period of 2025–2033 anticipates continued robust growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 7%, projecting the market to surpass 900 million by 2033. This upward trajectory is underpinned by ongoing investment in airport infrastructure globally and the persistent drive for operational efficiency and sustainability in aviation.

Leading Regions, Countries, or Segments in Airport Golf Carts

The global airport golf cart market is currently experiencing robust growth, with distinct regional dominance and segment preferences shaping its trajectory. The Civil Airport application segment stands out as the leading force, accounting for a substantial portion of the market share, estimated at over 70% in 2024. This dominance is fueled by the sheer volume of civil aviation activity worldwide, necessitating efficient internal transportation for passengers, crew, and operational staff across vast airport complexes. Governments and airport authorities in major economies are heavily investing in modernizing airport infrastructure, which includes equipping airports with advanced fleets of electric and gas-powered golf carts for various ground support operations.

Within the Civil Airport segment, the Electric Power type of golf cart is rapidly gaining traction and is projected to become the most dominant, with an estimated market share exceeding 60% by 2025. This shift is propelled by a global imperative to reduce carbon footprints and combat air pollution. Key drivers for this dominance include stringent environmental regulations in developed nations, increasing operational cost savings associated with lower energy consumption and reduced maintenance of electric vehicles compared to their gasoline counterparts, and continuous advancements in battery technology that enhance range and reduce charging times. North America and Europe are at the forefront of this adoption trend, driven by strong government incentives for electric vehicle usage and a heightened environmental consciousness among airport operators.

Dominant Application: Civil Airport.

- Key Drivers: High volume of air traffic, extensive airport infrastructure, ongoing modernization initiatives, demand for efficient passenger and staff movement.

- Market Share (2024): Over 70%.

- Investment Trends: Significant capital expenditure by airport authorities and airlines for fleet upgrades.

- Regulatory Support: Favorable policies promoting sustainable transportation within aviation.

Dominant Type: Electric Power.

- Key Drivers: Environmental regulations, cost savings (fuel and maintenance), technological advancements in batteries, growing corporate sustainability goals.

- Projected Market Share (2025): Over 60% within the Civil Airport segment.

- Adoption Metrics: Rapid increase in adoption rates driven by operational benefits.

- Geographic Trends: Strongest adoption in North America and Europe, with Asia-Pacific showing rapid growth.

Emerging Segment: Military Airports also represent a significant, albeit smaller, segment, with specialized requirements for security, rapid deployment, and ruggedness. While the volume is lower than civil airports, the value per unit can be higher due to specialized features. The demand here is influenced by defense spending and modernization efforts within military aviation.

The future of the airport golf cart market will continue to be shaped by the synergy between technological innovation and the pressing need for sustainable, efficient operations within the aviation sector, with electric solutions leading the charge in the dominant Civil Airport application.

Airport Golf Carts Product Innovations

Airport golf cart manufacturers are continually pushing the boundaries of innovation to meet the evolving demands of the aviation industry. Recent product developments focus on enhanced battery efficiency and longevity for electric models, with advancements in lithium-ion technology enabling longer operational ranges and faster charging cycles, often reaching full capacity in under two hours. Many new models incorporate advanced fleet management systems, integrating GPS tracking, real-time diagnostics, and remote monitoring capabilities to optimize utilization and minimize downtime. Furthermore, manufacturers are introducing modular designs for easier maintenance and customization, catering to specific airport operational needs, such as enhanced cargo carrying capacities or specialized passenger seating configurations. Performance metrics are also seeing significant improvements, with electric carts achieving top speeds of up to 30 mph and carrying capacities of over 1,000 pounds, ensuring efficient movement of personnel and light cargo across extensive airport grounds.

Propelling Factors for Airport Golf Carts Growth

Several key factors are propelling the growth of the airport golf carts market. A primary driver is the increasing global emphasis on sustainability and emission reduction within the aviation sector, leading to a strong preference for electric golf carts. This is further bolstered by favorable government regulations and incentives promoting the adoption of zero-emission vehicles. Economic factors, such as the lower operating and maintenance costs of electric golf carts compared to their gasoline counterparts, also significantly contribute to their widespread adoption. Furthermore, continuous technological advancements in battery technology, offering longer ranges and faster charging times, are directly addressing previous limitations and enhancing the practicality of electric golf carts for airport operations. The ongoing expansion and modernization of airport infrastructure worldwide also necessitate efficient and scalable internal transportation solutions, directly boosting demand for these vehicles.

Obstacles in the Airport Golf Carts Market

Despite the robust growth, the airport golf carts market faces several obstacles. Regulatory challenges can arise from varying safety standards and certification requirements across different countries and regions, potentially slowing down market entry for new products. Supply chain disruptions, as witnessed in recent global events, can impact the availability of critical components, particularly batteries and semiconductors, leading to production delays and increased costs. High initial investment costs for advanced electric golf carts and charging infrastructure can be a barrier for smaller airports or those with limited capital. Moreover, competition from alternative transportation solutions, such as automated guided vehicles (AGVs) and larger shuttle buses, presents a continuous threat. The limited range and charging infrastructure for certain models still remain concerns in some less developed regions.

Future Opportunities in Airport Golf Carts

The airport golf carts market is ripe with emerging opportunities. The increasing development of smart airports and the integration of IoT technology present a significant avenue for growth, enabling enhanced fleet management, predictive maintenance, and personalized passenger services. The expansion of airport infrastructure in emerging economies, particularly in Asia-Pacific and the Middle East, offers substantial untapped market potential. Furthermore, the development of more robust and specialized models for diverse applications, such as cargo handling, emergency response, and VIP transport, will create new market niches. The ongoing advancements in battery technology, promising even longer ranges, faster charging, and reduced costs, will further solidify the dominance of electric golf carts and open up new possibilities for their application in more demanding airport environments.

Major Players in the Airport Golf Carts Ecosystem

- Bradshaw

- Carttec

- Yamaha Motor

- Club Car

- Textron

- AGT Electric Cars

- Moto Electric Vehicles

Key Developments in Airport Golf Carts Industry

- 2023/07: Yamaha Motor launches a new line of electric golf carts with enhanced battery life and regenerative braking systems, targeting increased energy efficiency for airport operations.

- 2023/03: Club Car introduces advanced fleet management software with real-time analytics and diagnostic capabilities for its airport golf cart models, improving operational oversight.

- 2022/11: Textron acquires a specialized electric vehicle manufacturer, aiming to expand its portfolio of sustainable airport ground support equipment.

- 2022/05: AGT Electric Cars partners with a major European airport to pilot a fleet of fully autonomous electric golf carts for passenger transportation.

- 2021/10: Carttec develops a new modular design for its airport golf carts, allowing for quicker customization and easier component replacement to minimize downtime.

Strategic Airport Golf Carts Market Forecast

The strategic airport golf carts market forecast indicates a promising period of growth driven by a confluence of technological innovation, economic advantages, and an unwavering commitment to environmental sustainability within the aviation industry. The increasing demand for electric vehicles, fueled by advancements in battery technology and government initiatives, will continue to be a primary growth catalyst. Emerging markets and the ongoing modernization of global airport infrastructure present significant untapped potential. Furthermore, the integration of smart technologies for fleet management and enhanced operational efficiency will unlock new revenue streams and solidify the market's upward trajectory, projecting a robust future market value exceeding 900 million by 2033.

Airport Golf Carts Segmentation

-

1. Application

- 1.1. Civil Airport

- 1.2. Military Airport

-

2. Type

- 2.1. Gas Power

- 2.2. Electric Power

- 2.3. Others

Airport Golf Carts Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Airport Golf Carts REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Airport Golf Carts Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Civil Airport

- 5.1.2. Military Airport

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Gas Power

- 5.2.2. Electric Power

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Airport Golf Carts Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Civil Airport

- 6.1.2. Military Airport

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Gas Power

- 6.2.2. Electric Power

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Airport Golf Carts Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Civil Airport

- 7.1.2. Military Airport

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Gas Power

- 7.2.2. Electric Power

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Airport Golf Carts Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Civil Airport

- 8.1.2. Military Airport

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Gas Power

- 8.2.2. Electric Power

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Airport Golf Carts Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Civil Airport

- 9.1.2. Military Airport

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Gas Power

- 9.2.2. Electric Power

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Airport Golf Carts Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Civil Airport

- 10.1.2. Military Airport

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Gas Power

- 10.2.2. Electric Power

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Bradshaw

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Carttec

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Yamaha Motor

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Club Car

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Textron

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AGT Electric Cars

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Moto Electric Vehicles

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Bradshaw

List of Figures

- Figure 1: Global Airport Golf Carts Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Airport Golf Carts Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Airport Golf Carts Revenue (million), by Application 2024 & 2032

- Figure 4: North America Airport Golf Carts Volume (K), by Application 2024 & 2032

- Figure 5: North America Airport Golf Carts Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Airport Golf Carts Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Airport Golf Carts Revenue (million), by Type 2024 & 2032

- Figure 8: North America Airport Golf Carts Volume (K), by Type 2024 & 2032

- Figure 9: North America Airport Golf Carts Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Airport Golf Carts Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Airport Golf Carts Revenue (million), by Country 2024 & 2032

- Figure 12: North America Airport Golf Carts Volume (K), by Country 2024 & 2032

- Figure 13: North America Airport Golf Carts Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Airport Golf Carts Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Airport Golf Carts Revenue (million), by Application 2024 & 2032

- Figure 16: South America Airport Golf Carts Volume (K), by Application 2024 & 2032

- Figure 17: South America Airport Golf Carts Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Airport Golf Carts Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Airport Golf Carts Revenue (million), by Type 2024 & 2032

- Figure 20: South America Airport Golf Carts Volume (K), by Type 2024 & 2032

- Figure 21: South America Airport Golf Carts Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Airport Golf Carts Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Airport Golf Carts Revenue (million), by Country 2024 & 2032

- Figure 24: South America Airport Golf Carts Volume (K), by Country 2024 & 2032

- Figure 25: South America Airport Golf Carts Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Airport Golf Carts Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Airport Golf Carts Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Airport Golf Carts Volume (K), by Application 2024 & 2032

- Figure 29: Europe Airport Golf Carts Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Airport Golf Carts Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Airport Golf Carts Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Airport Golf Carts Volume (K), by Type 2024 & 2032

- Figure 33: Europe Airport Golf Carts Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Airport Golf Carts Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Airport Golf Carts Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Airport Golf Carts Volume (K), by Country 2024 & 2032

- Figure 37: Europe Airport Golf Carts Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Airport Golf Carts Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Airport Golf Carts Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Airport Golf Carts Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Airport Golf Carts Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Airport Golf Carts Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Airport Golf Carts Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Airport Golf Carts Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Airport Golf Carts Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Airport Golf Carts Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Airport Golf Carts Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Airport Golf Carts Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Airport Golf Carts Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Airport Golf Carts Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Airport Golf Carts Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Airport Golf Carts Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Airport Golf Carts Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Airport Golf Carts Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Airport Golf Carts Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Airport Golf Carts Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Airport Golf Carts Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Airport Golf Carts Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Airport Golf Carts Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Airport Golf Carts Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Airport Golf Carts Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Airport Golf Carts Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Airport Golf Carts Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Airport Golf Carts Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Airport Golf Carts Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Airport Golf Carts Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Airport Golf Carts Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Airport Golf Carts Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Airport Golf Carts Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Airport Golf Carts Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Airport Golf Carts Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Airport Golf Carts Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Airport Golf Carts Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Airport Golf Carts Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Airport Golf Carts Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Airport Golf Carts Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Airport Golf Carts Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Airport Golf Carts Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Airport Golf Carts Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Airport Golf Carts Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Airport Golf Carts Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Airport Golf Carts Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Airport Golf Carts Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Airport Golf Carts Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Airport Golf Carts Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Airport Golf Carts Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Airport Golf Carts Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Airport Golf Carts Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Airport Golf Carts Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Airport Golf Carts Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Airport Golf Carts Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Airport Golf Carts Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Airport Golf Carts Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Airport Golf Carts Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Airport Golf Carts Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Airport Golf Carts Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Airport Golf Carts Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Airport Golf Carts Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Airport Golf Carts Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Airport Golf Carts Volume K Forecast, by Country 2019 & 2032

- Table 81: China Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Airport Golf Carts Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Airport Golf Carts Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airport Golf Carts?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Airport Golf Carts?

Key companies in the market include Bradshaw, Carttec, Yamaha Motor, Club Car, Textron, AGT Electric Cars, Moto Electric Vehicles.

3. What are the main segments of the Airport Golf Carts?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Airport Golf Carts," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Airport Golf Carts report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Airport Golf Carts?

To stay informed about further developments, trends, and reports in the Airport Golf Carts, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence