Key Insights

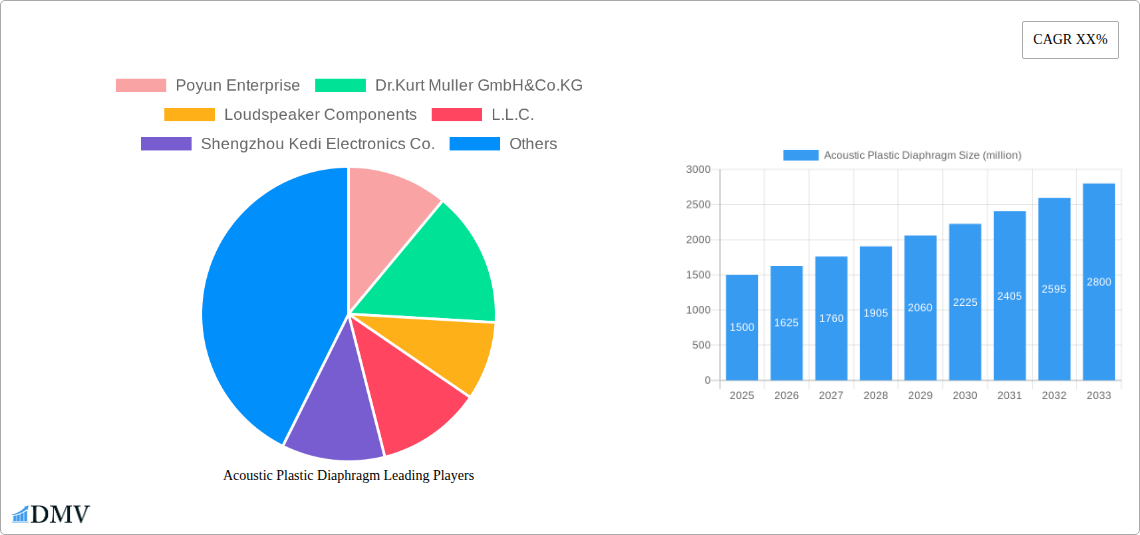

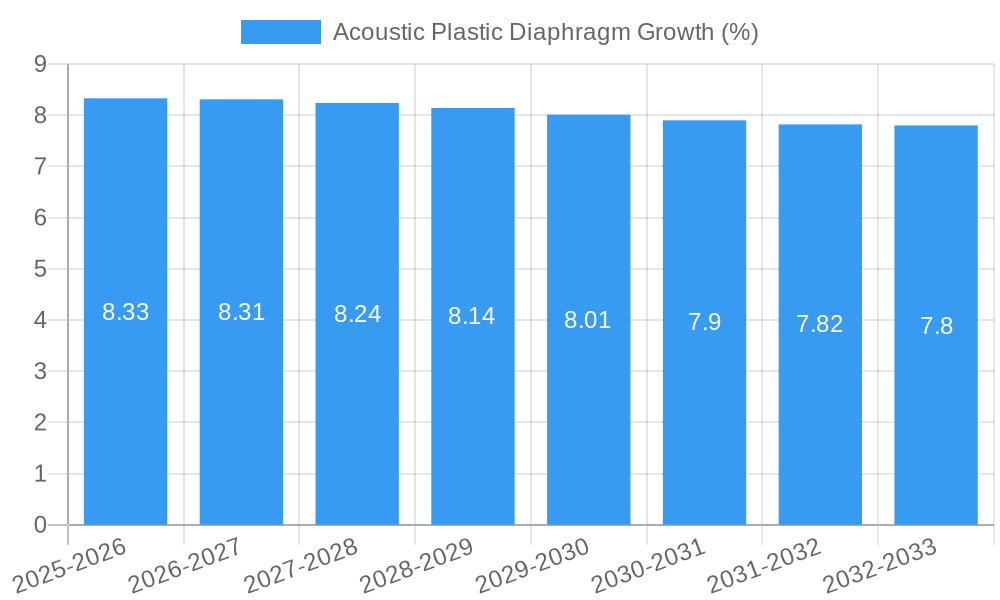

The Acoustic Plastic Diaphragm market is poised for significant expansion, projected to reach approximately $1.5 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8.5% anticipated throughout the forecast period ending in 2033. This impressive growth is primarily fueled by the burgeoning demand for high-quality audio devices across consumer electronics, professional audio, and automotive sectors. The increasing adoption of smartphones, wireless earbuds, and advanced home theater systems necessitates sophisticated diaphragm materials that offer superior acoustic performance, durability, and miniaturization. Furthermore, the expanding market for noise-cancelling headphones and the growing integration of loudspeakers in smart home devices and wearable technology are key drivers. Polyarylate (PAR) and Polyetheretherketone (PEEK) diaphragms are expected to dominate the market due to their exceptional stiffness-to-weight ratio, thermal stability, and acoustic properties, enabling clearer sound reproduction and enhanced bass response. The growing emphasis on personalized audio experiences and the development of immersive sound technologies further underscore the importance of advanced diaphragm materials.

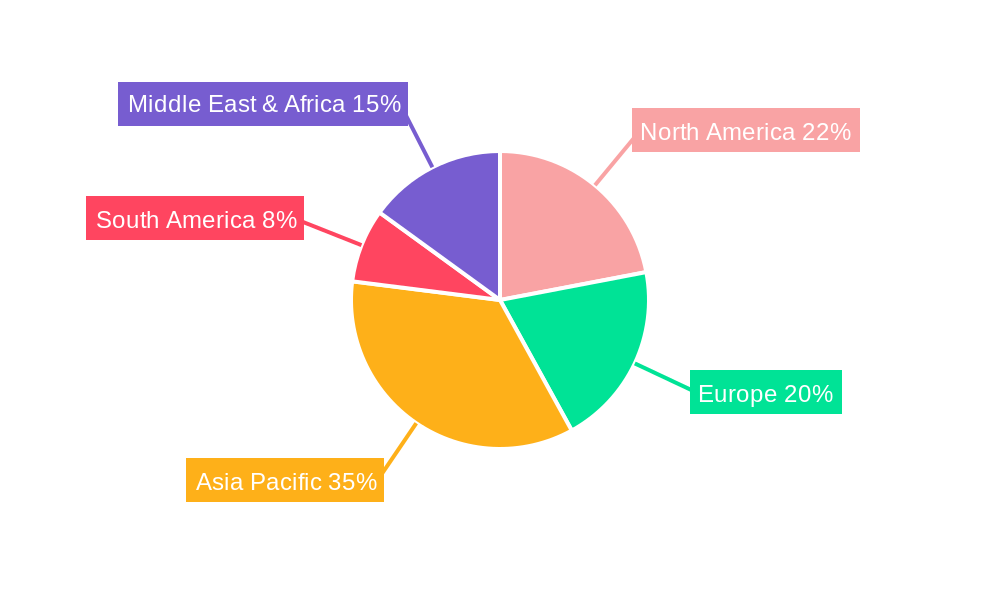

However, the market also faces certain restraints, including the raw material price volatility of specialized polymers and the stringent quality control required for consistent acoustic performance. The development of cost-effective manufacturing processes and the exploration of novel composite materials are crucial for sustained market penetration. Geographically, the Asia Pacific region, led by China and India, is expected to be the largest and fastest-growing market, driven by a massive consumer base, a strong manufacturing ecosystem for electronics, and increasing disposable incomes. North America and Europe also represent substantial markets, characterized by a high demand for premium audio products and continuous technological innovation. The competitive landscape features a mix of established players and emerging manufacturers, all vying to innovate and capture market share through product differentiation and strategic partnerships, contributing to the dynamic evolution of the acoustic plastic diaphragm industry.

Acoustic Plastic Diaphragm Market Composition & Trends

This comprehensive report delves into the dynamic acoustic plastic diaphragm market, offering critical insights for stakeholders navigating this evolving landscape. The market analysis spans the Study Period: 2019–2033, with a deep dive into the Base Year: 2025 and an Estimated Year: 2025, culminating in a detailed Forecast Period: 2025–2033 based on Historical Period: 2019–2024 data. We meticulously evaluate market concentration, identifying key players and their strategic positioning. Innovation catalysts, including advancements in polymer science and manufacturing techniques, are thoroughly examined, alongside the intricate regulatory landscapes that influence product development and market entry. The report critically assesses substitute products, evaluating their impact on acoustic plastic diaphragm demand. End-user profiles are meticulously detailed, providing a granular understanding of diverse application needs, from high-fidelity earphone and headphone diaphragms to robust loudspeaker components and sensitive microphone diaphragms. Furthermore, significant Mergers & Acquisitions (M&A) activities are analyzed, including an estimation of deal values reaching several million, providing a clear picture of consolidation and strategic partnerships. Key metrics such as market share distribution and recent M&A deal values are presented to illuminate market dynamics.

- Market Concentration: Analysis of key players and their strategic market share in the global acoustic plastic diaphragm sector.

- Innovation Catalysts: Identification of technological advancements driving the adoption of new diaphragm materials and designs.

- Regulatory Landscapes: Overview of relevant regulations impacting manufacturing, safety, and market access for acoustic plastic diaphragms.

- Substitute Products: Assessment of competing materials and their potential impact on market share.

- End-User Profiles: Detailed segmentation of key consumer and industrial applications for acoustic plastic diaphragms.

- M&A Activities: Examination of recent merger and acquisition trends, including estimated deal values in the million range, and their impact on market structure.

Acoustic Plastic Diaphragm Industry Evolution

The acoustic plastic diaphragm industry has witnessed remarkable evolution, driven by relentless technological innovation and an ever-increasing demand for superior audio experiences. Over the Historical Period: 2019–2024, the market has experienced significant growth, fueled by breakthroughs in material science and manufacturing processes. The Study Period: 2019–2033, with Base Year: 2025 and Estimated Year: 2025, highlights a sustained upward trajectory in the Forecast Period: 2025–2033. Advancements in polymer research have led to the development of advanced materials such as Polyarylate (PAR) Diaphragm, Polyethylene Dicarboxylate (PEN) Diaphragm, Polyetheretherketone (PEEK) Diaphragm, and Polyetherimide (PEI) Diaphragm, each offering distinct acoustic properties and performance characteristics. These material innovations are directly contributing to enhanced sound quality, durability, and miniaturization in a wide array of audio devices.

The growth trajectory of the acoustic plastic diaphragm market is intrinsically linked to the booming consumer electronics sector, particularly the earphone and headphone segment, which continues to drive significant demand. The increasing sophistication of audio technology, coupled with a growing consumer preference for high-fidelity sound, has propelled the adoption of premium acoustic plastic diaphragms. Furthermore, the burgeoning use of these diaphragms in microphones for professional audio recording, communication systems, and voice-activated technologies, as well as their critical role in loudspeaker components across home audio, automotive, and professional sound systems, underscores their expanding market footprint. Adoption metrics reveal a consistent year-on-year increase in the integration of specialized plastic diaphragms, often exceeding growth rates of xx% in key applications. Technological advancements are not merely focused on material properties but also on precision manufacturing techniques, enabling the creation of thinner, lighter, and more acoustically efficient diaphragms. This pursuit of enhanced performance is a constant catalyst for market expansion. The industry's evolution is also shaped by shifting consumer demands for personalized audio, noise-cancellation features, and portable, high-performance audio solutions, all of which rely heavily on the innovative capabilities of acoustic plastic diaphragm manufacturers. The market size is projected to reach hundreds of million by the end of the forecast period, indicating a robust and expanding industry.

Leading Regions, Countries, or Segments in Acoustic Plastic Diaphragm

The acoustic plastic diaphragm market exhibits distinct regional and segmental leadership, driven by a confluence of technological prowess, manufacturing capabilities, and market demand. Asia Pacific, particularly China, stands as a dominant force in this sector, accounting for a significant portion of global production and consumption. This dominance is fueled by a robust manufacturing ecosystem, a highly skilled workforce, and substantial investments in research and development by leading companies like Shengzhou Kedi Electronics Co.,Ltd. and Suzhou Sonavox Electronics Co.,Ltd. The region’s extensive supply chain for electronics components, combined with strong domestic demand for consumer audio products, solidifies its leading position.

Within the Application segments, Earphone and Headphones emerge as the primary driver of growth, consuming a substantial percentage of acoustic plastic diaphragms due to the sheer volume of production and the continuous innovation in personal audio devices. The demand for lightweight, durable, and acoustically superior diaphragms for true wireless earbuds, over-ear headphones, and portable audio systems is a key contributor to this segment's dominance. The Loudspeaker segment also represents a significant market, encompassing applications from high-end home theater systems and professional audio equipment to automotive sound systems and smart home devices. The drive for enhanced bass response, clarity, and power handling in loudspeakers directly translates to a growing demand for advanced plastic diaphragms. The Microphone segment, while smaller in volume, showcases high growth potential due to the increasing use of microphones in smartphones, laptops, voice assistants, and advanced communication devices, requiring diaphragms with exceptional sensitivity and frequency response.

In terms of Types, Polyarylate (PAR) Diaphragm and Polyethylene Dicarboxylate (PEN) Diaphragm are leading the pack due to their favorable balance of stiffness, lightness, and acoustic performance, making them ideal for a wide range of audio applications. Polyetheretherketone (PEEK) Diaphragm and Polyetherimide (PEI) Diaphragm are gaining traction in niche applications demanding extreme durability, high-temperature resistance, and superior acoustic dampening. Investment trends in advanced manufacturing facilities and R&D centers in Asia Pacific, coupled with supportive government policies aimed at fostering technological innovation in the electronics sector, are critical drivers behind this regional and segmental dominance. Regulatory support for advanced materials and the growing consumer appetite for premium audio experiences further bolster the market's expansion.

- Dominant Region: Asia Pacific, led by China, due to its extensive manufacturing infrastructure and substantial consumer demand.

- Key Application Segment: Earphone and Headphones, driven by the global proliferation of personal audio devices.

- Emerging Application: Microphones, propelled by the expansion of voice-enabled technologies and advanced communication.

- Leading Diaphragm Types: Polyarylate (PAR) and Polyethylene Dicarboxylate (PEN) Diaphragms, offering a strong balance of performance and cost-effectiveness.

- Growth Drivers: Investment in R&D and manufacturing, favorable government policies, and increasing consumer demand for high-fidelity audio.

Acoustic Plastic Diaphragm Product Innovations

Product innovations in the acoustic plastic diaphragm market are continuously pushing the boundaries of audio performance. Companies are focusing on developing ultra-thin and lightweight diaphragms from advanced polymers like PEEK and PEN, enabling the creation of smaller, more efficient, and more powerful audio transducers. These innovations enhance sound clarity, improve frequency response, and reduce distortion, directly benefiting applications such as high-fidelity earphones, advanced loudspeakers, and sensitive microphones. Unique selling propositions often lie in proprietary material formulations and precision manufacturing techniques that optimize acoustic impedance and damping characteristics, leading to unparalleled listening experiences. Technological advancements are also enabling the development of multi-layer diaphragms and diaphragms with specialized surface treatments for enhanced performance in demanding environments. The market is witnessing a growing demand for sustainable and recyclable diaphragm materials, spurring further innovation in this area.

Propelling Factors for Acoustic Plastic Diaphragm Growth

The acoustic plastic diaphragm market is propelled by several key factors. Technological advancements in polymer science and precision manufacturing are leading to the development of diaphragms with superior acoustic properties, such as enhanced stiffness-to-weight ratios and improved damping. The ever-growing global demand for consumer electronics, particularly earphones, headphones, and loudspeakers, serves as a significant market driver. Increasing consumer awareness and preference for high-fidelity audio experiences further stimulate the adoption of advanced acoustic plastic diaphragms. Additionally, economic growth in emerging markets is expanding the consumer base for audio devices. Regulatory support for advanced materials and miniaturization in electronics also plays a crucial role.

- Technological Advancements: Development of novel polymers and manufacturing techniques for superior acoustic performance.

- Consumer Electronics Boom: Sustained global demand for audio devices like earphones, headphones, and speakers.

- High-Fidelity Audio Demand: Increasing consumer preference for immersive and detailed sound reproduction.

- Economic Growth: Expansion of disposable income in emerging economies, boosting audio device sales.

- Miniaturization Trends: Industry push for smaller, lighter, and more efficient audio components.

Obstacles in the Acoustic Plastic Diaphragm Market

Despite its robust growth, the acoustic plastic diaphragm market faces several obstacles. Volatile raw material prices for advanced polymers can impact production costs and profit margins. Intense competition among manufacturers can lead to price pressures and a need for continuous innovation to maintain market share. Stringent quality control and the development of specialized diaphragms for diverse applications require significant R&D investment. Supply chain disruptions, exacerbated by geopolitical events or natural disasters, can affect the availability of essential materials. Furthermore, the development and adoption of alternative materials or technologies, although currently niche, pose a long-term threat. The cost of advanced materials can also be a barrier for some lower-end applications.

- Raw Material Price Volatility: Fluctuations in polymer costs impacting manufacturing expenses.

- Intense Competition: Pressure on pricing and the need for ongoing product differentiation.

- High R&D Investment: Significant capital required for developing specialized and high-performance diaphragms.

- Supply Chain Vulnerabilities: Potential disruptions impacting material availability and production schedules.

- Emerging Alternatives: The threat of new materials or acoustic technologies gaining traction.

Future Opportunities in Acoustic Plastic Diaphragm

Emerging opportunities in the acoustic plastic diaphragm market are abundant. The increasing integration of smart technologies and AI in audio devices, such as advanced noise-cancellation and personalized sound profiles, will drive demand for highly specialized diaphragms. The growth of the automotive audio sector, with its focus on premium sound systems, presents a significant opportunity. Furthermore, the expansion of virtual and augmented reality applications will necessitate the development of immersive audio solutions, where advanced acoustic plastic diaphragms will play a crucial role. The increasing focus on sustainability is creating opportunities for bio-based or recyclable diaphragm materials. The wearable technology market also offers untapped potential.

- Smart Audio Integration: Demand for diaphragms in AI-powered audio features and personalized sound.

- Automotive Audio Systems: Growth in in-car premium sound experiences.

- Immersive Technologies: Role in VR/AR audio for enhanced realism.

- Sustainable Materials: Development and adoption of eco-friendly diaphragm solutions.

- Wearable Technology: Integration into next-generation audio wearables.

Major Players in the Acoustic Plastic Diaphragm Ecosystem

- Poyun Enterprise

- Dr.Kurt Muller GmbH&Co.KG

- Loudspeaker Components, L.L.C.

- Shengzhou Kedi Electronics Co.,Ltd.

- Suzhou Sonavox Electronics Co.,Ltd.

- Dongguan Liangyin Precision Electronics Factory

- YuonYunn Membrane Co.,Ltd.

- Dongguan Huihong Plastic Co.,Ltd.

Key Developments in Acoustic Plastic Diaphragm Industry

- 2023: Launch of novel, ultra-thin PEN diaphragms for true wireless earbuds, enhancing sound clarity and reducing size, with market impact estimated in the millions of units.

- 2022: Significant investment by Suzhou Sonavox Electronics Co.,Ltd. in advanced manufacturing facilities to increase PEEK diaphragm production capacity, addressing growing demand in high-end audio and automotive applications.

- 2021: Introduction of a new line of PAR diaphragms by Shengzhou Kedi Electronics Co.,Ltd. with improved damping characteristics, leading to a xx% improvement in distortion reduction for loudspeaker components.

- 2020: Dr.Kurt Muller GmbH&Co.KG announces a strategic partnership to develop next-generation PEI diaphragms for advanced microphone applications, with an estimated market potential reaching tens of millions.

- 2019: Poyun Enterprise expands its product portfolio with a range of cost-effective acoustic plastic diaphragms, targeting the burgeoning consumer electronics market in emerging economies.

Strategic Acoustic Plastic Diaphragm Market Forecast

The strategic acoustic plastic diaphragm market forecast indicates sustained growth driven by persistent innovation and expanding applications. The increasing demand for superior audio quality in consumer electronics, coupled with advancements in smart audio technologies and automotive sound systems, will fuel market expansion. The development of novel polymer materials and precision manufacturing techniques will continue to unlock new performance benchmarks, catering to evolving consumer preferences. Emerging markets and the integration of acoustic diaphragms in new technology frontiers, such as VR/AR, present significant untapped potential, projecting a robust outlook for the industry, with market value anticipated to reach hundreds of million within the forecast period.

Acoustic Plastic Diaphragm Segmentation

-

1. Application

- 1.1. Earphone and Headphones

- 1.2. Microphone

- 1.3. Loudspeaker

-

2. Types

- 2.1. Polyarylate (PAR) Diaphragm

- 2.2. Polyethylene Dicarboxylate (PEN) Diaphragm

- 2.3. Polyetheretherketone (PEEK) Diaphragm

- 2.4. Polyetherimide (PEI) Diaphragm

- 2.5. Others

Acoustic Plastic Diaphragm Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Acoustic Plastic Diaphragm REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Acoustic Plastic Diaphragm Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Earphone and Headphones

- 5.1.2. Microphone

- 5.1.3. Loudspeaker

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Polyarylate (PAR) Diaphragm

- 5.2.2. Polyethylene Dicarboxylate (PEN) Diaphragm

- 5.2.3. Polyetheretherketone (PEEK) Diaphragm

- 5.2.4. Polyetherimide (PEI) Diaphragm

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Acoustic Plastic Diaphragm Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Earphone and Headphones

- 6.1.2. Microphone

- 6.1.3. Loudspeaker

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Polyarylate (PAR) Diaphragm

- 6.2.2. Polyethylene Dicarboxylate (PEN) Diaphragm

- 6.2.3. Polyetheretherketone (PEEK) Diaphragm

- 6.2.4. Polyetherimide (PEI) Diaphragm

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Acoustic Plastic Diaphragm Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Earphone and Headphones

- 7.1.2. Microphone

- 7.1.3. Loudspeaker

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Polyarylate (PAR) Diaphragm

- 7.2.2. Polyethylene Dicarboxylate (PEN) Diaphragm

- 7.2.3. Polyetheretherketone (PEEK) Diaphragm

- 7.2.4. Polyetherimide (PEI) Diaphragm

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Acoustic Plastic Diaphragm Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Earphone and Headphones

- 8.1.2. Microphone

- 8.1.3. Loudspeaker

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Polyarylate (PAR) Diaphragm

- 8.2.2. Polyethylene Dicarboxylate (PEN) Diaphragm

- 8.2.3. Polyetheretherketone (PEEK) Diaphragm

- 8.2.4. Polyetherimide (PEI) Diaphragm

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Acoustic Plastic Diaphragm Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Earphone and Headphones

- 9.1.2. Microphone

- 9.1.3. Loudspeaker

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Polyarylate (PAR) Diaphragm

- 9.2.2. Polyethylene Dicarboxylate (PEN) Diaphragm

- 9.2.3. Polyetheretherketone (PEEK) Diaphragm

- 9.2.4. Polyetherimide (PEI) Diaphragm

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Acoustic Plastic Diaphragm Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Earphone and Headphones

- 10.1.2. Microphone

- 10.1.3. Loudspeaker

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Polyarylate (PAR) Diaphragm

- 10.2.2. Polyethylene Dicarboxylate (PEN) Diaphragm

- 10.2.3. Polyetheretherketone (PEEK) Diaphragm

- 10.2.4. Polyetherimide (PEI) Diaphragm

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Poyun Enterprise

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dr.Kurt Muller GmbH&Co.KG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Loudspeaker Components

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 L.L.C.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Shengzhou Kedi Electronics Co.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ltd.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Suzhou Sonavox Electronics Co.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ltd.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dongguan Liangyin Precision Electronics Factory

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 YuonYunn Membrane Co.

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Ltd.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Dongguan Huihong Plastic Co.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Ltd.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Poyun Enterprise

List of Figures

- Figure 1: Global Acoustic Plastic Diaphragm Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Acoustic Plastic Diaphragm Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Acoustic Plastic Diaphragm Revenue (million), by Application 2024 & 2032

- Figure 4: North America Acoustic Plastic Diaphragm Volume (K), by Application 2024 & 2032

- Figure 5: North America Acoustic Plastic Diaphragm Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Acoustic Plastic Diaphragm Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Acoustic Plastic Diaphragm Revenue (million), by Types 2024 & 2032

- Figure 8: North America Acoustic Plastic Diaphragm Volume (K), by Types 2024 & 2032

- Figure 9: North America Acoustic Plastic Diaphragm Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Acoustic Plastic Diaphragm Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Acoustic Plastic Diaphragm Revenue (million), by Country 2024 & 2032

- Figure 12: North America Acoustic Plastic Diaphragm Volume (K), by Country 2024 & 2032

- Figure 13: North America Acoustic Plastic Diaphragm Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Acoustic Plastic Diaphragm Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Acoustic Plastic Diaphragm Revenue (million), by Application 2024 & 2032

- Figure 16: South America Acoustic Plastic Diaphragm Volume (K), by Application 2024 & 2032

- Figure 17: South America Acoustic Plastic Diaphragm Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Acoustic Plastic Diaphragm Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Acoustic Plastic Diaphragm Revenue (million), by Types 2024 & 2032

- Figure 20: South America Acoustic Plastic Diaphragm Volume (K), by Types 2024 & 2032

- Figure 21: South America Acoustic Plastic Diaphragm Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Acoustic Plastic Diaphragm Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Acoustic Plastic Diaphragm Revenue (million), by Country 2024 & 2032

- Figure 24: South America Acoustic Plastic Diaphragm Volume (K), by Country 2024 & 2032

- Figure 25: South America Acoustic Plastic Diaphragm Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Acoustic Plastic Diaphragm Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Acoustic Plastic Diaphragm Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Acoustic Plastic Diaphragm Volume (K), by Application 2024 & 2032

- Figure 29: Europe Acoustic Plastic Diaphragm Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Acoustic Plastic Diaphragm Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Acoustic Plastic Diaphragm Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Acoustic Plastic Diaphragm Volume (K), by Types 2024 & 2032

- Figure 33: Europe Acoustic Plastic Diaphragm Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Acoustic Plastic Diaphragm Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Acoustic Plastic Diaphragm Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Acoustic Plastic Diaphragm Volume (K), by Country 2024 & 2032

- Figure 37: Europe Acoustic Plastic Diaphragm Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Acoustic Plastic Diaphragm Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Acoustic Plastic Diaphragm Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Acoustic Plastic Diaphragm Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Acoustic Plastic Diaphragm Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Acoustic Plastic Diaphragm Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Acoustic Plastic Diaphragm Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Acoustic Plastic Diaphragm Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Acoustic Plastic Diaphragm Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Acoustic Plastic Diaphragm Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Acoustic Plastic Diaphragm Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Acoustic Plastic Diaphragm Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Acoustic Plastic Diaphragm Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Acoustic Plastic Diaphragm Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Acoustic Plastic Diaphragm Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Acoustic Plastic Diaphragm Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Acoustic Plastic Diaphragm Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Acoustic Plastic Diaphragm Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Acoustic Plastic Diaphragm Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Acoustic Plastic Diaphragm Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Acoustic Plastic Diaphragm Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Acoustic Plastic Diaphragm Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Acoustic Plastic Diaphragm Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Acoustic Plastic Diaphragm Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Acoustic Plastic Diaphragm Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Acoustic Plastic Diaphragm Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Acoustic Plastic Diaphragm Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Acoustic Plastic Diaphragm Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Acoustic Plastic Diaphragm Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Acoustic Plastic Diaphragm Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Acoustic Plastic Diaphragm Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Acoustic Plastic Diaphragm Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Acoustic Plastic Diaphragm Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Acoustic Plastic Diaphragm Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Acoustic Plastic Diaphragm Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Acoustic Plastic Diaphragm Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Acoustic Plastic Diaphragm Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Acoustic Plastic Diaphragm Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Acoustic Plastic Diaphragm Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Acoustic Plastic Diaphragm Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Acoustic Plastic Diaphragm Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Acoustic Plastic Diaphragm Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Acoustic Plastic Diaphragm Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Acoustic Plastic Diaphragm Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Acoustic Plastic Diaphragm Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Acoustic Plastic Diaphragm Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Acoustic Plastic Diaphragm Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Acoustic Plastic Diaphragm Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Acoustic Plastic Diaphragm Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Acoustic Plastic Diaphragm Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Acoustic Plastic Diaphragm Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Acoustic Plastic Diaphragm Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Acoustic Plastic Diaphragm Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Acoustic Plastic Diaphragm Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Acoustic Plastic Diaphragm Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Acoustic Plastic Diaphragm Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Acoustic Plastic Diaphragm Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Acoustic Plastic Diaphragm Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Acoustic Plastic Diaphragm Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Acoustic Plastic Diaphragm Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Acoustic Plastic Diaphragm Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Acoustic Plastic Diaphragm Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Acoustic Plastic Diaphragm Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Acoustic Plastic Diaphragm Volume K Forecast, by Country 2019 & 2032

- Table 81: China Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Acoustic Plastic Diaphragm Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Acoustic Plastic Diaphragm Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Acoustic Plastic Diaphragm?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Acoustic Plastic Diaphragm?

Key companies in the market include Poyun Enterprise, Dr.Kurt Muller GmbH&Co.KG, Loudspeaker Components, L.L.C., Shengzhou Kedi Electronics Co., Ltd., Suzhou Sonavox Electronics Co., Ltd., Dongguan Liangyin Precision Electronics Factory, YuonYunn Membrane Co., Ltd., Dongguan Huihong Plastic Co., Ltd..

3. What are the main segments of the Acoustic Plastic Diaphragm?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Acoustic Plastic Diaphragm," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Acoustic Plastic Diaphragm report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Acoustic Plastic Diaphragm?

To stay informed about further developments, trends, and reports in the Acoustic Plastic Diaphragm, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence